VioletaStoimenova

Investment Outlook

Perficient, Inc. (NASDAQ:PRFT) recently reported its Q4 2023 financial results, missing both revenue and earnings consensus estimates.

I previously wrote about PRFT in July 2026 with a Hold outlook on growing bookings amid client conservatism for new projects.

Clients continue to be cautious on spending, although there are signs that the second half of 2024 may bring an opening up of discretionary spending.

I remain Neutral [Hold] on PRFT due to its stable earnings results as I watch to see if clients will really start spending more in the second half of the year.

Perficient’s Market And Approach

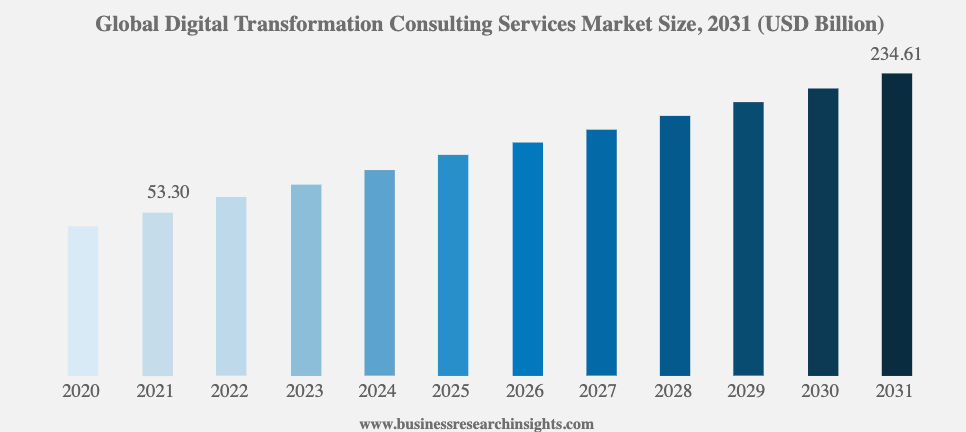

The global market for digital transformation software and services was an estimated $53 billion in 2021 and is forecasted to reach $235 billion by 2031, according to a market research report by Business Research Insights.

If achieved, that growth would represent a compound annual growth rate [CAGR] of 13.16% from 2021 to 2031, a reasonably high growth rate.

The industry is expected to be propelled forward by the continued migration of on-premises computing to the cloud and more recently by the need for cost-takeout and efficiency gains from the promise of AI and machine learning technologies.

The chart below indicates the historical and forward projected trajectory of the digital transformation consulting market through 2031:

Business Research Insights

However, the market has seen strong demand through the pandemic which appeared to pull forward demand by companies seeking to further digitize their operations.

More recently, though, client companies have been scaling back their ambitions to focus on non-discretionary engagements, slowing growth in the industry.

