Anton Aleksenko

Egypt has made the adjustment investors were waiting for. The US dollar (USD)-Egyptian pound (EGP) exchange rate has been devalued by 38%, and the government has agreed to an increase in its loan program with the International Monetary Fund (IMF) to US$8 billion.1 It also recently agreed to make a long-term investment with the United Arab Emirates (UAE), which will pay US$35 billion for property development rights on Egypt’s Mediterranean coast.2 We adopt a neutral stance toward Egyptian equities for now.

This influx of capital presents a landmark opportunity to revitalize an economy grappling with inflation, instability and the effects of regional conflicts. The currency devaluation, UAE’s injection of funds and the IMF’s support have the potential to rejuvenate Egypt’s economy. Pivotal projects, like the Ras al-Hikma on Egypt’s Mediterranean coast, are not just about boosting tourism but also a way to initiate critical fiscal and monetary reforms.

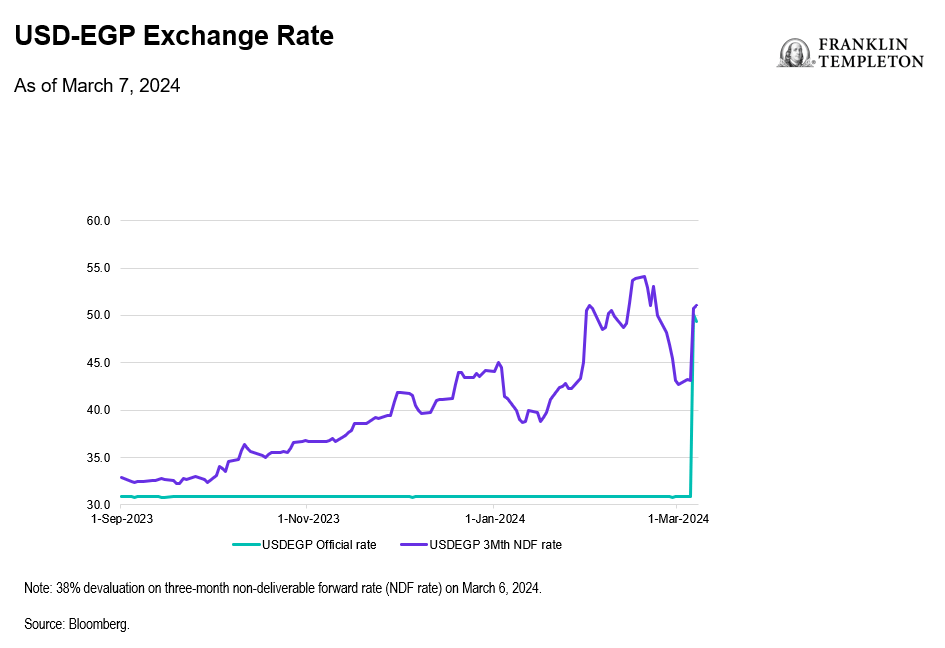

Interest rates up, currency down

On March 6, the Central Bank of Egypt (CBE) hiked interest rates by 600 basis points, surpassing market expectations. This bold decision pushed the discount rate to 27.75% and is targeted at lowering inflation, which stood at 29.8% in January 2024. Simultaneously, the foreign exchange market saw substantial adjustments, with the USD-EGP devalued to 50.09, translating to a 38% decline. These changes have introduced greater flexibility in the foreign exchange market, effectively unifying the official and parallel exchange rates. It also signals a key strategic pivot toward orthodox economic policies.

Exhibit 1: USD-EGP Exchange Rate

A 38% devaluation

The 38% adjustment in the EGP’s official rate may initially push inflation higher, notably in regulated sectors like energy, pharmaceuticals and public services. However, much of the economy has pre-emptively adapted to these changes, with an estimated 50%-60% already operating at parallel exchange rates since April 2023.3 This adaptation is expected to limit the inflationary impact. There is potential for exchange-rate appreciation resulting from foreign inflows and transfers by Egyptians working abroad as well as from foreign investors, thus creating a disinflationary environment after the initial price adjustment.

