Tim Platt/DigitalVision via Getty Images

Thesis

Scorpio Tankers (NYSE:STNG) is a shipper of refined products such as gasoline, jet fuel, kerosene, and naphtha. Multiple market disruptions such as draughts in the Panama Canal, attacks in the Red Sea, and Russian sanctions, have caused global realignment of these trade flows, which in turn, has increased the international shipping demand for these products. Additionally, the world has become more polarized in terms of who deems refinery business acceptable in their country and who does not.

This polarization and new interferences are driving up ton-miles in an industry that is supply constrained. This is a result of underinvestment as well as limitations in shipyards to accommodate newbuilds. As polarization continues to build, spare excess capacity is consumed, while driving up both utilization and charter rates for Scorpio’s vessels.

STNG is taking this generational opportunity to fundamentally improve its business through debt reduction and share buybacks. Doing so simultaneously improves EPS and reduces breakeven rates for when the pendulum swings the other way to less profitable times. This, coupled with no relief capacity in sight, causes me to conclude STNG is on a multi-year bull run.

This bull run may at times lose some steam should issues in the Panama Canal and the Red Sea reverse. However, this will not overcome the predominant force in the market that continues to polarize between countries with refining capacity and those who predominantly consume refined products.

Market Polarization

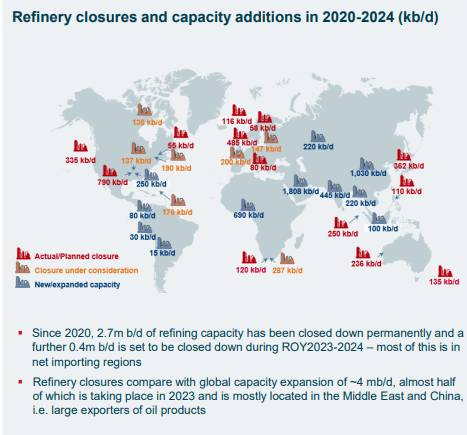

Global refining capacity took a hit in the years surrounding the COVID pandemic, accounting for several millions of barrels per day in capacity coming offline. The bulk of these closures came in developed countries such as the US, Australia, and Europe. All the while, China, India, and the Middle East have brought additional capacity online.

While the net effect is a higher net global capacity, this is not an important factor for shipping companies. The distance between the supply and the demand is what drives this shipping industry. The longer the voyage, the more shipping capacity that is tied up with each cargo. This differential only grew larger recently, as the Grangemouth oil refinery in Scotland is slated to close and will remove 150,000 barrels per day from the supply chain.

The image below shows the growing gap between the haves and the have nots. Except in this case, its refining capacity, not riches. The US and Europe combined, have closed over 1.9 million barrels per day of refining capacity with another 1 million barrels on the chopping block. With global consumption returning to pre-pandemic levels, the difference between consumption and production will have to be made up by imports.

TORM Investor Presentation

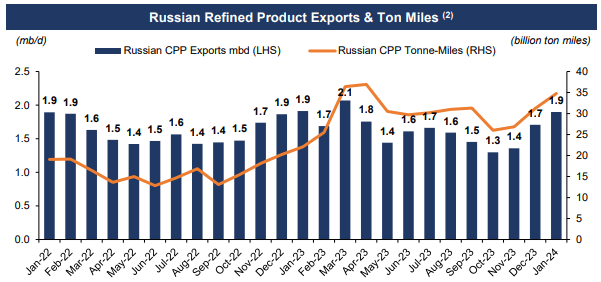

Europe previously had relied on Russia for the bulk of its energy needs. Sanctions resulting from the Russian-Ukraine conflict have interrupted this supply chain. Additionally, Ukraine has targeted and damaged several of Russia’s refineries, making the eventual restoration of this trade pattern unlikely. Therefore, the safest direction for Russian production is to hit the open waters toward large consumers in Asia and the Pacific.

