HJBC

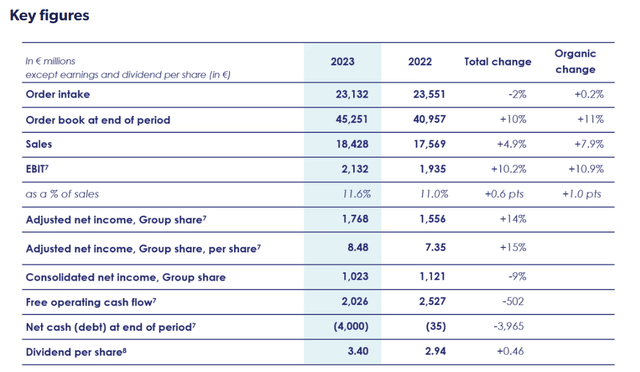

Thales (OTCPK:THLEF) reported its earnings for the FY. Things look alright, but with acquisitions meaningfully changing the profile of the business by adding new growth engines and shifting the mix in more profitable directions, stronger results with a better profile are to come in the next year once acquisitions, some of which we’ve already covered, come to a close and start getting included in the results. Broadly, we note that Thales trades quite cheaply compared to peers, at lower multiples than even some European peers, suggesting a valuation case that seems credible considering the relatively unimpeachable and high-visibility businesses that Thales carries. While some small parts within the mix are liquidating unprofitably, even those are the subject of operational improvements that should be able to lift underlying margins as secular growth in Thales markets, meaningfully now in defense and cybersec/digital identity, continues to play out. A nice company.

The FY Results

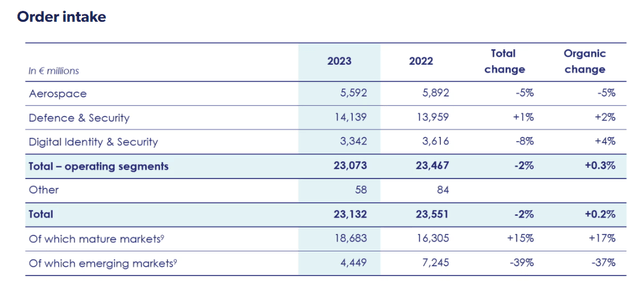

Let’s begin with some comments on the orderbook.

Highlights (FY PR) Order Intake by Segment (FY PR)

Firstly, orderbook grew nicely as deliveries did not grow beyond order intake, in other words, a book to bill was 1.26x. This is in spite of no growth in order intake. However, due to the exceptional comp from 2022 Rafale orders by the UAE, we shouldn’t perceive this at all as an alarm for demand conditions. In fact, demand seems strong in all segments as one would expect from the combination of a civil aviation recovery and the current spending optimism, particularly in Europe, on defense (DIS has a quick sales cycle and order data isn’t that important for forecasting results there). Even more beleaguered segments within aerospace garnered large orders, such as those concerning the space business, although order intake did slow in aerospace altogether due to structural demand issues in the telecommunications business. In general, though, orderbook analysis mainly relates to defense, which has a long sales cycle among the Thales segments, and it looks perfectly fine as you’d expect with an ongoing war in Europe.

The major UK MSET (sensor) order with the UK is worth calling out since it alone was 1.8 billion GBP. Second tranches of previously established orders, particularly in defense and related to the Rafale where sales cycles are long, added to the orderbook figures this year in Indonesia, and we expect more of that from the bloated defense orderbook. We also note that the most large orders closed in Q4, and this is where some of the civil aviation orders cropped up, signaling decent overall and within civil aviation even after this year’s catch-up effects.

In general, though, the orderbook is so big and covers years of sales, and really mainly concerns defense, which is a business we can have very high confidence in regardless of the data due to broad geopolitical considerations, that there’s not too much to call out – certainly nothing majorly concerning considering the level of confidence in secular spending plans in defense.

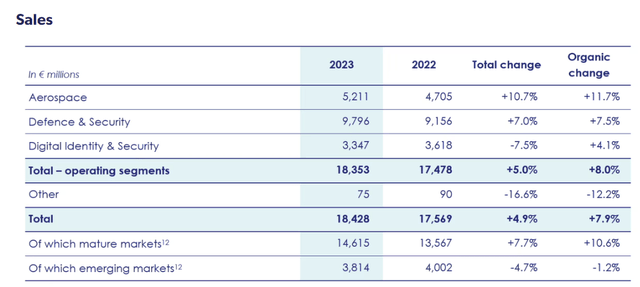

Let’s look at sales. Aerospace is the fastest-growing segment organically. The space part of the business, which is occupied meaningfully (33%) by some telecommunications contracts that were affected by supply issues and delays, is the only real headwind. However, demand remains quite good as order intake is solid here outside of telecom. These delivery delays end up not dragging on income because inflation of components means that this backlog won’t liquidate profitably, and its reduction in the mix is a good thing for margins. What is driving growth is the civil aviation and aftermarket recovery, where the latter is higher margin, and organic growth, in general, was very substantial thanks to recovered air traffic and activity in commercial aviation. Greater manufacturer production rates are also being seen, so money is being ploughed back into civil aviation after a real depression in the business due to COVID-19.

