Jacob Wackerhausen/iStock via Getty Images

Introduction

I’ll admit when Innovative Industrial Properties (NYSE:IIPR) was the new hot thing on the stock market, I almost bought into the company for the appealing dividend. I watched the stock explode and trade near $300 before crashing back down to earth. I remember saying to myself, I’m glad I didn’t start a position, or I would have been way underwater.

Despite the share price decline, the company’s fundamentals have remained strong. The REIT recently reported their latest earnings to close out the year and I have to admit I was utterly impressed, prompting me to conduct another analysis on the stock and ponder opening a position in my retirement account. In this article, I’ll discuss what makes IIPR attractive and why I may soon open a position.

Previous Analysis

I last covered Innovative Industrial Properties this past November in an article titled: The Dividend Looks Juicy But Growth Outlook Looks Dry. I discussed that although the dividend growth was impressive and well-covered, their tenant troubles and growth outlook were some things that made me skeptical.

Cannabis industry sales were expected to grow 66% to $58 billion over the next 6 years but despite the impressive growth, IIPR’s financials are expected to decline by the end of 2024, again making the REIT a risky investment in my opinion.

However, there were some metrics I liked, such as their well-covered dividend and strong balance sheet. Well, since then, the company has reported Q4 earnings, closing out the year strong with a beat on both the top & bottom lines. And analyzing the company a bit further, it may be time to consider starting a position.

Follow-Up

IIPR reported quarter four earnings on February 27th and impressively beat FFO estimates by $0.05 and revenue estimates by nearly $3 million. FFO was $2.07 while revenue came in at $79.16 million. While FFO declined slightly quarter-over-quarter from $2.09, revenue climbed from $77.8 million in Q3. However, both FFO & revenue rose year-over-year roughly 6% and 12% respectively from $1.95 and $70.5 million.

The REIT also collected 100% of their rent, which rose from 97% in Q3 and 94% from Q4 ’22. Considering their tenant problems with Parallel, Green Peak, and Medical Investor holdings, I was a bit surprised and impressed they were able to collect 100% rent.

Especially, considering the challenging economic backdrop portfolio companies have faced with higher for longer interest rates. The stressful environment has caused companies to not only default on rents, but some have even filed for bankruptcy. As far as their 100% rent collection, $800k of this was applied from security deposits, while $700k was from the $1.7 million Parallel judgement awarded in the REIT’s favor.

In regard to Green Peak, management expects a move-out date of March 1st and have received significant interest in the assets since the announcement of Green Peak’s departure. Furthermore, IIPR received $1.7 million dollars for a possession & damages judgement after Parallel wound down its operations in October. IIPR is currently exploring leasing options for the property.

New Investment Activity

Regarding new business for the REIT, IIPR executed on new opportunities with current tenant partners. They amended a new lease with Goodness Growth during the quarter, providing additional funding to complete the development, cultivation and process facility.

They also executed a lease amendment with PharmaCann, their largest tenant by annualized base rent. The company is expected to provide additional funding of $16 million to the company as they strategize to expand their production capacity after they were awarded an adult-use production license late in 2023.

Besides the lease amendments, the REIT did not make any additional acquisitions outside their existing portfolio companies. And as of the end of Q4, their portfolio company count remained at 108 properties across 19 states, the same at the start of 2023.

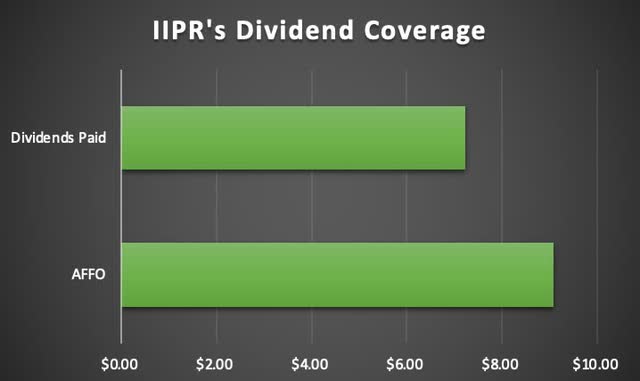

Dividend Safety

With uncertainty surrounding the cannabis industry, IIPR has impressively grown the dividend and maintained a conservative payout ratio within a range of 75% – 85%. The current dividend of $1.82 is well-covered with AFFO of $2.28. As an avid REIT investor, adjusted funds from operations is the preferred method when measuring dividend safety.

AFFO declined slightly by a penny from Q3 but rose from $2.25 in Q1. Despite this, IIPR’s payout ratio declined from 85% in Q4 ’22 which is something I like to see. Although REITs are required to pay out most of their distributable earnings, I prefer to see payout ratios below 80%.

