golibo

In my previous coverage of the leading digital advertising company, Taboola (NASDAQ:TBLA), in June 2023 last year, I shared my buy thesis on how TBLA’s fundamentals and market leadership could pave the way to share price appreciation. Today, my call is proven to be right.

TBLA is now trading at $4.36, an almost 50% upside from $2.9, the price it was trading at in my first coverage. With a 50% upside, it has also surpassed my price target expectation, which only projected a 33% maximum upside at the time.

I maintain my buy rating for TBLA. My 1-year target price of $6 projects a 39% upside from the current price level of $4.3.

Financials Review

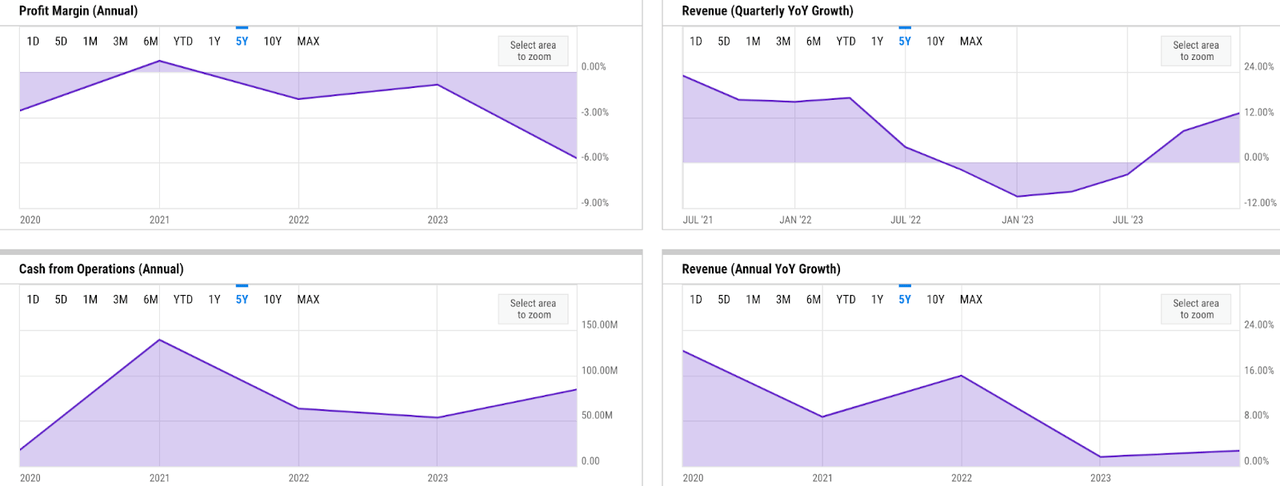

As per my projection in previous coverage, quarterly revenue growth has accelerated sequentially from a negative 3% in June 2023 to 8.3% and 13% in the two following quarters. This has helped TBLA to finish FY 2023 with a 2.75% growth in annual revenue, around the mid-end of its expected 2% – 5% guidance. Despite the seemingly low growth, the 2.75% is already an acceleration from the prior year’s revenue growth of 1.65%.

In my opinion, TBLA’s GAAP profitability outlook suggests a potential room for improvement. In FY 2023, GAAP net loss margin expanded to 4% in FY 2023, despite already seeing a slight improvement in 2022. Over the past five years, TBLA has barely reached GAAP net profitability.

Nonetheless, cash from operations / OCF has been relatively steady. In FY 2023, TBLA delivered over $84 million of OCF, over a 60% YoY increase from the previous year. The main use of cash in FY 2023 has been to repay long-term loans and to repurchase shares. I estimated TBLA’s overall long-term debt to be around $159 million in FY 2023, already down from over $220 million in the prior year.

