Koshiro Kiyota/iStock Editorial via Getty Images

Note: All amounts referenced are in Canadian dollars. Stock price referenced is from TSX and not the USD OTC price.

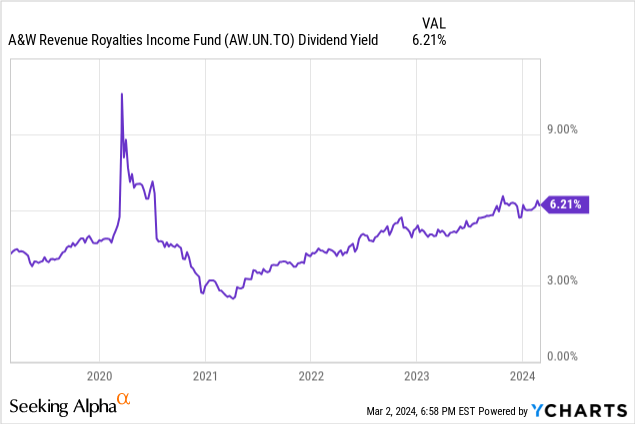

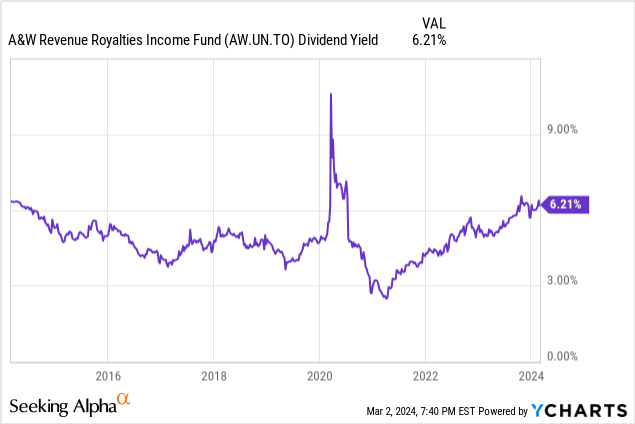

You can bid up anything to any price. You can throw rational multiples out and move to “this time is different”. That almost always means poorer returns from that point than from the preceding period. A&W Revenue Royalties Income Fund (OTC:AWRRF) (TSX:AW.UN:CA) was in the same category as its valuation flew high in 2021 and leapt to extremely irrational levels. Sure, there was the “reopening” ahead but moving this to a trailing 12 month dividend yield of 3% was just plain silly.

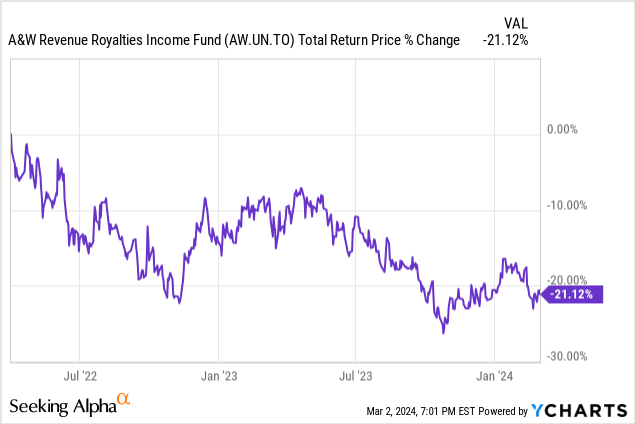

Briefly, though A&W’s trailing 12 month dividend yield actually moved up faster than the price and the stock actually peaked near $42 in 2022. If you bought then, you are sitting 21% losses, despite some hefty dividends.

We go over the Q4-2023 results and tell you why you can now consider this for an investment position, and what risks you should take into account.

The Company

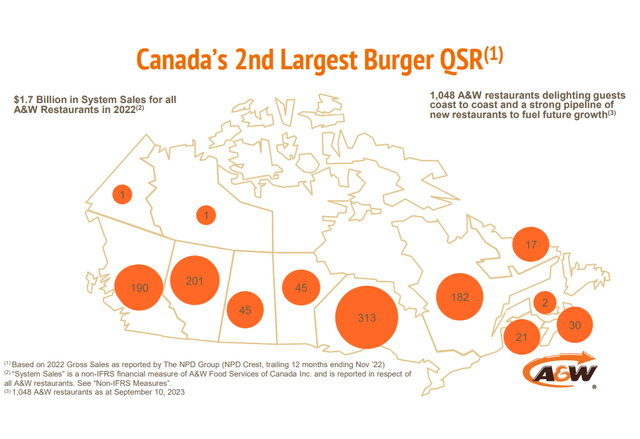

We have introduced this company more than once, so we won’t get into the details here.

