Shopify is one of the best growth stocks today, with two sizable competitive advantages.

Many growth investors are buying Shopify (SHOP 0.63%) stock hand over fist. It’s not hard to see why: Shares have significant long-term upside.

The first reason an investment in Shopify can be so lucrative is that the company is a platform business. Platform stocks are some of the most profitable investments you can find.

The second reason Shopify stock is that it is just beginning to benefit from artificial intelligence (AI). There’s reason to believe AI will add big value to the company in the months and years ahead.

Praise for platform stocks

Some of the most profitable stocks in history have been platform stocks. These companies are exactly what they sound like: They build platforms upon which other things can be built. Consider the aptly named Meta Platforms, which owns a portfolio of businesses including Facebook, Instagram, and WhatsApp.

When people log on to Facebook, they aren’t viewing content created by Meta. Although Meta created the software that made viewing this content possible, the users themselves created the content. In this way, Meta has hundreds of millions of content producers building on top of its software platform for free.

You can likely already see how platform companies, once set in motion, are incredibly difficult to compete with. No single company could create the content that Meta is able to produce on a daily basis. That’s because Meta’s workforce only needs to run the software — its users do the rest.

Shopify is a powerful platform company in its own right. It launched its e-commerce platform in 2006, which allowed merchants to set up a digital storefront in seconds. Very early on, Shopify allowed outside developers to build on its platform. As with Facebook, these developers were allowed to monetize their contributions, quickly attracting a “free” workforce numbering in the thousands.

Note that Shopify’s e-commerce platform differs in a fundamental way to Amazon‘s e-commerce marketplace. Anyone can buy or sell on Amazon, but the company doesn’t open up its software to allow developers unfettered access to tweak and change it however they want. Yet that’s essentially what Shopify offers. Developers can tweak its platform in almost any way that they would like, adding new payment options, inventory tracking tools, design templates, marketing tools, or customer analytics dashboards. All of these features are then accessible to every Shopify user — a mounting competitive advantage that other e-commerce platforms can’t match.

There are competing e-commerce platforms like WooCommerce and Wix Stores, but Shopify is the heavyweight in the U.S. Statista estimates that the company commands a 28% market share, with WooCommerce controlling 17%, and Wix Stores coming in at 16%. Shopify’s platform leads the industry simply because it has more functionality than the competition. That’s all thanks to its massive distributed developer workforce.

Successful platform businesses like Shopify can grow for far longer than the market anticipates. These businesses truly are investments worth holding for decades. Once they’ve gained critical mass, they are hard to stop.

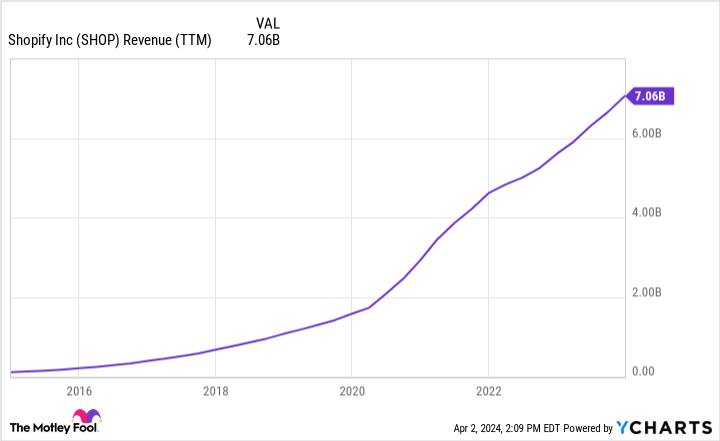

SHOP revenue (TTM) data by YCharts; TTM = trailing 12 months.

Shopify will benefit directly from AI

Artificial intelligence (AI) is a hot topic these days. Many investors are focused on companies creating AI tools, but investing in companies that will benefit from it is another way to win.

Morgan Stanley recently named Shopify one of its “high conviction” winners when it comes to incorporating AI into its business model. It’s not hard to see why, given the company’s platform business model.

Technology is an increasingly crucial component for selling online. Behind every e-commerce site is a suite of tools that attempt to track and optimize every potential customer visit.

For example, when you visit a Shopify-powered website, the store might already know which products you are interested in based on your browsing history or location. It can then dynamically present you with the items you’re most likely to buy.

Optimization tools like this will increasingly be powered by AI. Developers will be needed to build these tools. Where will they ply their trade? Most likely Shopify. These developers want to contribute to a platform that will earn them the most money. As the largest e-commerce platform in the U.S., Shopify can be expected to attract most AI developers working on these applications.

All of this will only end up strengthening its platform over time, attracting more users. And in turn, Shopify will become even more attractive to developers, thus attracting yet more users. It’s a virtuous cycle that platform stocks can benefit from for decades.

Shopify is a true platform stock. Investors looking to maximize long-term upside should strongly consider an investment.

Randi Zuckerberg, a former director of market development and spokeswoman for Facebook and sister to Meta Platforms CEO Mark Zuckerberg, is a member of The Motley Fool’s board of directors. Ryan Vanzo has positions in Shopify. The Motley Fool has positions in and recommends Meta Platforms and Shopify. The Motley Fool has a disclosure policy.