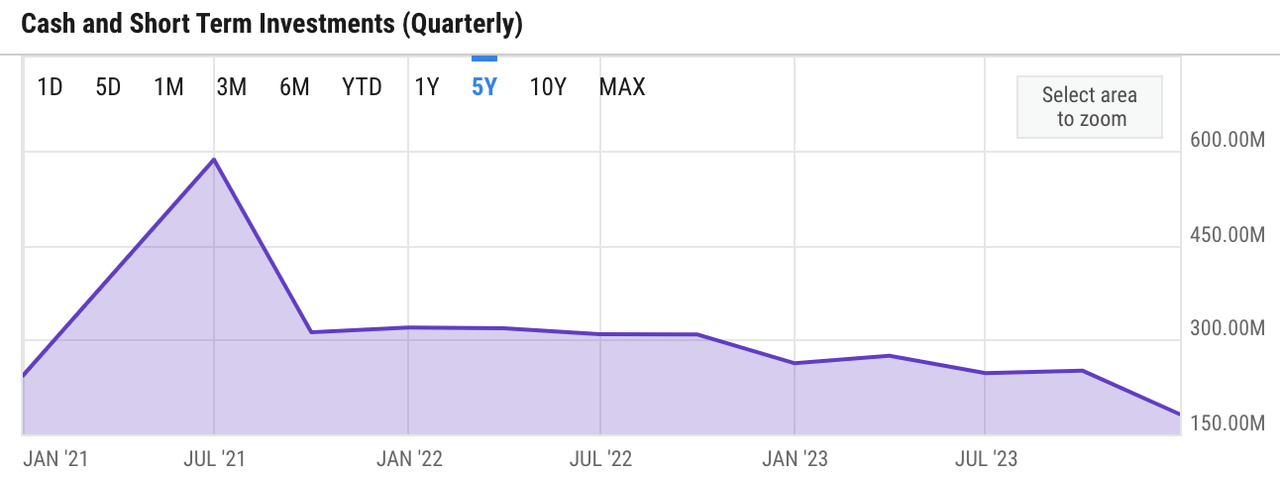

The biggest impact of the financing activities has been on liquidity. Despite being relatively safe today, liquidity has been on the downtrend. Upon the $55 million of share repurchases and $82 million of debt repayment, TBLA finished FY 2023 with $181 million of liquidity, down 30% from the prior year’s level.