Recent Financial Trends And Valuation

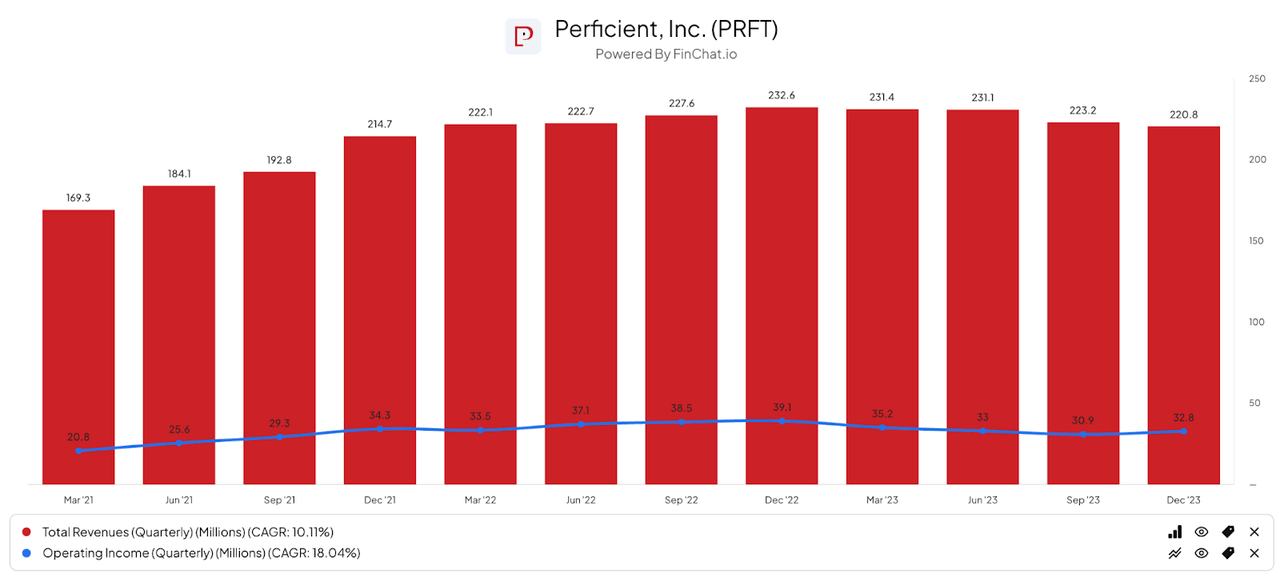

Total revenue by quarter (columns) has dropped in recent quarters due to increasing client delays and reduced spending; Operating income by quarter (line) has dipped as the firm has sought to retain talent in hopes of a client spending turnaround, resulting in higher operating costs.

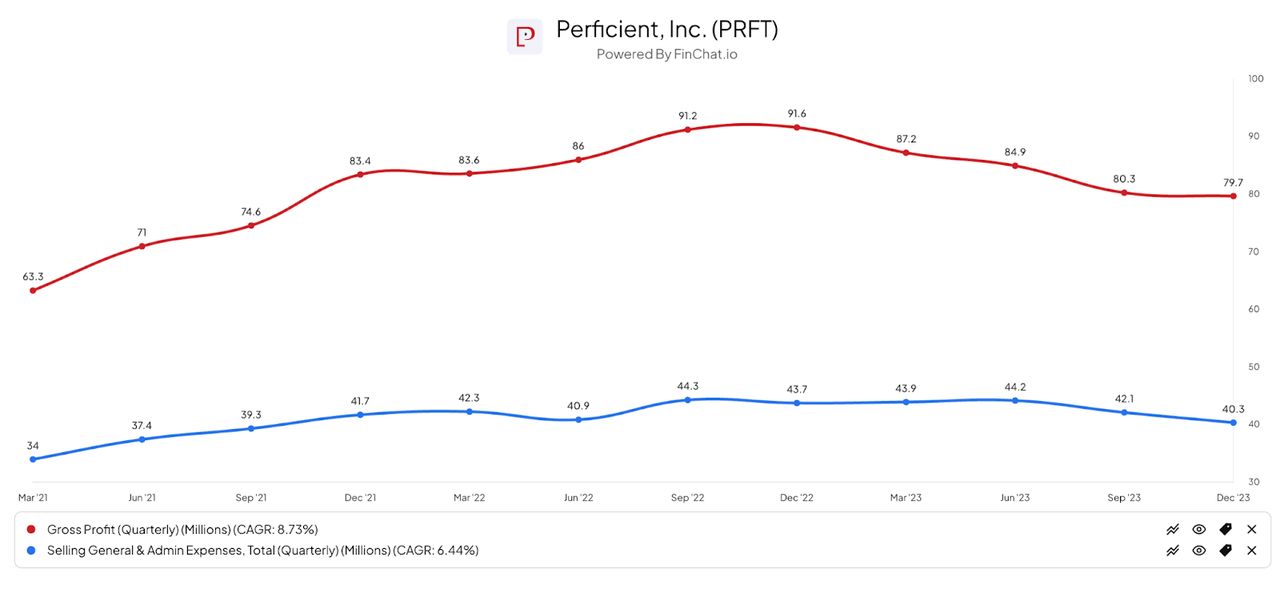

Gross profit margin by quarter (red line) has fallen as a result of higher benefit costs; Selling and G&A expenses as a percentage of total revenue by quarter (blue line) have dropped due to some employee attrition while management expects to maintain an overall utilization rate of 80% throughout 2024.

