Dragon Claws

Global X SuperDividend REIT ETF (NASDAQ:SRET) seeks to provide income investors with an ETF that is comprised of the 30 highest-yielding REITs in the world. This passively managed ETF has offered investors monthly distributions the last eight years, but little to no dividend growth. The ETF selection process is rather basic and we believe prone to picking yield traps. For these reasons, we rate SRET a hold.

Selection Process

SRET begins with a universe of the highest 60 paying REITs in the world. They must have a minimum size of $100M, trade at least $5M daily, and have a “stable” dividend forecast, meaning no announcement has been made that dividends will be significantly reduced or canceled. REITs meeting this first pass are then run through a volatility filter with the 30 REITs chosen for the ETF having the lowest volatility of the top 60. The ETF is then equally weighted. Given the ETF’s extremely high 93% annual turnover, we believe this screening process is too simplistic and not that robust.

REITs Can Be Value Traps, Too

REITs have an unusual legal structure which requires 90% of income to be paid in the form of dividend distributions to investors. This avoids taxation at the corporate level and is taxed at the investor level. Hence, the higher yields REITs can potentially offer.

We believe investing solely on dividend yield can lead to the dreaded yield trap or value trap that REITs can still be subject to. Companies may pay high yields if they have stable mature low-growth business lines. Certain companies may pay high yields out of cash flows better spent on paying down debt, or investing in the business: this use of cash may limit capital appreciation. Certain financial fundamental metrics can help investors steer clear of these companies by evaluating earnings growth, revenue growth, cash flow growth, and the level of the dividend payout ratio. SRET does not take any fundamental criteria into account in its selection process.

Country Selection

While SRET is called a Global ETF, note 73% of the companies are US based. The next largest country holding is Singapore with close to a 7% exposure. We view Singapore exposure positively as they require REITs to be 75% invested in mature income-producing companies and a maximum debt/equity ratio of 45% in a nod to pay quality dividends out of earnings.

SRET Country Exposure (Global X)

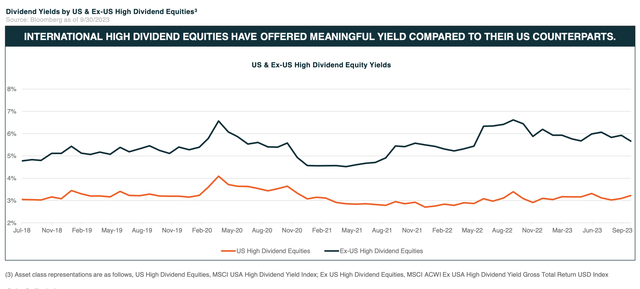

Global X seeks yield outside of the US. Their internal research suggest that foreign high-dividend equities offer higher dividends relative to US counterparts.

International High Dividend Equities vs US (Global X Insights)

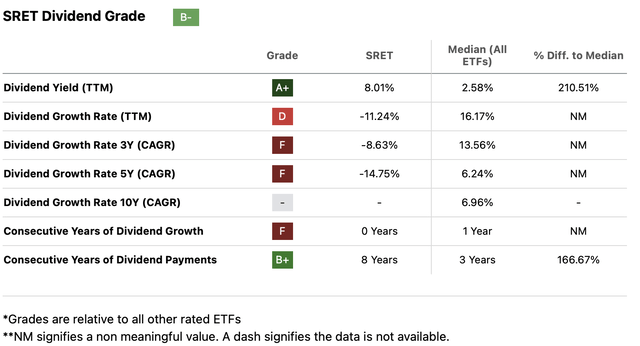

SRET aims to provide investors a monthly high-yield dividend, which it does, and has provided monthly payouts for over 8 years. However, it has a dismal growth rate after reviewing SA’s dividend analysis. With an almost total annual turnover, we believe the ETF is potentially selecting cheap REITs that likely are cutting dividends and/or dividend forecasts.

Seeking Alpha Dividend Ratings (Seeking Alpha)

Competitors

SRET is a hybrid of US and Global REITs as well as broader equity REITs and mortgage REITs (mREITs). Equity REITs tend to have more stable rental income and provide investors with both capital appreciation growth and income. MREITs typically are more yield-focused, tend to do better in a rising interest rate environment, and require more investor risk tolerance.

