- Government tweaks to council tax mean some homes will pay more, and sooner

- But those who inherit homes will get a year before being double-taxed

Owners of empty homes will pay double council tax after 12 months under Government plans – but grieving families will now get a year’s grace.

The Government is shaking up how council tax works to cut down on the number of second homes and those left empty for long periods.

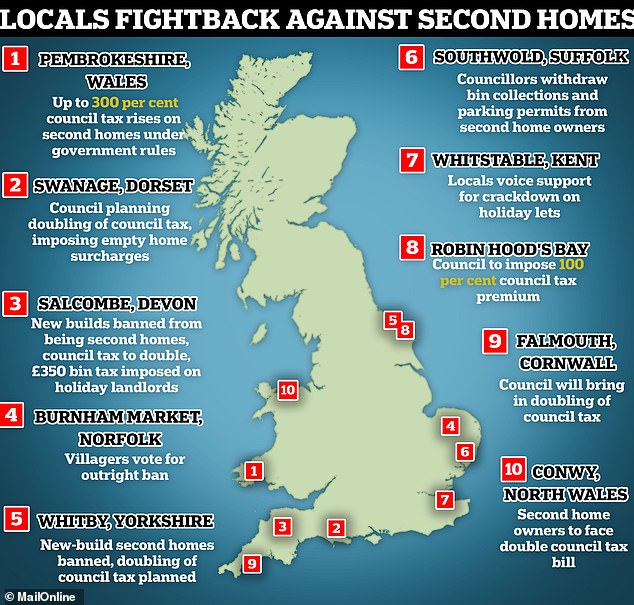

The issues of second homes and vacant properties have sparked anger in regions such as Devon, Cornwall, Norfolk and parts of Wales.

Many residents feel their regions are suffering from an influx of holiday homes that are empty for much of the year, hollowing out communities and causing house prices to rise.

The Department for Levelling Up, Housing and Communities (DLUHC) has now announced tweaks to the second homes council tax premium, which lets local authorities double this tax on eligible homes.

The DHLUC said it would allow councils to charge double council tax on properties after 12 months of being empty, down from two years currently.

But it will also remove inherited properties from double council tax for as much as 12 months, to be kinder to grieving families

The strengthened empty homes premium will come into effect from April 2024.

However, each council must wait at least a year before bringing the extra charges in, so the earliest it will happen is April 2025. The exemption for inherited properties will also apply from April 2025.

The extra money raised will go to local authorities, who can spend it as they like. The changes will only apply in England.

Long-term empty properties are shutting local families and young people out of the housing market

Simon Hoare, Local government minister

The second home premium already applies, having been made law in October 2023 with the passing of the Levelling Up and Regeneration Act.

But the Government wanted to fine tune the rules and canvass opinion, so consulted on the issue too.

The Government response to its consultation said: ‘Large numbers of empty homes can contribute to housing supply pressures, whilst also reducing the desirability of local areas.

‘Second homes can provide flexibility to enable people to work in and contribute to the local community, whilst being able to return to a family home in another part of the country on a regular basis.

‘However, large concentrations of second homes reduce the size of the permanent population, which can lead to local services becoming unsustainable.’

Local government minister Simon Hoare added: ‘Long term empty properties are shutting local families and young people out of the housing market as they are being denied the opportunity to rent or buy in their own community.

‘So, we are taking action as part of our long-term plan for housing. That means delivering more of the right homes in the right places and giving councils more powers to help give local people the homes they need.’

Almost all local authorities are planning to increase their council tax by 4.99 per cent from April 2024.

The Government also abolished tax perks for properties rented as holiday homes in the recent Budget, claiming that the measure would help those seeking affordable properties to rent and buy.