temizyurek

An analysis of the iron ore miner Rio Tinto (NYSE:RIO) is a very good example right now of just how much things can change in just a quarter to alter perspective on it. When I wrote about it the last time, in December 2023, there were clear signs that its price was due for a correction, prompting me to change my rating on it from Buy to Hold. And indeed, the correction has happened, with a 9% fall in its price since.

But this price fall has also been accompanied by changes in its fundamentals. Here I assess them in some detail to see what they mean for its rating.

A look back

To understand better where it’s at right now, first, here is a quick look back at where it was a quarter ago. More specifically, the reasons why I went with a Hold rating:

- The company had reduced its dividends by 34% when it released its first half (H1 2023) results on falling earnings. Softer commodity prices, particularly for iron ore, which contributed ~84% to the company’s underlying EBITDA in 2023, led to a 43% year-on-year (YoY) decline in net attributable profits.

- While iron ore prices had seen an uptick in H2 2023 on the possibility of improved demand from China and potentially reduced sales from BHP (BHP) due to the likelihood of industrial action, the reasons were not strong enough to indicate a sustained price rise. China’s economy was still at risk of weakening, evident from the fact that the government was stepping in with a fiscal stimulus. Also, BHP recently made an agreement with the workers’ union.

- The stock’s trailing twelve months [TTM] and forward price-to-earnings (P/E) ratios were both higher than the average levels for the past years, indicating that a correction was likely at a time of uncertain fundamentals.

Since then, there have been largely positive developments that have impacted the stock and can do so going forward as well. Here, I assess how their balance is likely to play out for Rio Tinto in the future.

Some improvement in full-year results

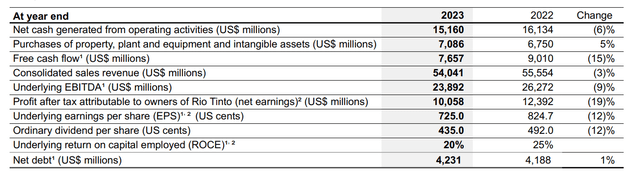

The pickup in iron ore prices in H2 2023 worked well for the company, with net sales revenue up by 6.2% YoY during this time after a 10.4% contraction in H1 2023. But the real highlight was the 43.3% increase in net attributable income after a 42.8% decline in H1 2023.

While the full-year numbers were still impacted by a challenged H1 2023, the extent of decline reduced significantly. Net sales revenue fell to 3% and net attributable earnings fell by 19%.

Key Financials (Source: Rio Tinto)

The dividend yield looks good

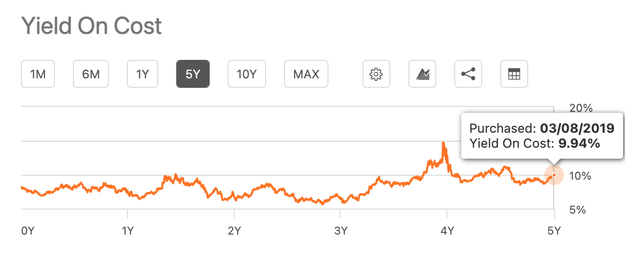

With weaker earnings, the company also cut its dividends by ~12% during the year to USD 4.35. But here too, the extent of the cut declined from 34% in H1 2023. This results in a TTM dividend yield of 6.94%. Further, despite dividend cuts for the past two years straight, the yield on cost for investors who have held the stock for the past five years is robust at almost 10%. In other words, it’s still a good dividend stock to consider buying.

Iron ore price forecasts positive for Rio Tinto

It’s disappointing though, that the iron ore price uptick has reversed YTD, resulting in a 17% decline in price since the start of 2024. However, it may still turn out to be positive for Rio Tinto. Here’s why.

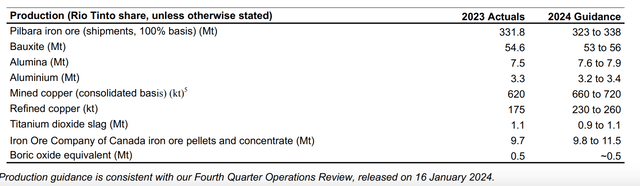

Last year, its realised iron ore price was already up 2% YoY to USD 108.4 per dry metric tonne. While the exact realised price can differ based on the category of the iron price most relevant to it, in general, the present iron ore price of USD 118 per tonne is still higher than that level. Further, ING forecasts that prices will stay at around these levels through the year, with their average for 2024 at USD 120 per tonne. This can reinforce the company’s financials positively, since it expects a broadly similar iron ore production compared with last year (see table below).

While the potential for demand from China remains somewhat uncertain in the year ahead, going by the government’s slightly reduced forecasts for growth this year and weakness in other big markets too (see discussion on ‘Macros indicate it’s not out of the woods yet’ of the link), how far the prices are impacted from here remains to be seen.

Market multiples moderate

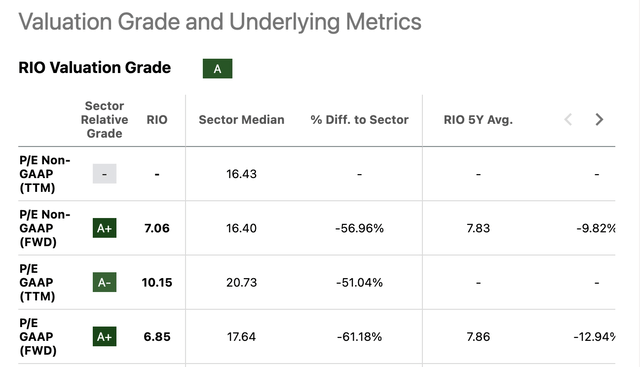

The stock’s market multiples have also moderated significantly since I last checked. The GAAP TTM P/E is now at 10.15x, which is below its past decade’s ratio of 11x and much lower than the 13.5x it was when I checked last. Also, the GAAP forward P/E at 6.85x is lower than the five-year average of 7.86x and also the past decade’s average of 8.53x. The ratios are also significantly lower than the median levels for the materials sector (see table below).

What next?

The key takeaway from the discussion is that Rio Tinto is much better placed now than it was a quarter ago. Not only did its earnings show a sharp improvement in H2 2023, but the company’s dividend yield looks good too despite a dividend cut for the past two years. Iron ore price forecasts also look positive and can buoy the company’s revenues and earnings in the year ahead. The price correction in the meantime has contributed to more attractive market multiples.

There are still risks stemming from the global macro conditions, particularly in China. While there are no alarm bells yet, it needs to be watched carefully to assess how they can impact Rio Tinto. However, with the insight available right now, it looks like the company will see a better 2024 than 2023. I’m upgrading the stock to Buy again, but for investors looking for capital gains, the rating is subject to change if the macro picture evolves less favourably. For medium-to-long-term income investors, the developments going ahead in this year can impact the returns less meaningfully.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.