VioletaStoimenova

As a value investor, the price that I pay for an opportunity is very important. I truly believe that there is a real intrinsic value to each business. And when I can buy shares of that business at a discount to that intrinsic value, then I maximize my potential to achieve upside. The natural implication of this is that once an investment is an attractive prospect, its status can change. It can become more attractive or less attractive, depending not only on a change in fundamentals, but also a change in price. So when a firm sees its share price skyrocket over a short window of time, that naturally makes me want to re-evaluate the situation.

A good example of this playing out can be seen by looking at Premier Financial Corp. (NASDAQ:PFC), a rather small bank located in my home state of Ohio. Despite the fact that the institution is located in Youngstown, which is one of the most depressed cities within the state, it has done well for itself and its shareholders over the long haul. Back in early November of last year, I ended up publishing an article about the firm wherein I rated it a ‘buy’ because of its track record and because of how attractively priced units were. But since then, the stock has shot up 19.3%, narrowly outperforming the 18.1% rise seen by the S&P 500. The good news is that, even with this move higher, the stock does look attractive. It might not be as appealing as it was previously, but it is appealing enough to warrant further upside from here.

Shares can keep climbing

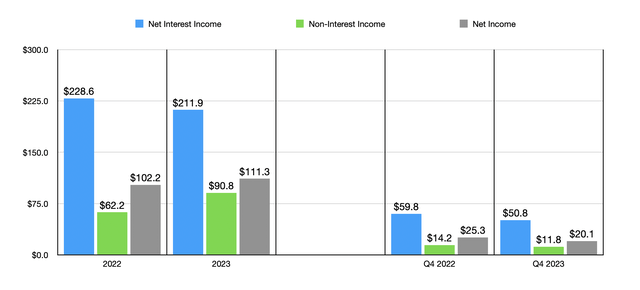

Back when I last wrote about Premier Financial, we only had fundamental data extending through the third quarter of the 2023 fiscal year. That data now extends through the final quarter as well. To start off with, we should probably touch on the bad news for the business. And that is that the last quarter of 2023 ended up being disappointing from a revenue and profit perspective. Net interest income, for instance, came in at only $50.8 million. This represents a decline from the $59.3 million reported for the final quarter of the 2022 fiscal year. The primary culprit on this front was the firm’s net interest margin, which fell from 3.28% last year to 2.65% this year.

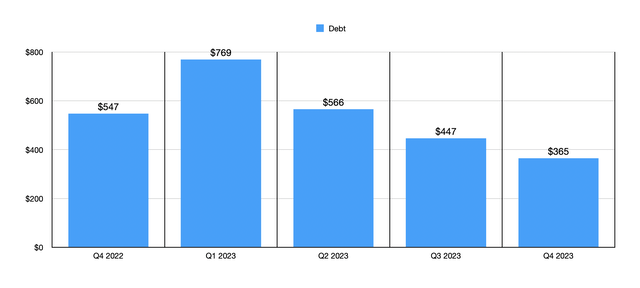

There are several working parts that make up these numbers. But for the most part, the pain stemmed from an increase in its interest-bearing liabilities. Interest bearing deposits, for instance, went from costing the firm 1.07% per year to costing it 2.83%. And debt went from as low as 3.76% to as high as 5.49%. The picture would have been worse, but management has done well to decrease the amount of debt on the company’s books. At the end of 2022, debt totaled $547.3 million. This spiked to $769.4 million by the first quarter of the year. But by the end of 2023, it had fallen to $365.2 million.

Non-interest income for the bank dropped as well, falling from $14.2 million to $11.8 million. This, combined with the decline in net interest income, pushed net profits down from $25.3 million to $20.1 million. As you can see in the first chart in this article, for the year as a whole, only net interest income weakened year over year. Both non-interest income and net profits managed to rise nicely. However, this would not have been possible had it not been for the gain that the company booked on the sale of its insurance agency. That was a benefit earlier in 2023 that amounted to $36.3 million.

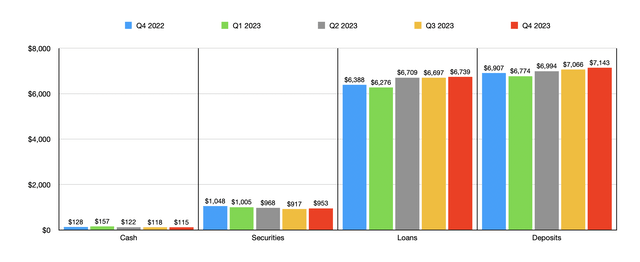

Despite the bad news on the top line and on the bottom line, most of the other data for the institution came in strong. The value of deposits totaled $7.14 billion at the end of 2023. That’s up from the $6.91 billion reported for the end of 2022, and it stacks up nicely against the $7.07 billion generated in the third quarter of last year. Uninsured deposit exposure inched up slightly from 32.8% to 33.1%. But if we make certain adjustments centered around deposits that are collateralized, then the increase was from 17.7% to 18.9%. This is lower than the 30% upper limit that I tend to prefer.