The company is trying to address the general drag on the business from space, which overall is a lower margin even without this special telecommunications drag. They are targeting medium-term margins at around 7% for space, which will lift the overall margin profile of aerospace. However, since we don’t have the intrasegment split, we cannot guess what terminal margins could be expected from this business also since Thales’ mix here is quite unique from possible comps in Europe. Space remains an interesting area, issues here are on operations, not as much on the end markets outside of telecom. However, the scope for margin growth in space is good to see, especially since space continues to generate quite a lot of orders, which means that even without too much momentum, we should expect profit growth in the segment.

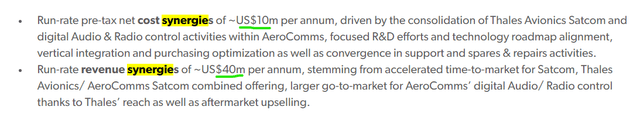

For aerospace, we should also mention the company is going to acquire Cobham. That transaction has not closed yet, so it’s not baked into current results, but will be at some point in 2024. They are an avionics business, and we will treat it as if it concerns the aerospace segment, where it will add around $64 million in EBIT or 58 million EUR based on the multiples provided for the transaction. This is before synergies.

Cobham Synergy Forecasts (Cobham Acquisition PR)

It’s not insignificant, accounting for 16% of current aerospace EBIT without synergies, a major inorganic factor, and also likely to contribute double-digit growth from its EBIT in 2023 thanks to extensive retrofit opportunities and defense markets, as well as new product developments in store. Things that improve the cockpit are generally going to be growth areas. This also skews more of the segment towards avionics, which should be above the segment average in profitability.

Defense and security did well on backlog thanks to a major contract win with the UK fleet for sensor equipment of around 1.8 billion GBP. In general, the recon and surveillance systems are performing strongly, and defense markets remain very positive across the board and likely to be an area of secular and consistent growth for Thales, which is well positioned in the still under-invested defense landscape of Europe.

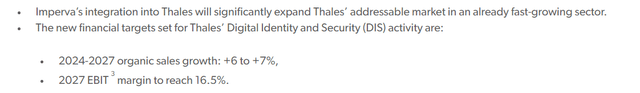

DIS is undergoing a major portfolio change. Headline declines are partially the result of disposal, but organic performance is decent. The pressures are coming from the EMV and SIM card businesses which are under a profit management regime, but all the stuff related to identity and biometrics systems, which is a growing market, is performing well as expected and keeping the organic growth up. Importantly, the new acquisitions of Imperva and Tesserent should continue to bolster this business, which is a bit of an outlier altogether at Thales as it has more commercial markets than the other businesses, operates on shorter sales cycles and doesn’t really feature a backlog. It’s possible that markets are not fully appreciating what is a pretty robust and typical cybersec business hidden within Thales.

Note that Imperva closed very close to the end of the year, and therefore barely factors into this year’s closed books. Next year it could grow the EBIT by around 38% inorganically, assuming all synergies come through as we’ve been given a post-synergy multiple (post-synergy multiple is on 2024 EBIT forecasts). This segment is basically its own identity and cybersecurity tech company within Thales at this point, and Imperva itself is expected to reach margins and grow in line with leading cybersec companies involved in application security. Tesserent closed in October. We don’t have the same amount of disclosure, but we can make some educated guesses. The revenues are $185 million, and we assume the same margin as general DIS as forecast by Thales post transformation at 16.5%, which leads to an inorganic improvement of around 5.5% based on current FY 2023 EBITs, so a modest effect for next year, but a small effect baked into this year’s results after it closed in October.