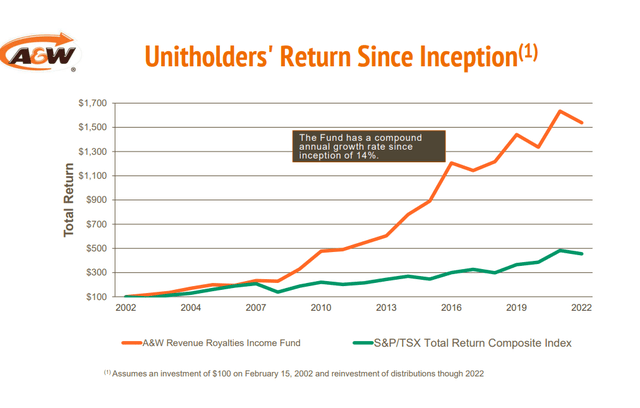

A&W Presentation

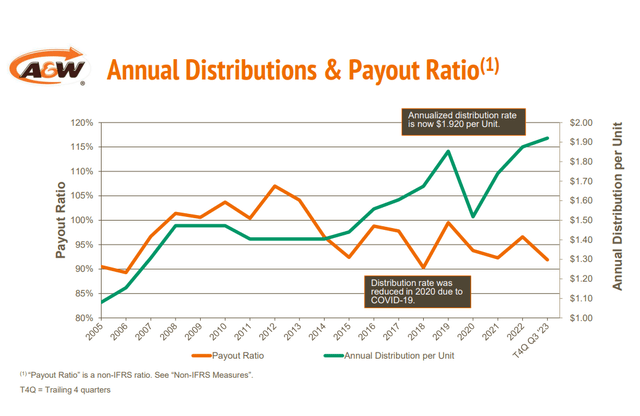

Those interested, can see an earlier article spelling out the setup and why that is useful. We want to add here that the company generally retains very little cash as it does not need cash to fund its expansion. It also tends to pay out most of its earnings as dividends and it is literally aiming for a 100% payout. So investors should not be complaining about the payout ratio being extremely high. That’s a feature, not a bug.