Catalyst

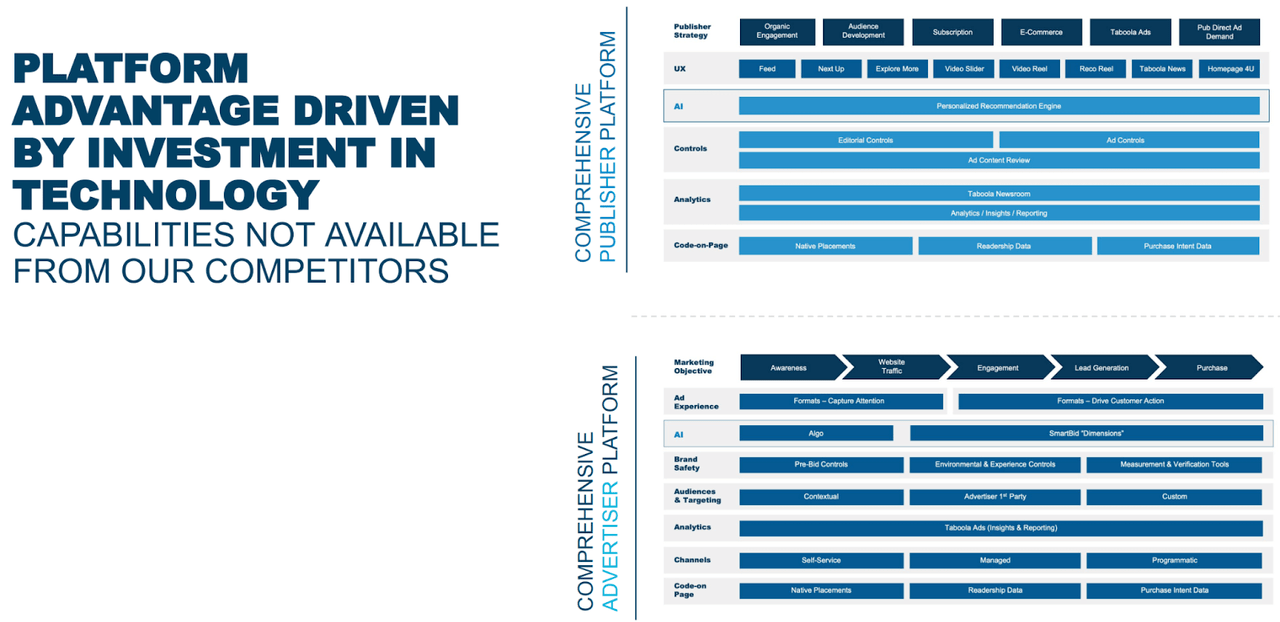

There is a good possibility that TBLA’s R&D investments in 2023 to enhance its AI capability will start paying off in 2024. Despite the recent headwinds, TBLA continued to invest in R&D. In fact, it is the only operating expense item that saw meaningful growth in FY 2023. TBLA’s R&D expense was over $136 million in FY 2023, a 5% growth YoY from the prior year. At that level, R&D already even grew faster than the revenue:

2023 was going to be an investment year for growth. We’re investing more than $100 million a year in R&D and AI to bring users and advertisers the same amazing experience they have when they interact with search and social platforms.

Source: Q4 earnings call.

So far, TBLA has seen early signs of success. In my opinion, as more advertisers experience the benefits of TBLA’s AI bidding solution “Maximize Conversions,” their adoption is expected to continue, driving yield growth. In the Q4 earnings call, the management also highlighted the solution’s strength in driving up to a 50% boost in conversion and reducing CPA / Cost per acquisition by 20%.

Driven by generative AI trends, the launch of AI-based advertising campaign design features should also help TBLA see increased platform activities, which should drive advertising spend growth. The early results here have also been encouraging:

In Q4, we launched Generative AI ad maker helping advertisers kick off a campaign faster. For self-serviced advertisers, one is four new creative are being generated using our new Generative AI.

Source: Q4 earnings call.

