400tmax/iStock Unreleased via Getty Images

Introduction

It’s time to talk about one of the most interesting stocks on the market. While the FedEx Corporation (NYSE:FDX) may not be as fascinating as some of the high-flying tech stocks right now, it is one of America’s largest transportation companies, delivering more than 9 million packages every day. And that’s FedEx Ground only!

My most recent article on the stock was written on August 6, 2023, when I gave the stock a Sell rating, which is somewhat rare as I mainly focus on buying opportunities.

Back then, I went with the title “90% Off Its Lows – Sell FedEx, Buy Better Compounders Instead.”

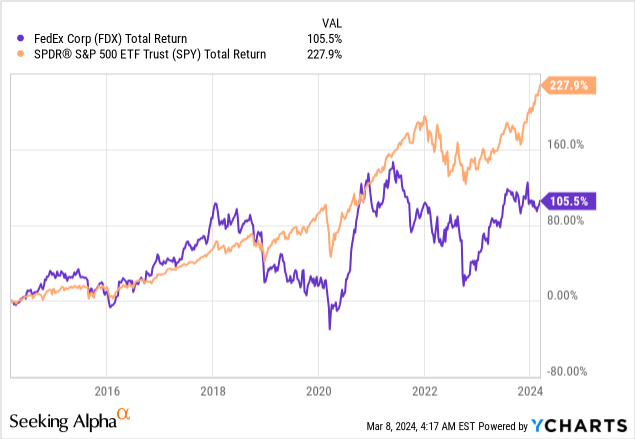

Since then, FDX shares have fallen roughly 5%, underperforming the S&P 500 by 20 points.

Over the past ten years, FDX shares have returned 106%, including dividends. This lags the S&P 500 by a wide margin, as FDX tends to be prone to steep sell-offs whenever economic growth and consumer sentiment turn sour.

In this article, I’ll revisit the stock and explain what I think of the current risk/reward, especially in light of the Amazon (AMZN) threat.

So, let’s get to it!

Amazon Is In The Rearview Mirror

Usually, I do not use articles that are a few months old, as they often contain info that is already well known, are not relevant anymore, or both.

However, on November 27, the Wall Street Journal published an article I always wanted to use in a FedEx article, as it described the increasing pressure on established players.

This article is still relevant. Not only because Amazon keeps pressuring both FedEx and UPS (UPS) but also because we’ll discuss how FedEx is differentiating itself in light of this threat.

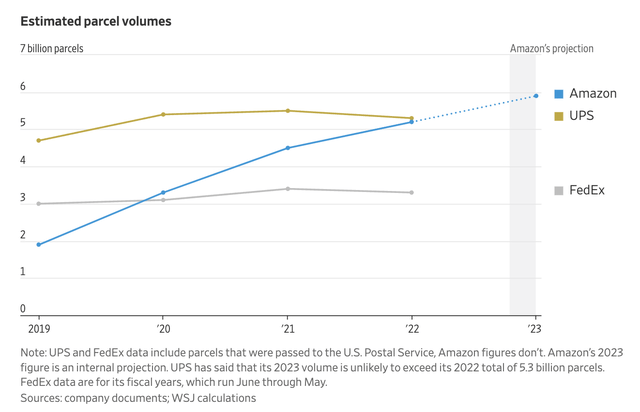

Essentially, as the title suggests, Amazon has turned into the top delivery business in the United States, beating both UPS and FedEx in parcel volumes.

This move perfectly reflects Amazon’s rising power, as it has long grown beyond just offering a handy website for e-commerce.

According to internal data and industry insiders, Amazon delivered more packages to U.S. homes in 2022 than UPS, after it had already exceeded FedEx in 2020.

Given the trends back then, we can assume that this gap is further widening.

With that in mind, the Journal explains that a decade ago, Amazon was primarily a customer of UPS and FedEx.

Now, it is beating its competitors, and it only includes packages directly shipped to customers (from start to finish), whereas both UPS and FedEx count packages delivered to postal services for final delivery.

Furthermore, Amazon’s rise to the top spot has been supported by strategic initiatives, including regionalizing its logistics network and launching a franchise program for package delivery.

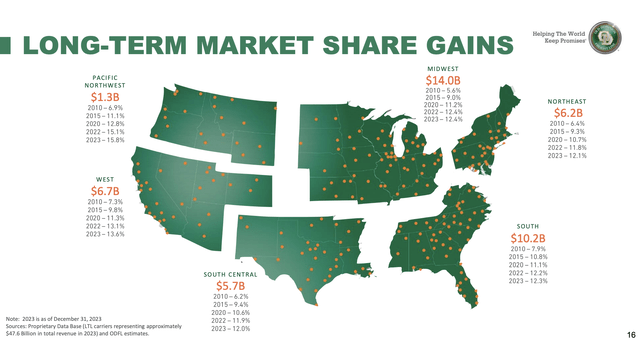

This is highly common among the most successful transportation companies.

