grinvalds

Jerkiness isn’t as respectable as it used to be, not even in L.A. Which is why they had to build Vegas. ― Ross Macdonald

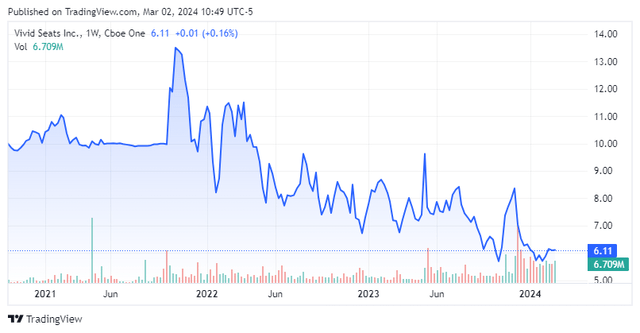

Shares of online ticket exchange Vivid Seats Inc. (NASDAQ:SEAT) touched an all-time intraday low of $5.54 on February 2, 2024 as private equity overhang menaces. The shares have bounced back some 10% since. The company’s acquisitions of Vegas.com and Wavedash expanded its total addressable market by more than 50% in 2023 and will bolster revenue and Adj. EBITDA in 2024. With 76.2 million shares of private equity overhang remaining but formerly bloated valuation metrics now less so, this busted IPO merited a deeper dive. An analysis/recommendation follows below.

Company Overview

Vivid Seats Inc. is a Chicago based online ticket marketplace, coordinating customer payments and ticket delivery through its website and app. It also provides a loyalty program, ticket insurance, and fantasy sports offerings. Vivid was formed in 2001 and went public when it merged into special purpose acquisition company (SPAC) Horizon Acquisition Corporation in 2021 with its first trade transacted at $13.14 per share. The stock currently trades for just over six bucks a share, equating to a market cap of just under $1.3 billion.

The company is capitalized by two classes of stock. The 133.7 million publicly traded Class A shares bestow economic interest and one vote per share. The 76.2 million privately held Class B shares are predominantly owned by private equity interests, specifically Vista Equity Partners and GTCR. They bestow no economic interest, one vote per share, and convertibility into Class A shares.

Business Model

Vivid splits its activities between agency (Marketplace) and principal (Resale).

Marketplace provides a platform for ticket buyers and sellers to transact, with the company receiving 10% of the gross order value (GOV) from the seller, as well as service and delivery fees from the buyer. In addition to these revenue streams, Vivid sells buyer insurance through a third-party provider, generates proceeds from its platform as a private label offering, and produces additional contribution to its top line through daily fantasy sports offerings. This segment generated contribution margin of $166.4 million on revenue of $430.1 million during the first nine months of 2023 (YTD23), up 20% and 16% from YTD22 (respectively), consisting primarily of concert (56%), sports (33%), and theatre (11%) tickets sales. [Contribution margin is defined as revenue minus cost of revenue, as well as marketing and selling expenses.]

Resale is predominantly Vivid acquiring tickets to sell on secondary ticket marketplaces, including its own. It accounted for YTD23 contribution margin of $20.4 million on revenue of $84.5 million, representing increases of 36% and 31% over YTD22, respectively.

These segments are buttressed by what management depicts as the most generous loyalty program in the space, which drives repeat business. Launched in 2019, this offering – featuring a buy 10 tickets get one free promotion – was an attempt to drive brand awareness, which was below 10% and the lowest amongst the big five ticket brokers when the company went public in 2021. The approach has shown teeth, with repeat buyers orders as a percentage of total growing from 47% in 2018 to 56% in 2022.

