C3.ai (AI -0.22%) started last year red hot as a top growth stock thanks to surging interest in artificial intelligence (AI). Not only did the company have a ticker symbol to go along with the hot trend, but it’s also a provider of AI solutions, making it a prime target for growth investors.

But toward the latter half of the year, the excitement surrounding C3.ai stock cooled significantly. During the last six months of 2023, the stock fell 21% as investors grew worried about whether the company would actually benefit from an uptick in demand for AI products and services, as its results weren’t all that impressive.

C3.ai recently posted its fiscal 2024 third-quarter numbers, which restored investors’ confidence with the AI stock jumping following the earnings release. Is this just the start of a much bigger rally for C3.ai? Did the company prove the short-sellers betting on its drop wrong with its latest results?

C3.ai’s revenue rose by 18% in Q3

The company beat its guidance for Q3 (ended Jan. 31) with revenue totaling $78.4 million. That figure was up 18% year over year.

CEO Thomas Siebel credits the company’s “significant first-mover advantage in enterprise AI” as a key reason the business has been doing well. The company says customer engagement rose by 80% compared to the previous year. Customer engagement includes things such as distinct product applications and unique customer contacts.

The company expects revenue to potentially reach $86 million next quarter

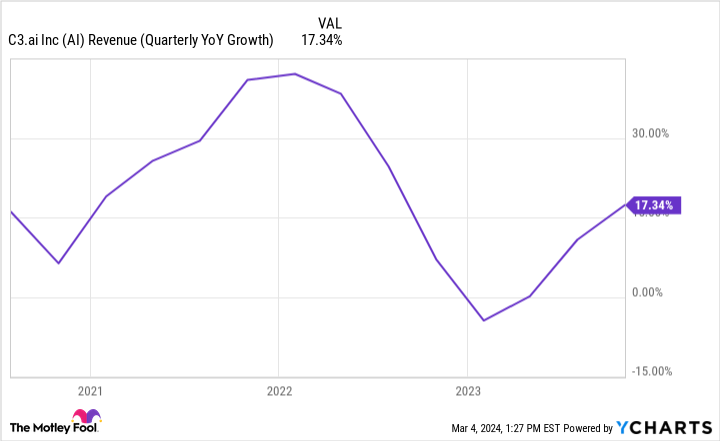

For the last quarter of fiscal 2024, C3.ai expects revenue to land between $82 million and $86 million. At the midpoint, that would imply a year-over-year growth rate of 16%. The company’s growth rate has been improving in recent quarters, but it’s a far cry from where it was a couple of years ago.

Data by YCharts.

Investors shouldn’t expect profitability anytime soon

The business still expects to be unprofitable with management projecting its adjusted operating loss to be between $43.5 million and $51.5 million in the fourth quarter. A lack of profitability is another reason investors have been wary of the stock as C3.ai has been investing heavily into AI, which has made breakeven no longer a realistic possibility.

Previously, the company was expecting to achieve profitability on an adjusted earnings basis by the end of the current fiscal year. Now, it’s projecting an adjusted operating loss for fiscal 2024 of $115 million to $123 million.

The hope is that with a larger customer base, it may be more likely for C3.ai to report a profit in the future. But for now, profitability no longer appears to be a key priority for the business as it aggressively pursues growth opportunities, and thus expenditures are likely to be high for the foreseeable future.

Is C3.ai stock a better buy today?

C3.ai only beat its fiscal Q3 guidance slightly, and the company’s growth rate doesn’t appear impressive enough to warrant the stock trading at a price-to-sales multiple of 12. And with no profitability in sight, the company hasn’t done anything significant to suggest it’s a less risky stock than before. It surely hasn’t proven the short-sellers wrong, at least not yet — as a percentage of float, short interest remains high at 37%.

I’d keep C3.ai on a watchlist, but as an investment, it’s still a bit too risky to buy right now. There are better AI stocks out there for investors to consider instead.