Serjio74/iStock via Getty Images

Three Small News Items

First, we should begin with three small news items on NewtekOne before we dive into the analysis. All of these pieces are small positive pieces worth noting in any update on NewtekOne (NASDAQ:NEWT).

Partnership With 1-800Accountant

NewtekOne partnered with 1-800Accountant on Nov 29, 2023 to offer accounting services to NewtekOne’s clients. This would be adding another functionality to the Newtek Advantage, adding more stickiness to NewtekOne’s business customer base. From a qualitative standpoint this is excellent for NewtekOne: on average, 1-800Accountant has been able to save the typical small business client 20-50% on their accounting costs.

SBA Loan Growth (Business As Usual)

2023 was another year of loan growth across the SBA loan products. NewtekOne ended 2023 with a record $262.9M of closed 7(a) loans in Q4, which is a 20.6% increase over the same quarter the previous year. 2023 saw a total of $828.1M of closed 7(a) loans while 2022 saw a total of $771.9M closed. In total in 2023, NewtekOne closed a total of $1.1B of loans.

For Q1 2024, Newtek Bank expects to close $175-200M of 7(a) loans, the midpoint of which would be a 23% increase over the $152.5M of 7(a) loans from Q1 2023. A more recent press release stated that the total loan pipeline at NewtekOne from Jan 2023 to Jan 2024 reached $1.4B, up from $1.1B the year before.

Loans are the lifeblood of a bank, and so we should be happy to see that despite the disruption of the transition from the BDC to bank, as well as associated share price gyrations, the bread-and-butter core of the business has been stable and growing.

S&P Ratings Raised On 2018-1 and 2019-1 Securitization Notes

On Jan 18 2024, S&P Global raised its ratings on the Class A notes and Class B notes on NewtekOne’s 2018-1 and 2019-1 securitization notes from A to A+, and BBB- to BBB respectively. While this shouldn’t materially affect the market valuation of NewtekOne, it is a vote of confidence on Newtek’s loan underwriting.

These securitization trusts contain the vintages most likely to be impacted by the COVID crisis, and despite the crisis, the ratings have been improved. This has a secondary effect that the corresponding equity portion of the securitizations that Newtek keeps can be considered to have become slightly safer.

With these three miscellaneous news items out of the way, let’s dig into the Q4 2023 transcript and presentation.

First, let’s note that earnings for Q4 2023 were 53 cents/share; with full year 2023 earnings at $1.70/diluted common share. This falls squarely at the midpoint of the original guidance for 2023 of earnings of $1.60-1.80/share.

Q4 2023 Transcript & Presentation

Newtek Bank Efficiency Ratio

2023 was a transition period for the swap from BDC to bank model, and so too will 2024. The success of this ongoing transition period may be judged by the efficiency ratio of Newtek Bank. Here are the quarterly figures:

| Efficiency Ratio (Newtek Bank) | |

| Q1 2023 | 114.6% |

| Q2 2023 | 53.1% |

| Q3 2023 | 40.3% |

| Q4 2023 | 34.4% |

I would personally expect the efficiency ratio of Newtek Bank itself to ultimately be in the 20s range. This is because of how efficiency ratio is calculated: non-interest expenses / revenue. Because the loan book at NewtekOne generally generally yields about prime + 3.0% and not the typical home mortgage / auto loan, this means that net interest margin is unusually large, theoretically at around 6.0%, and so the denominator for this calculation is quite large.

The real number that is a determinant of share price is the efficiency ratio of the organization as a whole: this has lagged behind relative to the figures for Newtek Bank:

| Efficiency Ratio (NewtekOne) | |

| Q1 2023 | 82.8% |

| Q2 2023 | 75.6% |

| Q3 2023 | 63.8% |

| Q4 2023 | 61.2% |

Typical efficiency ratios for banks in general are about 50%. However, Newtek’s model is simply unique, and this eventually should be reflected in its efficiency ratio as Newtek Bank grows more and more. The efficiency ratio for NewtekOne as a whole though is less satisfactory, hovering around 70% right now for 2023; we can only really wait and see for further efficiencies to materialize down the road for the organization as a whole. One year into the bank conversion, it’s still a bit too soon to tell.