A&W Presentation

Q4-2023

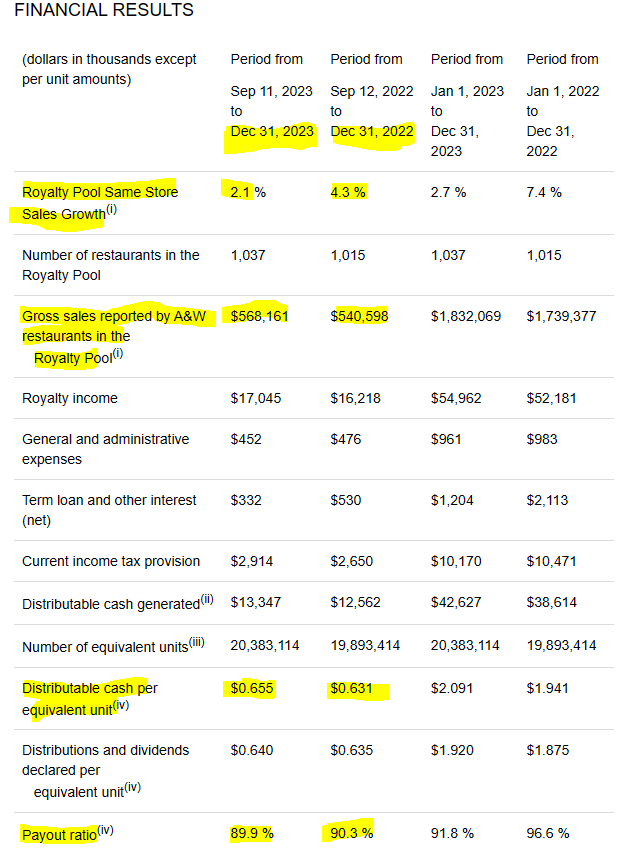

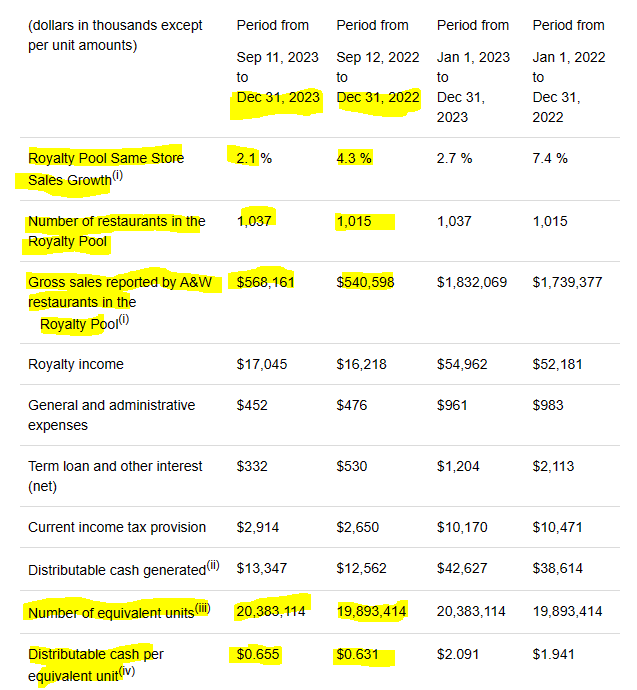

Q4-2023 marked a good end to a good year for A&W. The same store growth was mediocre at 2.1%, but overall gross sales were up by over 5% from Q4-2022.

A&W Q4-2023 Results

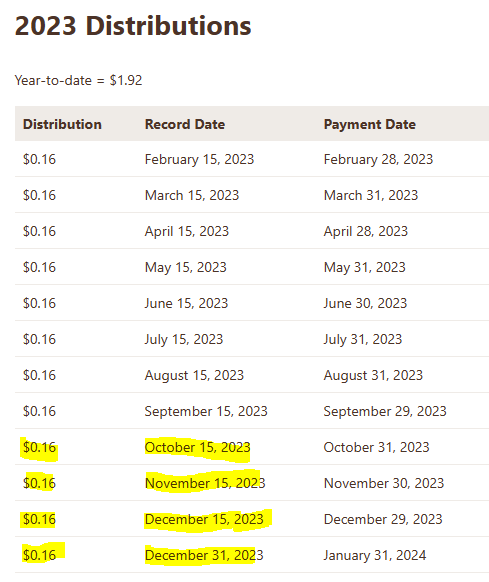

The total number of restaurants in the royalty pool expanded and the distributable cash per unit was up by 3.8%. Despite a slight increase in the total amount of distributions in Q4-2023 relative to Q4-2022, the payout ratio fell slightly. Those confused about the amounts, must note that there is one extra distribution made in Q4 and Q1 will skip one.

A&W Presentation

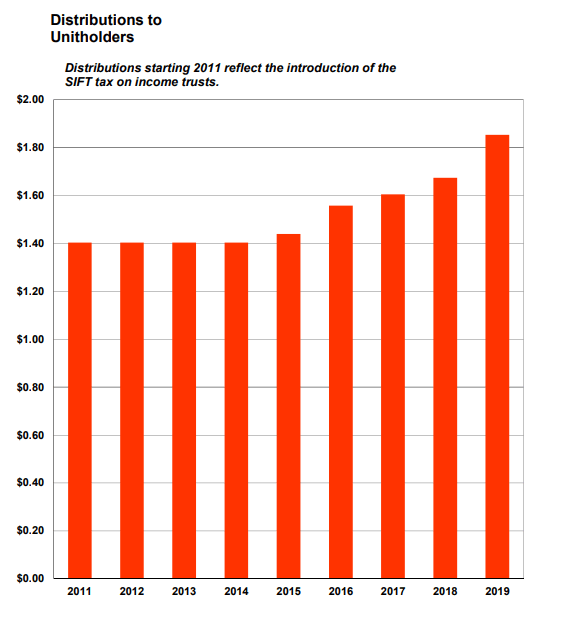

The distributions are now firmly past the pre-pandemic levels on an annual basis and look well covered.