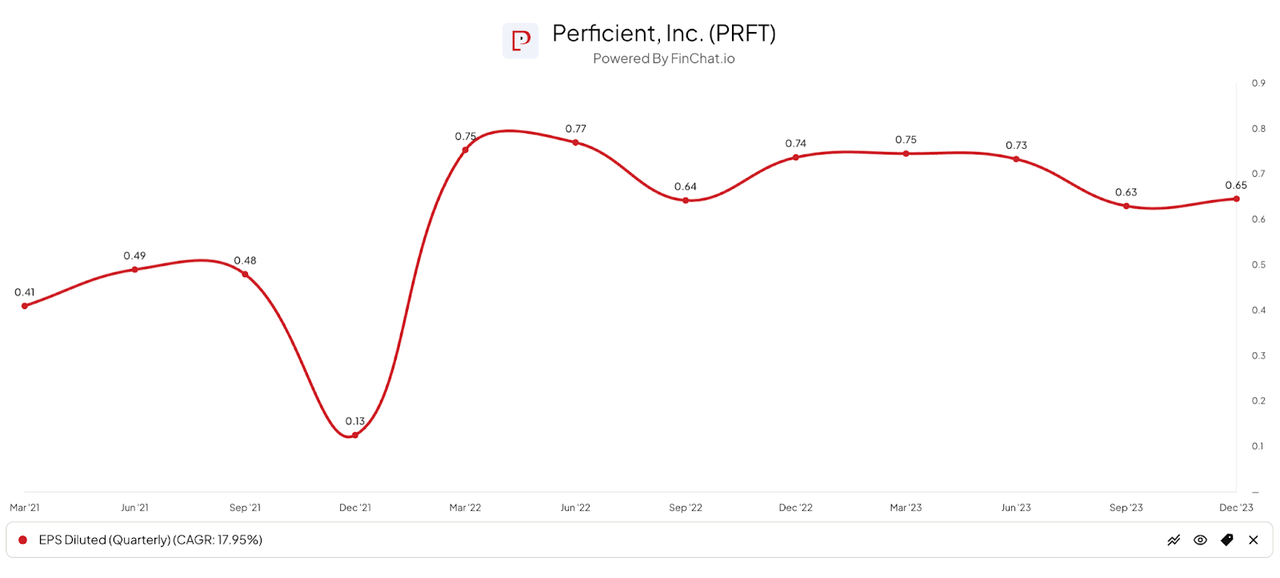

Earnings per share (Diluted) have fallen in recent quarters but remain reasonable at $0.65 in Q4 2023:

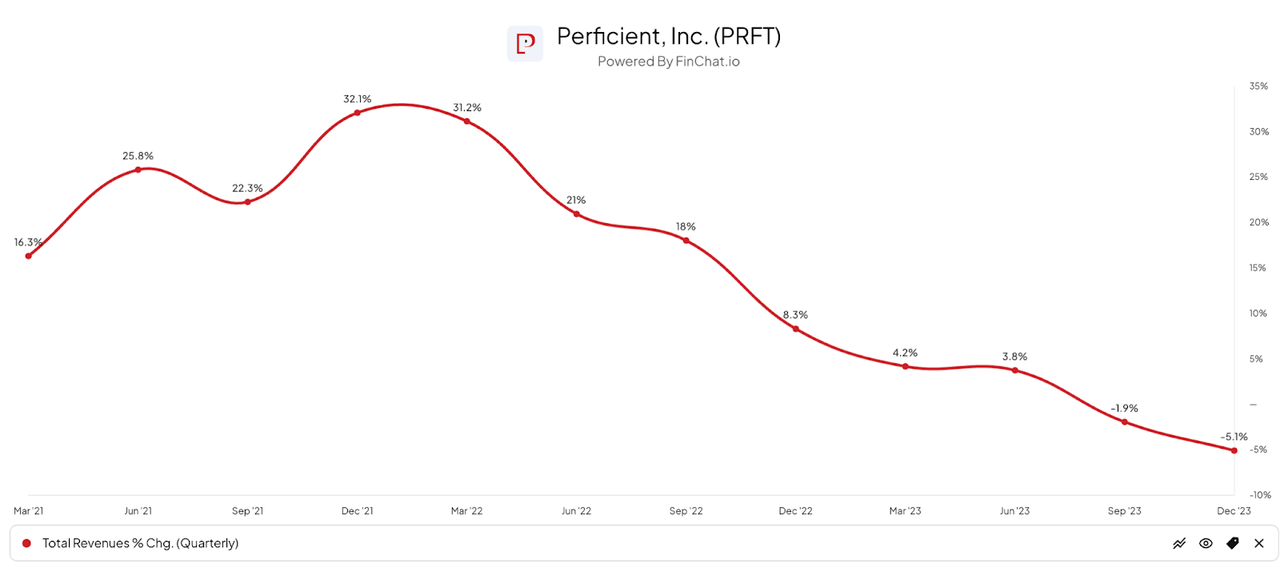

However, most tellingly is the year-over-year revenue growth (decline) on a quarterly basis, shown below:

While the company performed quite well during the pandemic, it has since been a one-way direction downward into year-over-year top line revenue contraction in the last two quarters, with no stabilization in sight.

(All data in the above charts is GAAP.)

Compared to consulting company EPAM Systems (EPAM), the two companies’ major metrics are shown here:

|

Metric |

EPAM Systems |

Perficient |

Variance |

|

EV/Sales (“FWD”) |

3.3 |

2.8 |

-16.2% |

|

EV/EBITDA (“FWD”) |

19.7 |

13.0 |

-34.2% |

|

Rev. Growth Estimate (“FWD”) |

4.6% |

3.8% |

-18.8% |

|

Net Income Margin |

8.9% |

10.9% |

22.7% |

|

Operating Cash Flow |

$562,630,000 |

$142,970,000 |

-74.6% |

(Source: Seeking Alpha.)

Both companies now have reduced forward revenue growth estimates, lower net income margins and less operating cash flow from my previous analysis as of the company’s Q1 2023 results.

This is consistent with the consulting industry in general which is facing reduced client spending on discretionary projects and sales cycle delays.

Below is a table of major metrics for valuation, performance and forward estimates:

|

Metric |

Amount |

|

EV/Sales (“FWD”) |

2.8 |

|

EV/EBITDA (“FWD”) |

13.0 |

|

Price/Sales (“TTM”) |

2.4 |

|

Revenue Growth (“YoY”) |

0.2% |

|

Net Income Margin |

10.9% |

|

EBITDA Margin |

17.8% |

|

Market Capitalization |

$2,270,000,000 |

|

Enterprise Value |

$2,560,000,000 |

|

Operating Cash Flow |

$142,970,000 |

|

Earnings Per Share (Fully Diluted) |

$2.76 |

|

2024 FWD EPS Estimate |

$4.05 |

|

Rev. Growth Estimate (“FWD”) |

3.8% |

|

Free Cash Flow/Share (“TTM”) |

$4.05 |

|

Seeking Alpha Quant Score |

Hold – 2.57 |

(Source: Seeking Alpha.)

Why I’m Neutral On Perficient

While I’ve previously expressed a positive hope for Perficient due to its improved bookings results, which management contends is a “strong correlation between bookings realized and revenue recognized five to six months out.”

However, when I covered PRFT for its Q1 2023 results, management predicted a stronger revenue picture in the second half of 2023 due its same contention, namely, that it was seeing stronger bookings and it would lead to stronger revenue recognition later in 2023.

Well, the company’s revenue contracted in the second half of 2023 on a YoY basis, so if the bookings/revenue connection is true, PRFT still produced declining revenue.

As a result, I don’t see any near-term positive catalyst for revenue, despite management’s bookings = future revenue assertions.

