andresr

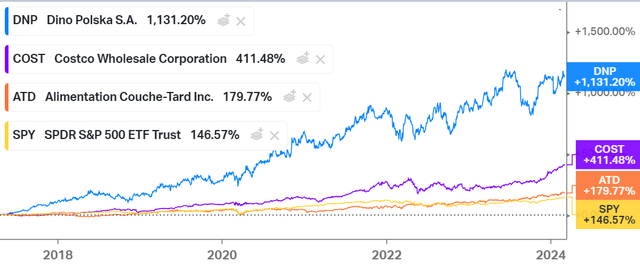

Founded in 1999 by Tomasz Biernacki (current CEO at just 50 years old), Dino Polska (OTCPK:DNOPY) is the fastest-growing Polish retailer in the country. The business model has several peculiarities that set it apart from the competition. With a market capitalization of PLN 45.27 billion, it is a company with significant expansion potential, operating in a low-disruption business model executed very effectively. Since its IPO in 2017, Dino Polska has delivered a total shareholder return of 1131%, outperforming major competitors in the same sector (though not necessarily in the same market).

Business Model

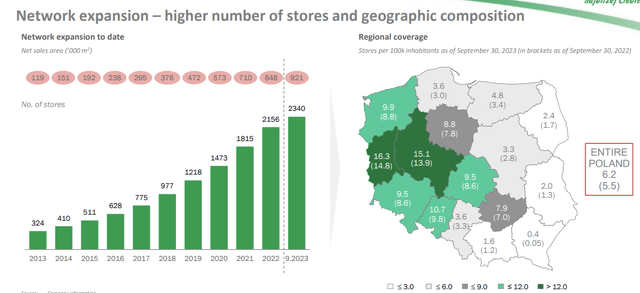

Dino is a chain of supermarkets operating in rural areas of Western Poland, but with ample room for expansion throughout the country. It is characterized by its low-priced and fresh products (over 40% of the sales). According to its latest earnings presentation (slide 4), the company operates 2,340 supermarkets (compared to the 775 it had at the time of its IPO). These supermarkets all have the same format, around 400 m2 in size, offering about 5,000 products, with small parking lots, located in rural areas, conveniently situated for walking access. Dino also owns the logistics centers that serve an average of 350-400 supermarkets each. As mentioned, the company stands out for its wide range of fresh meat and sausage products, facilitated by the acquisition of Agro-Rydzyna. Dino has never had to close any store.

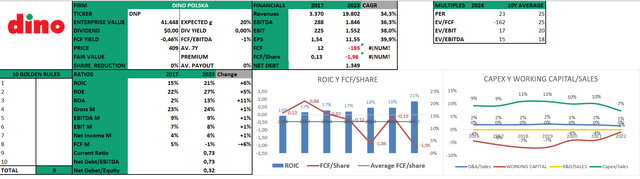

Dino Polska also owns almost all of its stores, in addition to owning the company that manufactures them, Krot Invest Kr Inżynieria Sp. It also purchases, rather than leases, the land on which they are built. We can say that Dino Polska is fully vertically integrated, and all of this is achieved with minimal debt (it has a Net Debt/EBITDA ratio of 0.73). It is a company designed and built to endure over time, providing significant scale and cost advantages, as well as agility in constructing its standardized locations.

Source: DINO POLSKA S.A. 3Q 2023

Since Dino purchases the land and owns the stores, the initial capital expenditures for opening new supermarkets tends to be high. Stores typically break even by the third year. Looking at Dino’s annual CAPEX as a percentage of sales, historically it has been around 10% of sales, but in 2022 it decreased to 7%. This could indicate a potential slowdown in Dino’s store expansion pace. So far, it has achieved a Compound Annual Growth Rate of 23%. Once the store is built, the maintenance cost is low (the company’s Depreciation and Amortization expenses represent only 1%-2% of sales).

Competitive Advantages

Despite the simplicity of its business model, Dino has several competitive advantages.