They tend to invest a lot of money into building a dense footprint, which allows for superior delivery times. Once a carrier has a time/quality advantage, penetrating this market becomes much easier.

While Old Dominion Freight Line (ODFL) is different (it’s an LTL carrier), it is using the same strategy, which has made it one of the best-performing stocks on the market.

Going back to Amazon, these investments, combined with a rapid expansion of warehouses and sorting centers, have allowed the company to improve its operations so much that it’s hard to compete.

This was the most-liked comment from the aforementioned Wall Street Journal article:

I use Amazon fairly often.

You go onto Amazon site and search for item A. They show you 130 of item A’s to choose from. They show you all the details and pros and cons.

You buy it and the next day it’s on your doorstep.

You don’t like it? You go to the local Amazon return store and say “no thanks” and give it back to them.

I bought my wife 2 new ceramic cooking things from someone else. 1 arrived fine but the other one is shattered. Gave it back to the UPS guy the next day. Called UPS and got the run around from someone who barely spoke English. Sent an email to the company that sold me the item……got the “someday you will get something back…..maybe” response.

Convinces me to use Amazon more.

Here’s another one:

If you live in a Condo building with a centralized Mail Room, all you have to do is look at the packages stacked up daily to see Amazon is way overtaking UPS and FedEx in terms of number of deliveries.

Furthermore, what’s interesting is that the gap between Amazon and UPS/FDX will likely grow further – and not just because Amazon has an advantage.

FedEx is diversifying, including healthcare and small businesses. It is increasingly focusing on that.

It also has a network that allows for global coverage that Amazon cannot compete with.

On a side note, did you know that FedEx was the first company to use tracking numbers?

Via StartupTalky

In other words, there’s plenty to work with for FedEx, even if Amazon is expanding in the U.S. parcel market.

How Attractive Is FedEx?

Usually, I don’t show the valuation until the end of the article. However, in this case, I wanted to highlight upbeat analyst expectations.

See, despite the threat of Amazon, analysts are upbeat about FedEx, expecting the following EPS growth rates:

| Year | EPS Growth |

| 2024E | 18% |

| 2025E | 25% |

| 2026E | 14% |

The numbers can also be found in the chart below.

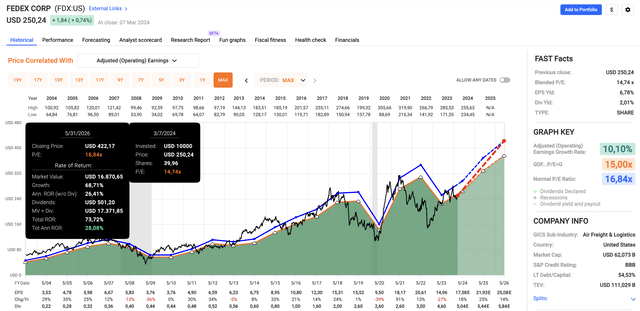

This chart shows that FDX trades at a blended P/E ratio of 14.7x, which is below its long-term normalized 16.8x multiple.

A return to this multiple by incorporation of expected EPS growth and its 2% dividend yield could pave the way for elevated returns.

Purely technically speaking, the numbers above imply a $422 target, which is almost 70% above its current price.

The current consensus price target is a few bucks shy of $300.

While I won’t make the case that FDX is poised for a 70% gain, there are some interesting developments that hint at sustained growth.

