Apple research and development costs might be headed lower, or at least redeployed to something more productive.

The release of the hotly anticipated Vision Pro from Apple (AAPL 0.45%) — the headset that does virtual reality (VR) things, but which Apple calls a “spatial computing” device — is not providing the lift some investors had hoped for. Instead, Apple has found itself embroiled in some of the same regulatory issues as its megatech peers. After hitting it with a $2 billion fine, the European Commission is further investigating the iPhone company for other anticompetitive practices.

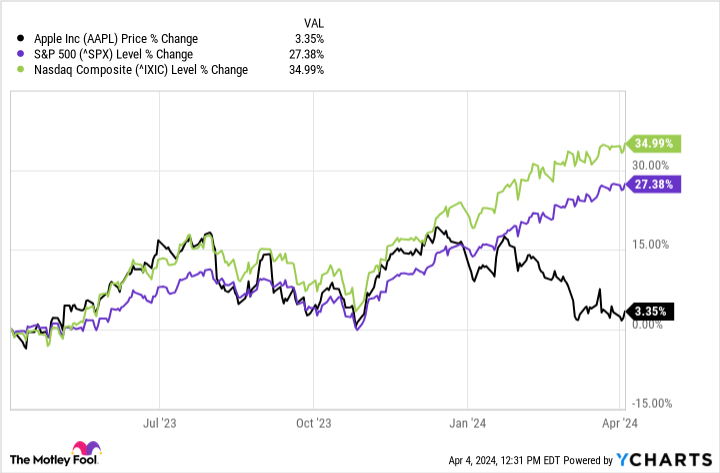

These regulatory issues, paired with slowing revenue growth, have caused the stock to underperform market indexes over the last 12 months.

Data by YCharts.

Amid these challenges, Apple has begun cutting back secretive expenses that one big tech peer, Meta Platforms (META 3.21%), has been surprisingly transparent about: research and development (R&D).

Apple about to take a cue from… Meta?

According to widely reported information from a series of leaked internal notifications, Apple is apparently scrapping two big R&D projects that have been the source of all sorts of Apple product fan excitement (or speculation) for years. Project Titan, the code name for an Apple self-driving electric car, or at least some sort of underlying technology, is being wound down. Likewise, longtime work on microLED technology for use in products like the Apple Watch is also being scrapped.

No word on if anything will happen to Apple’s 5G modem project for mobile devices. However, given Apple just signed new multiyear 5G chip supply agreements with both Broadcom and Qualcomm last year, I wouldn’t be surprised to hear this project is being sunsetted as well.

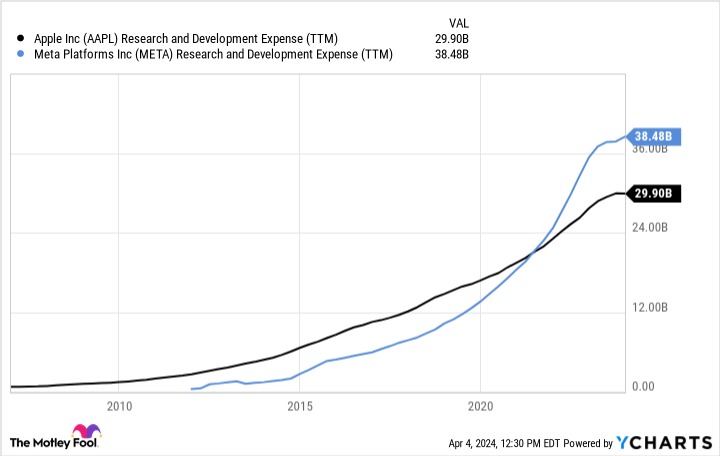

Of course, investors who peel back Apple’s spending habits probably could have guessed sweeping changes were coming. After a couple of decades of R&D increases since the iPhone was announced in 2007, a new era of financial efficiency appears to be beginning for Apple. R&D expenses actually declined in the last year. Meanwhile, Meta has also been enjoying the fruit of CEO Mark Zuckerberg’s work on becoming a more efficient business — although R&D is overall still on the rise.

Data by YCharts.

While investors have to largely speculate on Apple’s specific project spending, and how it might redeploy those expenses, Meta has been remarkably transparent. It changed its name from Facebook to its current corporate name back in 2021 to reflect that chunky line item for Reality Labs (RL), the VR headsets and related technology that Apple is now competing against with Vision Pro. The RL segment rang up a whopping operating loss (R&D expense included) of $16.1 billion in 2023. Much of the rest of Meta’s R&D spending spree is no doubt related to its data centers and artificial intelligence (AI) as it spends heavily on Nvidia hardware and other related projects.

It seems Apple is ready to pivot as well, and pare back some spending in favor of driving higher profit margins. Perhaps we’ll get some clearer direction on future project developments from CEO Tim Cook and company, too.

Don’t count Apple out just yet

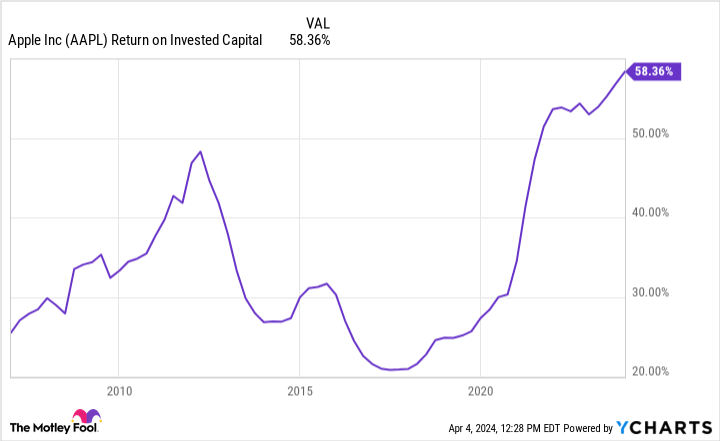

Before taking all of this as some sort of signal that Apple’s dominance is waning, I have one more chart for you: return on invested capital (ROIC), which measures the profit gained from past investments made.

Apple’s ROIC has gone through the roof in recent years as its mobile product lineup matures.

Data by YCharts.

Based on this track record of successful innovation and new product commercialization, investors should hope Apple redeploys R&D spending from its scrapped car and mobile display experiments to something new. ROIC of over 50% is mind-bogglingly good. Imagine if you, an individual investor, invested $1, and received $0.50 from that investment every year going forward. That’s the kind of return Apple is getting from its development efforts right now.

Granted, like all things in investing, past results are not indicative of future performance. Nevertheless, with a large global user base of its products, Apple has ample room to bring more products and services (say, an AI assistant, one better than Siri) to market and make more money.

In the meantime, as 2024 rolls on and as more news surfaces about Apple cutting costs, investors’ best hope for the stock making a rally may be in good old-fashioned earnings growth — exactly the secret to Meta’s resurgence the last couple of years.

Randi Zuckerberg, a former director of market development and spokeswoman for Facebook and sister to Meta Platforms CEO Mark Zuckerberg, is a member of The Motley Fool’s board of directors. Nicholas Rossolillo and his clients have positions in Apple, Broadcom, Meta Platforms, Nvidia, and Qualcomm. The Motley Fool has positions in and recommends Apple, Meta Platforms, Nvidia, and Qualcomm. The Motley Fool recommends Broadcom. The Motley Fool has a disclosure policy.