Shutter2U

Introduction

On November 2, I wrote an article titled “Down 40% – 3.6%-Yielding American Tower Is A Deep-Value Opportunity.”

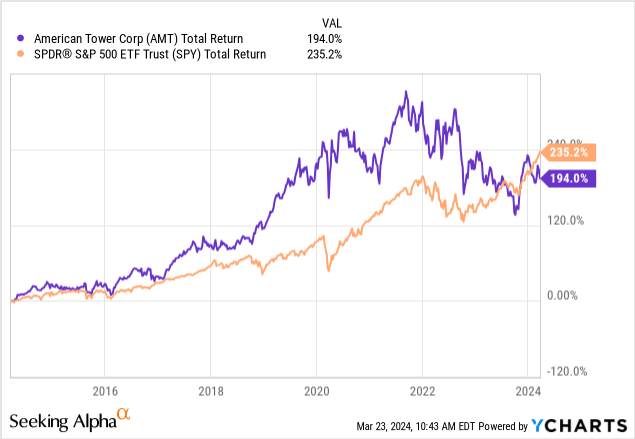

Since then, shares have returned roughly 6%. It’s a good start, but nothing compared to the 21% return of the S&P 500.

Over the past ten years, AMT has returned 194%, lagging the S&P 500 by roughly 41 points. Most of this is due to the impact of rising rates and sticky inflation on the REIT sector.

The reason I’m writing this article is the fact that a lot of readers have been concerned because the American Tower Corporation (NYSE:AMT) recently cut its dividend.

In this article, we’ll discuss what to make of that move and why I continue to like the risk/reward of this telecom REIT.

So, let’s get to it!

A Dividend Cut I’m Not Worried About

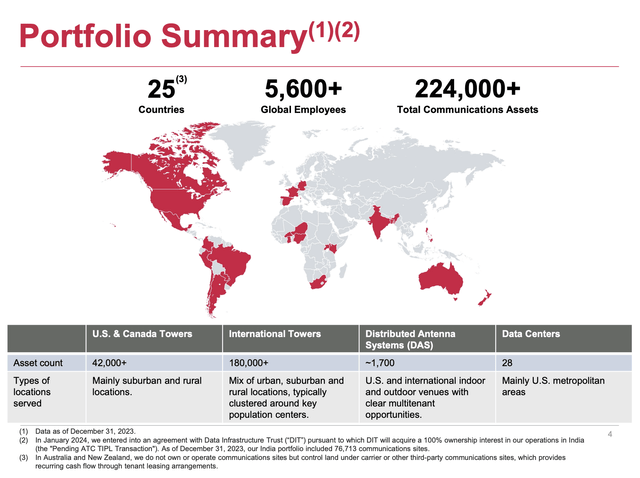

With a market cap of roughly $90 billion, American Tower isn’t just the largest telecom REIT but also one of the largest REITs in the world.

What sets this company apart is its massive footprint consisting of more than 42,000 cell towers in the U.S. and Canada, more than 180,000 international towers, and 28 data centers.

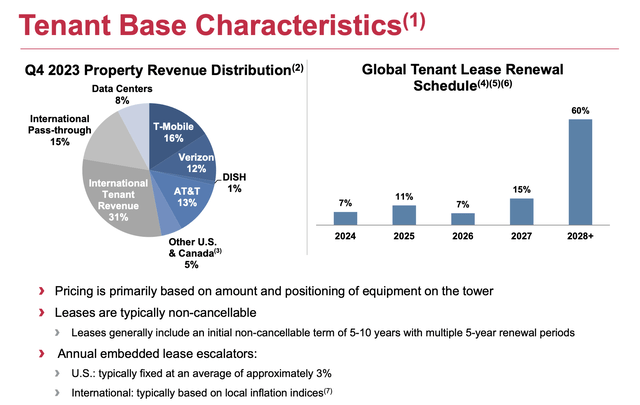

Roughly 41% of its revenue comes from the three telecom giants, T-Mobile (TMUS), Verizon (VZ), and AT&T (T), with 60% of total leases being due after 2028.

Most of these leases have 5-10-year terms with multiple 5-year renewal periods.

Lease escalators are roughly 3% in the United States, with international leases being tied to local CPI indices.