Temporary Pause In Deposit Growth

NewtekOne has proven that it is capable of strong-arming deposits towards Newtek Bank in the market, leading to explosive deposit growth in Q2 2023. This is not without consequence: while NewtekOne does not issue loans on these deposits, they are empty calories for Newtek Bank: the funds are deposited as reserves with the Federal Reserve, and the interest paid by the Fed is passed on to the customer as the interest paid by their savings account.

For the time being, NewtekOne has seen fit to temporarily pause deposit growth, until the previously gathered deposits have been put to work by being issued as interest bearing loans. But the key thing going forwards is: we know for sure that NewtekOne is capable of competing on the marketplace for deposit funds.

Growing The Nonconforming Loan Business

During the Q3 2023 conference call and presentation, this slide was presented:

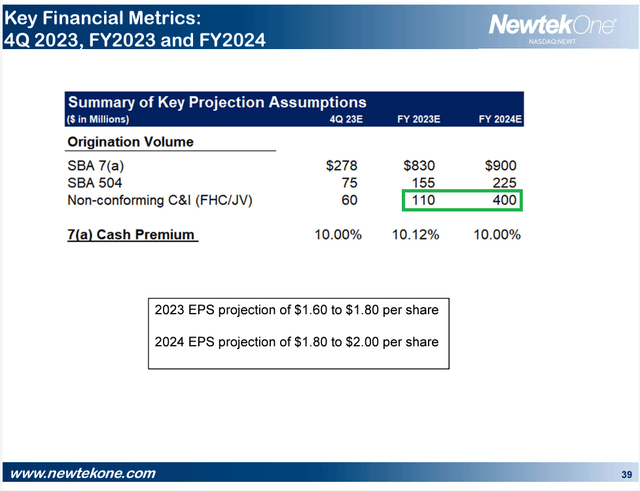

Q3 2023 Conference Call Presentation – Slide 39 (NewtekOne Website)

I expect that one of the reasons for converting to a bank is the added freedom to participate in originating non-conforming commercial and industrial loans. To be precise, these loans won’t be sold for a cash premium (because they are not SBA loans), but rather they will be packaged in securitization trusts and have notes sold against them. This securitization trust business by itself has a raw expected 20-30% return on invested equity – recall that NewtekOne is owning the equity portion of the trusts with some leverage.

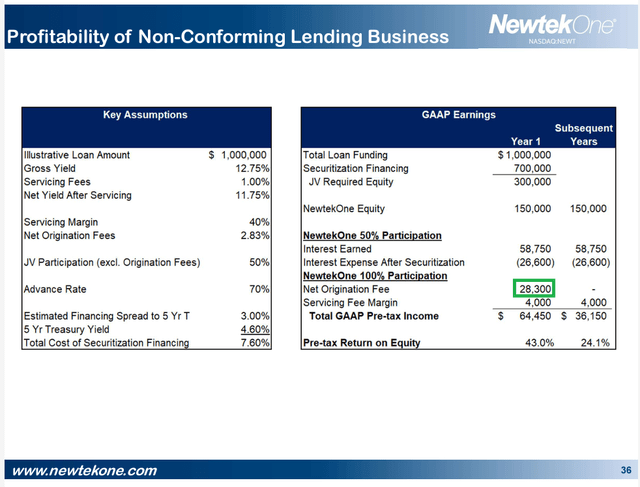

Q3 2023 Conference Call Presentation – Slide 36 (NewtekOne Website)

Slide 36 contained an illustration of how this business works. All calculations are done on a $1,000,000 illustrative loan balance. Boxed in green is the origination fee to be earned by NewtekOne, and the Total GAAP Pre-tax income from the transaction is listed for Year 1 and subsequent years. Note the pre-tax return on equity of this transaction: that is the new earnings driver for NewtekOne.

My main concern here is that it is not entirely clear to us what a mean, median, and mode (in short, the distribution) of what nonconforming loans looks like, in terms of loan balance, credit score, industry, business size, etc. I feel that if Barry Sloane could provide some extra colour on this during future conference calls, it would remove some of the mystery. But make no mistake here, this will be a primary engine of growth for NewtekOne.

