If you’re a book collector, I wanted to give you a heads up that the first print of the first edition of Buy This Not That is almost sold out.

My editor at Portfolio Penguin informed me that the second print of the first edition will arrive in their warehouse on April 24, 2024. Subsequently, these second prints will be distributed to bookstores and warehouses for online retailers.

As you may recall from reading my post on collecting rare books, the value of a book often depends on its popularity, with first editions being the most coveted. Specifically, first prints of the first edition hold the highest value, particularly those with errors.

If an author goes on to become a prolific writer and bestselling author, the first prints of their first editions will likely become highly sought after in the future.

Additionally, obtaining a signed copy of a first print, first edition, bestselling book can significantly increase its future value. In such cases, it’s advisable to store the book in an airtight bag in a dark and temperature-regulated container to preserve its condition.

Why I Invest In Collectibles

I’ve been an avid collector of baseball cards, Chinese coins, shoes, stickers, watches, and rare books for decades. I would also collect fine wine if I didn’t experience a stuffy nose and headache 25% of the time I drank.

Collecting brings me joy because I get to appreciate the items I acquire, and the potential for their value to increase over time is an added bonus. Think about collecting as a two-for-one special. Owning stocks, on the other hand, brings me no pleasure.

My passion for collecting as a young person has carried over to my enthusiasm for purchasing prime residential real estate. My preference is for single-family homes with ocean views or single-family homes with oversized lots.

To be able to enjoy your home, raise children, and create wonderful memories while also potentially building home equity feels like winning the lottery. Without real estate, I wouldn’t have been able to leave my corporate job in 2012. Today, real estate accounts for about 60% of my passive income.

Clarifying Between First Print and First Edition

Before we get into why investing in first print, first edition books may be a good investment, let me first explain what both terms mean.

What’s a Print?

A printing refers to a single print run of a book. When a publisher sets a publishing date, they determine the number of copies to print for the book’s launch.

The goal is to print just enough copies to meet immediate demand. If demand exceeds supply, the publisher may miss out on potential profits. Conversely, printing too many copies risks oversupplying the market and resulting in financial losses.

For example, if a publisher prints 10,000 copies of a book and subsequently prints an additional 5,000 copies after selling out, the initial 10,000 copies constitute the first printing, while the subsequent 5,000 copies comprise the second printing.

These printings belong to the same edition. However, there are often differences between them, such as variations in paper stock, cover stock, ink coloration, and any corrections or updates made between printings.

Changes like alterations to paper or cover stock and the printer used can vary between printings. Consequently, two books from different printings within the same edition may exhibit slight differences, such as variations in ink coloration.

What’s an Edition?

An edition refers to a significant change made to a book. Major alterations include updates to the cover image, changes in trim size, new introductions or conclusions, and the addition of new chapters. By comparing or examining two editions of the same book, you can discern the differences between them.

Minor revisions, such as correcting typos or art mistakes, do not constitute a new edition. Second editions are often created to update classic books to reflect current trends and information.

Second, third, or subsequent editions typically offer superior content compared to earlier editions. New and relevant content is more valuable than outdated material. That’s why I regularly update hundreds of my most important posts on Financial Samurai at least once a year.

For instance, discussing a 401(k) employee contribution limit of $10,500 in 2024 when the actual limit is $23,000 would not be ideal. Similarly, using outdated charts to project 401(k) savings based on contribution limits from previous years would provide inaccurate information.

First Prints of the First Edition: Highly Coveted Books

For book collectors, the ultimate goal is to acquire first print, first edition books by established authors or those with potential for huge growth.

Whether you’re just starting out or you’re a value investor like myself, the thrill lies in hunting for first print, first edition books by relatively unknown authors who may skyrocket to success. Even if an author remains relatively obscure, the works of “one-hit wonder” writers can also appreciate in value over time.

The value appreciation of first print, first edition books as an author’s popularity grows is rooted in simple mathematics.

Initially, the first print of the first edition comprises 100% of all books sold, let’s say 10,000 out of 10,000 copies. As the author sells more books, such as reaching 1 million copies sold, the first print then represents only 1% of the total books sold.

Therefore, identifying a book with exceptional entertainment or utility value that is currently undervalued by the market prompts collectors to acquire as many first print first editions as possible. Eventually, the market may recognize the book’s quality, leading to heightened demand and increased prices.

Another reason why first print, first edition books are highly sought after is due to the presence of typos. If you come across a first print, first edition book by an emerging author containing typos, it’s wise to add copies to your collection. Typos and artistic errors are elements collectors are willing to pay a premium for.

Why I’m Investing in Buy This Not That as a Book Collector

As the author of Buy This Not That, it’s fair to say I’m biased. I firmly believe it’s one of the most insightful and underappreciated personal finance and lifestyle books available today. The book employs a probabilistic approach to help readers make informed decisions, addressing life’s major dilemmas through rational analysis.

