Sheila Bair talks about the crisis at New York Community Bank on ‘The Claman Countdown.’

The incoming CEO of New York Community Bank (NYCB) said Thursday he’s working on a new business plan after the beleaguered bank received a $1 billion lifeline from investors Wednesday. He also announced its second dividend cut this year and revealed a 7% decline in deposits.

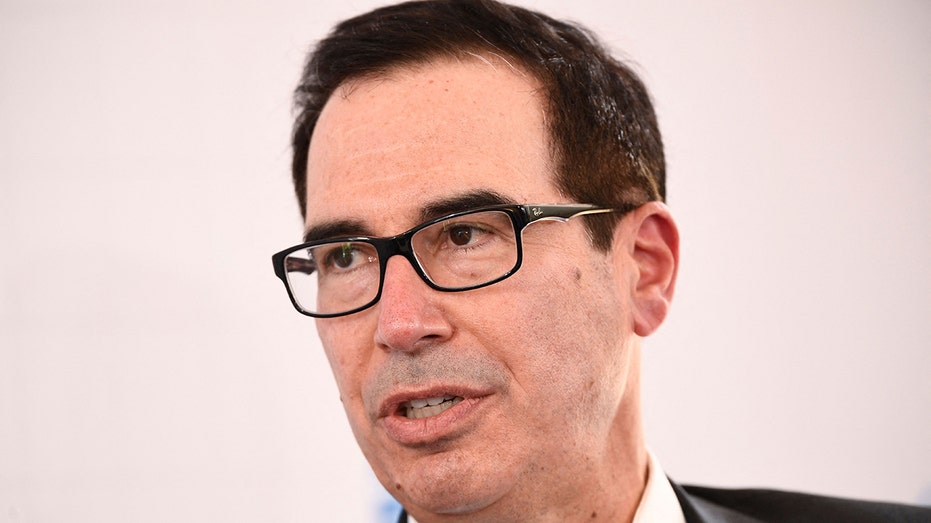

Joseph Otting, former comptroller of the currency for the Trump administration, was named NYCB’s CEO yesterday as the bank received a $1 billion equity infusion from a group of investors that included former Treasury Secretary Steven Mnuchin’s Liberty Strategic Capital and several other firms and members of the bank’s management team.

Otting and non-executive chair Alessandro DiNello said on a call with analysts Thursday they will present a new business plan for the bank in late April. Otting was previously credited with the turnaround of IndyMac, a mortgage lender Mnuchin bought out of the Federal Deposit Insurance Corporation’s (FDIC) receivership in 2009 with an investor group.

The bank reported that it had $77.2 billion in total deposits as of March 5, a decline of about 7% from a month ago when they totaled $83 billion. About 19.8% of its deposits were uninsured, a relatively low concentration compared to peers in the banking industry, and NYCB disclosed it has enough liquidity to offer customers expanded deposit insurance.

EMBATTLED BANK NYCB LANDS $1B INVESTMENT FROM GROUP INCLUDING MNUCHIN’S FIRM

New York Community Bank announced a second dividend cut and a deposit decline, though it noted it has enough liquidity to offer expanded deposit insurance. (Bing Guan/Bloomberg via Getty Images / Getty Images)

DiNello said some customers lined up to withdraw their deposits Wednesday as media reports said the bank was seeking capital, but that stabilized later in the afternoon once the company’s press release was out.

| Ticker | Security | Last | Change | Change % |

|---|---|---|---|---|

| NYCB | NEW YORK COMMUNITY BANCORP INC. | 3.62 | +0.14 | +4.17% |

NYCB has been trying to stabilize pressure on its stock after it announced a surprise quarterly loss and cut its dividend in late January as it looked to meet stricter regulatory requirements on banks with more than $100 billion in assets.

The lender passed that threshold last year following its 2022 acquisition of Flagstar Bank and its purchase of Signature Bank’s assets following its failure amid the regional banking crisis.

NEW YORK COMMUNITY BANCORP SEEKS CASH INFUSION

Former U.S. Secretary of the Treasury Steven Mnuchin’s Liberty Strategic Capital was part of the investment group that provided NYCB with a $1 billion capital infusion. (Patrick T. Fallon/AFP via Getty Images / Getty Images)

The bank also announced another cut to its quarterly dividend Thursday, reducing it to 1 cent per share rather than the 5 cents it had announced in January.

Investors have focused on NYCB’s exposure to the struggling commercial real estate sector in New York and the bank’s announcement last week that it found “material weakness in the Company’s internal controls related to internal loan review, resulting from ineffective oversight, risk assessment and monitoring activities.”

New York Community Bank’s stock rebounded following the announcement of a $1 billion lifeline from investors. (Bing Guan/Bloomberg via Getty Images / Getty Images)

GET FOX BUSINESS ON THE GO BY CLICKING HERE

NYCB’s stock rose as much as 12% in early trading Thursday, though the market has since pared back some of those gains. Its stock was trading at $3.69 a share as of mid-afternoon Thursday, a gain of 6.65%, although it’s down over 64% year to date.

Reuters contributed to this report.