STNG Investor Presentation

The Middle East, China, and India have all made investments to fill the European void by bringing online large-scale refineries. This sets up a dynamic of very large supply hubs and large consumption hubs. The last ingredient that is needed is a conduit to connect the customer and the supplier.

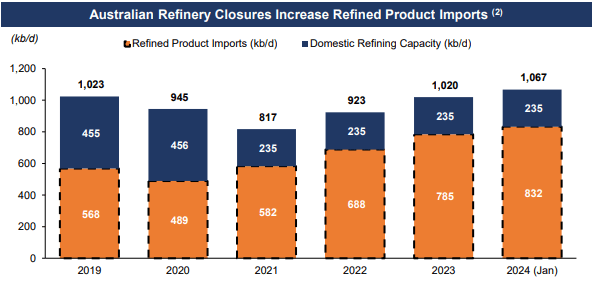

Australia and New Zealand are in the same boat, having only two refineries left on the entire continent. While this isn’t exactly a demand hub with only 26 million people, the isolated location of Australia makes this demographic a trapped customer. Further refinery closures and/or population growth will consume even more shipping capacity and support rates going forward.

STNG Investor Presentation

Free Cash Flow Analysis

In 2023, STNG averaged a daily rate of $32,000/d across its fleet of 115 vessels. Under these conditions, the company was able to return nearly $890 million to shareholders in the form of dividends, share repurchases and debt reductions. It should be noted that this level of return did result in a slight cash burn for the year.

To kick off 2024, STNG’s management has estimated Q1’s average rate to be just below $40,000/d. This is a significant increase above 2023’s average. For conservatism, I will assume an average rate of $36,000/d for 2024 as a base case. This provides some margin should the Red Sea situation calm and/or the Panama Canal resume normal operations.

In the 2024 model, STNG plans on retiring $600 million in debt, while also increasing the quarterly dividend to $0.40/share. This would still allow for $200 million in share repurchases without tapping into any of the company’s cash reserves. The total return to shareholders would be approximately $885 million, generally in line with 2024. This flat performance is largely due to an additional $37 million that is budgeted for dry dockings in 2024.

| 2024e ($36,000/D) | 2023 ($32,000/D) | |

| TCE Revenue | $1,520 million | $1,341 million |

| OP Expenses | $400 million | $365 million |

| Admin Expenses | $110 million | $106 million |

| Interest Expenses | $125 million | $158 million |

| Free Cash Flow | $885 million | $716 million |

| Dividend Expense | $85 million | $57.7 million |

| Share Buybacks | $200 | $490 million |

| Debt Reductions | $600 million | $340 million |

It is important to note the difference in allocation in 2024. By spending $600 million on debt reductions, STNG is retiring approximately 37% of the company’s total debt. This is a crucial step toward long-term profitability. STNG is taking the appropriate steps during this upcycle to permanently improve the financial footing of the company. This may not line investor’s pocketbooks today, but it ensures long-term profitability for tomorrow, and is a valuable safety net should rates decline in the future.

After looking at the base case, I turned my attention to understand what top end performance could look like for STNG. I altered the model for a more bullish market and assumed rates are able to maintain their current pace for the duration of 2024. A sustained rate of $39,500/d would result in TCE revenue growth to $1.660 billion. This additional revenue will flow straight to the bottom line and create additional $140 million in discretionary free cash flow.

President Robert Bugbee has stated that any excess free cash flows would be used to accelerate debt reductions in the Q4 conference call.

Jon Chappell

So, versus where we were 3, 6 months ago and you talked about target net debt levels and maybe shift in capital allocation, how do you see attaining those targets earlier versus maybe continuing to deleverage further just given a lot of the volatility in the markets today?

Robert Bugbee

I think the best thing to say is, yes, we are moving very fast towards a deleveraged state where the company can then have a lot of choices, but we’re certainly not distracting ourselves right now on thinking what the best choices would be at that time.