In other words, the company is protected against inflation soaring above the Fed’s 2% inflation target, although substantially higher inflation would limit its pricing power in the United States.

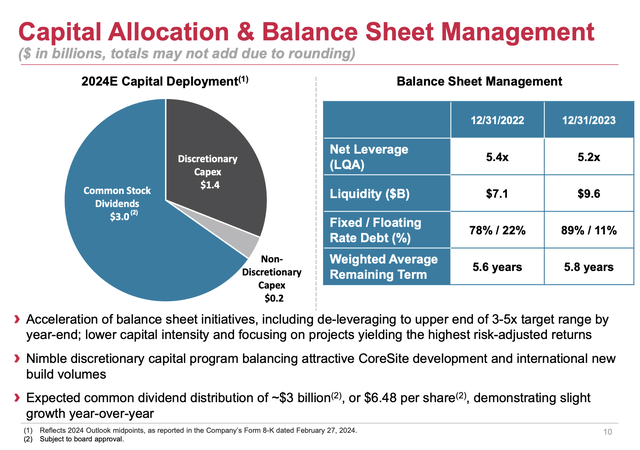

One of the things that AMT has been focusing on – besides growth – is debt reduction.

During the twelve months between 4Q22 and 4Q23, the company lowered its net leverage ratio by 0.2 points to 5.2x EBITDA, boosted liquidity to almost $10 billion, increased the percentage of fixed-rate debt to 89%, and increased the weighted average remaining term on its debt to 5.8 years.

As we are in an environment of elevated rates and sticky inflation, the healthier the balance sheet the better – as obvious as that may sound.

With that in mind, this is what the company said during its 4Q23 earnings call (emphasis added):

And as we look to 2024 and beyond, our capital allocation program is going to prioritize resiliency and flexibility in this evolving economic environment. Together with other strategic initiatives like reducing our overall capital intensity of executing on cost savings across the business, we’ll hold the dividend relatively flat in 2024, subject to board approval. – AMT 4Q23 Earnings Call

As we can see above, the company made the case that it will hold the dividend relatively flat.

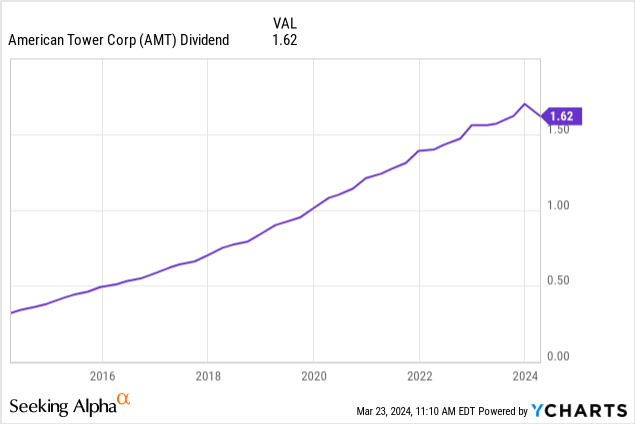

Roughly two months before the company’s 4Q23 earnings call, it hiked its dividend by 4.9% to $1.70 per share. That hike was already somewhat conservative, as its five-year dividend CAGR is 15.4%.

On March 15, the company announced a $1.62 per share dividend.

While this is officially a cut, it’s not a year-over-year cut, as it declared a $1.56 per share dividend in March 2023.

A $1.62 quarterly dividend translates to a yield of 3.4%.

Although I believe it looks extremely silly that the company hiked its dividend at the end of 2023 before it announced to aim for a consistent dividend, I’m not bothered by the fact that the company (briefly) lowered its dividend.

There’s Plenty Of Growth In American Tower

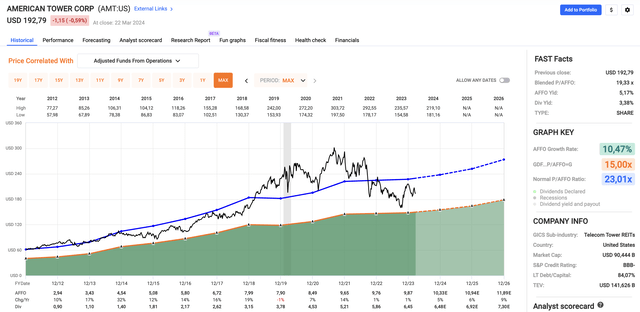

Usually, I show this chart at the end of my articles. However, given what we’re about to discuss next, I may as well show it now.

