Matteo Colombo

Introduction

I just put a new stock on my watchlist. A company I thought about for months before I finally decided to cover it.

And guess what? It’s an industrial company!

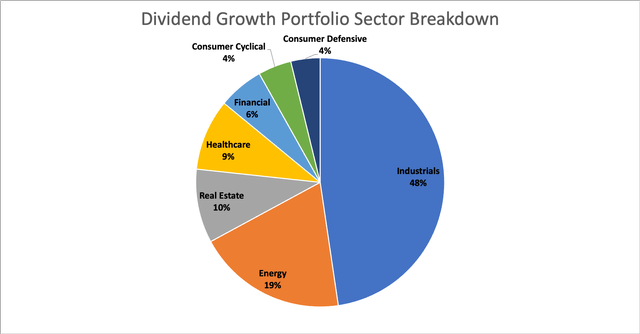

Given that I have roughly 50% industrial exposure, this may not come as a surprise…

However, while I may be massively overweight in industrial stocks, I am still highly diversified, as my industrial exposure consists of a wide range of companies, including aerospace & defense companies with anti-cyclical demand, transportation companies, machinery producers, and industrial construction distributions.

Now, I’m considering buying Watsco Inc. (NYSE:WSO), an industrial distribution giant I have never converted before.

In this article, I’ll walk you through my thoughts and explain why this company is a perfect fit for my portfolio.

So, let’s get to it!

A Genius Business Model

When I invest in companies, I want to buy something truly special. A company with a dominant position in its supply chain, secular growth opportunities, and (if possible) recurring revenues.

The other day, I listened to a Wealthion podcast with Bill Pulte, who’s part of the Pulte family that founded the homebuilder with the same name.

The reason I’m bringing this up is because he explained what he’s looking for in a good investment. Something that perfectly fits the core of this article.

And we’ve learned this through our Pulte Homes experience, which is that you really want to focus on recurring revenue business because and what I mean by that is, we are focused on you know, air conditioning, which as I mentioned, is a recurring revenue business that goes into the home, right, when your home air conditioning unit goes out, right, you have to get it replaced. mobile home park business, you own the land, and you get paid to own the land, or in the case of single family rental, you can offer affordable, either rent to own or single family homes.

Not only did Mr. Pulte mention recurring revenues, but he brought up a very specific area: air conditioning.

That’s where Watsco comes in!

“What’s Watsco?” you may ask.

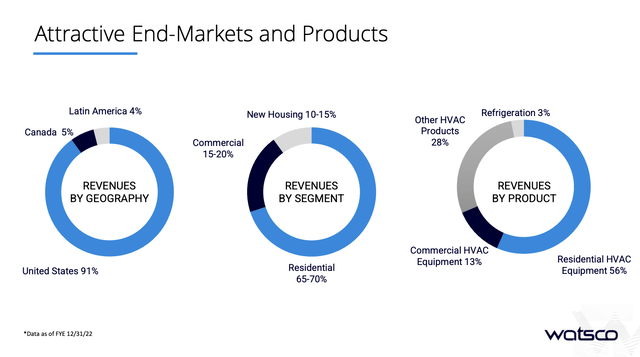

With a $15 billion market cap, WSO is a heavyweight in the HVAC/R (heating, ventilation, air conditioning, and refrigeration) distribution industry, where it provides a wide range of products and services in the commercial and residential markets.

The key word here is “distribution.”

Watsco does not produce HVAC/R applications.

This company offers a mix of inventory including equipment, parts, supplies, and plumbing materials.

As one can imagine, the company primarily operates in the Sun Belt states, where demand for HVAC/R products is high due to population growth and climate conditions.

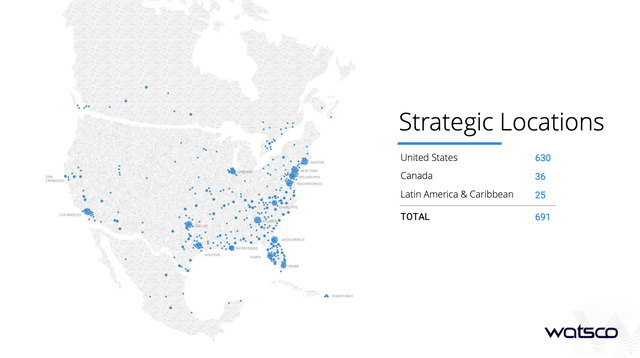

Going into this year, WSO operated through a network of over 690 locations to effectively reach local demand.

Founded in 1956, the company has a network that caters to more than 125,000 active contractors and dealers that service both replacement and new construction markets.

