Spencer Platt

Dear readers/followers,

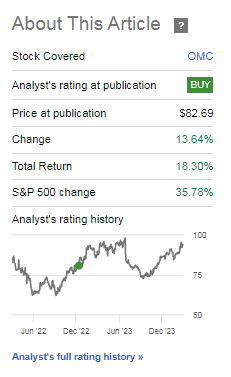

I’ve covered Omnicom Group (NYSE:OMC) and other advertising giants before, buying them during trough valuation and selling them at attractive prices. In my last article, which by the way you can find here, I made a point for why Omnicom represented a “BUY” but not the “best” buy out there. This article was published well over a year ago at this point. Here is the return since that time, and while you can see that we’re up since then, we’re not up that much overall – confirming what I saw as a relatively “poor” upside all things considered.

Seeking Alpha OMC RoR (Seeking Alpha)

To say that the advertising space has “changed”, would be an absolutely colossal understatement. I would say that for myself, I would not invest in any but the market-leading, top-tier firms out of the sheer necessity of scale to make any sort of serious money or returns in this business – that is how I see it. That is why my investment targets include companies like OMC, but also companies like French Publicis Groupe (OTCQX:PUBGY), as well as Interpublic (IPG).

These are my “primary” picks. I’m theoretically also interested in Google (GOOG), but I don’t own stocks in the company at this time.

In this article, I’m going to downgrade my rating on OMC – and here, I will show you why.

Omnicom – The downgrade reflects less appealing fundamentals and market trends

So, this is an area that I have been following for a long time – and I’m not only talking about online advertising spend or trends, or marketing spend from an SG&A perspective. I’m talking online/advertising overall.

For over 10 years, I’ve been questioning the effectiveness of online/click-based advertising. I have done this based on my own experience, my interviews with management, studies, and what I’ve seen in terms of company results and sales increase. It’s obviously not a one-sided sort of issue – and some online ads and sales driving “does” work. However, the underlying statistics show worrying signs – and these are now being confirmed by severe cuts in advertising revenues, far shorter contract cycles with advertising firms, and other trends. Digital advertising is fraught with issues, including the fact/s and signs that over 35% of click-based paid ads are fraudulent (Source: Search Engine Journal), the fact that a study showed that as much as 71% of advertising campaigns failed to meet set expectations (Source: Demandbase). The fact that companies like Google and Meta (META) really exist mostly due to brands spending on targeted ads where the statistics on whether they work or not is usually made by the people who sell it (Other statistics show different signs, such as WordStream’s analysis of over $3B in annual advertising spend. (with a click-through rate of 2.35% with less than 10% of non-bounce clicks, means that it’s less than 0.21% of finding a lead, which is exactly zero new customers when multiplied by the average conversion rate)

I could spend a few articles just discussing this – but let me instead just conclude that I am dubious about the future of strict online advertising, and this is the reason why I apply lower multiples to the strictly tech-based ad businesses compared to most, and why I favor the more “old-school” approaches which are made by firms like OMC, PUBGY and IPG. They bring the best of the new, and the best of the old world to the table.

However, it should be no surprise to anyone that advertising trends are in a bit of a crunch.

The company did manage 4Q23 4.4% organic revenue growth and continues to estimate top-line growth going into 2024E – but the company’s EBITA income is not keeping pace. We’re up 2.9% on adjusted operating income – and this is with Omnicom actually managing some very impressive client wins for the full year.

Other companies that do not have Omnicom’s scale or expertise are faring worse. The signs that this has been going down have been clear since 2022-2023, with digital ads dropping single digits in the last year, and even with some recovery here, I would be somewhat careful – especially with the higher valuations that some of these companies currently demand.

This is especially clear also in the geographical overview. NA is not going all that well. The company’s revenue in the USA saw 0.6% growth in 4Q, and a 1.3% decline in other NA. Europe, LATAM, Asia, and the UK make for the company’s overall best regions.

On the company’s income/expenses, what was clear was the company’s successful move to cut salary, but with incidentals clearly up as a percentage of revenue from 18.1% to almost 20% for the year.

While Omnicom remains a very solid business in terms of debt – ridiculously so in fact, at 0.5x net debt/EBITDA and a net debt total of only $1.2B and having completed several relevant M&A’s during the year, valuation remains at the center of my overall approach and consideration.

Omnicom IR (Omnicom IR)

Aside from Coffee & TV, the company also bought Flywheel Digital – both relevant purchases, and both significantly more attractive as a part of the OMC family and the company’s completely vertically integrated capabilities than any strictly digital advertising agency in terms of investment attraction – at least for me.

To be clear, Omnicom had a decent quarter and a good year. That is not in question here. I’ve always, since my first COVID-19 discount articles on Omnicom, maintained that the company is qualitative. It’s EBIT margin above all, over 14%, is very good – even if the company’s gross margin declines have put it below 18.5%, which isn’t all that good. Still, the company maintains very impressive financial KPIs and a solid business model. There’s very little danger for any sort of substantial or fundamental downturn, as I see things here. OMC also remains BBB+ rated and with a very well-covered yield, as far past things go.

In addition, OMC is excellent at hitting its performance targets. It really never, or very rarely misses those estimates, and when the company does, those misses are typically small (Source: FactSet).

So why am I saying that I am downgrading OMC during a period like this instead of buying the company?

For one reason.

