Nikada

Article Thesis

JD.com, Inc. (NASDAQ:JD)(OTCPK:JDCMF) will report its Q4 2023 earnings results on Wednesday. In this report, we will take a look at what investors can expect while also delving into the question of whether JD.com is an attractive investment at current prices.

Past Coverage

I have covered JD.com in the past, most recently last fall, in this article. In that article, I argued that JD.com’s operating performance was good thanks to improving margins but that geopolitical risks exist and that JD.com is highly exposed to China’s economy. Since then, shares have declined, which has made them even cheaper. With upcoming results being a potential catalyst, it is time to take another look at the company.

What Can Investors Expect?

The consensus estimate for JD.com’s revenues stands at $41.6 billion for the upcoming quarterly report. This implies a revenue decline of about 2% compared to the previous year’s quarter. Naturally, this isn’t a great result in general — e-commerce businesses are seen as growth investments, and a small decline in revenues does not really fit with that narrative. That being said, there are a couple of other things investors should consider when it comes to the expected revenue decline.

First, even quality e-commerce businesses can expect a bit of a temporary downturn — not all quarters will be equally strong, and some quarters will show a better year-over-year growth rate than others. Even an e-commerce giant such as Amazon (AMZN) has seen its revenue growth rate fall to the single digits at times. That’s still better than a 2% revenue decline, but the point is that Amazon is not a bad company or doomed to grow at a slow pace forever if it has a quarter, or two, of weaker year-over-year growth. Business growth can accelerate again.

Second, JD.com is oftentimes underestimated. The company has beaten revenue estimates in 17 out of the last 20 quarters, thus there is a clear trend for Wall Street analysts to underestimate JD.com. There is no guarantee that this will happen again when it comes to the upcoming quarterly earnings report, but history suggests that there is a good chance that JD.com will outperform expectations once again. In that case, the year-over-year performance would be better than what is expected right now.

Third, investors should consider the fact that revenue growth itself isn’t the ultimate goal for a company. Businesses want to earn money, and while revenue growth can help with that, it is not necessary per se. When companies shed unprofitable businesses or reduce incentive spending, revenues may pull back temporarily, but in those scenarios, profits may very well grow nevertheless, as margin improvements more than offset the small revenue declines. JD.com has put more emphasis on profitability in the recent past, deciding against chasing revenue growth at all costs. While some might argue that this hurts the growth narrative, I believe that such a strategy is beneficial for shareholders in the long run. Rising profits on a per-share basis drive share price gains in the long run, thus seeking to optimize for earnings per share growth seems like a good idea to me.

This brings us to the earnings per share estimates for JD.com’s upcoming quarterly report. Analysts are currently predicting that the company has earned $0.63 per share during the quarter. While this would represent a decline compared to the previous year’s period, it is very important to note that the analyst consensus estimate has been pretty far from target in the past: JD.com has beaten the consensus earnings per share estimate by 15%, 9%, 35%, and 38% over the last four quarters, respectively [see Seeking Alpha page linked above]. With Wall Street analysts being this far off when it comes to estimating JD.com’s profitability in the recent past, I believe that there is a serious chance the company will outperform expectations once again.

JD.com: Very Inexpensive

JD.com has a good chance of reporting better-than-expected results, but the company will not showcase any extraordinary or explosive business growth for sure. The good news is that very strong growth isn’t needed when JD.com trades at a very undemanding valuation.

Based on the consensus earnings per share estimate for 2023, JD.com trades at less than 8x forward earnings — that makes for an earnings yield of close to 13%. In theory, JD.com could thus be a pretty nice investment if the company never grew again and just returned all of its profits to its shareholders. That isn’t what JD.com plans to do, but the little thought experiment shows that JD.com does not necessarily have to generate massive growth going forward. Of course, higher growth would be better, but even in a no-growth or low-growth scenario, JD.com could be an appealing investment as the market currently prices JD.com as if its earnings were about to decline into perpetuity.

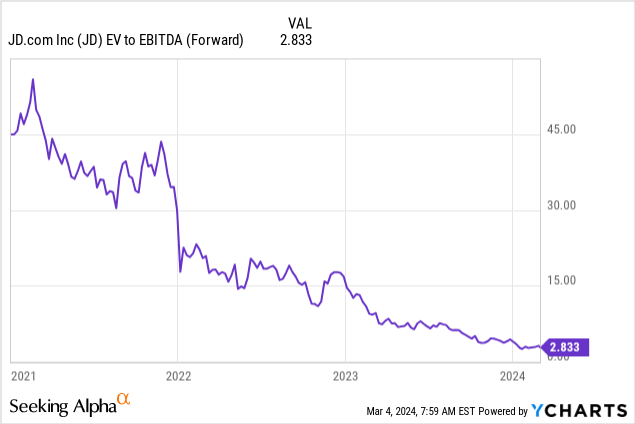

Likewise, the enterprise value to EBITDA multiple suggests that JD.com is very inexpensive and trading below fair value today:

The EV to EBITDA multiple stands at below 3.0 right now, thanks in part to a fortress balance sheet: JD.com had cash and short-term investments totaling $33 billion as of the end of the third quarter, whereas short-term debt and long-term debt stood at just $6 billion combined. With a huge net cash position, JD.com’s enterprise value is considerably lower than its market capitalization, resulting in a very low EV/EBITDA multiple. Oftentimes, EV/EBITDA multiples below 10 are seen as solid value indicators — JD is way below that level.

One could argue that the massive cash pile on the balance sheet does not generate a lot of value when it is just sitting there, apart from generating some interest income, but JD.com could eventually use its cash hoard to drive shareholder value. This could happen via the introduction of higher dividend payments, for example. Meta Platforms (META) and Alibaba (BABA) have recently introduced dividends and the market appreciated these moves. JD.com already offers dividends, but in an environment where more and more tech companies are offering up direct cash payments to their owners, JD.com could decide to hike its dividend substantially. The current payout ratio is around 20%, which would allow JD.com to increase dividends substantially. JD.com could also ramp up its buyback activity in order to reduce the share count as much as possible, thereby increasing each share’s portion of the company and its future earnings. That has worked well for other tech companies including Apple (AAPL) and would make productive use of JD.com’s huge cash position, I believe.

Is JD.com A Good Investment?

While not growing like a weed, JD.com is active in an industry with growth tailwinds. When China’s economic growth picks up again, JD.com and other consumer-focused businesses should benefit and see their growth rates pick up as well.

JD.com is very inexpensive, and not a lot of growth is needed for substantial shareholder returns. If JD.com were to trade at 10x net profits a year from now, without profits growing at all over that time frame despite margin improvement initiatives, then JD.com’s share price would still appreciate by around 28%, which would make for a ~30% return when we also account for dividends. This example shows that valuation changes, e.g. due to better shareholder returns or due to improving macro sentiment, can help drive highly attractive returns when one buys a company that is trading at a very low valuation.

Investors should not neglect the China-specific risks, of course. There’s the reliance on the Chinese economy, for example — in a major economic downturn, JD.com would be heavily exposed. Regulatory risks exist as well, although JD.com has recently been a beneficiary of regulation, as courts ruled in favor of and against Alibaba in a court case about anti-competitive practices. If tensions between the United States and China were to rise, Chinese stocks such as JD.com could face sell-offs as well. JD.com is thus not a risk-free company at all, but for someone looking for China exposure, JD.com could nevertheless make sense in a diversified portfolio — the valuation is so low that even moderate business growth could result in great total returns in the long run.