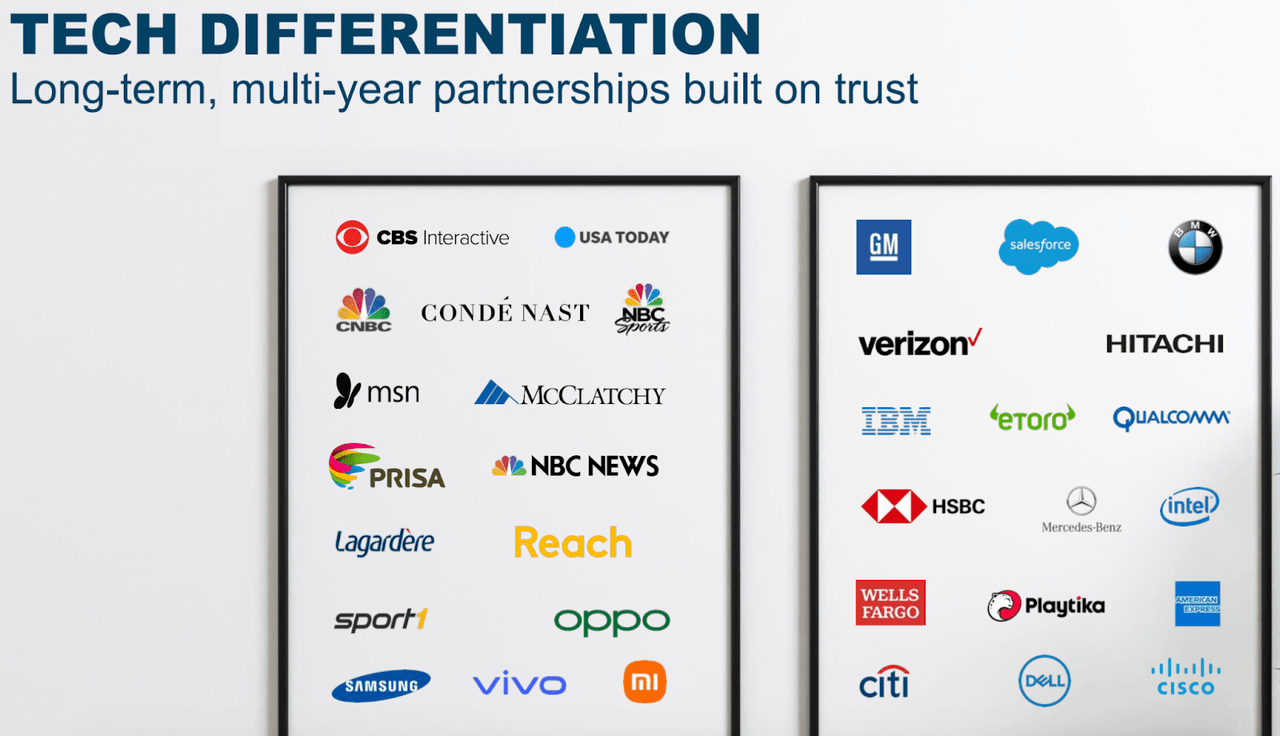

As the open web advertising market continues to grow, TBLA is well-positioned to capture a larger share due to its focus on not only innovation but also strategic partnerships. As per my discussion in the prior coverage, I continue to see a sizable untapped potential in TBLA’s Yahoo partnership. So far, the integration ramp-up with Yahoo’s ecosystem has been encouraging, with the management expecting up to $100 million of revenue from the partnership in Q1 2024:

And then to your second question about $1 billion opportunity with Yahoo, the simple answer on that is yes, we still believe there is more than $1 billion of value in that partnership. It’s been — by the way, we did say that we expect to see $100 million in revenue from the supply in Q1, so that’s encouraging. That’s a good step towards that. Advertisers will be fully migrated only in Q3, so that’s also key to capturing the base value of the partnership.

Source: Q4 earnings call.

With an aim to generate $1 billion of revenue from the partnership, I believe the expectation remains ambitious, yet achievable. In the Q4 earnings call, the management already commented on Yahoo’s meaningful contribution to top-line growth. Since Yahoo’s partnership is still at the early stage, TBLA should expect greater revenue contribution once the advertisers all migrate into TBLA’s AI-powered platform and start spending, in my opinion.

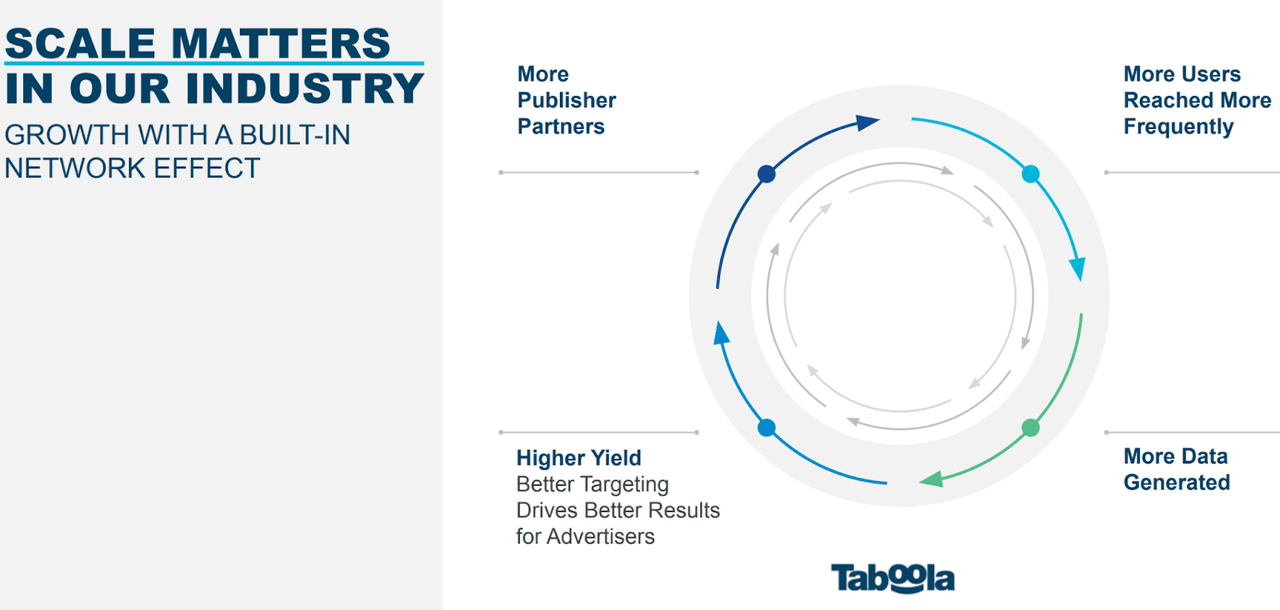

At the same time, the scale of data being processed by TBLA over its partners’ network, including Yahoo’s, should also be useful in improving its AI platform, creating a flywheel effect. As of FY 2023, TBLA has generated tens of billions of clicks a year from the content recommendations it has pushed to over 600 million DAU / Daily Active Users.

