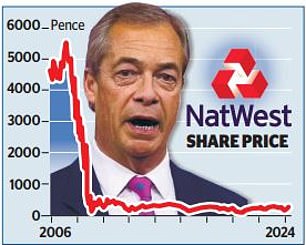

Debanked: Former UKIP leader Nigel Farage

Nigel Farage yesterday warned that his debanking row with NatWest is ‘far from over’ as the Chancellor confirmed plans to sell shares in the lender to the public this summer.

Jeremy Hunt said he will press ahead with a multi-billion-pound retail offer to offload some of the almost 32 per cent stake in NatWest still held by the Government.

It will be the highest-profile public share offering since Royal Mail more than a decade ago, though analysts expect a chunky discount to convince the public to take part.

But former Ukip leader Farage said his battle against the bank will continue.

NatWest – then known as RBS – was given a £45billion bailout by the taxpayer during the financial crisis in 2008.

The Government remains the biggest single shareholder, although its stake has been whittled down from more than 80 per cent.

Though shares are up 15 per cent so far this year, they are still down 95 per cent from their 2007 peak.

Reacting to the announcement yesterday, Farage told Sky News: ‘For a retail NatWest share sale to work, as outlined by Jeremy Hunt in the Budget, investors must have confidence in the bank.

‘Until they provide full disclosure and apologise for their behaviour, why should any retail customer trust them?’

A row between Farage and NatWest broke out last summer after his bank account with elite private bank Coutts – owned by the lender – was closed.

Former NatWest chief executive Alison Rose was forced to quit after admitting to telling a BBC journalist that the leading Brexiteer’s account was closed for commercial reasons.

Internal reports showed that Farage’s political leanings had been a factor in the decision.

A share sale will take place ‘at the earliest, subject to supportive market conditions and achieving value for money’, according to Budget documents.

Richard Hunter, at Interactive Investor, said: ‘Any offer would inevitably have to be at a discount to the current price to entice investors, and subject to the risk warnings that owning shares in individual companies brings.’