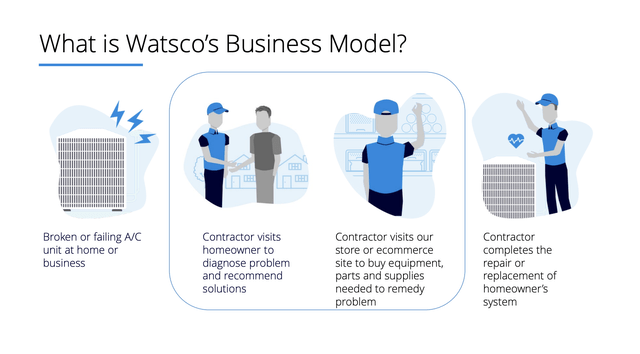

Simply put, it has a genius business model that allows the company to avoid the fierce competition between HVAC producers and focus on recurring revenue.

As we can see in the example below:

- A company or home has a broken A/C unit.

- The contractor visits the home/business to see what needs to be done.

- The contractor visits a Watsco store or e-commerce site to buy equipment and everything else he may need to get the job done.

- The contractor fixes the problem.

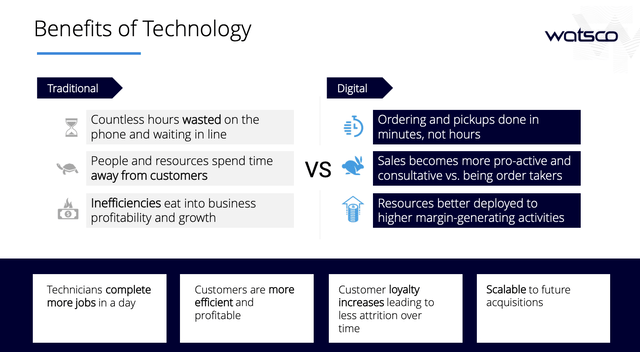

In other words, instead of producing HVAC systems and whatnot, the company provides technical support, efficient delivery services, and what it believes to be very convenient online platforms for ordering and information access.

Here are some of the many businesses it owns:

It also has strategic joint ventures with companies like Carrier Global (CARR) that allow the company to expand its footprint and strengthen relationships with producers of HVAC systems.

Moreover, it has supplier relationships with major companies like Rheem, Daikin, Mitsubishi, and Trane.

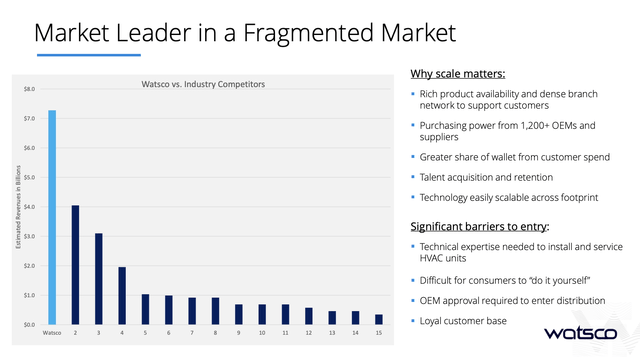

Despite facing competition from other distributors and manufacturers with in-house distribution channels, WSO believes its experienced sales force, extensive inventory, and brand reputation allow it to build a strong competitive advantage.

On top of that, the company has invested a lot in digital capabilities (like the aforementioned websites), which reduce ordering times and improve efficiency for all parties involved. This includes 63% less attrition for e-commerce users versus traditional customers.

So far, the company has proven that it has an advantage, as it is rapidly growing in a market that is highly fragmented.

Watsco estimates that we’re dealing with a total market with $64 billion in annual sales and roughly 2,200 distribution companies!

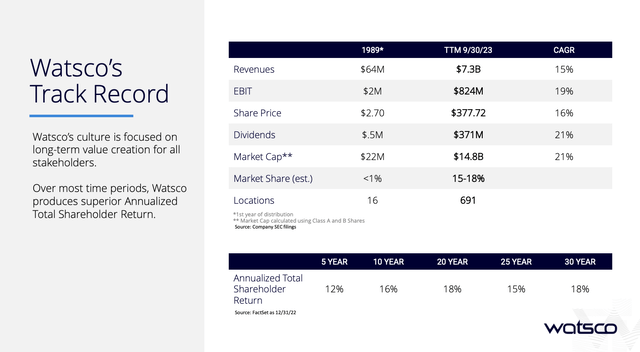

In light of this fragmented market, the company’s growth trajectory has been nothing short of impressive, with revenue climbing from $64.1 million in 1989 to $7.3 billion in 2023 (as of the third quarter).

Even better, while revenues grew by 15% per year(!), EBIT improved by 19% per year, which shows its successful focus on profitability.

Moreover, a big driver isn’t just the recurring nature of an increasingly large market, but also the fact that equipment is getting older, and newer models may offer cost-saving efficiencies.