With a background in finance and economics, including a degree from William & Mary and an MBA from UC Berkeley, along with over 13 years in investment banking at Goldman Sachs and Credit Suisse, I bring a wealth of firsthand experience to my writing. Since July 2009, I’ve authored more than 2,300 personal finance articles.

For readers seeking finance insights from a practitioner with a finance background, both Buy This Not That and Financial Samurai offer valuable perspectives. Have you subscribed to my free newsletter yet?

Beyond the quality of the content, let’s consider the investment potential of acquiring Buy This Not That.

1) Not all books go to second print

Consider this: roughly 90% of self-published books sell fewer than 100 copies, and about 50% of traditionally published books, such as Buy This Not That, sell fewer than 1,000 copies. Selling a significant number of books is indeed challenging.

While a publisher could initially under-order a first print of, say, 500 copies, major publishers typically wouldn’t sign an author if they anticipated such low initial sales. The resources invested in producing the book would outweigh the potential returns, rendering it economically unviable.

I’ve chosen to invest in the first print of Buy This Not That because it has already sold over 10,000 hard copies and is set for a second print on April 24, 2024. With demand clearly demonstrated, there’s potential for further growth as more readers discover and share the book.

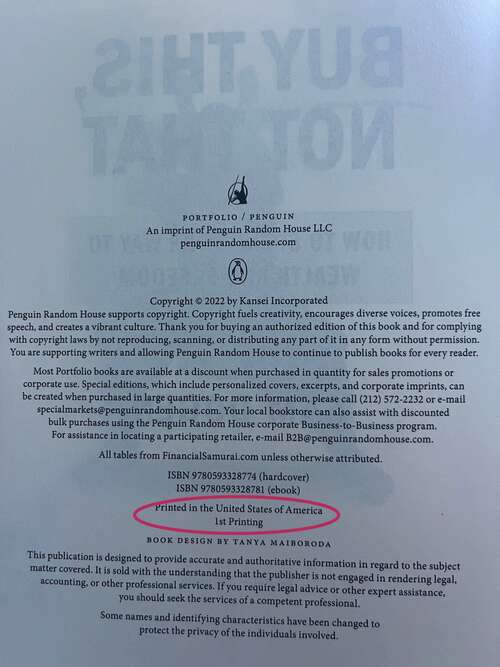

Please note, I’m buying hard copies, not electronic copies. Also, to find out what print and edition is of the book, you must look at the copyright page in the beginning. You can read more here about what to look for.

2) The first print of Buy This Not That has errors

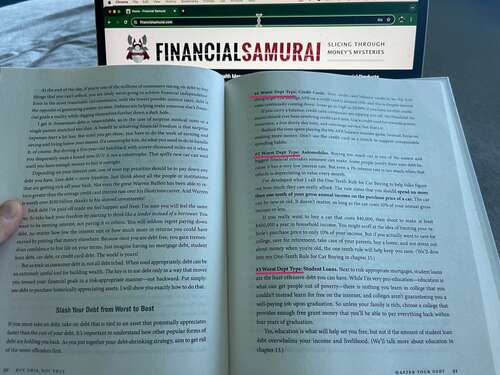

Buy This Not That contains a significant typo that appears four times. In Chapter 4, titled “Master Your Debt,” the word “Debt” was erroneously retyped as “Dept” in four subsections spanning pages 51 and 52. I was surprised to discover this typo, especially considering that my final submission for printing did not contain these errors.

Prior to sending the book to print, both my editor and my wife, along with myself, meticulously reviewed the manuscript over 50 times, spanning numerous hours. Despite our thorough efforts, the typo managed to slip through, likely due to an inadvertent error during the final copying process.

While the error was somewhat embarrassing, it went largely unnoticed by most readers. In fact, out of the thousands of copies sold, only one person brought it to my attention.

I have reviewed the second print and ensured that the misspelling of “debt” has been corrected. Additionally, I took the opportunity to update several facts and figures in the book to ensure its relevance in today’s environment.

3) Two more books will eventually be released by me

Following the success of Buy This Not That, I secured a new two-book deal with Portfolio Penguin. Consequently, I anticipate tens of thousands more copies being sold in the future, further enhancing the rarity of the first print, first edition of Buy This Not That and consequently increasing its value.

While there are no guarantees regarding the success of my second and third books, my publisher has confidence in their potential. Therefore, they are likely to order 10,000+ first print hard copies of the first edition for each subsequent book, amplifying the scarcity of the first print, first edition of Buy This Not That.

As an investor in Buy This Not That today, you also have the potential for upside if my subsequent books gain significant popularity. While outcomes are uncertain, the current low cost of investing in BTNT presents an attractive opportunity.

The Content Of Each The Book Alone Is Already Well Worth The Cost

I’ve been immersed in books, devouring at least one per month since the pandemic began because of my deep love for reading. The content of each book has proven to be invaluable, often exceeding the cost of the book by multiple folds.