Bottom Line

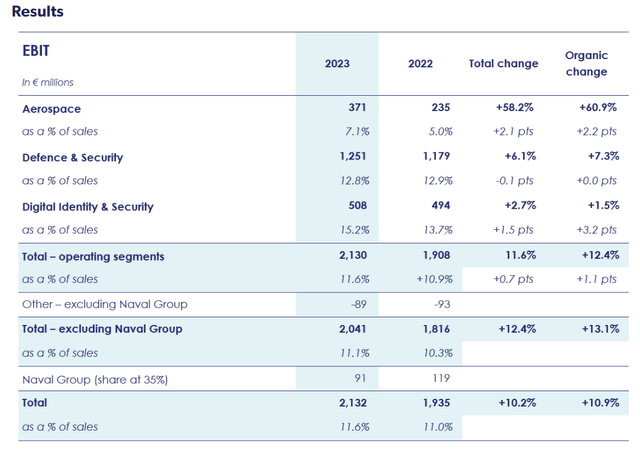

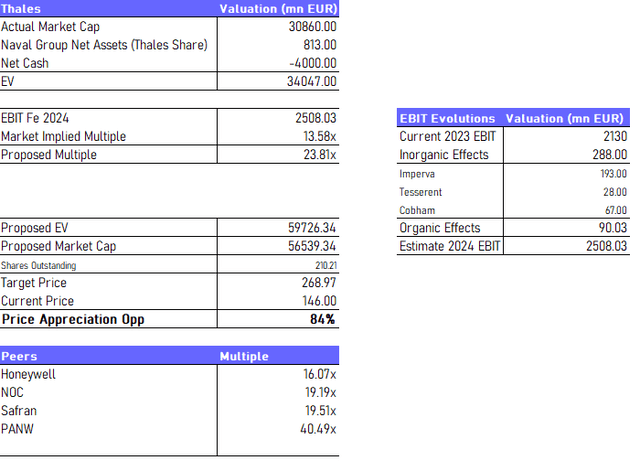

To build our valuation case, we are going to go with EBIT multiples. The company expects slower growth than in 2023 for aerospace on an organic basis. This is a reasonable view, as the comps have been easy thanks to depressed activity in civil aviation these last years. Therefore, EBIT shouldn’t be growing too much either for this segment. We will be conservative and assume EBITs stay flat next year, taking into account directional effects from a space recovery, which may drive some new sales once supply issues are sorted but not new contributions due to its lower profitability. Although the aftermarket is supposed to rise too, it is indeed conservative to estimate flat evolutions (this is the smallest EBIT segment, so it’s not that important).

For defense and security, we expect this business to continue to proceed with the same growth, as no other guidance is provided, assuming that not too much new utilisation can be achieved considering 2023 would have been an active year for a defense player. Possibly with easier procurement, which has been broadly an issue even with top-tier defense companies, things will get better and allow for continued growth at 6% in EBIT.

For DIS, we continue to expect 2.7% growth organically, based on the businesses within DIS preceding the acquisitions.

Thales gives vague margin guidance only, so some kind of extrapolative approach is necessary based on the facts. Understandable given the dynamics of contract economics businesses.

Then for the inorganic effects, we add the forecast 2024 income related to the acquisitions. In the case of Cobham, implied by the disclosed multiples are, 2023 EBIT figures. We don’t want to guess at growth since all Thales says about growth prospects here are “double-digit”, so we just conservatively assume no growth in Cobham 2023 EBIT, but we’ll throw in the cost synergy expectations as a consolation.

The EBIT figure ends up being somewhat in line with what we see forecast on marketscreener. One thing we do note is that for all the inorganic effects, we can’t know exactly when acquisitions will close, so our figure is more front-loaded and looks at a run rate of what the comprehensive business will be by the end of 2024. But being close to marketscreener forecasts is a good sign, even if we’re above.

We use the net asset value for the naval base business in the equity bridge. For comps, we take a cybersec comp in Palo Alto Networks (PANW) since that’s becoming a much larger part of Thales’ business, and for the others we take defense and aerospace comps with a skew towards companies that also have some avionics focus, as well as a fellow European player.

The relative case looks strong for Thales, but it’s exaggerated by the PANW multiple. It’s a little optimistic because while Imperva is pretty close in profile in terms of margins and growth expectations to PANW, the comprehensive DIS segment is going to end up in single-digit growth according to forecasts and with margins in the teens rather than the 20s% going forward. Imperva is only around 38% of the current segment EBIT.

Secular Hopes for DIS (Close Announcement Imperva)

We don’t want to go fudging things, but it’s plain to see that Thales alone trades at a lower multiple than each of its comps, so the relative valuation case is there, even if we were to use marketscreener EBITs for Thales. With improvements in space hopefully driving longer-term EBIT performance in aerospace, helped also by Cobham which shifts the mix in aerospace towards more profitable avionics businesses, and with the profile of the DIS segment improving thanks to the higher-growth acquisitions, even eyeballing the 14x EV/EBIT has us liking this high visibility and secularly growing issue.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.