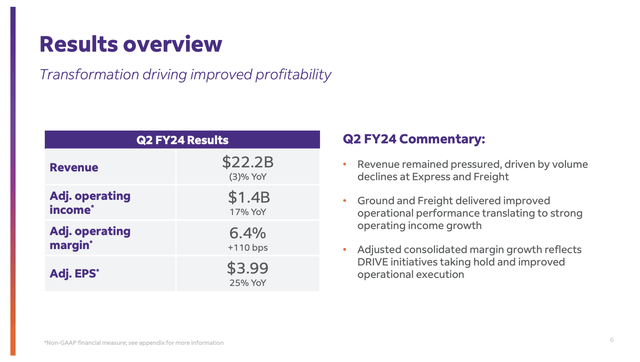

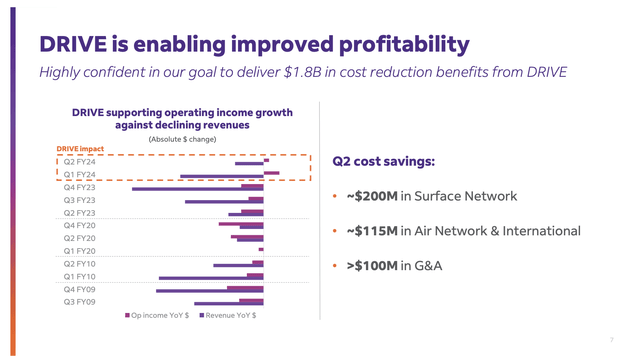

For example, the company’s transformation, including its DRIVE program, is showing positive results.

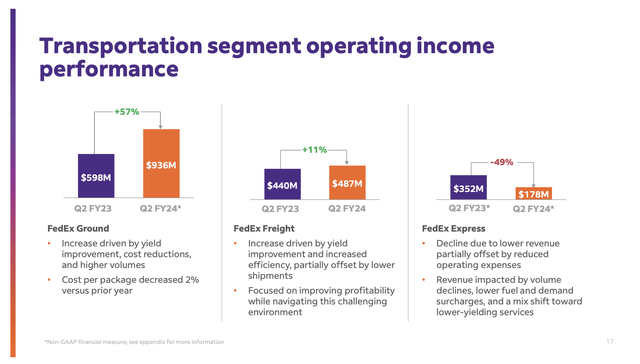

Despite a 3% decline in total revenue in 2Q24, the company achieved a 17% improvement in adjusted operating income and a 110 basis points adjusted margin improvement compared to the previous year.

Additionally, FedEx Freight showed a strong performance, driving double-digit profit improvement and a margin expansion of more than 270 basis points compared to 2022.

Going back to FedEx’s DRIVE initiatives, the company noted that these are helping to offset revenue pressures by reducing costs across its entire business.

For example, in the second quarter alone, the company achieved roughly $200 million in cost reductions in its surface network and U.S. Express operations.

Meanwhile, structural flight reductions and changes in procurement strategies also contributed to significant savings. In this case, they totaled over $100 million in G&A expenses.

These cost-saving efforts are expected to result in $1.8 billion in benefits from DRIVE this fiscal year.

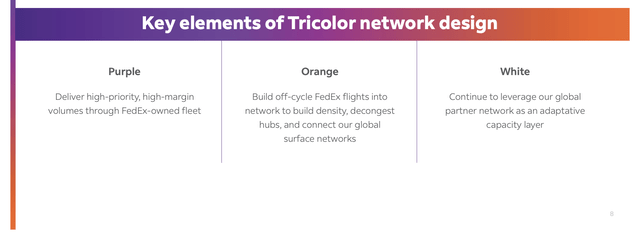

On top of that, FedEx Express, which had the worst operating performance in 2Q24 (among FDX’s segments), is undergoing a massive network redesign.

The company has named this program the Tricolor (purple, orange, and white) design, which is aimed at improving asset utilization, growing margins, and taking the overall return on invested capital (“ROIC”) to a higher level.

These changes are expected to support the company’s targeted savings of $4 billion by fiscal year 2025.

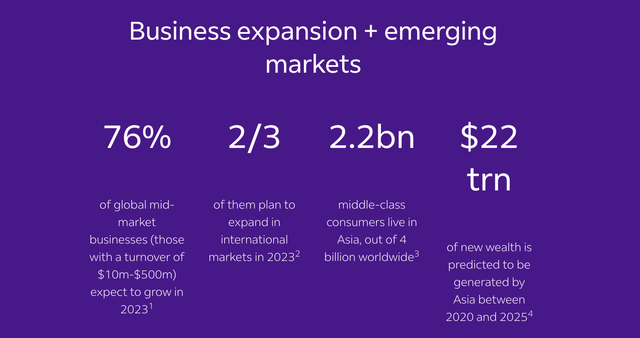

Furthermore, and with regard to my earlier diversification comments, FedEx is diversifying to capitalize on growth in emerging markets.

For example, the company opened the Advanced Capability Community (“ACC”) in Hyderabad, India.

In general, FedEx is very bullish on emerging markets.

By developing digital solutions such as tracking APIs with Picture Proof of Delivery (“PPOD”), FedEx aims to enhance customer experience, attract new business, and generate profitable incremental revenue streams.

Speaking of picture proof, the company isn’t giving up on e-commerce. On the contrary, the company is focusing on expanding its weekend residential coverage and improving last-mile delivery capabilities, potentially allowing it to capitalize on the booming e-commerce market.