Risk

Though Yahoo’s partnership integration has been going well so far, it remains at an early stage today. In my opinion, integrating platforms and migrating advertisers could be complex, potentially leading to delays, technical difficulties, or advertiser churn. All of these issues could pressure TBLA’s top-line estimates.

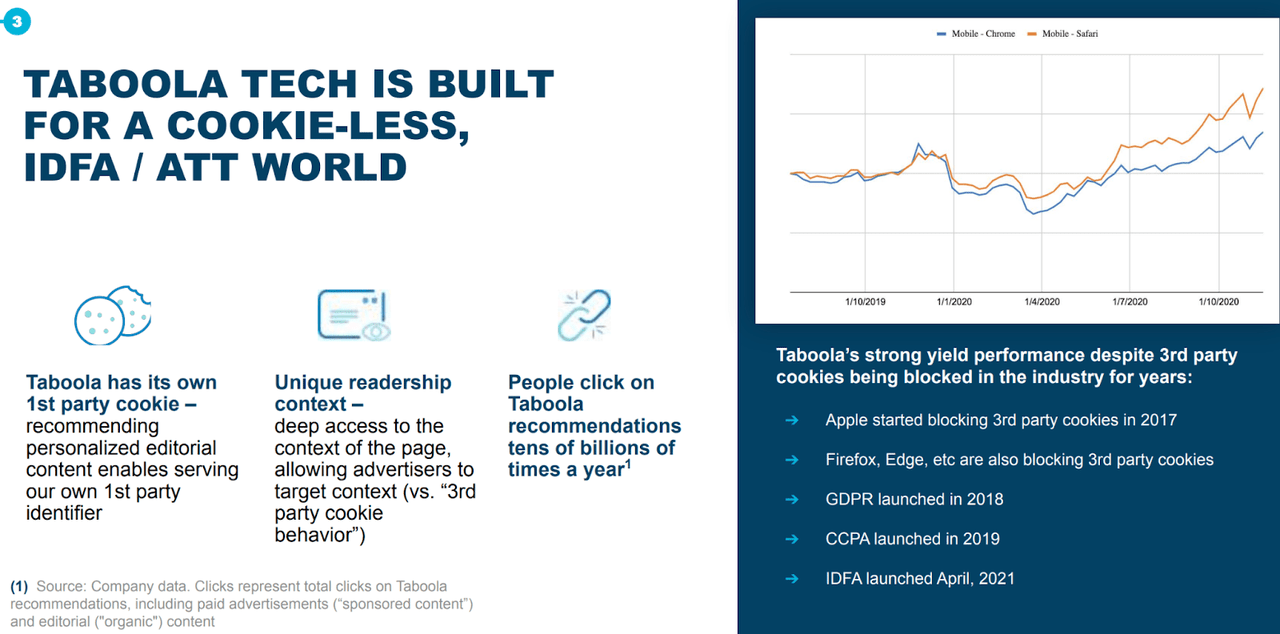

While TBLA has navigated past advertising landscape changes, the upcoming cookie deprecation in Chrome, the world’s leading browser, in 2024, could present uncertainties. In my view, continued adaptation in targeting and measuring ad effectiveness would remain key to sustaining campaign performance and hinder a slowdown in revenue growth due to advertiser churn.

I believe a considerable part of the uncertainty from the cookieless shift could also lie in competition. In the worst-case scenario, I see a possibility of advertisers scaling back ad spend allocations on the open web – where TBLA operates – and instead spending more into walled garden ad ecosystems established by leading players like Google, TikTok, or Meta.

