SIphotography

Investment Thesis

Global X SuperDividend ETF (NYSEARCA:SDIV) warrants a strong sell due to multiple concerning factors impacting the fund. While SDIV offers a very high dividend yield, it has seen a steep decline in share price along with poor fundamental qualities for its top holdings. These factors have resulted in a negative dividend yield growth rate that has also further driven down SDIV’s share price. Additionally, SDIV contains a high number of international holdings that represent noteworthy geopolitical risk. Therefore, despite its alluring dividend yield, investors seeking alpha should steer away from SDIV. There are multiple alternative funds I will discuss in this article that offer a substantial dividend yield while also demonstrating an ability to achieve capital appreciation.

Fund Overview and Compared ETFs

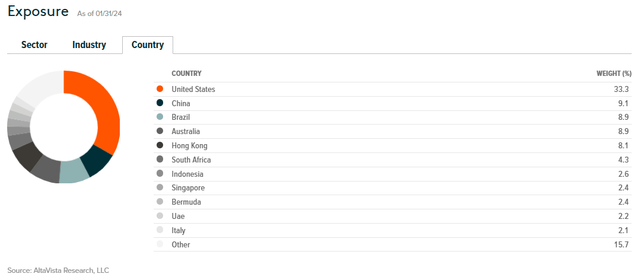

The Global X fund seeks to capture the 100 highest dividend paying equities in the world. With its inception in 2011, the ETF has 135 holdings with $735M in AUM. SDIV has a high number of international holdings and is heaviest by geographic break-down on U.S. holdings (33.30%), followed by China (9.1%), Brazil (8.9%), and Australia (8.9%). Its heaviest market sector weights include financials (27.3%), followed by energy (18.0%) and materials (15.0%).

For comparison purposes, I am including other funds that see a substantial dividend yield along with capital appreciation. These alternative funds may be considered in an investor’s due diligence process as an acceptable alternative to SDIV. These are Invesco’s S&P 500 High Dividend Low Volatility ETF (SPHD), Amplify’s CWP Enhanced Divided Income ETF (DIVO), and JPMorgan’s Equity Premium Income ETF (JEPI).

SPHD tracks the S&P Low Volatility High Dividend Index and contains only U.S. holdings. The fund is heaviest on utilities (19.70%), consumer staples, (15.63%) and real estate (14.33%). SPHD includes predominantly mid-cap equities, followed by large cap, and small cap. DIVO includes high-quality dividend stocks and incorporates some covered calls. It seeks holdings that have a history of providing dividend returns. JEPI is the youngest of ETFs compared with an inception in 2020. However, it was the fifth most popular ETF in 2023 now reaching over $32B in AUM. It is an actively managed fund that seeks to deliver monthly income along with capital appreciation. JEPI includes predominantly S&P 500 holdings and offers a dividend yield with relatively low volatility. All ETFs compared pay out dividends monthly.

Performance, Expense Ratio, and Dividend Yield

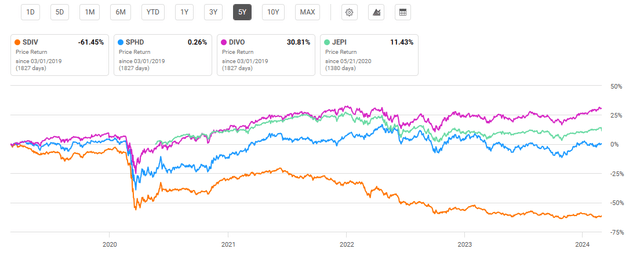

Multiple ETFs exist that allure investors with a high dividend yield only to see sharp declines in share price. SDIV is one of those funds. SDIV has a 5-year average annualized return of -6.41% and a 5-year total price return of -61.45%. This is the key difference between SDIV and the other alternative dividend ETFs discussed. By comparison, SPHD has a 5-year annualized return of 4.71%, DIVO has a 5-year annualized return of 11.69%, and JEPI has a 3-year annualized return of 8.83%.

5-Year Price Return Performance: SDIV and Compared Dividend Funds (Seeking Alpha)

In addition to a concerning decline in share price, SDIV also has the highest expense ratio of compared funds at 0.58%. SDIV’s most attractive quality is its dividend yield at just over 12%. However, this dividend yield has been declining with a 3-year dividend CAGR of -3.84%. Comparatively, the other peer funds have increased their dividend yields. The likely root cause of this difference is the fundamental qualities of its holdings including payout ratios that I will discuss further later.