The company “hopes” to grow its footprint in e-commerce by combining competitive pricing, superior service levels, and innovative delivery solutions.

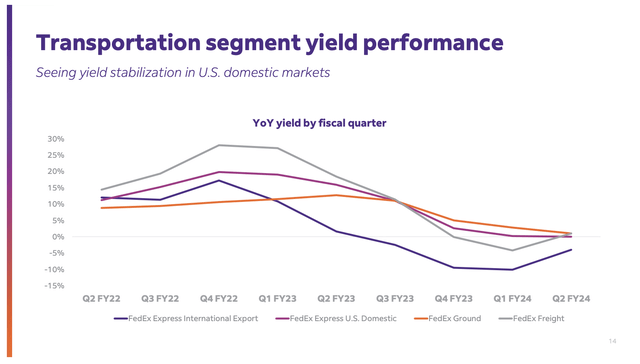

With that in mind, the company is also focusing on high-quality volumes, which are shipments with favorable yields and long-term growth potential.

By focusing on this market, the company can mitigate weaknesses in other areas.

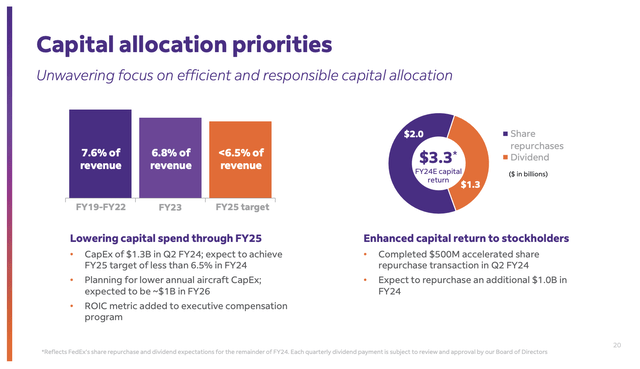

Having said that, the company also aims to use lower capital spending to boost shareholder returns.

This year, it expects to return $3.3 billion to shareholders. That’s 5.3% of its current market cap.

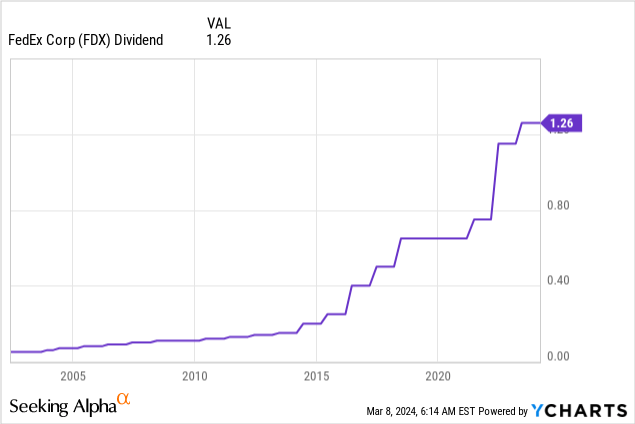

FDX currently pays $1.26 per share per quarter in dividends, which translates to a yield of 2.0%.

The most recent hike was 9.6% on April 5, 2023. The five-year dividend CAGR is 14.2%, which was skewed by the pandemic, as we can see in the chart below.

The dividend is protected by a very low payout ratio of 30% and an investment-grade balance sheet with a BBB rating.

Having said all of this, I like FDX. It’s a good company, and they will find ways to stay relevant in their industry, despite competition from Amazon.

However, it has a poor total return picture, returning just 7.4% per year since 2003. This includes its dividend.

I do not expect the operating environment to improve in the years ahead despite its shift to advanced deliveries, tech implementation, emerging markets, and an overall focus on quality volumes.

That’s why I stick to a Neutral/Hold rating. It’s not a Sell at these levels, but I also cannot make the case that it has become an attractive dividend growth opportunity.

I respectfully believe that there are better plays on the market, especially companies that have wider moats, including railroad stocks.

Needless to say, please feel free to disagree with me.

Takeaway

While FedEx faces competition from Amazon in the parcel delivery market, its diversification efforts, a bigger focus on emerging markets, and its commitment to technological improvements show its determination to remain relevant and capture growth in key markets.

Despite its underperformance compared to the S&P 500, upbeat analyst expectations and cost-saving initiatives offer potential for future growth.

However, as FedEx finds its way in the evolving e-commerce business, its ability to adapt and innovate will be key factors in driving long-term shareholder returns.

Given the risk/reward, I’m upgrading my rating from Sell to Hold.