A&W Presentation 2019

Outlook

A&W is a royalty play that benefits primarily from sales growth (volume in same restaurants) and from inflationary changes to the top line in these restaurants. What they don’t really benefit from, at least to the same extent, is the opening of new franchise locations. The reason is that they have to issue new units for these restaurants.

The Royalty Pool is adjusted annually to reflect sales from new A&W restaurants added to the Royalty Pool, net of the sales of any A&W restaurants that have permanently closed. Food Services is paid for the additional royalty stream related to the sales of the net new restaurants, based on a formula set out in the Amended and Restated License and Royalty Agreement. The formula provides for a payment to Food Services based on 92.5% of the amount of estimated sales from the net new restaurants and the current yield on the Units, adjusted for income taxes payable by Trade Marks. The consideration is paid to Food Services in the form of additional limited partnership units (“LP units”).

Source: Annual Report

They do share somewhat in these and of course over time these sales grow as well, but the equity issuance does neutralize this angle of growth to some extent. You can see this in this quarter’s results where the distributable cash per unit grew 3.8%, somewhere between same store growth rate (2.1%) and total growth rate (5.1%).

A&W Q4-2023 Results

This is a fairly good model though, as if you add the 6.2% yield and get 3.8% distribution growth in the long run, you get to 10% total returns with rather minimal capital risk. They have actually done better than that over the very long run, though we would not hold our breath for anything in this ballpark today.

A&W Presentation

We can see that lack of risk even on the debt side of the equation as A&W had accessed barely $15.7 million of its $40 million credit facility.

As at December 31, 2023, Food Services had drawn $15,726,000 on the credit facility (January 1, 2023 – $8,149,000), of which $3,366,000 was repaid by January 28, 2024, and had issued $198,000 in letters of guarantee (January 1, 2023 – $198,000), leaving $24,076,000 of the facility available (January 1, 2023 – $31,653,000)

