hernan4429

Co-produced by Austin Rogers for High Yield Landlord.

The real estate sector has taken a beating over the last few years.

The problems of office real estate are well-known today, but there are pockets of distress building in other sectors as well. There are plenty of negative headlines about commercial real estate right now, especially in the wake of New York Community Bancorp’s (NYCB) steep dividend cut and stated desire to offload some of its real estate loans.

These factors, in addition to the pushback of market expectations for the first Fed rate cut from March to May, are pressuring real estate investment trusts (“REITs”) right now.

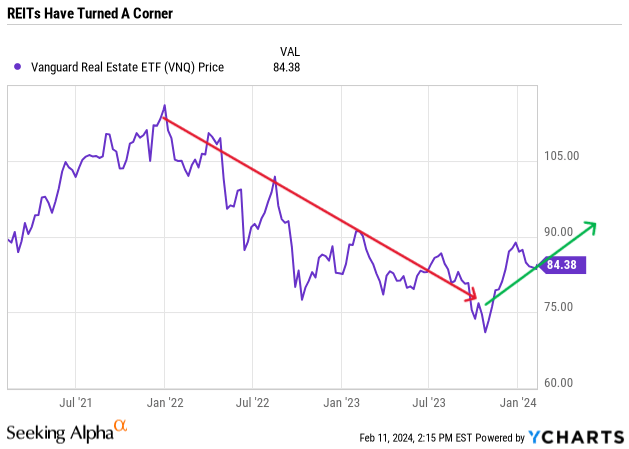

This is, of course, on top of the huge pressure REITs (VNQ) have felt since the beginning of 2022 as high inflation has triggered an aggressive rate-hiking cycle by the Fed.

YCharts (modified by author)

From January 2022 through October 2023, REITs suffered an almost 40% selloff as interest rates soared higher than many (including us) expected. In November and December, REITs enjoyed a nice rally, fueled by a change in Fed language suggesting an ensuing pivot.

Year to date, however, REITs have unfortunately suffered another setback as initial Fed rate cut expectations have been pushed back by a few months and negative headlines hit the news.

We think this represents a great buying opportunity for long-term investors. In fact, we think REITs’ outperformance seen in November and December of 2023 is likely to resume over the balance of 2024. We see three main reasons why this is likely to be the case.

1. Interest Rates Are Expected To Fall

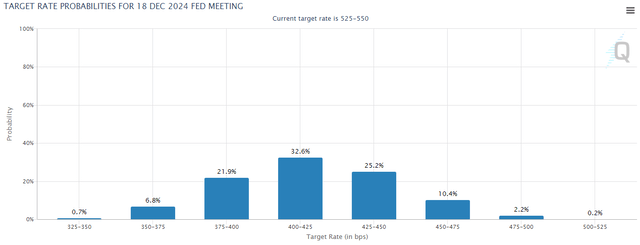

The market overwhelmingly expects the Federal Reserve to cut their key policy rate this year, and not only once or twice but 4-6 times.

As you can see from the CME FedWatch Tool below, the market’s view is that by the December 2024 meeting, the most likely outcome is that the Fed will have cut rates five times. The second most likely scenario is 4 cuts, followed by 6 cuts over the course of the year.

The market assigns a virtually zero percent chance that the Fed does not cut rates at all this year.

Whether it is because of falling inflation (highly likely) or a recession (plausible but not certain), there are simply more reasons to cut rates this year than hold them flat.

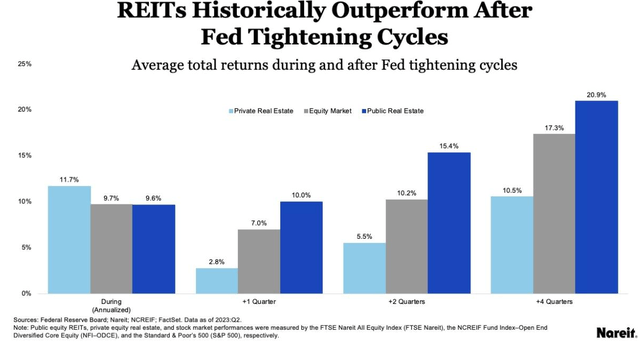

What happens to REITs after the end of Fed tightening cycles?