Omnicom Group – The valuation dictates that this is no longer as attractive an investment.

My valuation target during my last OMC article put the company at $86/share. I am not adjusting this target as of this article – instead, keeping it where it is. The company typically maintains a 12-13x P/E valuation, which might seem low for BBB+ and the history and safety of this company. Two things to remember here. First off, the company has a sub-3% yield in a world where 4.25% risk-free is commonplace. Secondly, Omnicom does show the capacity for volatility. Also, growth is at the mid-single digit range, with an expected 2024E adjusted earnings increase of around 4-5%, depending on where you look (Source: FactSet, S&P Global). My own forecasts are at around 5%.

However, this still means that the company might not necessarily be all that superbly attractive. Analysts following the company have acted in characteristic exuberance, raising their target from the average low $70’s a year ago, to over $100/share on average today.

Let me clarify that I do not believe OMC has become 30% more valuable in less than a year. I believe this to be flawed forecasting, not listening to the lessons that a valuation approach brings. The target range begins at $82 now and goes up to $120. A year ago it was $53 and a high of $89. Again, I do not see anything of this magnitude having happened in the last 12 months – obviously, these analysts disagree. 5 out of 12 analysts have the company at a “BUY”, which means that not even 50% are following their own target averages as well.

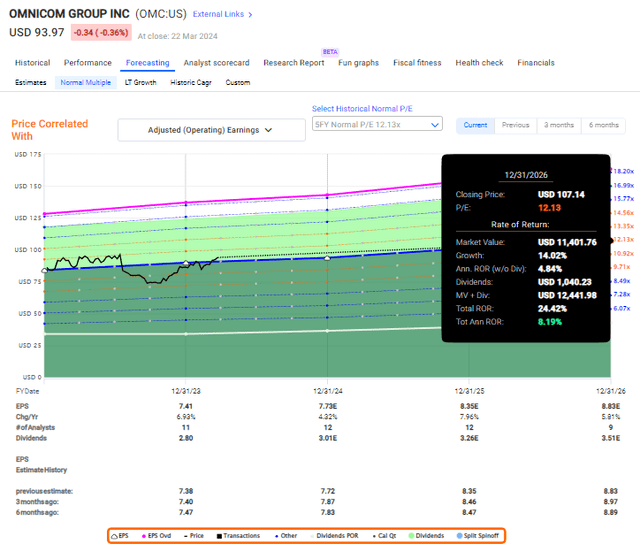

If you were to forecast Omnicom at a 12-13x P/E range, with a midpoint of 12.5x, you’d get less than 9% annually inclusive of the 2.98% dividend for the next 3 years, illustrated here.

Omnicom Upside (FAST Graphs)

Attractive? I would say not in the least. There are many, many other alternatives in investing that do not only yield better returns, but do so at a substantially higher dividend yield, as well as a higher credit rating/fundamentals above an A-rating.

In short, I do not see a good “case” to be made for OMC here. In fact, if we move down again to 9-10x P/E, which the company has done in last year, there’s a very real potential for a negative RoR from this point of valuation. If the company went down to 9.5x in these forecasts, your RoR would turn negative(Source: F.A.S.T graphs/FactSet).

I do not easily invest in realistic negative RoR, and I do think that the prospect of a negative RoR here is in fact entirely possible.

Omnicom currently does not meet my investment criteria. Not only does it have a sub-10% annualized RoR if we’re likely to see a performance in line with the previous 5-10 years, but we also have a very real potential for very slim gains or even capital loss. I’m also very careful with overvalued advertising businesses at this time. Some of the company’s closest peers include Publicis Groupe, and I sold what stakes I had in this French advertising giant because it went up well above its historical trading range.

Omnicom has not seen the same sort of development, but it’s moving in those lines. The fact is, you want to buy these companies at a discount – and that is not possible here.

I’m sticking to my PT for Omnicom, but I’m downgrading this to a “HOLD”.

Thesis

- My thesis for Omnicom is now a negative one, or a neutral one, depending on how you interpret it. Omnicom is a class-leading advertising giant with significant fundamental upsides across the board. I view the company as highly investable at the right valuation.

- The “right” valuation, as I see it, is no higher than $86/share to get that upside we’re looking for. Everything above that is a level where the upside is no longer intact, conservatively. That is why I am downgrading the company at this time.

- I’m sticking to my $86/share PT and giving the company a “HOLD” here.

Remember, I’m all about :

1. Buying undervalued – even if that undervaluation is slight, and not mind-numbingly massive – companies at a discount, allowing them to normalize over time and harvesting capital gains and dividends in the meantime.

2. If the company goes well beyond normalization and goes into overvaluation, I harvest gains and rotate my position into other undervalued stocks, repeating #1.

3. If the company doesn’t go into overvaluation, but hovers within a fair value, or goes back down to undervaluation, I buy more as time allows.

4. I reinvest proceeds from dividends, savings from work, or other cash inflows as specified in #1.

Here are my criteria and how the company fulfills them (italicized).

- This company is overall qualitative.

- This company is fundamentally safe/conservative & well-run.

- This company pays a well-covered dividend.

- This company is currently cheap.

- This company has a realistic upside based on earnings growth or multiple expansion/reversion.

The company cannot rightly be called “cheap”, and I don’t view it as having a high enough upside for investment at this time either. Because of that, I say “HOLD”.