Growth Through Acquisition

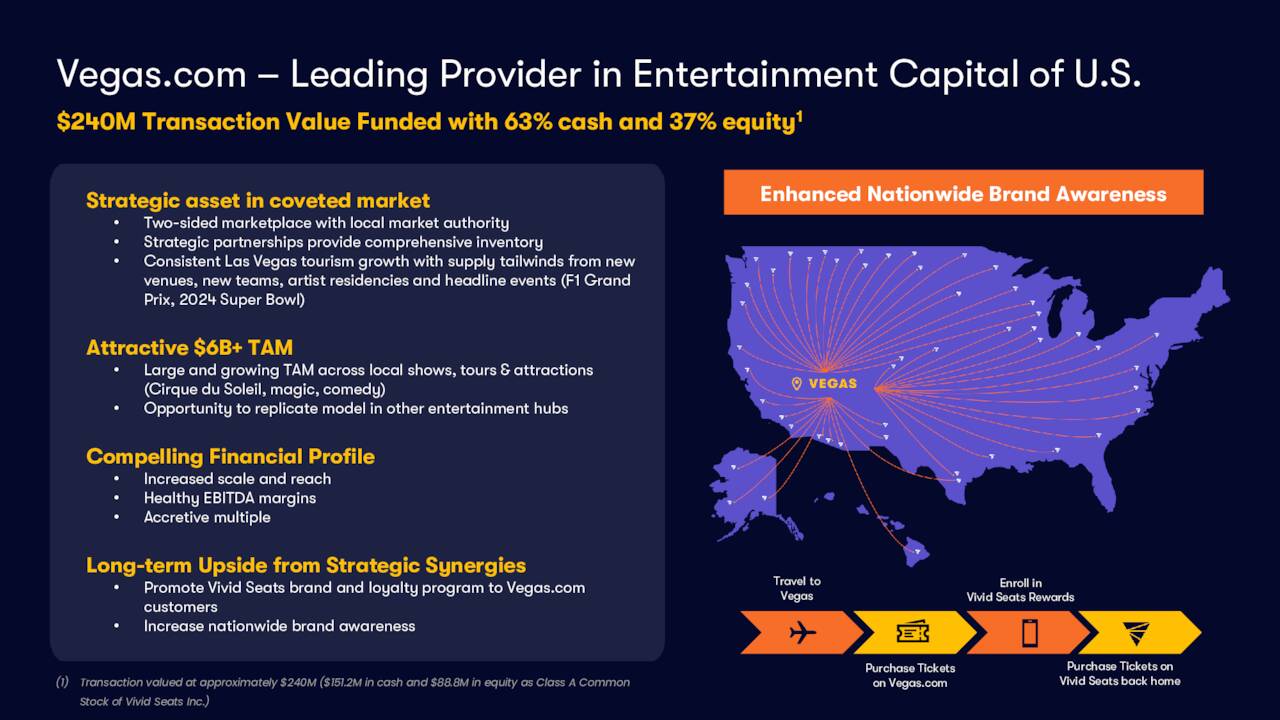

In addition to leveraging sales and marketing to grow its brand organically, Vivid has engaged in several transactions since going public to expand its total addressable market, the most important of which was its acquisition of Vegas.com in November 2023. The provider of access to shows, hotels, vacation packages, tours, attractions, dining, and nightlife in Sin City received a consideration of $243.8 million, comprised of $153.6 in cash and ~15.6 million shares of SEAT. In return, Vivid received an entrée into a $6 billion total addressable market [TAM], essentially its own oasis within the $20 billion North American opportunity (2023). When combined with its $74.3 million purchase of leading Japanese online ticket marketplace Wavedash in September 2023, Vivid grew its TAM by more than 50% to ~$21 billion in FY23.

November Company Presentation

Marketplace

That TAM expansion will help the company compete against the likes of StubHub, Live Nation’s (LYV) Ticketmaster, and Seat Geek in a worldwide market estimated to reach $63 billion in 2024. To put Vivid’s market upside into perspective, it sold the 100 millionth ticket of its existence (since 2001) in January of 2022. Live Nation, through Ticketmaster, other related websites and apps, retail outlets, and call centers sold 550 million tickets in 2022.

Share Price Performance

Having survived through the pandemic when no one was attending concerts or sporting events, Vivid went public as the world began returning to stadiums and theatres, but also just prior to interest rates surging to market re-valuation levels. After generating Adj. EBITDA of negative $80.2 million on revenue of $35.1 million in FY20, the company rebounded to produce FY21 Adj. EBITDA of positive $109.9 million on revenue of $443.0 million. However, its opening trade at $13.14 valued Vivid at an EV/FY21 Adj. EBITDA of 23.3. The market was still okay with management’s initial FY22 projection of Adj. EBITDA of $112.5 million on revenue of $530 million, which the company slightly surpassed with Adj. EBITDA of $113.3 million on revenue of $600.3 million.

However, as part of its IPO, Vivid received a $225 million PIPE investment from third-party investors including DraftKings (DKNG), who had an option to sell its shares at $9.77 one year after the closing of the Horizon SPAC merger. As markets are wont to do, that dynamic, significant overhang from private equity, and elevated valuations kept shares of SEAT in a narrow trading range between $7 and $9 from June 2022 and August 2023. And although Vivid has been profitable since going public, earning $0.36 a share (GAAP) in FY22 and $0.43 a share (GAAP) in YTD23, with an initial FY23 Adj. EBITDA forecast of $112.5 million (that has since been raised to $139 million to reflect its two acquisitions and slightly better than expected business), it was still expensive on EV/Adj. EBITDA basis given its middling growth prospects. As such, with private equity looking to exit, would-be buyers have been waiting for ‘selling shareholders’ secondaries as opportunities to make investments at somewhat depressed prices.

