Strata sales at Bosa Waterfront Centre buoyed Vancouver’s office market last year

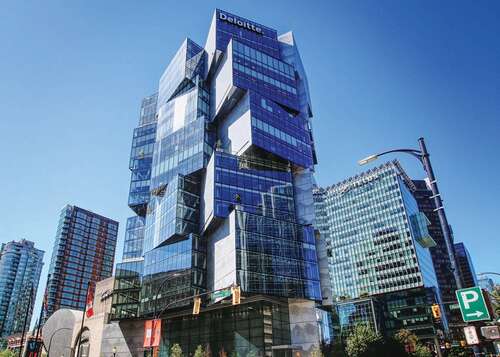

This week’s valuation of 400 West Georgia Street at $395 million as Allied Properties REIT boosts its stake in the distinctive 24-storey office tower by Westbank Projects Corp. is the first in a string of deals that gives insight into the worth of the city’s office market following the pandemic.

Kittycorner to the Post at 325 West Georgia, where Amazon is in the process of occupying 1.1 million square feet, Allied’s valuation of 400 West Georgia works out to approximately $1,125 per square foot. The project includes 345,034 square feet of office space and 5,525 square feet of retail.

The data is important.

The past year saw a dearth of office sales as high interest rates kept buyers on the sidelines. Overall investment sales in Vancouver were down 48 per cent versus a year earlier, at $7 billion, according to Colliers International, with much of the activity focused on industrial assets and residential development sites. (Colliers draws its data from Altus Group, which tracks transactions $1 million and up.)

The aggregate value of industrial deals approached $2 billion while residential land sales totalled $1.7 billion, Colliers reported.

Office deals, by contrast, totalled $512 million. The few that take place were largely closings at Bosa Waterfront Centre, which broke pricing records the project presold Nov. 3-5, 2017. Those deals continued to set benchmarks when the deals closed last year.

“A lot of the transactions that we saw for 2023 were the closings of the initial presales,” said Susan Thompson.

Presale prices reached upwards of $2,100 a square foot in 2017, prices confirmed at closing last year with $2,250 per square foot for Unit 1710 and $2,128 for unit 1210. Units that returned to the market last year underscored the strength of pricing, listing above $2,100 a square foot and remaining above $2,000 even when a slow market demanded concessions from the most motivated of sellers.

“It sets that high watermark, that new high threshold for price per square foot for strata office,” Thompson said. “The high interest rate environment has stalled out a lot of purchase activity, so these were quite significant in the market because there were so few other deals in the marketplace.”

This year should see more deals come to completion, giving the market additional data with which to value assets. This will help give buyers confidence in negotiating price, which, combined with greater stability in interest rates and even declines, will support investor activity.

The next properties set to give the market a read on value are 402 Dunsmuir Street and 401 West Georgia Street, just opposite The Stack. While a price has been reported in the media, those close to the deal discounted the reports pending an official announcement in the coming weeks.

Those deals will set the stage for what’s to come.

“There’s no more expectations that there’s going to be additional rate hikes, so that’s allowing the business confidence to come up and allowing some investors to contemplate coming off the sidelines,” Thompson said. “All the elements are starting to be there that activity’s starting to pick up. It just hasn’t played out into the numbers we can track yet.”

On a national basis, the decline in transaction activity in Vancouver was multiples of what was seen in Calgary and Edmonton, the two other markets Colliers surveyed in Western Canada. Calgary saw sales decline eight per cent, while sales in Edmonton declined five per cent.

Both markets were hit hard by the downturn in oil prices in 2015, meaning they had already experienced the pause in investment Vancouver saw last year.

Now, however, markets are set to rebound.

A recent report on the investment outlook from CBRE Ltd. indicates foreign investment, which lent resilience to real estate investment activity in 2023, will support a five per cent increase in transaction value this year. CBRE forecasts total volume of $52 billion.

“Mid-sized investment deals, which had been more muted in 2023, will rebound and drive transaction activity in 2024,” CBRE added.

Colliers shares the optimism regarding foreign investment, noting that Canada is a stable, growth-oriented market in a world beset by upheavals.

“Strong fundamentals underpin the investment market, including record-high population growth, a strong labour market, and above-inflation rent growth for many assets,” Colliers reported. “Canada remains attractive to international investors, who value the combination of political stability, a lower Canadian dollar, and outperformance in certain assets like industrial and housing.”