Chip Somodevilla

Blackstone Has Almost $200B In Dry Powder

I updated Blackstone Inc. (NYSE:BX) investors that the easy money in BX was likely over, even as BX surged and attempted to break through the $130 resistance level. However, the market has spoken, as BX has underperformed the S&P 500 (SPX) (SPY) since my previous update in December 2023.

Despite that, BX’s relatively attractive forward dividend yield of 3.4% should proffer support in its buying sentiments as seen lately. Observant investors should have gleaned BX’s momentary decline in January 2024 but found robust buying support at the $115 level. As a result, I assessed that BX’s buying enthusiasm has regained momentum, as macroeconomic conditions are increasingly constructive toward Blackstone’s proprietary strategies.

The leading alternative asset manager reported its fourth-quarter earnings in late January 2024. Blackstone recorded nearly $200B in dry powder to be deployed, flexing its muscles in a relatively downbeat commercial real estate environment.

Fee-earning AUM also rose to $762.6B in FQ4’23, up more than 6% YoY. Its increasingly influential perpetual capital AUM increased by almost 7%, with 44% attributed to fee-earning AUM, as Blackstone emerged from the challenges in 2022. Notwithstanding its well-diversified portfolio, Blackstone’s real estate segment is still a core earnings driver, as it comprised more than 40% of its invested performance-eligible AUM in Q4.

Therefore, paying close attention to the developments in the commercial real estate segment is fundamental to assessing BX’s ongoing recovery moving ahead. Blackstone management is sanguine that the economic recovery remains on track, with a soft landing outlook underpinning more benign inflationary dynamics. The recent PCE release has also corroborated Blackstone’s confidence, suggesting inflation has continued to moderate.

As a result, Blackstone is well-primed to leverage its dry powder to capitalize on the uncertainties in the segment while avoiding the more troubled office exposure (less than 2% of Blackstone’s real estate portfolio).

Furthermore, investing in Blackstone also gains investors access to less publicly available opportunities in nascent areas such as the AI ecosystem. Given its significant private equity arm with $80B in dry powder, Blackstone can leverage growth vectors in the “first or second derivative plays.” As a result, Blackstone management believes that its scale and data advantage across various sectors and themes provide BX investors a competitive edge to accrue long-term excess returns.

Is BX Stock A Buy, Sell, Or Hold?

There’s little doubt that BX is no longer priced at a discount. Seeking Alpha Quant’s “D-” valuation grade suggests Blackstone needs to continue executing very well to justify its premium. Moreover, BX’s forward normalized EBITDA multiple of 25.5x is well above its 10Y average of 15.8x. Consequently, while I believe BX investors can continue holding on to their positions, I assessed that the risk/reward seems relatively unattractive. In other words, the market appears to have priced in an optimistic 2024/25 recovery for BX, given the more constructive macroeconomic conditions and positive fundamental factors.

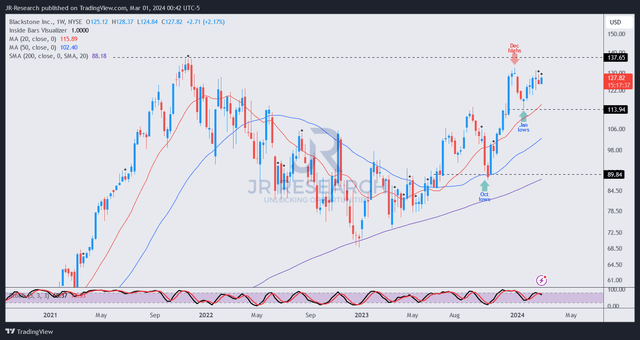

BX price chart (weekly, medium-term, adjusted for dividends) (TradingView)

I assessed that BX has regained its upward momentum, shaking off the downtrend bias that bedevilled it in 2022. As a result, investors who capitalized in October 2023 can consider hanging on to their positions.

Furthermore, the $115 level support in January 2024 has offered BX dip-buyers another opportunity to re-test the $130 level and recapture it decisively.

With BX already valued at a premium, I don’t think aggressive buying momentum will likely be observed unless we obtain markedly improved inflation headwinds lifting the real estate sector. While the private equity space could mitigate the challenges in real estate, Blackstone investors must be cautious about ascribing a more dovish Fed in 2024/25, given the resilience of the US economy. As a result, I believe the monetary policymakers will likely temper the cadence of their rate cuts to avoid unintentionally overheating the economy.

Consequently, I view BX’s thesis as relatively well-balanced at the current levels, with robust price action keeping holders onside.

Rating: Maintain Hold.

Important note: Investors are reminded to do their due diligence and not rely on the information provided as financial advice. Please always apply independent thinking and note that the rating is not intended to time a specific entry/exit at the point of writing unless otherwise specified.

I Want To Hear From You

Have constructive commentary to improve our thesis? Spotted a critical gap in our view? Saw something important that we didn’t? Agree or disagree? Comment below with the aim of helping everyone in the community to learn better!