The latest such occurrence transpired in December 2023, when private equity concerns sold 23.575 million shares at $6.50 per. However, the realization that another 76.2 million shares is still for sale at some point in the future has made it challenging for the market to get excited about investment in Vivid. It should also be noted that the principals in Vegas.com have filed to sell more than half of the shares (7.8 million) they received as consideration on its deal. As such, Vivid’s stock touched an all-time intraday low of $5.54 a share on February 2, 2024.

Q3’23 Financials

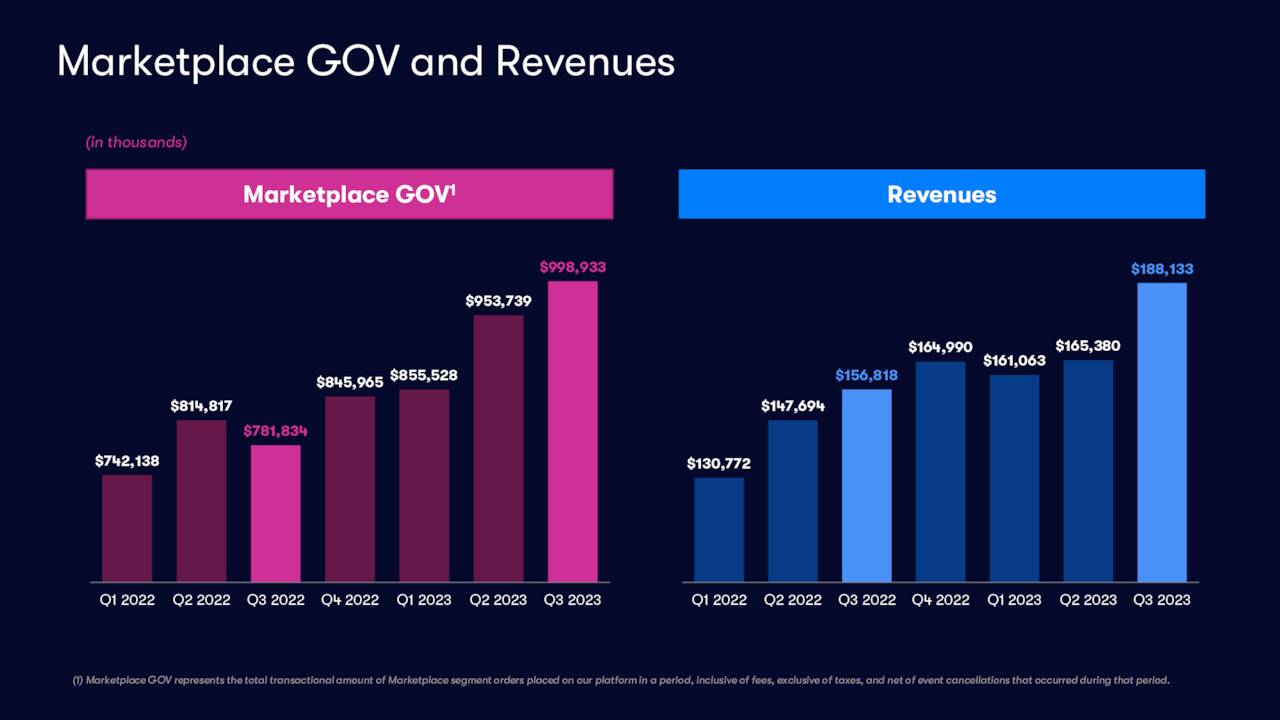

Even an early and optimistic FY24 outlook courtesy of its contemporaneous acquisition of Vegas.com on its Q3’23 financial report of November 7, 2023 did little to change sentiment. The company posted net income of $0.07 a share (GAAP) and Adj. EBITDA of $33.4 million on revenue of $188.1 million versus $0.09 a share (GAAP) and Adj. EBITDA of $28.3 million on revenue of $156.8 million in Q3’22, representing a 15% decline (in $ value) and gains of 18% and 20%, respectively. Also, marketplace gross order value (GOV) of $998.9 million was up 28% from $781.8 million in the prior year period.

November Company Presentation

With the announcement of the acquisition of Vegas.com, management took the added measure of providing an initial FY24 outlook that included Adj. EBITDA of $175 million on revenue of $825 million bolstered by marketplace GOV of $4.35 billion. Vegas.com’s contribution to the top-line outlook will be somewhere in the neighborhood of $82.5 million to $100 million. All forecasts are based on range midpoints.

