Target (TGT 1.55%) investors have had a rough year, with the share prices of the retail giant declining 8.8% over the past year. That drop stands in stark contrast to the S&P 500, which has rallied by nearly 28% in the past 12 months. Target’s returns even trailed industry peers like Walmart (WMT 0.26%) and Costco Wholesale (COST 0.75%) by a wide margin.

That performance gap reflects the company’s weakening customer traffic trends as shoppers shifted spending away from discretionary purchases like home furnishings. It’s hard to grow sales when you’re catering to fewer guests with each passing quarter.

Target’s growth problems could be ending soon, however. And as investors wait for the rebound, they can collect an unusually high dividend yield for the retailing industry. Let’s look at some reasons why income investors might want to put Target stock near the top of their watch lists.

A better holiday season for Target?

The retailer is slated to post its holiday-quarter earnings results in March, and there’s reason for cautious optimism about that update. That’s because Costco and Walmart each announced accelerating sales gains for their holiday quarters, confirming that shoppers were spending more freely as 2023 ended.

The latest report from Costco was particularly encouraging because it showed rising demand in the consumer discretionary space, which has been under significant pressure lately. This niche is Target’s most important, and even a small rebound here could put the chain on the cusp of a revenue resurgence.

Comparable-store sales fell 5% in the third quarter (ended Oct. 28, 2023), and management predicted that Q4 results would land in a wide range around that same rate. Most Wall Street pros are looking for reported revenue to rise slightly this quarter, perhaps ending the chain’s long sales slide.

Financial wins for much of 2023

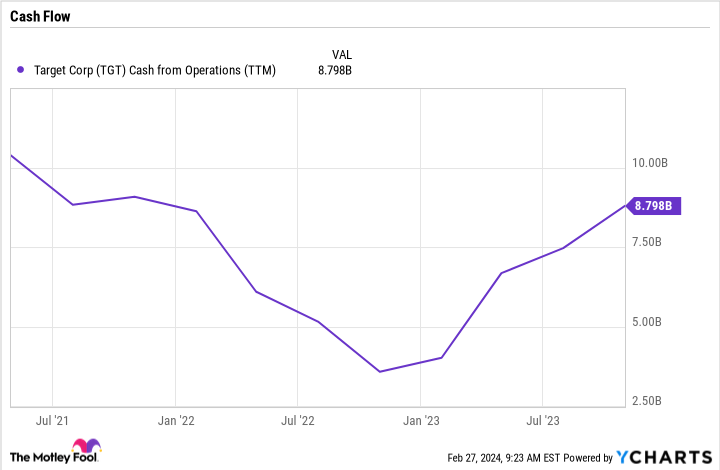

The news is more clearly positive when it comes to Target’s finances. Cash flow soared in 2023 as the company focused on efficiency and cut inventory in slow-moving merchandise categories. Prices rose in other areas, too, leading to a 27% gross profit margin through the first three quarters of 2023 (compared to 24% a year earlier). Target’s operating profit improved to 5.1% of sales from 3.5% of sales, putting it closer to its pre-pandemic level of 6%.

TGT Cash from Operations (TTM) data by YCharts

It’s great news that this rebound is happening even amid weak demand in the consumer discretionary niche. Resurgent growth there, then, could allow Target to easily boost margins while providing more resources that management can use to raise the dividend.

Cash returns

The big operating metric to watch in 2024 will be customer traffic, because Target absolutely needs to return to growth in this area. Yet its lower inventory and strong profitability and cash flow all point to a potentially large dividend increase when the chain makes its annual payout announcement (typically in June). Last year’s hike was a modest 2% as management decided to pivot toward saving more cash.

The good news is Target has raised its dividend in each of the last 52 consecutive years, and its current yield of 2.9% is far above Walmart’s 1.3% and Costco’s 0.6%. Most investors will still want to watch this stock for now until there are concrete signs that Target has put its customer traffic slump behind it heading into fiscal 2024. That’s the retailer’s surest path toward rebounding earnings and higher shareholder returns from here.