Tangible Book Value & Retained Earnings

One important long term story is that NewtekOne is retaining earnings in order to grow as a bank. This is already starting to come true even in 2023. I present below earnings per share, dividend paid, the difference, and the successive values of NewtekOne’s tangible book value per common share:

| EPS | Dividend Paid | Difference | Tangible Book Value Per Common Share | |

| Q1 2023 | $0.45 | $0.18 | $0.27 | $6.96 |

| Q2 2023 | $0.26 | $0.18 | $0.08 | $7.05 |

| Q3 2023 | $0.43 | $0.18 | $0.20 | $7.31 |

| Q4 2023 | $0.53 | $0.18 | $0.35 | $8.61 |

Naturally we applaud the beginning of this development and that this continue as a general trend for future years to come. I am quite confident that as earnings grow, the accretion over time to tangible book value will also accelerate. That said, this should be the start of a long, long, slow march upwards in tangible book value.

Market Pricing Of Common Shares

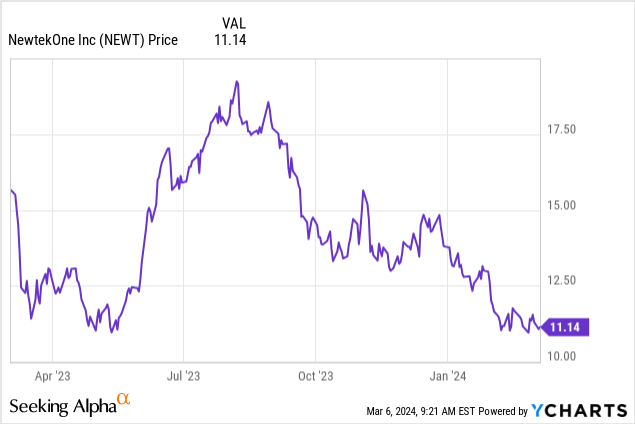

I think it’s fairly safe to say that the market doesn’t really truly know right now where to price NewtekOne shares. Prices have ranged from just over $10/share to just under $20/share, the range all within the past year:

Based on regular bank stock dividend yields, NewtekOne should be priced closer to $20/share right now, as at a $11/share price it sports a 6%+ dividend yield, higher than that of almost all bank shares, which are closer to 3%. To my mind, whenever NewtekOne dips to lows like this, it’s a buying opportunity.

Additionally, NewtekOne revised down its 2024 EPS guidance to $1.80-$2.00/share. This would imply a much slower rate of earnings growth than the original guidance of $2.80-$3.20/share. One reason for a pricing blip has been NewtekOne’s confidence in reaching its own guidance targets.

Without further information this is not easy to interpret. My best guess is that the original guidance was simply far too optimistic and not completely thought out. Nonetheless, with a yield curve that is still relatively flat, this is not an easy time to be a bank, and posting any sort of earnings growth is an applaudable feat for any bank.

I would consider the $2.80-3.20/share target for 2024 to have been hastily computed. What we are seeing is not share price reaction to a material reality, but rather a share price reaction to uncertainty and disappointed anticipations.

I would keep in mind that one year after the BDC to bank transition not all the dust has settled yet and 2024 still has some flavor of a transitional year, according to CEO Barry Sloane’s comments about “wearing three hats” in 2023 and “two hats” in 2024 in some of his conference calls in 2023.

My Conclusions

Guidance changes are little more than speed bumps and turbulence pockets in the air, and the market, not really seeming to know what direction NewtekOne is headed, blows the speed bumps out of proportion – hence the drastic share price gyrations. NewtekOne stock prices are in the awkward uncomfortable place of being the temporary loser in the short-term popularity contest that is the market, while at the same time the underlying figures that describe the business say that everything is just fine.

There is no other prescription to existing shareholders to make other than for shareholders to simply be patient: market temper tantrums do not last forever.

My bet is to just be patient and let the guidance kerfuffle news roll off our backs. When 9 years ago NewtekOne transitioned into being a BDC, the situation was just as uncertain. However over the 8 years of being a BDC, NewtekOne developed a reputation as a BDC that could gradually increase its earnings once the dust from the transition settled.

CEO Barry Sloane made many assorted comments in recent conference calls stating the transitional nature of 2023 and 2024, and seeking a new normalcy during which NewtekOne can focus fully on growth as a bank. So far things seem to be going as planned.

What do you get if you were to buy NEWT today? Firstly, its dividend is safe, and secondly its valuation has probably hit a floor, at 6-7x PE ratio. At these prices ($11-12/share) NEWT is actually an income opportunity with a substantial chance of capital gains.