Pursuing this strategy would result in STNG having a total debt position of approximately $875 million by year-end 2024 in the bull case. Mr. Bugbee previously indicated in the Q3 conference call that the target debt level would be approximate scrap value of the fleet to minimize exposure to debt risk.

So I think our thinking has developed in the following way, is we’d like to get the leverage of the company pretty much down to around scrap value of the fleet. At that point, that’s around $850 million, $900 million. And at that point, I think it’s an arguable that the company would have very low leverage and be in a really safe position. And whatever it does at that point, whether it’s buying stock, whether it’s increasing dividends, et cetera, et cetera, it would be really playing with our shareholders’ money, our money. We’re not risking a bank loan, et cetera.

By achieving their debt target, STNG is setting the stage for a shift in valuation.

Valuation and 2025 Outlook

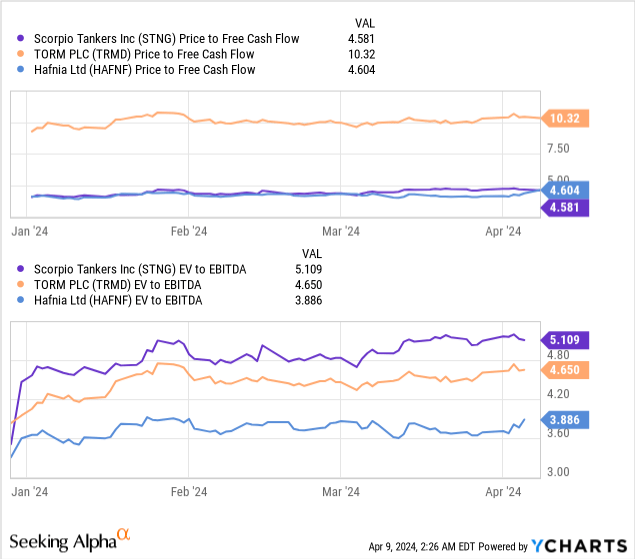

To help determine relative value for STNG, we’ll start with a comparison of its peers. Two companies that own a similar number of vessels and trade in the same market cap range are TORM plc (TRMD) and Hafnia Limited (OTCQX:HAFN).

Compared to TORM, Scorpio trades at a steep discount on a Price to FCF basis. However, STNG trades at the highest EV/EBITDA multiple of the peer group. To make sense of this, I need to add some background information.

1. TORM is paying a variable dividend that currently yields in the neighborhood of 20%. This obviously will command a premium for its shares.

2. Enterprise Value is calculated using a company’s market cap plus its debt, minus cash on hand.

As STNG completes its debt reduction mission in 2024, its EV will drop, thus causing contraction in its EV/EBITDA ratio. Using 2023 EBITDA and the projected year-end 2024 debt, this ratio would drop to 4.8x, which I believe is conservative.

As the shareholder returns program evolves, 2025 has a clear path to richly reward shareholders. Nearly all of the FCF can be sent to shareholder’s pocketbooks. This eventuality should trigger a premium to be paid on the stock on a Price to FCF basis as dividends and buybacks grow unimpeded. Currently, STNG trades at 4.5x free cash flow.

Assuming only one turn of multiple expansion (trading at 5.5x FCF), would imply a market value of $4.9 billion for STNG. This would yield a 36% increase in share price to approximately $95/share assuming my base case profitability model. The bull case scenario would imply a share price of $110/share.