Source: Annual Report

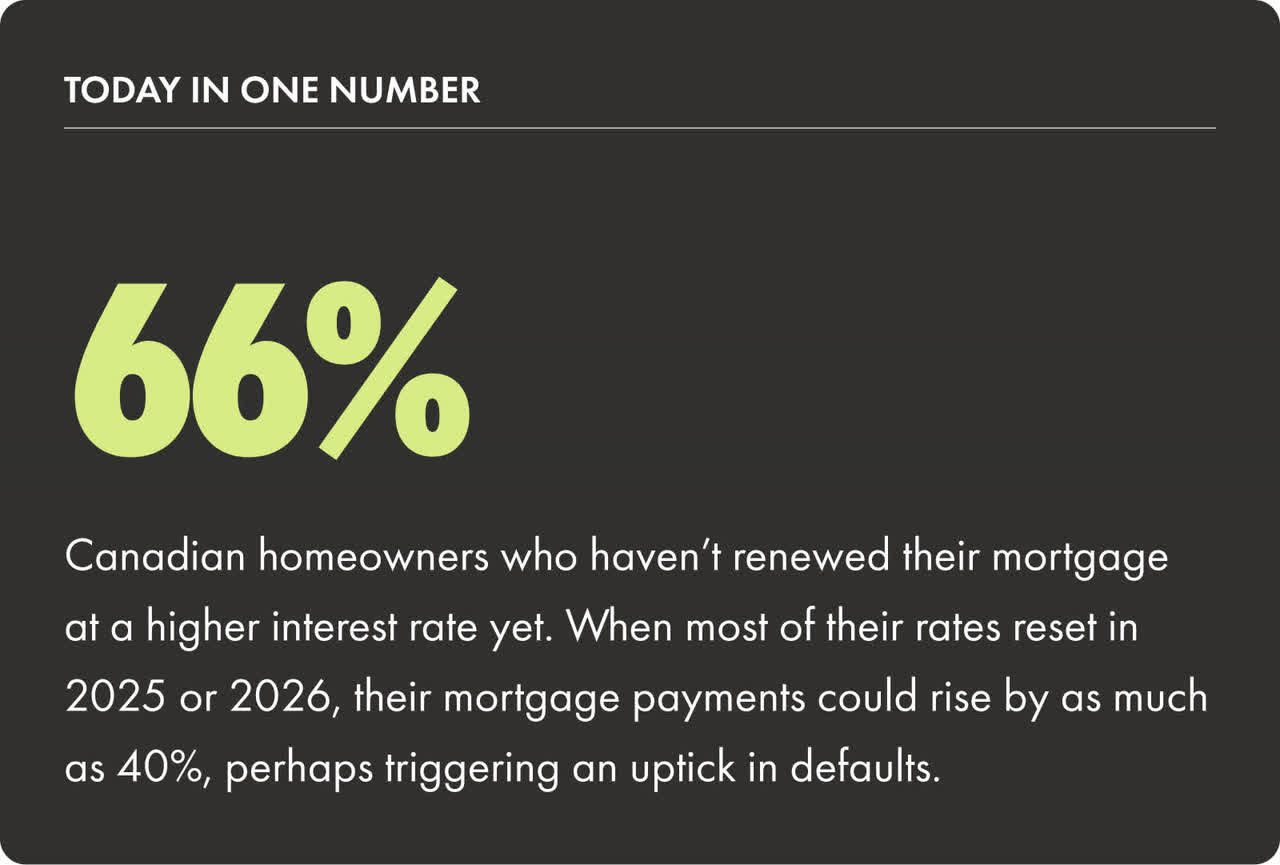

Annual pre-tax royalty income was around $55 million, leading to a microscopic debt to EBITDA number. The risk here comes from the broader macro issues for the company. Fast food was always expensive, and somehow the pandemic really made this into a “luxury item”. We have seen this first hand of menu items moving from $5 to $7 over the space of 4 years. 40% price increases are really hard to swallow and unless they get some pricing rationality soon, there will be blowback. Canadians are also heavily indebted and have hitched their hopes on interest rate cuts. We say that because as a country we thought that mortgages resetting every 5 years made more sense than locking it in for 30 years.

Wealth Simple On X

You also saw that in the last quarter the CEO refused to acknowledge what everyone with basic math skills knew, the customer was hurting. So you have a riskier setup, but on the plus side, we finally have A&W trading at a level that makes sense. If you ignore the 2020 COVID-19 price crash (where the trailing 12 month dividend yield went vertical), this is the highest yield you are getting from this over the last decade.

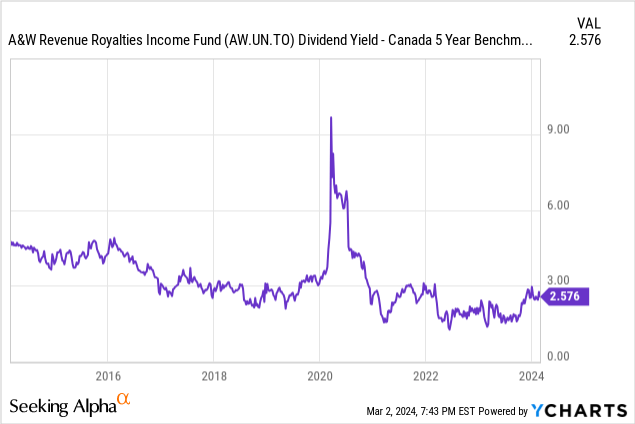

The counterargument of course is that interest rates are higher as well. If you plot the dividend yield as a spread to the 5 year Government of Canada bond yields, this is not exactly looking cheap today.

So which argument do we lean on?

Verdict

Our rationale of giving less weight to the spread here relative to the GOC-5 yields is because we think that a high rate environment will only persist if inflation is stubborn. While rapid price increases of 2020-2023 won’t be happening, we think A&W can price close to inflation rates in its annual price changes. The company has a built-in offset and the highest absolute dividend yield of the last decade is good enough to start getting in. We will also note here that if it paid out everything it earned, the dividend yield would have been 6.77%. All things considered, we think this is a good point to start nibbling on this one as valuation compression has taken enough of a toll. We are going to do just that with a starter position some time in the coming week.

Please note that this is not financial advice. It may seem like it, sound like it, but surprisingly, it is not. Investors are expected to do their own due diligence and consult with a professional who knows their objectives and constraints.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.