Given their rate-sensitive nature, REITs unsurprisingly outperform when the market becomes convinced that the Fed is definitely done raising rates and will soon begin cutting.

Historically, private real estate valuations react to Fed moves with a lag. Commercial real estate prices simply take a long time to price in changes in the market environment. That’s why private real estate historically outperforms during rate-hiking cycles but then underperforms after the hiking cycle ends.

Meanwhile, publicly traded REITs are forward-looking and priced based on what the market sees coming, not the situation that exists now or in the past. That’s why REITs underperform during rate-hiking cycles, when the market can’t yet see the end of rising rates. Once the Fed has definitively finished their tightening cycle, however, the REIT rally begins.

Remarkably, in the 12 months (4 quarters) after the end of Fed rate hikes, REITs return around 21% to the broader stock market’s ~17%.

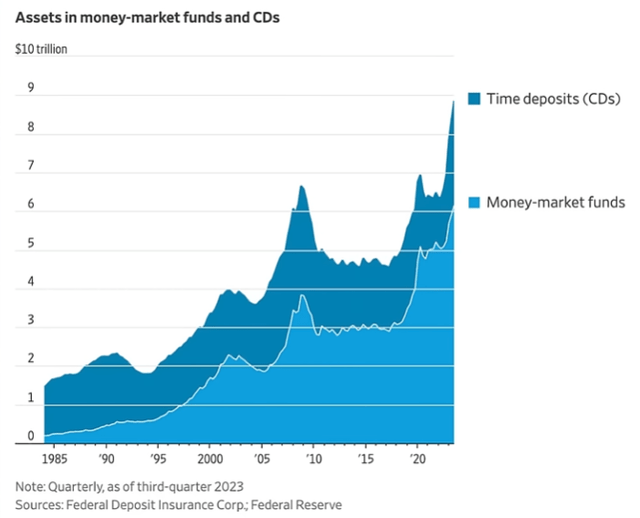

This time around, REITs should also benefit from eventual outflows of money in money market funds. As we explained in “$6 Trillion In Dry Powder Waits To Fuel The Rally In REITs,” income-seeking investors tend to shift money back and forth between money market funds and REITs, depending on the level of the Fed Funds Rate (“FFR”).

When the FFR is relatively high — say, around 5% or more — capital flows out of REITs and into money market funds. But when the Fed cuts rates and investors realize they are no longer making 5% virtually risk-free in their money market funds, that capital flows back into REITs.

Right now, there is a huge mountain of cash that has recently flooded into MMFs.

At least a significant portion of that $6 trillion in MMFs will likely serve as the dry powder to fuel a multi-year rally in REITs going forward.

The trigger for capital switching from MMFs to REITs, of course, is the Fed cutting rates to a sufficient degree.

2. New Supply Will Drop In 2025 And Beyond

Real estate, like any other part of the economy, is driven by supply and demand. Prices typically rise when demand outpaces supply and fall when supply outpaces demand.

In 2021 and 2022, amid a strong economy driven by cash-rich consumers, demand heavily outpaced supply across most sectors of commercial real estate. This spurred developers to start a huge slate of projects that began to come to market in 2023 and will continue over the course of 2024.

But at the same time, consumers have largely burned through their pandemic-era savings and are reining in spending, resulting in a situation where supply is outpacing demand across most sectors of commercial real estate.