November Company Presentation

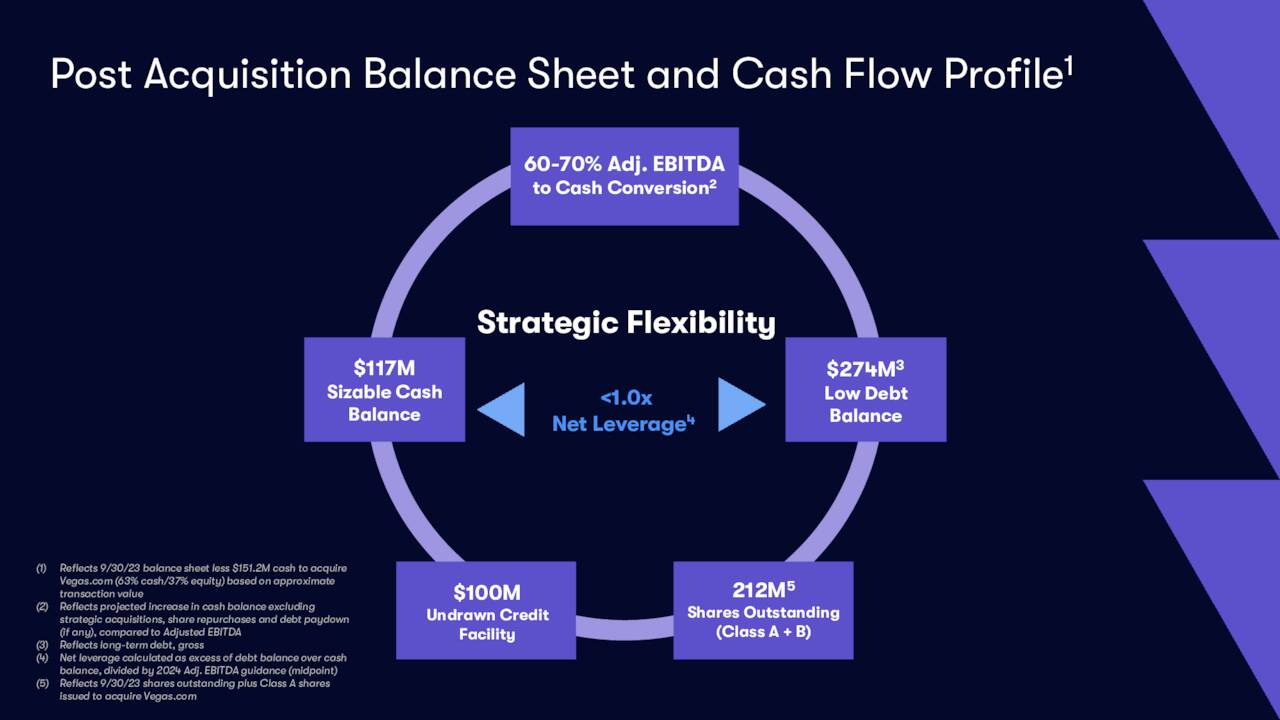

Balance Sheet & Analyst Commentary

The cash portion of the Vegas.com deal came from Vivid’s strong balance sheet, which held $105 million against debt of $274 million for net leverage of 1.2 post-acquisition (at YE23). Additionally, Vivid has access to $100 million on an undrawn credit facility. The company repurchased $40 million of stock in 2022 and then bought 2 million shares as part of the December 2023 selling shareholder secondary offering. Vivid does not pay a dividend.

November Company Presentation

Despite the private equity overhang, the Street is mixed on the company’s future, featuring three buy and outperform ratings against two hold ratings issued so far in 2024. On average, they expect the company to earn $0.46 a share (GAAP) on revenue of $698.6 million in FY23, followed by $0.42 a share (GAAP) on revenue of $822.4 million in FY24, reflecting the onboarding of Vegas.com.

Verdict

It is difficult to pick a bottom in a stock that just created a new all-time low, but the decline in share value coupled with the acquisition of Vegas.com has made Vivid attractive on an EV/Adj. EBITDA basis for the first time in its somewhat brief public company history, trading at just under 11 on FY23E Adj. EBITDA and 8.5 on FY24E Adj. EBITDA. Furthermore, its price to FY24E sales is currently 1.55, and its PE on FY24E GAAP EPS is just 14.5 – both reasonable given its future prospects. Private equity overhang is still a concern as is the economy, but with solid cash generation and its best valuation metrics since going public, this busted IPO is worth a small ‘watch item’ position if an investor is willing to wait out the private equity overhang. Fourth quarter results should be out later next week as well. At some point later this year, we will likely circle back on this story.

Las Vegas is the savage heart of the American Dream. ― Hunter S. Thompson