Coca-Cola (KO -0.82%) is one of the most recognized brands on Earth with a top-10 global brand value. It’s a Warren Buffett favorite, and it’s the top-selling beverage company in the world.

So it might come as a surprise that Coca-Cola stock has underperformed the broader market for decades. Over the past 10 years, it’s delivered a total return of 122%, while the S&P 500 has gained 232% (dividends included).

Coca-Cola has been flexing its brand and pricing power during the inflationary environment, raising prices to match rising costs, and it’s generating higher sales and income. Will it finally go back to beating the market this year?

Revitalizing tired sales

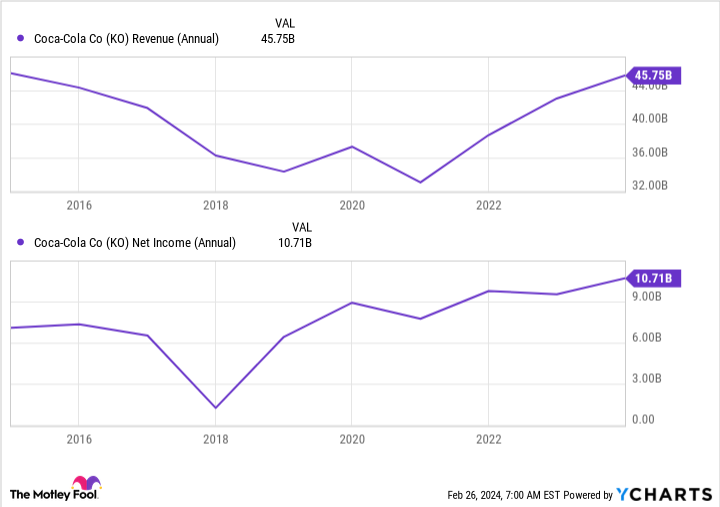

You’d have to delve into Coca-Cola’s historical performance to get a better sense of why it has been underperforming the market. For a quick glimpse, these charts tell part of the story.

KO Revenue (Annual) data by YCharts

Coca-Cola stock wasn’t performing well because the company wasn’t. It got a new CEO in 2017, and it took a few years and a global pandemic for it to make the right corrections and get back on track. Actually, just prior to COVID-19, as you can see, it began to turn around.

Sales plummeted again, but Coca-Cola made some major structural changes as the pandemic landed. It restructured its operating groups and slashed its brand portfolio from 400 to 200 brands. Those were bold actions, and they have led to incredible results. Revenue and net income are both rising, and the company is in an excellent cash position.

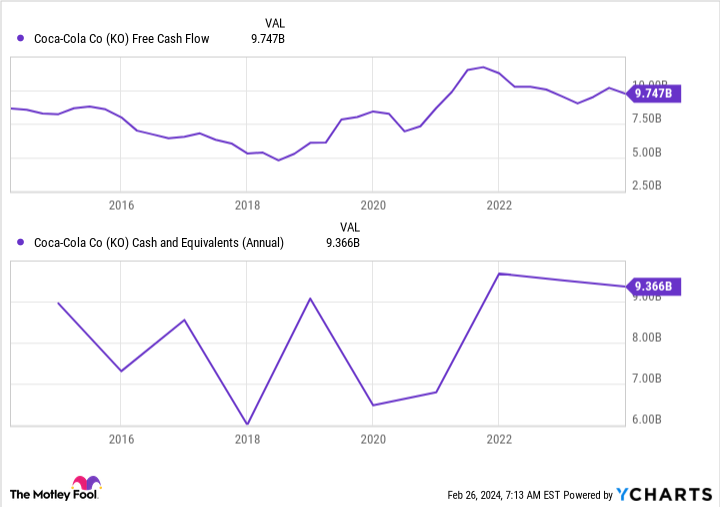

KO Free Cash Flow data by YCharts

Cash is important for any company, but it plays a major part in Coca-Cola’s strategy, since it needs to fund its storied dividend and the accompanying annual raises.

With sales back up, can Coca-Cola stock beat the market?

Believe it or not, Coca-Cola’s annual sales are still below where they were 10 years ago. But as they’re finally swinging higher, Coca-Cola stock might finally perk up, too. It did beat the market in 2022, when it gained 7% as investors piled into safe stocks and the market dropped 19%. But even though it excelled under pressured conditions last year, it lost 7% while the market rebounded.

In some ways, it’s back to where it started 10 years ago, and it can now start ramping up again. But is it likely to beat the market?

Coca-Cola is an established value stock, and these kinds of large, slow-growing secure stocks don’t typically beat the market. Coca-Cola’s sales increased 7% year over year in 2023, and earnings per share were up 13%. Management is expecting sales to increase a similar amount in 2024 with inflationary pricing moderating at some point.

But such stocks do offer other benefits. Coca-Cola is a classic Dividend King and has raised its dividend annually for 62 years. Its dividend yields 3.2% at the current price, which is more than double the S&P 500 average.

Even if Coca-Cola stock doesn’t beat the market this year, it could still be a valuable addition to your portfolio. One reason is the reliable and growing passive income stream. Another is as a value anchor to a diversified portfolio and a hedge for uncertain times, such as when it beat the market in 2022. Even if it doesn’t beat the market over the next decade, it’s likely to provide gains and value in other ways.

Jennifer Saibil has no position in any of the stocks mentioned. The Motley Fool has no position in any of the stocks mentioned. The Motley Fool has a disclosure policy.