IMF support

The IMF’s decision to increase its loan program to US$8 billion, given a return to orthodox economic policies and the challenges posed by regional conflicts, is a significant vote of confidence. Coupled with a possible additional US$1-$1.2 billion from the IMF’s Resilience and Sustainability Facility, and a potential US$12 billion in soft loans from the European Union and World Bank,4 international support for Egypt is robust.

The IMF’s policy support has six pillars that focus on:5

- Transitioning toward a credible flexible exchange-rate regime

- Implementing tighter monetary policy to reduce inflation and reverse dollarization

- Pursuing fiscal consolidation to maintain debt sustainability

- Slowing down infrastructure spending

- Ensuring sufficient social spending for vulnerable groups

- Implementing reforms in state ownership policies to foster private sector growth

Committing to structural reforms as part of the IMF program, especially efforts toward revitalizing the interbank foreign exchange market, is predicted to stabilize USD-EGP expectations and assist in adjusting the exchange rate to a more stable range with a potential appreciation in the coming months. The gradual resolution of foreign exchange backlogs is likely to further facilitate this adjustment.

Social measures and economic reforms

To alleviate the potential social burden of these economic adjustments, the government and the IMF have agreed on a comprehensive EGP180 billion social package, alongside a 50% hike in the minimum wage. These measures are designed not only to cushion the immediate impact on Egyptians but also to lay the groundwork for sustainable economic growth and stability.

Giga projects

Egyptian authorities are considering plans to develop the Ras Gamila area near Sharm el-Sheikh,6 which is increasingly attractive given its proximity to Saudi Arabia’s NEOM giga project. The project may unlock an investment of US$15-$20 billion. Discussions are at an early stage, and the investment is yet to be confirmed. Nevertheless, given the devaluation of USD-EGP, one of the obstacles to the project has been removed.

Similarly, negotiations with China about the construction of the largest industrial export zone on Egypt’s Mediterranean coast are underway.7 Such a venture could boost trade and economic growth in Egypt. While discussions on this project are also at an early stage, the project is potentially more significant than the development of Ras Gamila as it has the potential for sustained job creation in manufacturing and trade services.

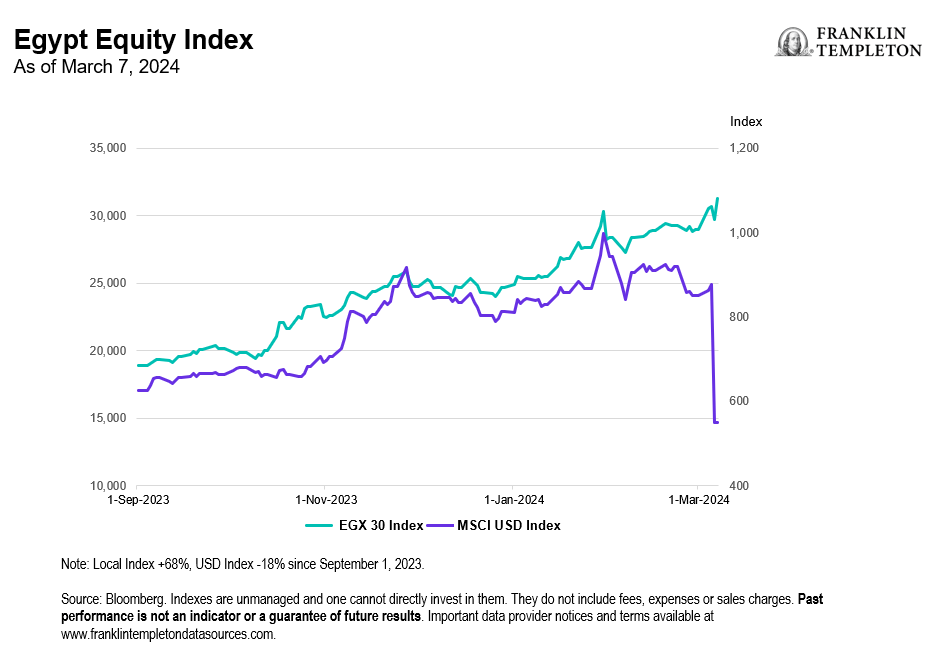

Market outlook

The Egyptian equity market, as represented by the EGX 30 index, has risen by 68% in local currency terms and is essentially flat in US dollar terms since September 2023.8 In light of the local equity market moves, we adopt a neutral stance. International investors with exposure to Egyptian equities may use the current liquidity surge to reduce exposure to equities, putting short-term downward pressure on the market.

