‘The Big Money Show’ co-host Brian Brenberg shows how inflation under President Biden has made life much more unaffordable for Americans on ‘Varney & Co.’

President Biden reacted to a report that showed inflation was higher than expected in February with a statement noting that prices are lower than a year ago – though not lower than when he assumed office.

A report released by the Labor Department on Tuesday said the consumer price index, a broad measure of the price of everyday goods including gasoline, groceries and rent, rose 0.4% in February from the previous month. It was a higher number than the 0.3% monthly increase recorded in January.

“My top economic priority is lowering costs and today’s report shows we continue to make progress on that front. Inflation is down two-thirds from its peak and annual core inflation is the lowest since May 2021,” Biden said in a statement, adding that wages have risen faster than prices since the pandemic.

“Prices for key household purchases like gas, milk, eggs, and appliances are lower than a year ago. Inflation is down while unemployment has remained below 4% for the longest stretch in more than 50 years,” Biden said.

INFLATION RAN HOTTER THAN EXPECTED IN FEBRUARY AS HIGH PRICES PERSIST

A customer shops in the meat department at a Costco store in Teterboro, New Jersey, on Feb. 28, 2024. Grocery prices have increased more than 21% since 2021. (Stephanie Keith/Bloomberg via Getty Images / Getty Images)

But what the president did not mention is that prices for common grocery items remain above what they were in January 2021, when he assumed office. A previous FOX Business report examined how inflation has driven up the cost of milk and eggs, according to data from the U.S. Bureau of Labor Statistics.

A similar analysis of the prices of butter, boneless chicken breasts, white bread and sugar likewise shows inflated prices compared to three years ago.

A stick of butter costs nearly $1 more per pound than when Biden entered office. In January 2021, butter cost an average $3.64 per pound but is now sold at $4.63 per pound as of February 2024, an increase of 27%.

The average price for butter per pound in January 2021 was $3.64 compared to $4.63 in February 2024. (Fox News / Fox News)

Boneless chicken breast has increased in price 26%, from $3.26 per pound in January 2021 to $4.11 per pound in February 2024.

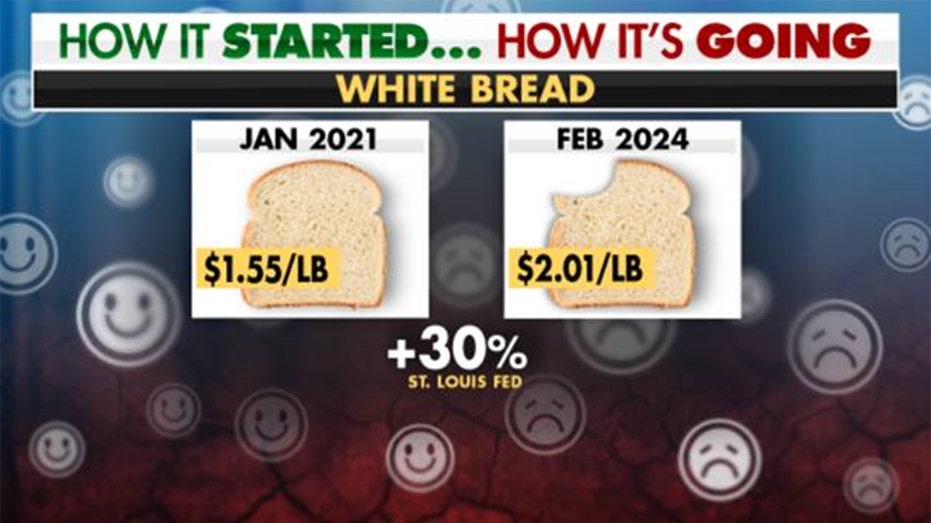

White bread per pound is 30% more expensive, up to $2.01 per pound in February vs. $1.55 per pound in January 2021.

And white sugar has increased cost per pound from $0.68 to $0.98 in the last three years, a 44% increase.

HOW IT STARTED … HOW IT’S GOING: PRICES OF EGGS, MILK, STEAK UP SINCE BIDEN TOOK OFFICE

The average price of boneless chicken breasts per pound was $3.26 in January 2021 and is now $4.11 in February 2024. (Fox News / Fox News)

Food prices are rising for several reasons, including ongoing supply chain issues, the smallest cattle inventory in 73 years, an avian flu outbreak that affected poultry supply and sent the cost of chicken and eggs skyrocketing, and a worldwide grain deficit that is the result of the prolonged conflict in Ukraine. Wages for food service workers in grocery stores, warehouses and processing plants have also increased, meaning many of those businesses are passing that cost along to the consumer.

February’s CPI numbers show housing and gasoline costs were the biggest drivers of inflation last month, accounting for 60% of the total monthly increase.

The average price of white bread per pound has increased from $1.55 in January 2021 to $2.01 in February 2024. (Fox News / Fox News)

Rent costs rose 0.4% for the month and are up 5.8% from the same time last year. Gasoline prices, meanwhile, surged 3.8% over the course of February. However, they remain down 3.9% when compared with the previous year.

Food prices were actually the silver lining in the inflation report, remaining unchanged from January. But groceries are still about 1% more expensive than they were at the same time last year, and overall grocery prices have surged more than 21% since the start of 2021.

Altogether, the report indicates that while inflation has fallen considerably from a peak of 9.1%, it remains above the Federal Reserve’s 2% target.

WHY ARE GROCERIES STILL SO EXPENSIVE?

The average price of white sugar was $0.68 per pound in January 2021 and has increased to $0.98 per pound as of February 2024. (Fox News / Fox News)

“What does the Federal Reserve take away from this? Mainly, it will be looking for more data given that it is already taken a March rate move off the table,” said Mark Hamrick, a senior economic analyst for Bankrate.

“Officials have said they can afford to be patient as they consider when and if to cut rates. They’d feel more comfortable about rate reductions if inflation were to be less sticky,” Hamrick said. “The slightly stronger than expected CPI doesn’t do much to add to their confidence, but they can still ponder the possibilities for May, June and July.”

The Federal Reserve has signaled it is closely watching the CPI report for evidence inflation is continuing to subside as policymakers try to determine what comes next for interest rates in 2024.

Persistently high grocery prices undermine the Biden administration’s claims of a booming economy. (Hannah Beier/Bloomberg via Getty Images / Getty Images)

Central bank officials have opened the door to cutting interest rates this year but indicated they will not do so until they are confident that inflation is conquered.

“The committee does not expect that it will be appropriate to reduce the target range until it has gained greater confidence that inflation is moving sustainably toward 2%,” Fed Chair Jerome Powell said last week while testifying on Capitol Hill.

Alfredo Ortiz, president and CEO of Job Creators Network, blamed Biden’s policies and Democrats’ “continued reckless spending” for persistent inflation.

GET FOX BUSINESS ON THE GO BY CLICKING HERE

“In contrast to Biden’s claim that he’s reduced the deficit, Democrats under his leadership have entrenched near $2 trillion annual deficits when the economy is supposedly running at full capacity. Ordinary Americans and small businesses are paying the price in terms of far higher costs on everyday items,” Ortiz said.

“Since inflation is rising faster than wages once again, living standards are also declining. This ongoing high inflation means that the Federal Reserve will likely have to delay interest rate cuts, making credit far more expensive and continuing the small business credit crunch. And today’s price increases are coming on top of the historic ones that have already occurred under Biden, exacerbating the cost-of-living increase felt by all Americans. The only inflation solution aside from a recession is to meaningfully cut government spending immediately.”

FOX Business’ Megan Henney contributed to this report.