vzphotos

There’s no sugarcoating the fact that AbbVie (NYSE:ABBV), the biggest healthcare stock by market capitalisation after Eli Lilly and Company (LLY), has seen dismal full-year results for 2023 last month with a 6.4% decline in revenue and a huge 59% drop in reported earnings per share [EPS].

Still, its price is on the up and up. Year-to-date [YTD], its price has risen by over 15%. To contextualise, the S&P 500 Health Care Index is up by less than half this at 7.1%. With this disconnect between fundamentals and price movements, here, I take a closer look at both what’s making the stock tick and what’s next for it in 2024 and beyond.

Revenues ex-Humira still strong

Patent expiration can be a challenging affair for pharmaceuticals, as I noted in my recent article on Bristol Myers Squibb (BMY) which had the experience recently with its cancer treatment Revlimid resulting in a more than halving of its share in revenues and a revenue contraction in 2023.

The same is true for AbbVie which lost patent protection for its immunosuppressant drug Humira, which has been estimated to be the “highest-grossing drug in the world”. As a result, revenues from the drug declined by 32.2% and its share in revenues declined by ~10 percentage points to 26.5% in the year.

However, revenues ex-Humira still grew by 8.4%, which is faster than AbbVie’s three-year compounded annual growth rate [CAGR] of 5.9% and is faster than the 3.3% reported revenue growth seen in 2022.

Skyrizi and Rinvoq save the day

Specifically, other drugs in its immunology portfolio, which brings in almost half its revenues, are doing well. Together, the other two drugs, the multi-disease treatment Skyrizi and arthritis treatment Rinvoq, saw a 52.6% increase in 2023.

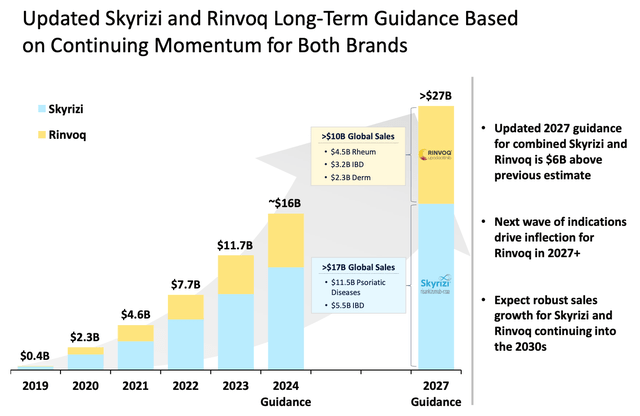

Moreover, AbbVie has upgraded its medium-to-long-term forecasts for both as well by USD 6 billion (see chart below). After continued expected strength in 2024 with growth expectations of 36.8%, the company now sees a CAGR of 23.3% up to 2027, if not more. This is up from the earlier expectation of a 15.7% CAGR.

Notable growth in neuroscience

Besides immunology, the neuroscience division is promising too. It’s the second biggest revenue generator for AbbVie, with a 14% share in total revenue that has grown by three percentage points from 2022 on its healthy 18% growth in 2023, up from 10.1% in 2022. Specifically, progress for the antidepressant Vraylar is notable. The acceleration in its growth to 35.4% (2022: 17.9%), making it the biggest contributor to neuroscience revenues, pipping Botox Therapeutic to it this year.

The company is also growing the division inorganically, with its recent acquisition of Cerevel Therapeutics (CERE), which focuses on psychological conditions like schizophrenia and mood disorders. While Cerevel isn’t revenue generating at present, AbbVie expects it to add to earnings from 2030 onwards, indicating its long-term plans for the fast-growing neuroscience segment.

Adjusted diluted EPS expected to stabilise in 2024

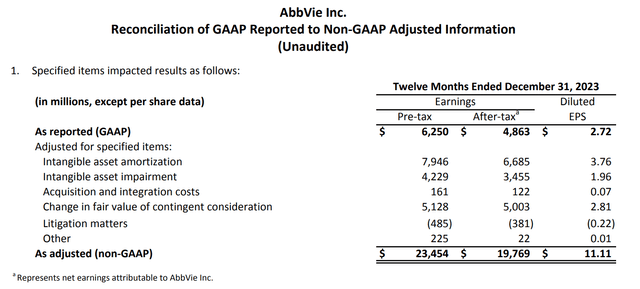

Next, while the reported EPS has been particularly hard hit by the revenue contraction this year, the adjusted diluted EPS is far less impacted, declining by 19%. This is because other drags on the reported figure like high amortisation, and impairment charges didn’t factor into its calculation (see chart below, see Section 1 on Page 12 of the results link provided above for more details on the charges).

Moving into 2024, the company expects to see a minor increase of 0.4% in adjusted diluted EPS if it comes in at the midpoint of the guidance range of USD 11.05-11.25. Moreover, with improved revenue growth expected particularly from 2025 onwards, discussed next, the EPS can conceivably rise as well.

Long-term growth looks good

Besides the fact that revenue growth can see a fillip in 2024 as the high base effect due to Humira seen in 2023 wears off, the medium-to-long-term outlook also looks good as evident in the following statement:

2024 is an exciting year for AbbVie, as we are well positioned to fully absorb Humira erosion and achieve modest operational revenue growth, followed by a return to robust growth in 2025 and a high single-digit CAGR through the end of the decade.”

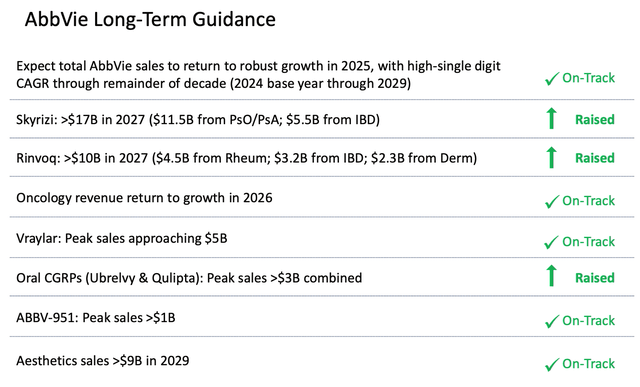

Besides the expectation of improved revenues from its immunology and neuroscience, the company expects growth in oncology and aesthetics segments as well (see chart below), which is particularly good news as both of them saw revenue contraction in 2023 (see Page 8 of results link provided above for details).

Forward non-GAAP P/E lower than the sector average

With the guidance provided, the forward non-GAAP P/E at 16x is higher than its five-year average of 10.7x. However, it is still lower than the median for the healthcare sector at 19.7x. As growth improves this year and in the years after, which is likely to be followed by EPS growth as well, I reckon there’s room for AbbVie to rise going forward despite what its past averages indicate.

Further, its dividends continue to look good. Not only does the trailing twelve-month dividend yield of 3.35% exceed the average for the healthcare sector at 1.5%, but the company has grown dividends every year over the past decade. These dividends have contributed 178 percentage points to its total returns of 427% over this time.

What next?

The key takeaway here is that AbbVie’s poor financial year needs to be seen in the context of Humira’s patent expiration. Revenues ex-Humira have seen good growth and even with the setback, the adjusted diluted EPS has declined far less than the reported number.

2024 is expected to be a better year for the company, and the performance of its immunology drugs and neuroscience segment is particularly promising. Over the longer term too, the company’s outlook is good, which can show up in earnings growth as well. For this reason, despite the non-GAAP forward P/E being higher than its past average, the stock still looks good, especially with its past dividend growth and dividend yield. I’m going with a Buy rating.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.