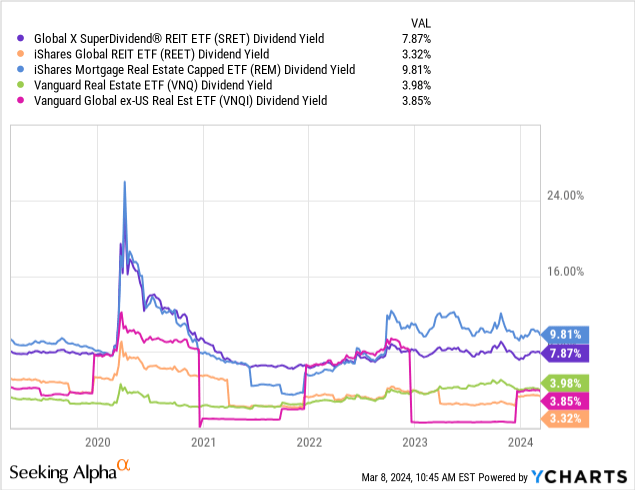

Therefore, we look at iShares Global REIT ETF (REET) and Vanguard Global ex-US Real Est ETF (VNQI) to compare the world-wide component of REIT investing. We further look at iShares Mortgage Real Estate (REM) and Vanguard Real Estate ETF (VNQ) to compare mREIT and equity REIT performance. Note the close correlation between yields of SRET and REM.

SRET Dividend Grade (Seeking Alpha)

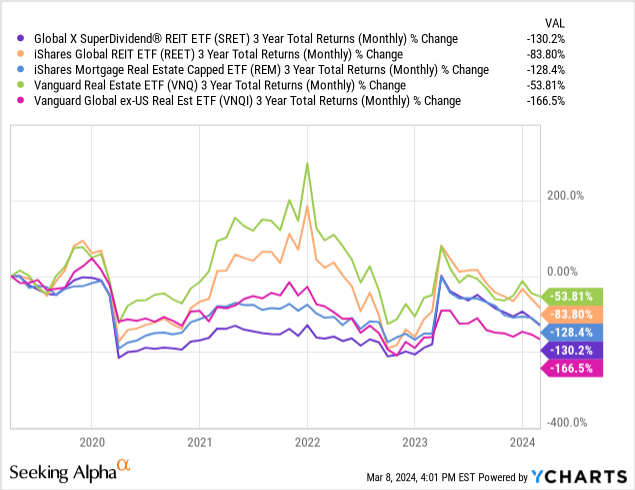

Although past performance is no indication of future performance, the 3Y rolling monthly returns on a normalized basis does not paint a pretty picture for any of these ETFs.

Further important comparisons. We note increased investor risk that comes with smaller AUM, higher turnover ratios, and greater small-cap exposure.

| SRET | REET | REM | VNQ | VNQI | |

| AUM | $217M | $3.5B | $594M | $62B | $3.8B |

| Turnover Ratio | 93% | 7% | 28% | 7% | 20% |

| Large Cap Exposure | 7% | 23% | 0% | 25% | 38% |

| Mid Cap Exposure | 26% | 57% | 17% | 55% | 46% |

| Small Cap Exposure | 67% | 20% | 83% | 20% | 16% |

Conclusion

We have a hard hold on SRET for several reasons. The selection process of this passively managed ETF leans toward potential yield trap status. Their process always produces backward-looking view of dividend distributions waiting to experience a cut or suspension or the announcement thereof: the main reason a REIT would get kicked out of the ETF. A turnover ratio of 93% speaks volumes to this. SRET’s past performance and dividend yield strongly track REM, which is a mortgage REIT ETF. Many economists and market strategists expect lowering interest rates this year, which tends to create lower total returns for mREITs.

Risks

Although SRET is equally weighted, thereby reducing concentration risk, it is a very small ETF with only $217M AUM, which increases liquidity risk. Additionally, its standard deviation is 20% according to Seeking Alpha, much higher than the median ETF of 15%. Turnover is even more worrisome at 93% vs the SA median of 29%.

There are the ever-present macro and geopolitical risks inherent with interest-sensitive investments like REITs. The higher the concentration of mREITs, like SRET and REM, the more likely the potential outcome of poor performance in a lowering rate environment many economists predict in 2024. This may or may not happen should inflation remain high.