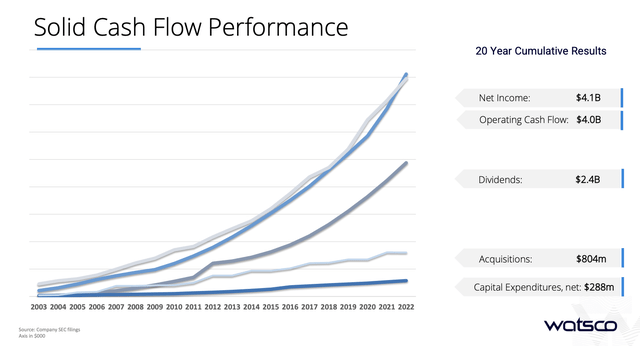

Furthermore, the company, which has bought 69 companies since 1989, has shown to be extremely resilient, with net income and operating cash flow not showing any downside during major recessions like the Great Financial Crisis.

It also needs to be said that the company is highly focused on employee satisfaction and creating incentives.

For that, it uses one of its biggest tools: its stock.

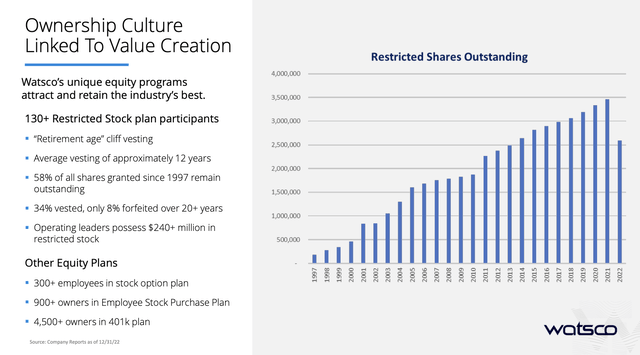

Throughout the years, the number of restricted shares outstanding has steadily increased, mainly fueled by more than 130 participants. Close to 60% of all shares granted since 1997 are still outstanding.

It also has more than 300 employees in a stock option plan and more than 900 owners in its Employee Stock Purchase Plan.

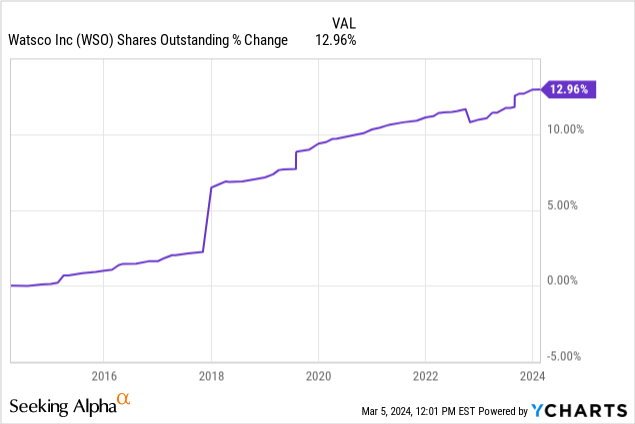

Over the past ten years, the number of shares outstanding has risen by 13%.

In other words, employees are motivated by benefitting from shareholder wealth generation.

That said, while WSO is not a typical buyback company (it does the opposite), it has not hurt shareholder value, as happy employees are the best asset a company can have – I think.

Shareholder Returns

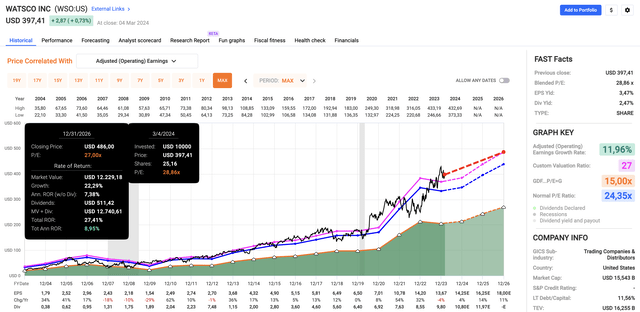

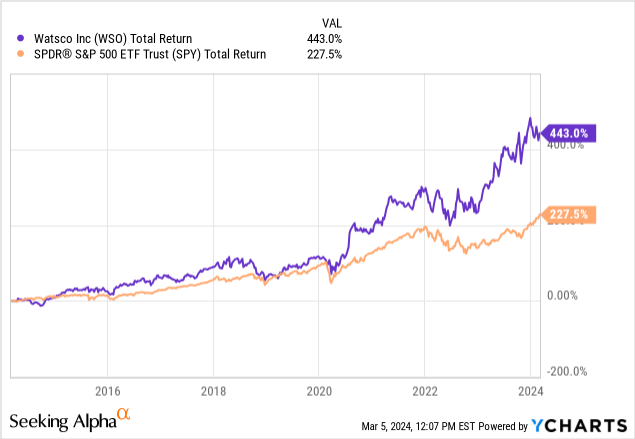

Since 2004, WSO has returned 16.4% per year!