Exhibit 2: Egypt Equity Index

Looking ahead

The CBE’s bold moves, which mark a return to economic orthodoxy, represent an important turning point for Egypt’s economy, in our view. With significant foreign liquidity from the UAE deal and IMF loan, further fluctuations in the foreign exchange rate are likely to be limited. The structure of the UAE deal, which includes a US$11 billion debt swap, should lower public foreign debt to GDP in 2024 by 6.6% to 35%.9

Egypt’s difficult financial adjustment, along with a pledge of structural reform under the IMF program, is likely to increase domestic confidence and boost investment. Over time, as inflation is brought back under control, interest rates could decline. Corporate earnings may show signs of recovery in the second half of 2024. We adopt a neutral stance toward Egyptian equities for now.

What are the risks?

All investments involve risks, including possible loss of principal.

Equity securities are subject to price fluctuation and possible loss of principal.

International investments are subject to special risks, including currency fluctuations and social, economic and political uncertainties, which could increase volatility. These risks are magnified in emerging markets. These risks are magnified in emerging markets. Investments in companies in a specific country or region may experience greater volatility than those that are more broadly diversified geographically.

Any companies and/or case studies referenced herein are used solely for illustrative purposes; any investment may or may not be currently held by any portfolio advised by Franklin Templeton. The information provided is not a recommendation or individual investment advice for any particular security, strategy, or investment product and is not an indication of the trading intent of any Franklin Templeton managed portfolio.

1. Source: Reuters. March 6, 2024.

2. Source: ADQ. February 23, 2024.

3. Source: EFG Hermes. March 3, 2024.

4. Source: Bloomberg. March 6, 2024.

5. Source: IMF. March 6, 2024.

6. Source: Reuters. February 28, 2024.

7. Source: Egypt Today. February 29, 2024.

8. Source: Bloomberg. March 7, 2024. They do not include fees, expenses or sales charges. Past performance is not an indicator or a guarantee of future results. Important data provider notices and terms available at www.franklintempletondatasources.com.

9. Source: EFG Hermes. March 3, 2024. There is no assurance that any estimate, forecast or projection will be realized.

This material is intended to be of general interest only and should not be construed as individual investment advice or a recommendation or solicitation to buy, sell or hold any security or to adopt any investment strategy. It does not constitute legal or tax advice. This material may not be reproduced, distributed or published without prior written permission from Franklin Templeton.

The views expressed are those of the investment manager and the comments, opinions and analyses are rendered as at publication date and may change without notice. The underlying assumptions and these views are subject to change based on market and other conditions and may differ from other portfolio managers or of the firm as a whole. The information provided in this material is not intended as a complete analysis of every material fact regarding any country, region or market. There is no assurance that any prediction, projection or forecast on the economy, stock market, bond market or the economic trends of the markets will be realized. The value of investments and the income from them can go down as well as up and you may not get back the full amount that you invested. Past performance is not necessarily indicative nor a guarantee of future performance. All investments involve risks, including possible loss of principal.

Any research and analysis contained in this material has been procured by Franklin Templeton for its own purposes and may be acted upon in that connection and, as such, is provided to you incidentally. Data from third party sources may have been used in the preparation of this material and Franklin Templeton (“FT”) has not independently verified, validated or audited such data. Although information has been obtained from sources that Franklin Templeton believes to be reliable, no guarantee can be given as to its accuracy and such information may be incomplete or condensed and may be subject to change at any time without notice. The mention of any individual securities should neither constitute nor be construed as a recommendation to purchase, hold or sell any securities, and the information provided regarding such individual securities (if any) is not a sufficient basis upon which to make an investment decision. FT accepts no liability whatsoever for any loss arising from use of this information and reliance upon the comments, opinions and analyses in the material is at the sole discretion of the user.

Products, services and information may not be available in all jurisdictions and are offered outside the U.S. by other FT affiliates and/or their distributors as local laws and regulation permits. Please consult your own financial professional or Franklin Templeton institutional contact for further information on availability of products and services in your jurisdiction.

