tadamichi

Introduction

Crawford United Corporation (OTCPK:CRAWA) is a US specialty industrial products and services group that is on my stock watchlist. The company focuses on inorganic growth, and it has more than doubled its operating income since 2022. In my view, the prospects for the business are bright and Crawford United looks undervalued at the moment at 7.2x EV/EBITDA. I’m considering opening a position over the coming weeks. Let’s review.

Overview of the business and financials

Crawford United was founded in 1910 and used to focus on the design and production of electronic testing products for the automotive and trucking industries. This business was sold in June 2018 and the company changed its name from Hickok Inc in May 2019. The new name comes from the Crawford family which acquired control of the company through a merger with First Francis Company in early 2016. Since being acquired by the Crawfords, Crawford United has built a portfolio of over a dozen companies that offer specialty industrial products and services in the USA. The products and services portfolio includes air handling solutions, machining parts, hoses, ceramics and coatings, forgings, and oil change systems among others. The group is also involved in the development of marketing and data analytic technology applications as well as the distribution of diesel fuel filtration products. Here are some of the notable subsidiaries of Crawford United at the moment:

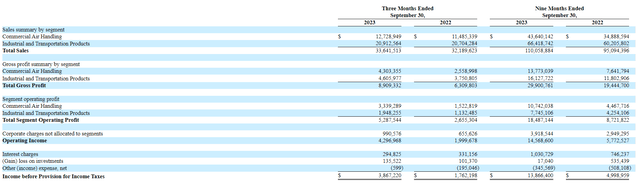

The business is currently split into two segments, namely commercial air handling equipment, and industrial and transportation products. The latter accounts for over 60% of revenues but around two-thirds of the operating profit comes from the commercial air handling equipment business. The industrial and transportation products segment was established in 2016 when Crawford United acquired Federal Hose. The latter specializes in the production of flexible interlocking metal hoses as well as the distribution of silicone and hydraulic hoses. The commercial air handling equipment segment, in turn, was created in June 2017 when Crawford United bought Air Enterprises. The latter is involved in the design and manufacturing of air handling solutions and its brands include FactoryBilt, and SiteBilt.

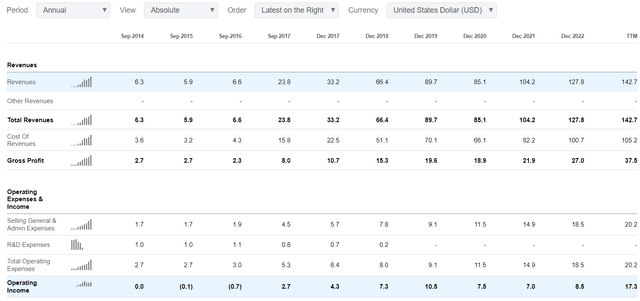

Looking at the financial performance of the business over the past several years, we can see that both revenues and operating income have grown significantly since the acquisition of the company by the Crawfords despite the sale of the legacy business as well as the negative effects of the COVID-19 pandemic. Most of the revenue growth can be attributed to acquisitions made in the past few years which include Data Genomix (2018), MPI Products (2020), Komtek Forge (2021), Global-Tek (2021), Emergency Hydraulics (2021), Reverso Pumps (2022), Separ America (2022), and Knitting Machinery (2022). All of these new subsidiaries were included in the industrial and transportation products segment.

Turning our attention to the latest available financial results of Crawford United, we can see that revenues increased by 4.5% year on year in Q3 2023 to $33.6 million while the operating income almost doubled compared to a year earlier to $5.3 million. Revenues improved across both segments thanks to price increases in the single-digit percentages as well as slightly higher volumes. Margins rose due to lower logistics and raw materials costs as the negative effects of global supply chain disruptions eased. The increase in operating income was much stronger in the commercial air handling business, which also benefited from efficiency improvement initiatives at the production facilities. In view of this, I expect the improvement in operating margins in this segment to be sustained in the long term.

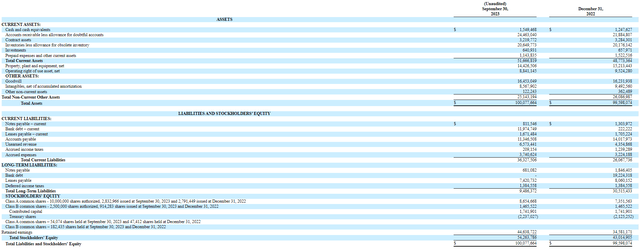

Looking at the balance sheet, the lack of acquisitions over the course of 2023 enabled Crawford United to reduce its debt levels as its net debt came down to $11.9 million in September compared to $21.3 million in December 2022. The tangible book value per share, in turn, improved to $8.33.

Overall, I think that Crawford United has a strong balance sheet and I think it has the funds to make a few small acquisitions in 2024. This is what CEO and President Brian Powers had to say with the release of the Q3 2023 financial results:

Crawford United is well positioned to pursue opportunities for increased revenue and profitability, always with an eye towards additional acquisitions – source

Crawford United should release its Q4 2023 financial results around March 20 and I expect it to report sales of around $34 million and EBITDA of about $6.3 million thanks to continuing efficiency improvements at its production facilities. My expectations for Q1 2024 are for revenues of about $36 million and EBITDA of some $6.7 million considering Crawford United has already made an acquisition this year. On January 2, the company announced the purchase of Heany Industries which offers materials engineering solutions for aerospace, industrial, and bio-medical applications. This acquisition is expected to add about $7 million in annual revenues and be immediately accretive to earnings. Crawford United should release its Q1 2024 financials in early May.

Turning our attention to the valuation, Crawford United trades at an EV/EBITDA ratio of 7.2x as of the time of writing. This is close to the levels the stock has historically traded over the past few years outside the COVID-19 pandemic. That being said, this could be a good time to open a position as I think 2024 is likely to be characterized by low single-digit organic revenue growth and acquisitions could enable Crawford United to boost its EBITDA to about $30 million. Looking at peers to which to compare Crawford United, the company reminds me of Decisive Dividend Corporation (DE:CA)(OTCPK:DEDVF). The latter specializes in the acquisition of profitable manufacturing firms with an enterprise value of up to C$25 million ($18.5 million) under a buy, build, and hold strategy and I’ve covered it here. As you can see from the chart below, the two companies have often traded at a similar EV/EBITDA ratio over long periods in the past three years and I think Crawford United has a good chance to close at least part of the gap in the coming months, perhaps to around 10x. In my view, a significant boost for the share price could come from a share repurchase program for up to 300,000 shares which was announced in December 2023.

Looking at the downside risks, I think the major one is that Crawford United is listed on the OTC Pink market and the daily trading volume rarely surpasses 1,000 shares. The lack of listing on a major US stock exchange and the thin trading volume could drive away many institutional and retail investors and the market capitalization of the company could stay below $200 million for quite some time due to the lack of interest.

Investor takeaway

Crawford United has become a rapidly growing compounder since the company’s takeover by the Crawford family in 2016. I expect the growth momentum to be sustained over the coming years. While there were no acquisitions made in 2023, I think this is likely to change in 2024 and we already have the purchase of Heany Industries. In my view, the valuation of Crawford United seems low and some of the gap to Decisive Dividend in terms of EV/EBITDA could be closed over the coming months, especially if the company implements a large part of its ambitious share repurchase program. My rating on the Crawford United stock is a speculative buy.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.