Finally, TBLA should continue to invest in R&D to drive the platform’s competitiveness. Its success with tools like “Maximize Conversions” shows how innovation pays off. However, the current liquidity outlook suggests the need for disciplined spending in 2024. TBLA’s recent decision to raise $300 million, coupled with substantial shareholder stock sales (nearly 28% of their stakes), could potentially affect market confidence, in my opinion.

Valuation / Pricing

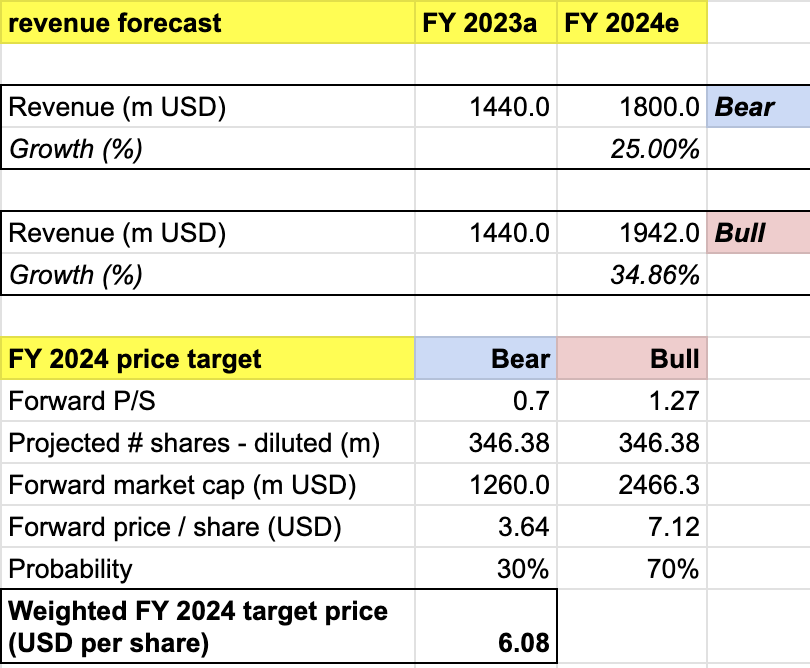

My target price for TBLA is driven by the following assumptions for the bull vs bear scenarios:

-

Bull scenario (70% probability) assumptions – TBLA to achieve $1.942 billion of revenue, a 34.86% growth at the highest end of its FY 2024 guidance. I expect TBLA to see continued advertiser demand for its strong AI-powered platform. I assign TBLA a P/S of 1.27x, implying a rebound towards $7, its 2022 high.

-

Bear scenario (30% probability) assumptions – TBLA to see $1.8 billion of revenue (25% YoY growth) in FY 2024, missing its low end guidance by $92 million. I would expect TBLA to see delays or advertiser churn, while Yahoo’s integration sees delays. I assign TBLA a P/S of 1x, where it is today, which implies a correction to $3.64 at the end of FY 2024.

own analysis – price target

Consolidating all the information above into my model, I arrived at an FY 2024 weighted target price of $6 per share. Given that the stock is trading at $4.3 today, my 1-year price target projects a 39% upside. I rate the stock a buy.

It is important to note that, upon simulation, my TBLA’s target price model is a little sensitive towards both the weighted probability and also P/S level. Due to my confidence of TBLA’s growth re-acceleration, my projection leans towards the bull scenario, as seen on the 70-30 weighted probability. My bull case valuation of 1.27x P/S also implies TBLA breaking a new 1-year high, which should depend not only on quarterly performance, but also market sentiment, in my opinion.

Though fundamentals seem to improve in FY 2024, I consider the potentially lagging market sentiment due to cautiousness around Chrome’s cookie phase-out, as the most imminent downside risk. This could manifest in various ways, such as sideways price action.

Conclusion

My June 2023 buy call on TBLA was spot-on. Up nearly 50% to $4.36, it’s exceeding expectations. I remain bullish and maintain my buy rating with a new target price of $6, representing a potential 39% upside. Strong AI adoption, successful partnerships, and open web focus fuel my optimism, despite potential risks. In my opinion, TBLA remains well-positioned for long-term growth.