As we can see below, analysts expect the company to report accelerating AFFO (adjusted funds from operations) in the years ahead. While both 2022 and 2023 saw just 1% per-share AFFO growth, 2024 is expected to see 5% growth, potentially followed by 6% and 9% growth in 2025 and 2026, respectively.

These numbers also indicate a fair stock price close to $274 based on a normalized P/AFFO ratio of 23.0x. That’s 42% above the current price. The current consensus price target is $233.

Although I believe it requires lower rates to “unlock” a >20x AFFO multiple, the valuation of AMT shares continues to be good.

This also bodes very well for its dividend.

Why?

Because even based on a $1.62 per quarter dividend, it has a 2024E AFFO payout ratio of 63%.

That’s a very healthy payout ratio that will allow the company to grow the dividend in line with AFFO growth rates in the years ahead.

This is what the company said during this month’s Deutsche Bank Annual Media, Internet & Telecom Conference:

We look out over time and say REIT taxable income is likely to grow in line with AFFO and AFFO per share growth. Now, it doesn’t mean that every year that the growth rates of those two metrics will be the same. But if you look over a number of years, are they likely to be very similar? They are. That’s our view.

So that means when you look over a number of years, the average REIT — or the average dividend growth rate is probably going to be somewhere in the zip code of the AFFO growth rates.

Speaking of this conference, the company also discussed its future and expects organic tenant billings growth of around 4.7% in 2024, with a long-term target of roughly 5% in the U.S. tower market.

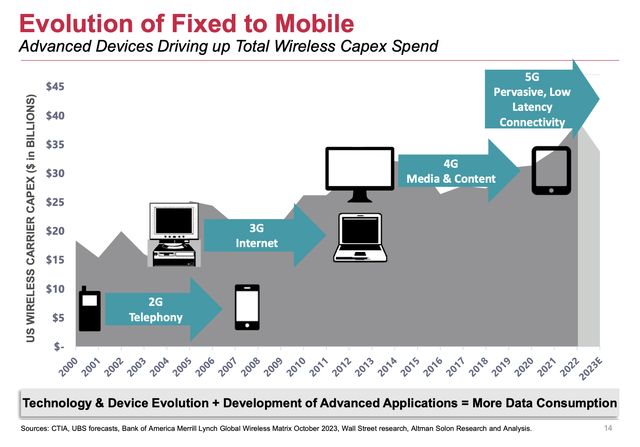

This growth is expected to be supported by continued investments in network infrastructure. Carriers are expected to spend more than $30 billion on network improvements, including 5G deployment and 4G expansion.

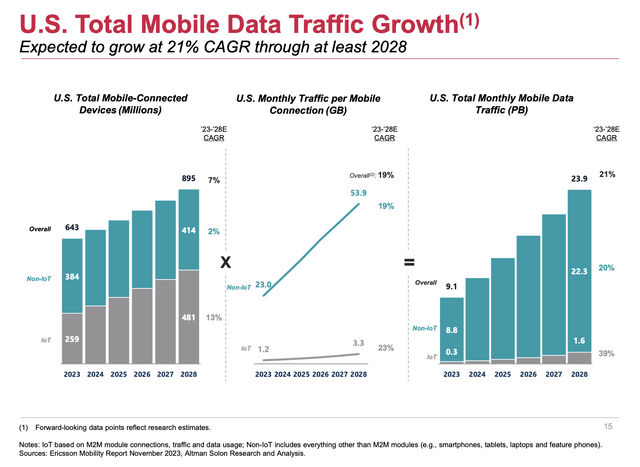

As we can see below, U.S. monthly traffic per mobile connection is expected to grow by 19% per year in the 2023-2028 period. Total monthly mobile data traffic is expected to grow by 21%, with 39% growth from IoT.

IoT stands for Internet of Things, which – to put it bluntly – refers to a network where “everything” is connected. This includes smart devices, autonomous cars, industrial sensors, and so much more.

In light of these ongoing trends, AMT’s massive portfolio of towers and infrastructure assets positions it as a critical supporter of this digital transformation.

Meanwhile, in Europe, the company closed major deals with companies like Drillisch 1&1 and Telefonica (TEF), which are giants in their markets.