The decline was primarily attributed to the taking back of four properties at Kings Garden that were occupied until late September. With the current dividend of $1.82, this puts the current payout ratio of 80% in the middle of management’s target range.

This also gives the REIT financial flexibility if additional tenants experience trouble going forward. Furthermore, it gives them additional liquidity to provide funding for existing portfolio companies or make continued investment/acquisitions to continue growing and expanding their portfolio. For the full year, IIPR grew their AFFO nicely to $9.08, representing a growth rate of 7% from 2022. Net income also grew 7.3% over the same period, showing IIPR’s strong growth metrics during challenging times.

Low-Leveraged

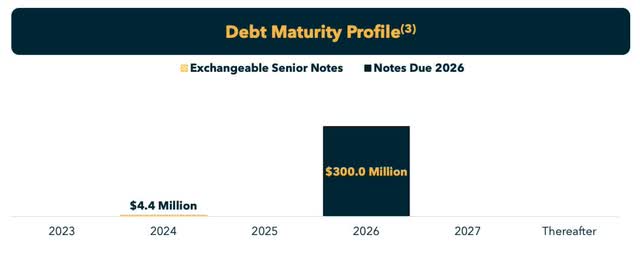

One of the best metrics that stands out to me is that Innovative Industrial Properties is one of the lowest-leverage public REITs amongst its peers, with no debt maturities until 2026. Additionally, they managed to increase their liquidity profile with an additional $15 million, bringing their total to $45 million on the revolving credit facility. At the end of the quarter, IIPR has a debt-to-gross assets ratio of less than 12% and a debt coverage service ratio in excess of 16x.

This is in comparison to cannabis peer, NewLake Capital Partners (OTCQX:NLCP) who virtually had no debt on their balance sheet with a balance of just $2 million at the end of their latest quarter and a net-debt-to EBITDA ratio of just 0.2x. Still, IIPR’s balance sheet remains strong and the REIT is in a good position financially with no debt maturities to worry about for two years. And the latter is also much larger in comparison to NLCP. Their debt is also fixed-rate so they are not subject to the threat of higher for longer interest rates.

Undervalued

At a price of less than $99 a share, IIPR’s current P/AFFO ratio of less than 11x along with the dividend makes the stock very attractive currently. Although peer NewLake Capital Partners’ 8.5x is more attractive, IIPR’s superior dividend growth, payout ratio, and upside potential gives them a higher valuation in my opinion. Comparing them to Terreno Realty (TRNO) P/AFFO ratio of 29.5x. IIPR is a compelling buy right now, especially comparing them to their 5-year average.

Both valuations, however, have a lot to do with the uncertainty and legalization process surrounding the cannabis industry as a whole. But investors who’ve held the stock through the volatility, especially when it dropped to the low $70’s may be rewarded with some nice upside.

You also get paid well-covered dividend while you wait as well. IIPR’s P/AFFO ratio also sits below the sector median, which is probably why Quant gives the REIT a valuation grade of A- further signaling it may be undervalued.

In the past, the stock has traded as high as $280 and has a 5-year P/AFFO average of nearly 18x. While it may never see that share price again, considering the stock’s strong fundamentals, I do think a 13x to 14x P/AFFO ratio is reasonable once interest rates start to decline. This would give them a fair value around $125 a share, roughly 27% upside from the current price of roughly $98 at the time of writing.

This is higher than analysts’ current price target of $112, but significantly lower than the high of $179 they have assigned for the REIT. But as long as their fundamentals and their balance sheet remain solid, I think IIPR warrants an upgrade from my previous rating of hold.

Risk Factors To Consider

Besides interest rates, which have impacted the REIT’s price along with the entire sector, IIPR’s biggest risk continues to be its tenants. This has likely impacted their share price somewhat. Coupled with uncertainty surrounding the industry, IIPR’s tenants are somewhat unknown, and their portfolio is small compared to peers in other sectors.

Their top ten tenants make up 78% of annualized base rent so, further defaults in lieu of an unexpected downturn will greatly impact their financials. They are also subject to political issues and seeing as 2024 is an election year, any further issues may impact the industry negatively in the coming months.

Bottom Line

Although I consider Innovative Industrial Properties to be a high-risk REIT due to cannabis industry uncertainty, the stock offers investors great upside to its fair value. Additionally, the high dividend yield is well-covered by growing AFFO and their balance sheet remains poised to navigate the current macro environment with only $300 million of fixed-rate debt maturing in the next two years.

They also managed to collect 100% rent in their latest quarter and made new investments in existing portfolio companies, showing investors their resiliency in a tough environment. Due to the expected growth of the cannabis industry, well-covered dividend, potential upside, and strong financial position, I am upgrading Innovative Industrial Properties from a hold to a buy.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.