Any ETF with over a 10% dividend yield should be approached with caution. While SDIV offers the highest dividend yield, its share price performance has been abysmal. Therefore, when looking at both qualities of dividend yield and price return together, SDIV has been the least desirable ETF compared.

Expense Ratio, AUM, and Dividend Yield Comparison

|

SDIV |

SPHD |

DIVO |

JEPI |

|

|

Expense Ratio |

0.58% |

0.30% |

0.55% |

0.35% |

|

AUM |

$735.44M |

$2.38B |

$3.06B |

$32.78B |

|

Dividend Yield TTM |

12.13% |

4.51% |

4.55% |

7.68% |

|

Dividend Growth 3 YR CAGR |

-3.84% |

1.60% |

1.79% |

4.60% |

Source: Seeking Alpha, 2 Mar 24

SDIV Holdings and Key Red Flags

Because SDIV simply seeks to provide the highest dividend yield holdings without any major consideration for quality and performance, its holdings vary significantly with SPHD, DIVO, and JEPI. SDIV is the most diverse of the funds examined with 135 holdings and holds the least weight on its top 10 holdings.

Top 10 Holdings for SDIV and Compared High Dividend ETFs

|

SDIV – 135 holdings |

SPHD – 51 holdings |

DIVO – 31 holdings |

JEPI – 132 holdings |

|

316 HK – 1.80% |

MO – 3.02% |

MSFT – 5.60% |

PGR – 1.7% |

|

639 HK – 1.54% |

VZ – 2.84% |

HD – 5.50% |

MSFT – 1.7% |

|

RC – 1.46% |

T – 2.83% |

WMT – 5.45% |

AMZN – 1.7% |

|

MMS AU – 1.37% |

KMI – 2.77% |

V – 5.45% |

TT – 1.6% |

|

3618 HK – 1.35% |

D – 2.59% |

PG – 5.18% |

INTU – 1.6% |

|

YAL AU – 1.34% |

OKE – 2.50% |

UNH – 4.91% |

MA – 1.6% |

|

BWLPG NO – 1.28% |

CCI – 2.39% |

CVX – 4.84% |

ACN – 1.6% |

|

UNIT – 1.27% |

LYB – 2.32% |

MCD – 4.79% |

V – 1.5% |

|

CPLE6 BZ – 1.26% |

SPG – 2.31% |

GS – 4.71% |

ABBV – 1.5% |

|

8 HK – 1.17% |

WMB – 2.29% |

CAT – 4.34% |

META – 1.5% |

Source: Multiple, compiled by author on 2 Mar 24

Upon close examination of SDIV’s holdings, several key red flags exist. The first is the poor fundamental metrics associated with several of its top-weighted holdings. The second concerning factor is the sustainability of its top holdings’ dividend yields. This red flag can be measured by looking at each holding’s dividend payout ratio. Finally, SDIV’s relatively heavy weight on international holdings represents geopolitical risk.

Red Flag #1: Shaky Fundamentals

The first worrisome factor is the poor fundamental metrics for several of SDIV’s top holdings. For example, looking at SDIV’s #1 holding, Orient Overseas International (316 HK). Orient Overseas is a container shipping and logistics company based in Hong Kong and has seen negative growth along with declining cash flow. With a -36.38% YoY revenue growth, the company has attempted to maintain a high dividend yield as high as 35%. However, with a -70.42% YoY FCF growth, its sustainability is highly questionable. SDIV does include U.S. holdings as well. One example is Uniti (UNIT), a real estate investment trust. While offering a dividend yield over 9%, UNIT has seen a -18.87% YoY AFFO growth along with a -23.25% YoY operating cash flow growth. Therefore, declining growth and cash flow found in multiple of SDIV’s top holdings represents the first red flag for the fund.

