Apple’s strategies within its Services sector, particularly through Apple Music and Apple TV+, are drawing antitrust attention, despite not being close to having monopoly power.

The company’s approach to integrating its services within its devices has been a double-edged sword. On one hand, it provides a seamless experience for users, enhancing the attractiveness of staying within the Apple ecosystem. On the other, it has raised questions about fair competition, especially given the company’s influence in the tech world.

Amidst the ongoing lawsuit against Apple from the Department of Justice, observers are examining the company’s business and how it affects users and competing platforms. For example, iPhone users have a strong preference for Apple-branded accessories like AirPods and the Apple Watch.

Apple also competes with other companies in its Services business. It offers its streaming music service, Apple Music, competing against major players like Spotify, Pandora, Google, and Amazon.

Additionally, it provides streaming video services through Apple TV+, challenging a diverse array of competitors, including Netflix, Google’s YouTube, Amazon, and Hulu.

Users love Apple Music but are tepid on Apple TV

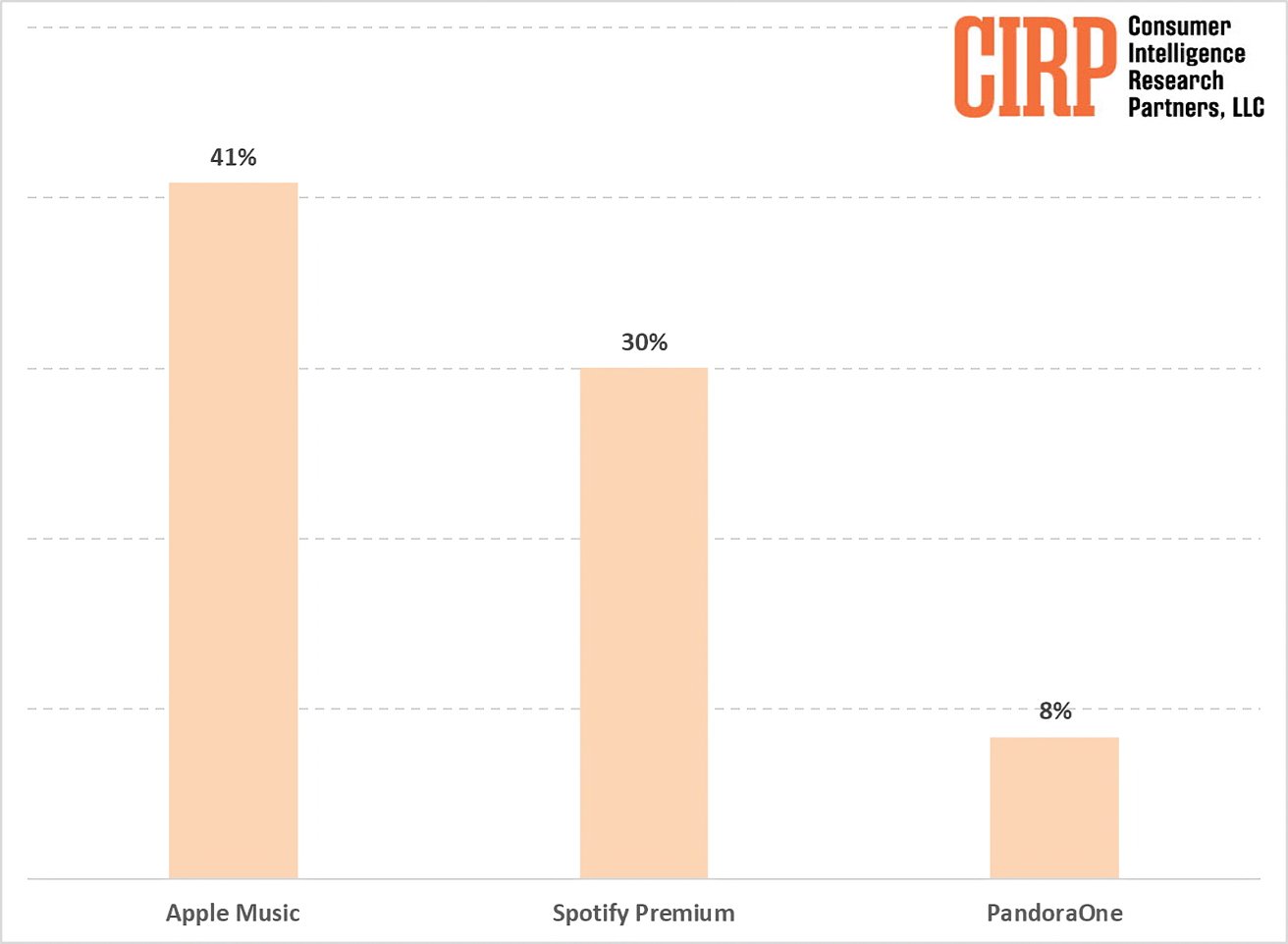

Apple leads in streaming music, outpacing Spotify and Pandora, according to Consumer Intelligence Research Partners (CIRP). Over forty percent of Apple users subscribe to Apple Music, compared to thirty percent for Spotify Premium and under ten percent for PandoraOne, Pandora’s paid version.

