Darren415

When GrowGeneration (NASDAQ:GRWG) was much higher in early December, I suggested that investors should avoid the stock. I said then that I would “buy some closer to $2” when the stock was trading near $3. It is now 15% of the model portfolio I share with members of my investing group. I named it a “Top Pick” on 2/23 at $2.

In this follow-up three months after sharing my very negative views, I discuss the outlook, the chart and the valuation, and I explain why I have such a large position in the stock in my model portfolio. The company will be reporting its Q4 on March 13th.

The GrowGeneration Outlook

When I wrote about the company three months ago, 7 analysts were predicting that GrowGeneration would generate $219 million in revenue in 2024. They still project that revenue will decline 1% to $219 million. Their outlook for adjusted EBITDA remains the same, too: -$2 million.

Three analysts were projecting 2025 revenue of $248 million, with adjusted EBITDA of $5 million. The outlook now is revenue growing 9% to $239 million, with adjusted EBITDA of $6 million. While this is “better” than before, there are just two analysts providing these estimates. The margin of 2.7% is very low in my view. In 2021, the adjusted EBITDA was 8.2% of revenue.

The GrowGeneration Chart

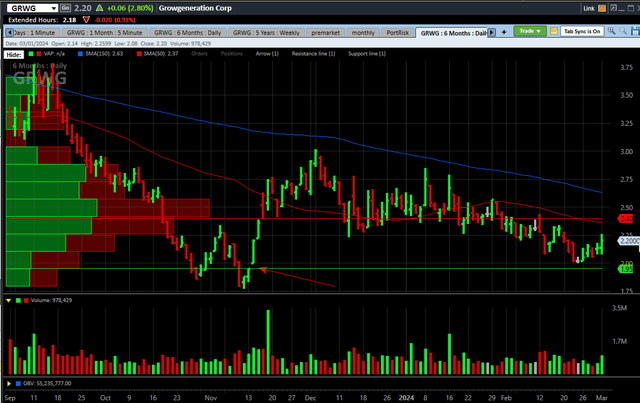

Looking at the chart from the past six months, the stock looks like it is in a down-trend but with a potential low set in November (ahead of my negative views that I expressed in the early-December article):

In the prior article, I discussed three open gaps from November, and one was filled. There is still a gap created on November 14th from $1.95 to $2.00. I don’t believe that the last of the three gaps must be filled, but it might get filled.

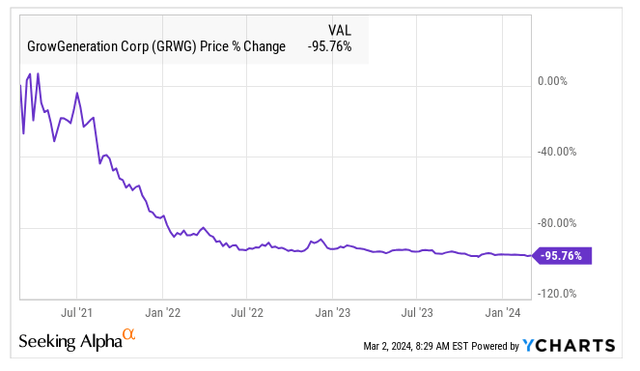

GRWG is down 12.4% in 2024 so far, and this is worse than the New Cannabis Ventures Ancillary Cannabis Index, which is down just 0.8%. GrowGeneration is one of the 7 stocks in that index, and it is down the most of them in 2024.

The stock has dropped a lot over the past three years:

One thing I like about the stock is that it has minimal risk of delisting, as it trades well above the $1 level.

GrowGeneration Is a Cheap Stock

What really stands out to me is that the company has a lot of cash and no debt. At the end of Q3, it reported cash of $66.6 million and no debt. The market cap is currently $131 million, which is just 83% of tangible book value.

In the last piece, I shared a year-end target of $2.72 based on achieving a ratio of 20X for its enterprise value to projected adjusted EBITDA for 2025. The current estimate for adjusted EBITDA has increased, and I get a target at the 20X ratio of $3.04. I am reducing the multiple to 16X, which works out to $2.65, which is about 20% higher. The current tangible book value per share is $2.59, so this would be a very modest premium.

I think that the stock could do a lot better than my target if the company can become more profitable.

Why I Am Long GrowGeneration

I have loaded up on GrowGeneration in my model portfolio at an average price of $2.10. I like the chart and the valuation, and I see good potential upside relative to the potential downside. I like ancillary cannabis companies. GrowGeneration is not my largest position. I have written about both the largest, which is 20% of the model portfolio, and the third-largest ancillary, which is 13%. Including the fourth, a REIT, my total ancillary exposure is 53.3%. The index I am trying to beat has 34.4% exposure to the sub-sector.

While I use 2025 projections for my targeting, I am well aware that many investors look at 2024 numbers for a while longer. I think that a big challenge for the company is that it is currently generating negative adjusted EBITDA, which is currently projected for Q4 and for Q1. I think that as long as the company doesn’t generate profits, it will be hard to excite many investors.

Another risk is that the company does a “bad” acquisition. Part of my attraction to the company is that it is rich in cash and yet trades below tangible book value. While an acquisition done on favorable terms could help the company, one that is overly expensive could add risks.

Investors seem to be confident that cannabis will be rescheduled and that 280E taxation will be eliminated. I base this on how well the MSOs are performing. My view is that if this is how things play out, ancillary companies like GrowGeneration will benefit from having a healthier customer. The estimates have come down a lot over the past few years as the customers have been cutting back. On the flip-side, things may get worse if 280E remains in play. I like the downside protection that the cash and high tangible book value offer.

Conclusion

I have disliked several cannabis stocks in writing over the past year, and lower prices don’t always get me to like them. Here, though, I said in advance that I would like the stock at a lower price. I have explained why I have a large position now. It may drop when the company reports in mid-March, and I discussed some risks above. I am a fan of ancillary stocks that trade now on the NASDAQ and don’t pay 280E taxes. They seem cheaper than the MSOs, which have benefited greatly from the potential elimination of 280E.