Cost Advantage: Being vertically integrated and owning some of its major suppliers, as well as the construction company for its stores and distribution centers, means that initial investments are high, but in the long run, they offset costs. Moreover, it makes Dino the owner of valuable locations that appreciate over time.

Regional Monopolies: Dino’s presence in areas with around 5000 inhabitants often makes it the sole competitor, as other businesses may find it economically unviable to operate profitably. Furthermore, Dino is known for its consistently low pricing strategy while still achieving growth rates above inflation. These regional scale advantages, coupled with competitive pricing, often deter potential competitors from entering the market.

Ownership of assets: This provides several advantages compared to leasing. For instance, flexibility in selecting locations, speed in commencing construction, avoidance of rental payments that may increase over time, ownership of valuable land, consistent construction of the same store format, streamlining construction processes, familiarizing customers with any of their locations, and lastly, lower maintenance costs for their premises.

Brand Power: Dino is associated with low prices, convenient locations, and fresh products. Poland is a country where much of the population still resides in outside the cities, and purchasing habits often involve buying fresh products several times a week. Dino has managed to carve out a space in the minds of its consumers, fostering loyalty and building lasting relationships with them.

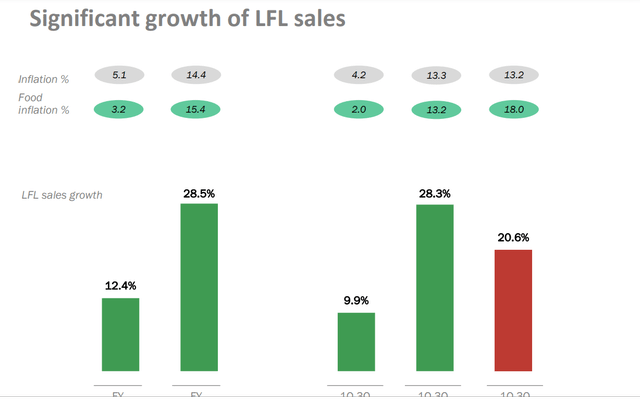

Pricing Power: Dino has consistently been able to maintain prices above the inflation rate. It is expected that these high growth rates (34% sales CAGR) may decrease if inflation rates in the country also decline.

Source: DINO POLSKA S.A. 3Q 2023. Slide 6

Capital Allocation

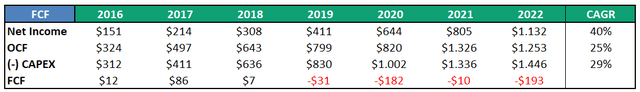

Dino Polska’s capital allocation is simple. It does not distribute dividends, it does not buy back shares and it does not make large acquisitions. All Operating Cash Flow goes to Capital Expenditures, which is why its Free Cash Flow is usually negative, compared to its positive Net Income. These capital expenditures are used to purchase land and open new stores. If we want to see how the business is evolving, we must look at the Operating Cash Flow or the Net Income, as the Free Cash Flow may lead us to the wrong conclusions.

Source: Author’s representation

Expected Growth

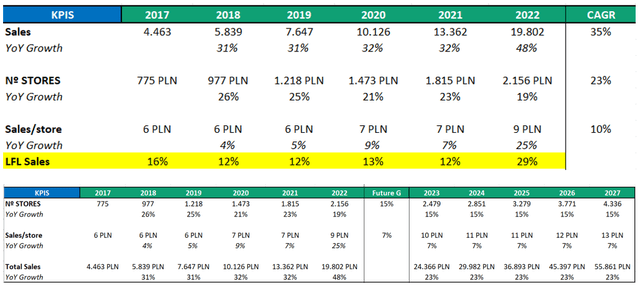

Once we know Dino’s strategy, it is possible to create a model to estimate its growth. First, let’s try to estimate sales. Over the past 6 years, Dino’s sales have increased at a 35% CAGR, thanks to a 23% increase in the number of stores and a 10% increase in sales per store. My estimates are that this growth rate decreases in both parameters. The number of stores drops to 15% CAGR and sales per store drops to 7% CAGR, due to a drop in inflation in Poland. With this, I believe Dino may be able to increase its sales by 23% over the next 5 years.