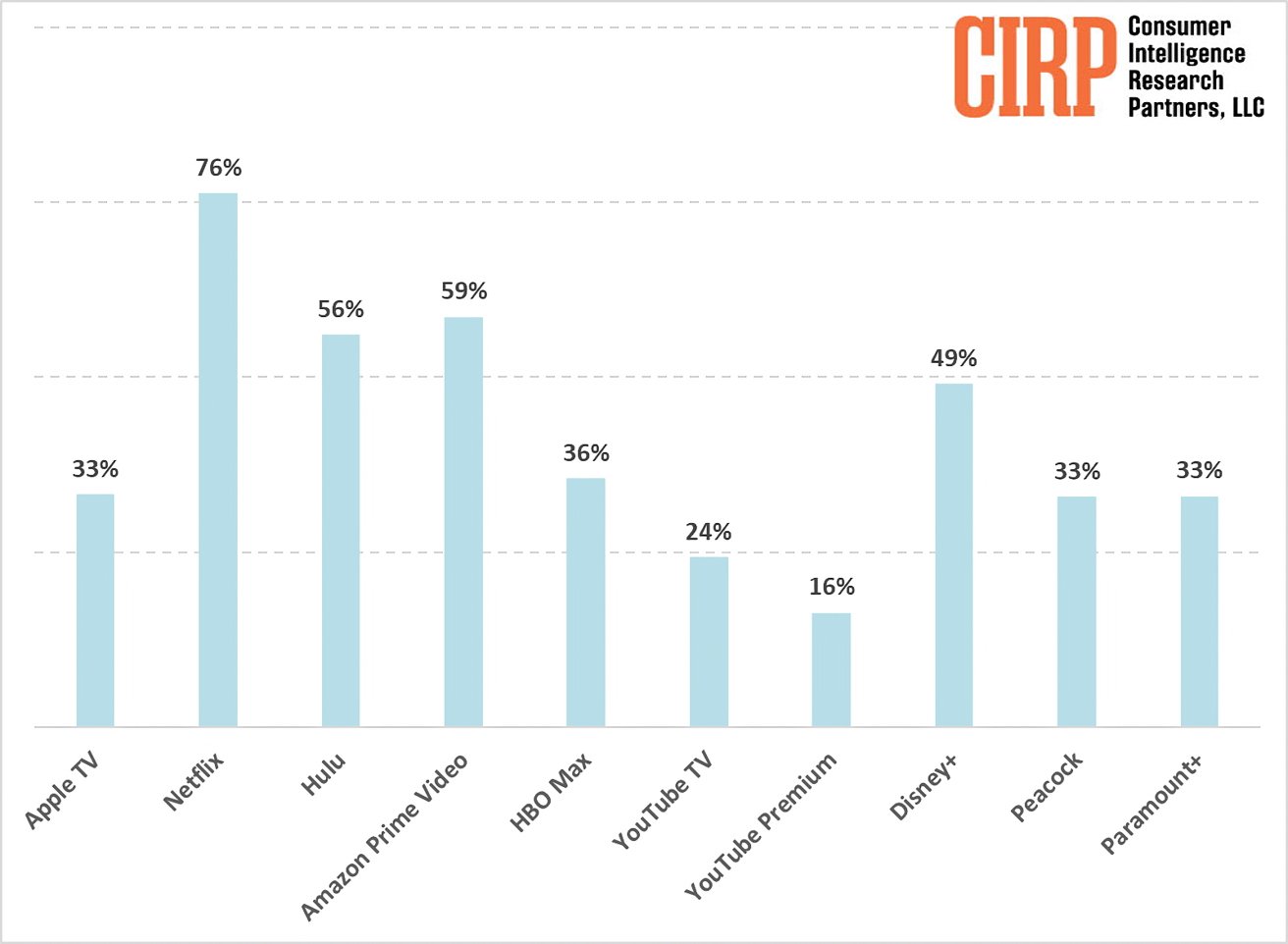

However, Apple occupies a slightly different status in the streaming video sector. Around one-third of Apple customers use Apple TV+, ranking it behind competitors like Netflix, Hulu, and Amazon.

Penetration of streaming music, subscription-based streaming services among all Apple customers (for the twelve-month period ending in December 2023)

The company’s lead in streaming music is unsurprising, as consumers tend to stick with one provider. Streaming music platforms have nearly identical catalogs so people can stick to one service.

But streaming video services are more exclusive. Apple TV+ has plenty of content not found elsewhere, such as Foundation, Ted Lasso, and other shows. The same applies to platforms like Netflix, which notably doesn’t hook into the Apple TV app.

As a result, CIRP believes it’s difficult to call Apple TV+ a monopoly since it doesn’t dominate its market. However, questions about Apple Music still need to be asked.

Apple Music is more competitive

“Is [Apple Music’s dominance] the result of a great service designed to work seamlessly with iPhones, iPads, and Macs?” CIRP asks. “Or are there visible or invisible barriers that restrict Spotify and other’s growth?”

Apple certainly has a contentious relationship with Spotify, for example. In 2019, Spotify complained of being in the App Store due to Apple’s fee for apps.

In recent years, Apple’s relationship with third-party music streaming services, notably Spotify, has been tense. Spotify’s accusations against Apple for unfair treatment and anti-competitive practices highlight a broader concern regarding Apple’s position in the market.

Adoption of streaming video, subscription-based streaming services among all Apple customers (for the year concluding December 2023)

Despite these allegations, Apple has made slight moves to open its platforms. For instance, the HomePod’s support for third-party music streaming services in iOS 14 marked a significant shift.

As the antitrust investigations unfold, Apple’s strategies for navigating the digital streaming market are under the microscope. But the company has been willing to make some concessions.

Whether Apple Music and Apple TV+ are examples of the company’s market dominance or its ability to compete fairly remains a contention. What is clear, however, is that the outcome of these discussions will have lasting implications for the tech industry at large, setting precedents for how digital markets operate and are regulated.