Several notable reads that stand out to me include “Where The Crawdads Sing” by Delia Owens, “Atlas Of The Heart” by Brené Brown, and “Healing Back Pain” by Dr. Sarno. These books have provided me with immeasurable joy and guidance, far surpassing their initial purchase price.

Similarly, I hold the belief that both How To Engineer Your Layoff and Buy This Not That offer significant value to readers.

Since 2012, I’ve received numerous personal emails expressing gratitude for How To Engineer Your Layoff, which empowered individuals to confidently navigate leaving unsatisfying jobs by negotiating a severance. It is sheer joy to break free from a micromanaging boss with money in your pocket!

Likewise, Buy This Not That has garnered hundreds of four and five-star reviews since its release in 2022, with readers on Financial Samurai expressing their appreciation for its insights.

Even if the first print, first edition of Buy This Not That doesn’t appreciate in value over the next 20 years, it’s still bound to provide immense value relative to its cost. For me, this represents a no-lose situation. And when faced with such scenarios in investing, I tend to go all in.

Giving The Gift Of Financial Freedom

Finally, I’ve found the act of gifting a book that addresses some of life’s most significant financial decisions to be truly rewarding. Instead of arriving at a house party with a bottle of wine, I prefer to present some of my favorite books as gifts, not limited to my own.

With time, the lessons and actionable steps outlined in Buy This Not That will grow in value. As a parent, I’m willing to make sacrifices, save diligently, and invest wisely to ensure my children receive a solid grade school and college education. Unfortunately, colleges are aware of this, which is why they persist in charging exorbitant tuition fees!

If I can impart even a fraction of the wisdom I’ve amassed over 29 years in finance through a book, it’s an enormous win at a significantly lower cost.

Given my rationale, I’ve decided to purchase as many of the remaining first print, first edition copies of Buy This Not That as my budget allows. Good thing for you, my liquidity is low, so I can’t buy up all the remaining inventory.

After the week of April 24, 2024, it will become harder to procure a first print copy online or at bookstores. And in the unlikely event this post becomes a viral hit, the availability of BTNT first prints will disappear sooner.

There’s only one time to buy first prints at retail price or less until the opportunity is gone forever.

You Must Own A Pristine Condition First Print To Profit The Most

For the thousands of you who already own a first print version of Buy This Not That, thank you! I hope you enjoyed the book and it’s in great condition. If it’s not in great condition because you’ve highlighted some passages, earmarked pages, or dropped the book on the ground and dented the corners, sadly, from an investor’s point of view, it will lose a lot of its resale value.

To be a successful book collector, you must try to invest in first prints that are as flawless as possible. If anybody has ever invested in sports cards know, every little imperfection dings the resale value of a card.

Hence, if you don’t have a copy of Buy This Not That in pristine condition, and want to invest in it as a collector’s item, you had best order a new copy. And if you don’t want to invest in another, that’s no problem too.

An Easier Life By Recognizing Opportunity

Sometimes, I can’t help but feel that life might be unfair because it seems too easy for those who are well-informed to get ahead. It’s like we have an unfair competitive advantage or something.

Only regular readers and e-mail subscribers of Financial Samurai will read this post. The rest come to the site through Google or random highlights to specific articles from the mass media. As a result, only a small percentage of people will be able to take advantage of this information I’ve provided.

By connecting the dots and paying attention, financial windfalls could shower riches upon you.

Here are some previous examples:

1) Focus On Trends: Why I’m Investing In The Heartland Of America (January 19, 2017): If you had invested in real estate in Texas back in 2016, you would have made a killing by the beginning of 2022. For example, the Heartland fund by Fundrise, which is now closed, was up 41% in 2021.

2) How To Predict A Stock Market Bottom Like Nostradamus (March 18, 2020): If you had bought the S&P 500 when the post was published, you would be up over 100%.

3) Artificial Intelligence And The Plan To Protect And Profit (April 26, 2023): After reading this post, I think you will find it wise to have some exposure to artificial intelligence through public and private company investments. If you do, you will be hedged against potential job losses for you and your children. If AI takes over the world, your portfolio with AI stocks will likely do well.

Even though Financial Samurai has been around since 2009, only a tiny minority of the American population reads this site. Consequently, I believe our community possesses the wisdom to outperform the majority significantly.

Naturally, we will make incorrect investment calls from time to time. However, overall, I am confident that with our combined knowledge and insights, we will continue to perform well above average.

Reader Questions

Do you have any first print, first edition books in your collection? If so, how have their values fared over time? Why do you think some people are unwilling to act upon opportunities, even if they are staring them in their faces? Is the decision to be financially independent more due to choice than luck?

Listen and subscribe to The Financial Samurai podcast on Apple or Spotify. I interview experts in their respective fields and discuss some of the most interesting topics on this site. Please share, rate, and review.

To expedite your journey to financial freedom, join over 60,000 others and subscribe to the free Financial Samurai newsletter. I’ll probably do a signed BTNT giveaway for several lucky subscribers. Financial Samurai is among the largest independently-owned personal finance websites, established in 2009.