Red Flag #2: High Payout Ratios

The second concerning factor for SDIV is the high dividend payout ratio for its holdings. A high payout ratio increases the risk of a company having to cut its dividend. In my mind, a dividend payout ratio over greater than 50% is concerning as more than half of the company’s earnings are being paid as dividends. Alarmingly, nearly all of SDIV’s top holdings have payout ratios greater than 50%. Several of these top holdings with high payout ratios are listed below.

|

SDIV Holding |

SDIV Weight |

Dividend Payout Ratio |

|

316 HK |

1.80% |

73.08% |

|

639 HK |

1.54% |

161.81% |

|

RC |

1.46% |

66.23% |

|

MMS AU |

1.37% |

148.30% |

|

YAL AU |

1.34% |

78.05% |

Source: Seeking Alpha and Yahoo Finance, Compiled by Author, 2 Mar 24

Likely because of these high payout ratios, SDIV has a 5-year dividend CAGR of -11.42%. Dividend yield cuts have a two-fold negative impact. In the event of a reduced dividend yield, not only do income seekers receive a lower dividend payment, but stock prices typically decline. This impact can already be witnessed by SDIV’s total 5-year price return of -61.45%. By comparison, Progressive (PGR), the top holding for JEPI, has a payout ratio of 18.65%. Alternatively, Microsoft (MSFT), the top holding for DIVO, has a payout ratio of 25.86%. These ratios imply a much greater sustainability than the payout ratios seen in SDIV’s top holdings.

Red Flag #3: Geopolitical Risk

The third and final concerning factor is the geopolitical risk associated with SDIV. Multiple of SDIV’s top holdings originate in Hong Kong (8.1%), which falls under China’s sovereignty, or China itself (9.1%). Due to China’s real estate development issues, a net outflow of foreign investment reached $11.8B in Q3 2023. Due to the strong bonds between China and Hong Kong economically, negative economic impacts directly cascade to Hong Kong as well. Therefore, even if conflict between the U.S. and China never occurs, the economic concerns for China alone are cause for concern in SDIV’s holdings.

SDIV Country Exposure Breakdown (AltaVista Research, GlobalXETFs.com)

Valuation and Risks to Investors

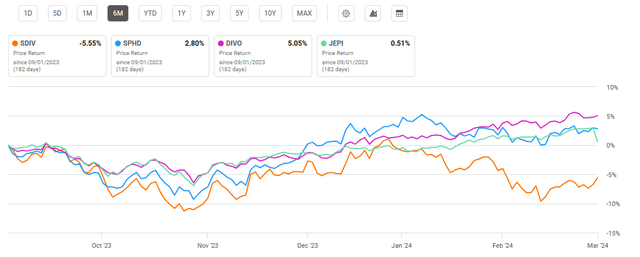

SDIV has a current price of $21.44 at the time of writing this article. This price is in the lower half of its 52-week range of $20.06 to $24.58 and below its all-time high of $78.60 seen back in 2014. Over the past six months, SDIV has performed the worst among compared dividend ETFs at -5.55%.

6 Month Performance: SDIV and Compared Dividend ETFs (Seeking Alpha)

SDIV demonstrates the most attractive valuation metrics when looking at price-to-earnings and price-to-book ratios. At 7.28, SDIV has the lowest P/E ratio compared to SPHD, DIVO, and JEPI. Additionally, SDIV has the lowest P/B ratio at 0.74. However, as already discussed with its high dividend yield, this does not translate into the most attractive buying opportunity. Poor fundamentals and high payout ratios for SDIV’s top holdings along with geopolitical risks will continue to drag down the fund. While I anticipate SDIV to continue providing a very high dividend yield looking forward, it will continue seeing a precipitous decline in share price.

Valuation Metrics for SDIV and Peer Competitors

|

SDIV |

SPHD |

DIVO |

JEPI |

|

|

P/E ratio |

7.28 |

12.72 |

15.40 |

20.59 |

|

P/B ratio |

0.74 |

2.06 |

3.70 |

3.79 |

Source: Compiled by Author from Multiple Sources, 2 Mar 24

One positive quality of all dividend ETFs examined is that their volatility is lower than “the market” overall. While beta values are a measure of correlation, they may be used as an implied volatility metric. SDIV’s beta value compared to the S&P 500 is 0.89. However, this is the highest value or greatest implied volatility. By comparison, DIVO has a beta value of 0.69 and JEPI has a one-year beta value of 0.54.

Concluding Summary

SDIV is an ETF that offers a high dividend yield. However, this is its one redeeming quality. All investors must also consider dividend sustainability, fundamental qualities such as growth and profitability for each holding, and the long-term track record of the fund’s share price. For me, SDIV has too many red flags with regards to these factors. In contrast, SPHD, DIVO, or JEPI have all seen sizable dividend yields, along with strong holdings that have driven capital appreciation.