Issued in the U.S.: Franklin Resources, Inc. and its subsidiaries offer investment management services through multiple investment advisers registered with the SEC. Franklin Distributors, LLC and Putnam Retail Management LP, members FINRA/SIPC, are Franklin Templeton broker/dealers, which provide registered representative services. Franklin Templeton, One Franklin Parkway, San Mateo, California 94403-1906, (800) DIAL BEN/342-5236, Mutual Funds | ETFs | Insights.

Canada: Issued by Franklin Templeton Investments Corp., 200 King Street West, Suite 1500 Toronto, ON, M5H3T4, Fax: (416) 364-1163, (800) 387-0830, Mutual Funds | Investments | Franklin Templeton

Offshore Americas: In the U.S., this publication is made available only to financial intermediaries by Franklin Distributors, LLC, member FINRA/SIPC, 100 Fountain Parkway, St. Petersburg, Florida 33716. Tel: (800) 239-3894 (USA Toll-Free), (877) 389-0076 (Canada Toll-Free), and Fax: (727) 299-8736. Distribution outside the U.S. may be made by Franklin Templeton International Services, S.à r.l. (FTIS) or other sub-distributors, intermediaries, dealers or professional investors that have been engaged by FTIS to distribute shares of Franklin Templeton funds in certain jurisdictions. This is not an offer to sell or a solicitation of an offer to purchase securities in any jurisdiction where it would be illegal to do so.

Issued in Europe by: Franklin Templeton International Services S.à r.l. – Supervised by the Commission de Surveillance du Secteur Financier – 8A, rue Albert Borschette, L-1246 Luxembourg. Tel: +352-46 66 67-1 Fax: +352-46 66 76. Poland: Issued by Templeton Asset Management (Poland) TFI S.A.; Rondo ONZ 1; 00-124 Warsaw. South Africa: Issued by Franklin Templeton Investments SA (PTY) Ltd, which is an authorised Financial Services Provider. Tel: +27 (21) 831 7400 Fax: +27 (21) 831 7422. Switzerland: Issued by Franklin Templeton Switzerland Ltd, Stockerstrasse 38, CH-8002 Zurich. United Arab Emirates: Issued by Franklin Templeton Investments (ME) Limited, authorized and regulated by the Dubai Financial Services Authority. Dubai office: Franklin Templeton, The Gate, East Wing, Level 2, Dubai International Financial Centre, P.O. Box 506613, Dubai, U.A.E. Tel: +9714-4284100 Fax: +9714-4284140. UK: Issued by Franklin Templeton Investment Management Limited (FTIML), registered office: Cannon Place, 78 Cannon Street, London EC4N 6HL. Tel: +44 (0)20 7073 8500. Authorized and regulated in the United Kingdom by the Financial Conduct Authority.

Australia: Issued by Franklin Templeton Australia Limited (ABN 76 004 835 849) (Australian Financial Services License Holder No. 240827), Level 47, 120 Collins Street, Melbourne, Victoria 3000. Hong Kong: Issued by Franklin Templeton Investments (ASIA) Limited, 17/F, Chater House, 8 Connaught Road Central, Hong Kong. Japan: Issued by Franklin Templeton Investments Japan Limited. Korea: Issued by Franklin Templeton Investment Advisors Korea Co., Ltd, 3rd fl., CCMM Building, 101 Yeouigongwon-ro, Yeongdeungpo-gu, Seoul Korea 07241. Malaysia: Issued by Franklin Templeton Asset Management (Malaysia) Sdn. Bhd. & Franklin Templeton GSC Asset Management Sdn. Bhd. This document has not been reviewed by Securities Commission Malaysia. Singapore: Issued by Templeton Asset Management Ltd. Registration No. (UEN) 199205211E, Inc. 7 Temasek Boulevard, #38-03 Suntec Tower One, 038987, Singapore.

Please visit Franklin Resources, Inc. to be directed to your local Franklin Templeton website.

Copyright © 2024 Franklin Templeton. All rights reserved.

Editor’s Note: The summary bullets for this article were chosen by Seeking Alpha editors.