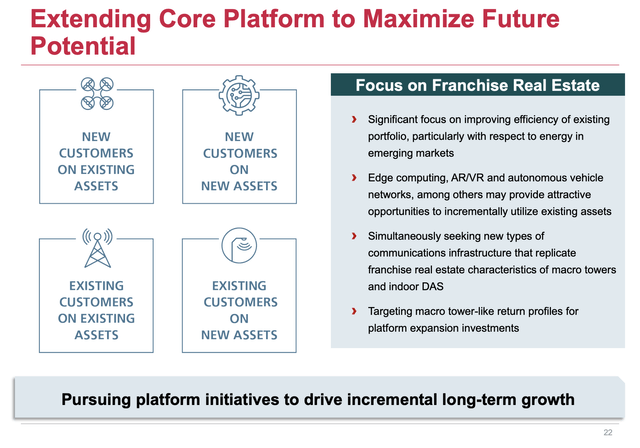

Moreover, the company’s acquisition of CoreSite exceeds expectations, thanks to its ability to host multiple cloud on-ramps and network providers.

As one can imagine, the rapid expansion of the digital economy and the increasing reliance on cloud computing infrastructure present significant opportunities for AMT.

So the reason we bought CoreSite is we see over time a convergence between wireline and wireless networks. And we think that owning an interconnection ecosystem, and I want to distinguish that from a colocation facility or hyperscale facility. Owning the interconnection environment is going to be critical to be able to monetize edge compute at the towers when it gets here. – Citi 2024 Global Property CEO Conference

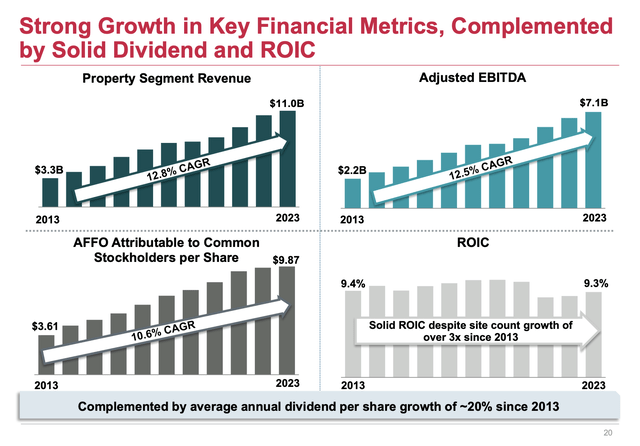

All things considered, the company remains in a fantastic spot to grow its business over time and should continue to benefit from a consistently elevated return on invested capital, which has fueled double-digit annual growth in revenues, EBITDA, and AFFO since 2013.

Hence, I expect that 2025 will see the return of dividend growth, likely in the mid-to-high single-digit range on a prolonged basis.

I also expect AMT to maintain elevated long-term returns, making it a good stock for a wide range of dividend investors.

Takeaway

American Tower’s recent dividend cut may raise eyebrows, but it’s not a cause for concern.

With a strong business model backed by a massive tower footprint and strategic partnerships, the company remains poised for growth.

Its focus on debt reduction and a resilient balance sheet in light of economic uncertainties is a smart move.

Meanwhile, analysts predict accelerating AFFO growth, indicating significant upside potential for the stock, backed by favorable secular growth trends.

Despite short-term uncertainty, AMT’s long-term outlook remains bright, with the potential for mid-to-high single-digit dividend growth in the coming years.

Pros & Cons

Pros:

- Resilient Infrastructure: With a large portfolio of towers and data centers, AMT is a major player in the telecom and IT sector.

- Stable Revenue Streams: Long-term leases with major telecom giants provide earnings visibility.

- Strategic Debt Reduction: AMT’s focus on debt reduction is a smart and necessary move in this environment.

- Future Growth Potential: Analysts expect accelerating growth, fueled by strong secular growth trends like IoT.

Cons:

- Dividend Adjustment: The recent dividend cut may raise concerns. However, while 2024 may not see dividend growth, the future of the dividend looks bright.

- Dependency on Telecom Giants: A significant part of revenue relies on contracts with telecom giants, potentially exposing AMT to their capital spending plans.

- Inflation Risks: Despite protections against inflation, sustained high inflation rates could limit AMT’s pricing power.