Over the past ten years, WSO has returned 443%, beating the 228% return of the S&P 500 by a wide margin!

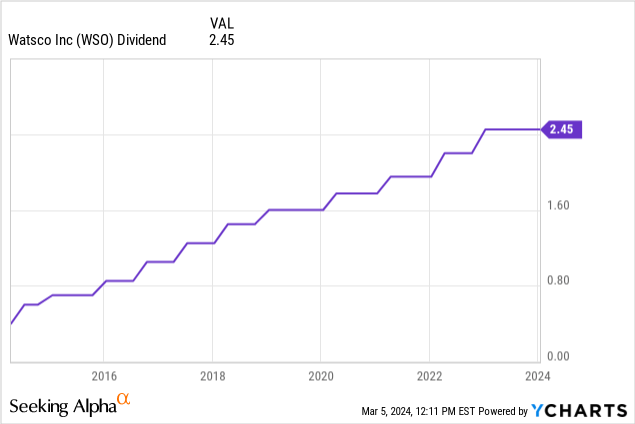

It’s also a dividend growth stock.

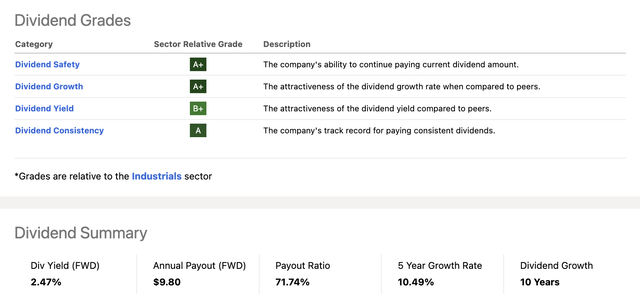

After hiking its dividend by 10.2% on February 13, it now pays $10.80 per year, which translates to a yield of 2.8%.

The five-year dividend CAGR is 10.5%. It has a 76% 2024E payout ratio.

Even better, as we can see below, the company has top scores in every category, including safety, growth, and consistency.

Moreover, the dividend is protected by a healthy balance sheet.

While the company has no S&P rating (that’s not uncommon), it has no positive net debt, which means it has more cash than gross debt.

This year, analysts expect the company to end up to $330 million in net cash.

Valuation

Using the data in the chart below:

- Analysts continue to be upbeat about the company’s future, expecting 4% EPS growth in 2024, 14% growth in 2025, and potentially 11% growth in 2026.

- Currently, the company trades at a blended P/E ratio of 28.9x, which is above its long-term normalized multiple of 24.4x (the blue line) and its 5-year normalized multiple of 27x.

- If the company were to maintain a 27x multiple, it could return roughly 9% annually through 2026, based on expected EPS growth and its dividend.

Given this valuation, I am bullish but not yet willing to buy aggressively.

This is mainly based on the market having rallied aggressively in recent months, making the risk/reward for new investments somewhat poor.

Hence, despite my Bullish (long-term) rating, I put the stock on my watchlist instead of my portfolio, with the plan to make it a core holding as soon as I get the opportunity.

I’m looking for 10% to 15% stock price weakness.

Takeaway

If there’s one thing I’ve learned from my deep dive into Watsco, it’s the power of a genius business model.

Watsco’s focus on distribution in the HVAC/R industry has propelled it into a heavyweight with a $15 billion market cap.

By prioritizing recurring revenue and investing in digital capabilities, Watsco has set itself apart in a highly fragmented market.

Its impressive growth trajectory and commitment to shareholder value, supported by its consistent returns and dividend growth, make it a compelling long-term investment.

While I’m not diving in aggressively just yet, WSO is definitely on my radar, poised to become a core holding in my portfolio when the timing is right.

Pros & Cons

Pros:

- Genius business model: Watsco’s focus on distribution in the HVAC/R industry provides a steady stream of recurring revenue and growth opportunities in a highly fragmented market.

- Impressive growth trajectory: With revenue climbing steadily and EBIT improving year by year, Watsco has shown its ability to thrive even in challenging economic conditions.

- Commitment to shareholder value: Consistent returns, dividend growth, and a focus on employee incentives prove Watsco’s dedication to creating value for shareholders and key stakeholders like its employees.

Cons:

- Valuation concerns: While I’m bullish on Watsco’s long-term potential, the current valuation is not very cheap – especially in light of the recent stock market rally.

- Market risks: The HVAC/R industry is not immune to economic fluctuations.

- Competition risks: Although the company has proven its ability to expand in a fragmented market, competition risks are always present.