Source: Author’s representation

On the other hand, if we have that Dino is reinvesting 100% of its OCF annually, at ROICs of approximately 20%, we can have growth rates of 20% in the top line. This can be seen increasing due to the little operating leverage that the company enjoys, or because many of the stores opened in the last 3 years are going to begin to generate positive profits, so Dino’s margins and returns should increase.

Management

The CEO and founder of Dino Polska is Mr. Biernacki. He still owns 51% of the shares, after selling 49% of the company to a private equity firm in 2010, to raise capital and continue the expansion of his stores. In 2017, this private equity took Dino Polska public without issuing new shares. Mr. Biernacki is still 50 years old, which is why he founded Dino at the young age of 26. His business vision is long term, focused on business expansion and growth, as well as cost management and good customer treatment. There is not much public information about him but is completely aligned with shareholders.

Financials

Dino Polska’s Financials are very attractive despite the simplicity of the business. The growth rates in its main figures in the last 6 years have all been greater than 30%. As we have said, despite owning and operating the entire construction and operation process of its supermarkets, the debt ratios are very low (0.73 Net Debt/EBITDA). Nor has it issued shares to finance itself, which means that the growth of the business comes all from the cash it generates.

Another very positive point is the evolution of its returns and margins, which in my opinion, still have room to improve, since in the last 3 years, Dino has opened more than a thousand stores that will begin to generate positive profits very soon. In fact, if we think that the growth rate of Dino’s store openings is going to decrease and that it is also going to have more stores generating profits, it is possible that not all the cash will end up being allocated to Capex and there will be some left to distribute a dividend among the shareholders. Although, at the moment, the strategy has not been this, it is an optionality that the business has.

Source: Author’s representation

Valuation

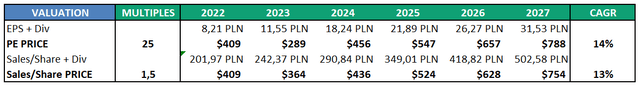

With the aforementioned growth rates and using figures from 2022, because those from 2023 are not yet official, so I am being more conservative in the valuation, I am projecting the EPS and sales per share of Dino. I am going to apply a PE multiple of 25x and a Price to Sales of 1.5x respectively. The expected growth in this conservative scenario, in my opinion, is 13%-14%, which I consider attractive returns with room to be higher. That is why I rate Dino as a buy.

The reason for applying these multiples is because the 10-year averages of both figures have been 29X and 1.7X. If we believe that Dino may decrease its growth rates slightly over the next few years and in order to be conservative with our valuation, I consider that these two multiples provide a good balance between margin of safety and attractive returns over the coming years. So, in the event that the market decides to assign higher multiples, we will still capture even more profitability.

Source: Author’s representation

Risks

Taking into account that it operates in a market niche with little technological disruption, offering a significant value proposition for the customer, boasting strong competitive advantages, and being capable of passing cost inflation increases onto higher prices, perhaps the company’s greatest risk lies in key personnel.

As we have already discussed, Dino’s CEO is its founder and has been responsible for evolving the company to its current state. While he is still 50 years old and heavily involved in the company’s day-to-day operations, a change in leadership could entail a shift in business strategy and its consequent performance. Although nothing has been mentioned regarding this matter and he still has many years until retirement, I consider this risk to be the greatest for Dino.

Conclusion

It must be taken into account that these growths are only projected until 2027, but I believe that Dino has many decades of expansion in Poland and who knows if in neighboring countries. It seems to me that Dino Polska is an attractive option for any long-term investor, since it combines great growth with a fairly secure business that will continue to exist for many years, so the ability to compound capital in it is very high.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.