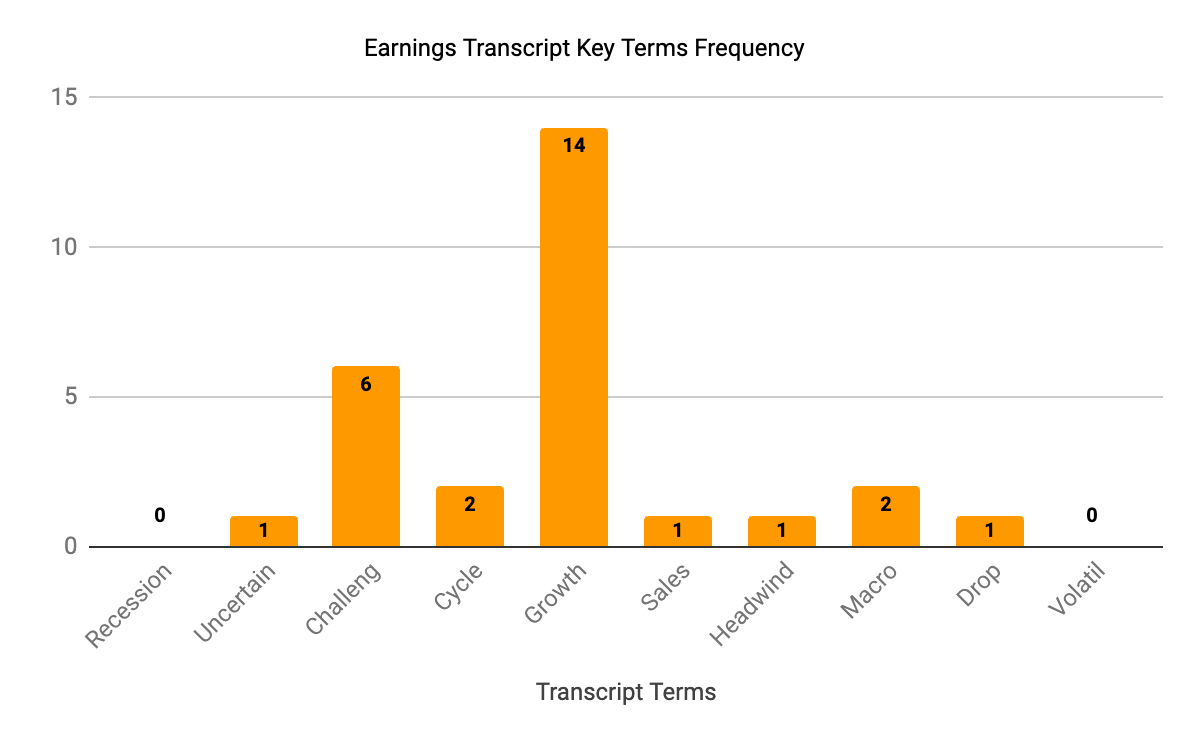

I’ve prepared a “sentiment indicator” of sorts for the most recent earnings conference call, showing the frequency of various keywords used by management and analysts:

Seeking Alpha

It’s clear the firm has been experiencing challenges with extended sales cycles and continued changes in client buying behavior as they have reduced their discretionary spend and focused on cost-takeout projects given a more difficult macroeconomic environment.

Having bookings growth or stabilization is one thing, but it appears to me that it really isn’t converting to meaningful revenue growth as the firm continues to produce contracting revenue year-over-year.

To be clear, this situation isn’t specific to PRFT as the consulting industry is generally in contraction mode.

Just recently, for example, noted consulting company Bain announced it offered buyouts and other options to certain of its UK staff.

Other consulting firms have been reducing or delaying their new hire initiatives.

However, some consulting firms have been working to retain their employee base, betting the downturn will be temporary and hoping to have operating leverage when client spending improves.

Perficient looks to be in the first case, with relatively stable utilization and slightly higher headcount due to an acquisition.

Qualitatively, management is maintaining that the firm’s conversations with clients is producing some budget “opening up” that promises to be positive for the second half of 2024, with some clients looking at increasing discretionary spending rather than the current focus on cost-takeout.

Count me in the camp of “wait and see,” though. Many other consulting firms are in the same situation, and some will be better positioned than others to take advantage of the turn in spending.

The questions are when that turn will occur and how sharp of a turn it will be. While we wait, I remain Neutral [Hold] on Perficient, Inc. due to its stable earnings despite possibly temporary revenue contraction.