Scorpio Will Be A Multi-Year Performer In Your Portfolio

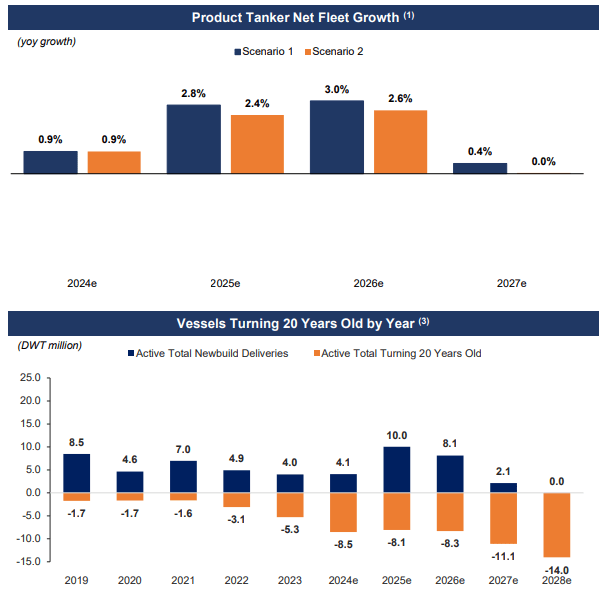

The shipping industry is known for boom and bust periods. These swings are caused by influxes of new vessels, which increase overall shipping supply and cause rates to drop. The image below shows that a net increase in shipping capacity of 7% is scheduled to enter the market by 2027. This totals approximately 24 vessels coming into service over the next four years.

During this time, 35 vessels are scheduled to enter the typical age range when a vessel is considered for scrapping (>20 years). It is possible that the scrap rate may be overestimated due to the lack of shipyard capacity to acquire new vessels. Very few order slots are available, with the bulk of global shipyard capacity tied up with the construction of hundreds of LNG vessels that are scheduled to enter service in the next 3 years. Higher charter rates and a lack of replacement options may convince owners to operate older vessels longer than originally planned.

STNG Investor Presentation

Regardless, the capacity forecast in the near term is slow and gradual. That should be a welcome sight to investors, as it lends to less market volatility. The current supply and demand outlook is supportive of the current market rate. Therefore, investors should expect more of the same performance moving forward.

With a multi-year outlook of strong profitability, investors should take advantage of the strong macro dynamics. The reality is that the industry has no real solutions to high shipping rates for the foreseeable future. The shipping capacity side of the equation is more or less fixed. The refining sector is in a similar boat, with low inventories in both the US and Europe. This indicates that demand for fuels is robust and healthy.

Risks

The main risk in the shipping market is generated from supply and demand imbalances. Two variables can affect this, the quantity of vessels available and the amount of product available to be shipped. It is possible for the industry to expand capacity by extending the life of older vessels.

Globally, 1.6 million barrels per day of refining capacity is scheduled to come online. This will require more vessels in operation to transport these products. Even if the retirement forecast is inaccurate, these new refineries should be more than sufficient capacity to employ the newbuilds as they enter service in 2025-2026. Startup issues with these facilities could cause brief periods of market imbalance, causing short-term rate compression.

On a long-term outlook, the demand for refined products is most likely to experience a slow decline over the next decade as electrification of more vehicles occurs. However, as developed nations continue to close existing refineries, the polarizing effect between supply and demand hubs will increase, causing higher demand in the shipping markets. Should this trend reverse or at least stop, the gradual reduction in fuel consumption will also lessen the need for shipping capacity.

Summary

STNG operates in a volatile industry, and thus an investment in this space is not for the faint of heart. Due to the inherent volatility, I view this sector as an active investment. Investors should monitor future shipping capacity to manage the risks of the shipping industry.

Currently, the shipping industry is supply constrained with little ability to add new vessels into the refined products market. This restriction on supply should prevent the risk of the classic ‘bust’ that is typical following a rapid influx of new vessels. With shipyards generally full due to LNG vessel construction, I view STNG as having a stable business environment over the next 3 to 4 years with strong profitability.

As the company progresses through its mission to eliminate debt, the company will emerge as extremely healthy and profitable in all macro conditions. I project this mission should be accomplished by year-end 2024 or early 2025. At that time, I expect multiple expansion in conjunction with expanding shareholder returns from unallocated FCF.

I rate STNG stock as a buy below $75/share to reap over 30% total returns.