According to a Bank of America analyst, home improvement retailer Home Depot (HD -4.06%) stock has slightly more than 10% upside potential. The analyst retained a buy rating on the stock and raised the price target to $425 from $400 following the announcement to buy SRS Distribution for an enterprise value, or EV, (market cap plus net debt) of $18.25 billion.

Home Depot’s deal details

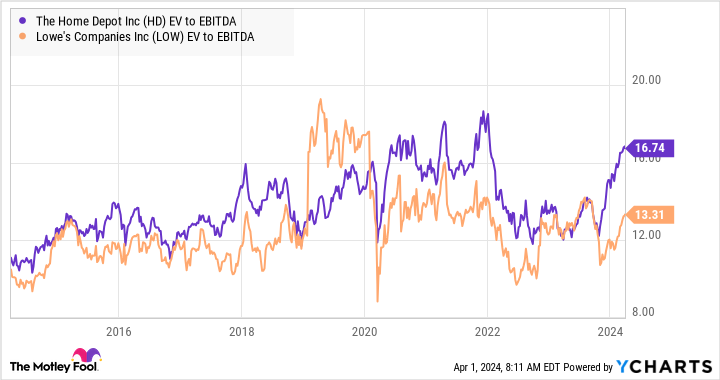

Looking into the deal’s details, SRS is a residential specialty trade distribution company focused on the professional roofing, landscape, and pool markets. It generated $1.1 billion in earnings before interest, taxation, depreciation, and amortization (EBITDA), implying an enterprise value (EV) to EBITDA multiple of 16.1.

As you can see below, that’s not a historically attractive multiple in this industry.

HD EV to EBITDA data by YCharts

However, it needs to be put into the context of a declining housing market and its impact on profits at home improvement retailers. Cyclical companies typically trade on high earnings multiples when they are in a trough in their end markets.

What the deal means to investors

As such, investors bullish on the housing market will welcome the deal as it’s precisely what they would want their companies to do in a slowdown – use their market power and position to invest for growth.

Image source: Getty Images.

The deal will increase Home Depot’s debt leverage from an adjusted debt to EBITDAR (the “R” bit stands for rents) of 2.1 times EBITDAR to 2.5 times EBITDAR and adjusted debt to $55 billion to $69 billion; this looks manageable. For example, management plans to get its pro forma debt down to 2 times EBITDAR over the next two years.

Meanwhile, the acquisition will expand Home Depot’s presence in the attractive pro-market while expanding its total addressable market.

Home Depot is attractive to investors looking for exposure to a recovering housing market, but there are better-value stocks that play the same theme.

Bank of America is an advertising partner of The Ascent, a Motley Fool company. Lee Samaha has no position in any of the stocks mentioned. The Motley Fool has positions in and recommends Bank of America and Home Depot. The Motley Fool recommends Lowe’s Companies. The Motley Fool has a disclosure policy.