With the rise in deposits also came growth elsewhere. Loans went from just under $6.70 billion in the third quarter of 2023 to $6.74 billion in the final quarter. And the value of securities went from $917 million to $952.5 million. Unfortunately, cash did decrease some, but only very modestly from $117.5 million to $114.8 million. But considering that debt has fallen as I indicated already, I see this as a nothing burger.

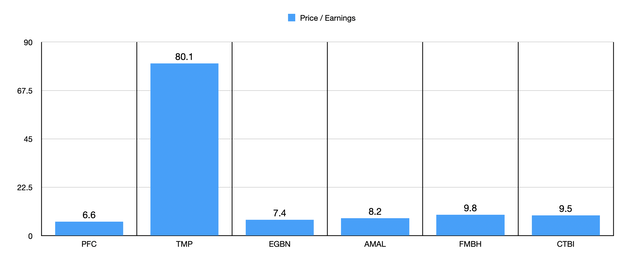

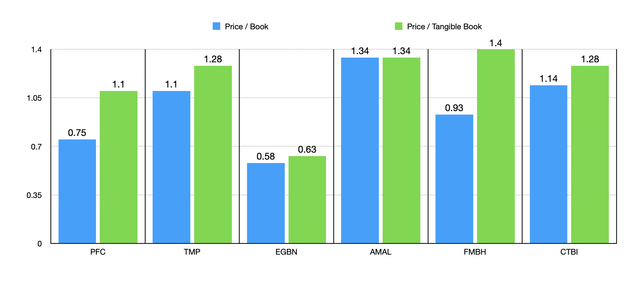

In terms of how the bank is priced, shares still look cheap in most respects. On a price to earnings basis, units are trading at a multiple of only 6.6. In the chart above, you can see how this causes the institution to stack up against five similar firms. When it comes to this particular metric, it ended up being the cheapest of the group. It’s also cheap on a price to book value basis as shown in the chart below. The company is trading at only 75% of its book value. Only one of the five firms that I compared it to were cheaper than it in this regard. That same ranking also holds true when it comes to the price to tangible book multiple of 1.10. All but one of its competitors that I brought up for the purpose of this article ended up being cheaper than it in this respect.

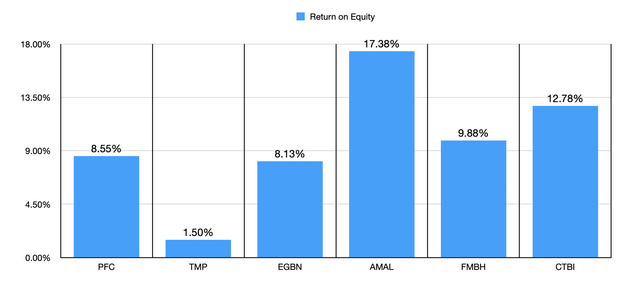

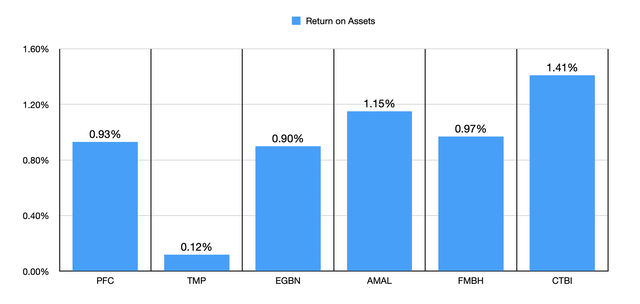

The firm’s relative valuation is important, but we should also be paying attention to the quality of the business as well. Sometimes, shares of firms are cheap for a reason. In the first chart below, you can see the return on equity, not only for Premier Financial, but also for the five firms I decided to compare it to. Two of the five ended up being lower than it when it comes to this particular metric. And then the chart below that, I decided to look at the picture through the lens of the return on assets. Once again, two of the five ended up being lower than it. This places Premier Financial more or less in the middle of the pack from a quality perspective, perhaps slightly on the low end of the scale. But it’s not such a stark difference that it makes me feel as though the firm deserves to trade at a material discount.

Author – SEC EDGAR Data Author – SEC EDGAR Data

Takeaway

Based on all the data provided, I must say that I remain impressed by Premier Financial. The firm is not a stellar prospect by any means. The fact of the matter is that there are probably better opportunities out there. But all things considered, the institution is continuing to expand its physical footprint by growing assets. Shares look cheap on both an absolute basis and relative to similar enterprises. And when it comes to the quality of the institution, it looks to be around the middle of the pack or just slightly below average. All combined, this makes me believe that the ‘buy’ rating I previously assigned the institution still should hold.