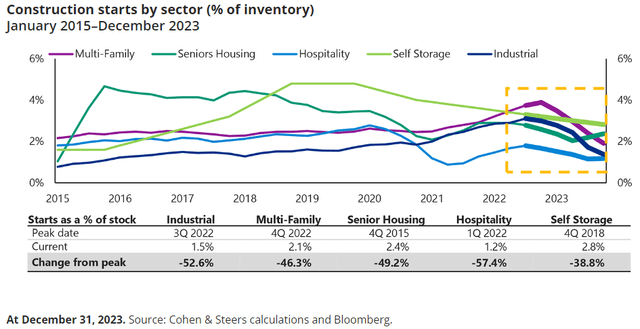

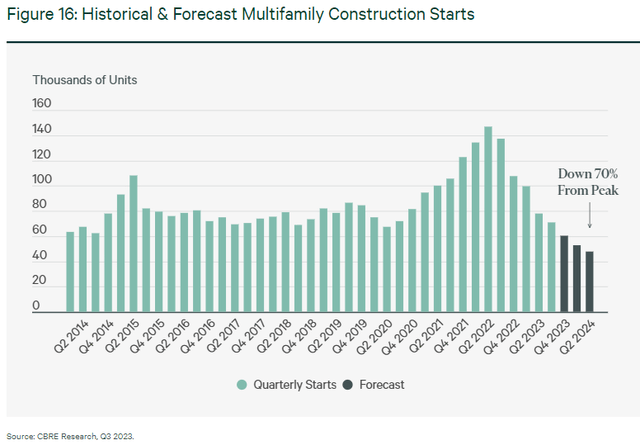

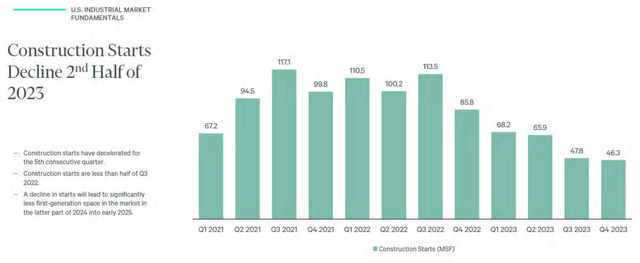

Fortunately, as you can see below if you look closely inside the yellow/orange box, the current environment of high interest rates and sluggish demand has led to a sharp slowdown in construction starts across most parts of real estate.

The sharpest drop in construction starts can be seen in two sectors: multifamily and industrial. These have been some of the hottest areas of real estate and thus are currently experiencing the largest influxes of new supply. Fortunately, the current pain being felt in these sectors should eventually give way to major gain in 2025 and 2026 due to very light supply deliveries expected those years.

For example, you can see the huge surge in multifamily starts in 2021 and 2022 and also the steady, steep decline in starts that is expected to continue through at least the first half of 2024.

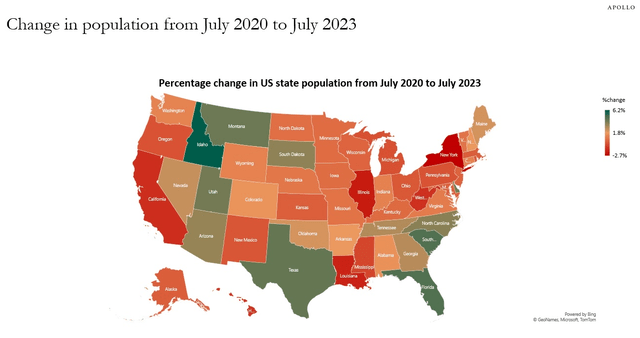

A disproportionate share of new apartments are being delivered into Sunbelt markets, especially states like Texas, Florida, the Carolinas, and Arizona, which enjoyed the highest population and job growth in 2021 and 2022.

While the Sunbelt is expected to continue enjoying above-average population and job growth for the foreseeable future, it will likely take a year or so to fully absorb the magnitude of new supply being delivered in these markets.

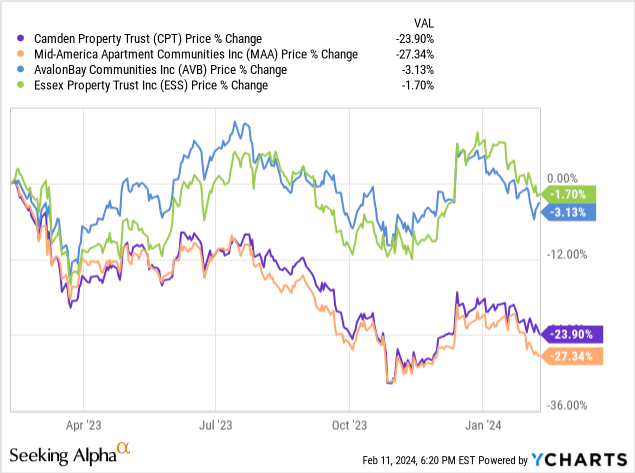

This explains the major divergence between the two biggest Sunbelt apartment REITs, Camden Property Trust (CPT) and Mid-America Apartment Communities (MAA), and two of the biggest coastal apartment REITs, AvalonBay Communities (AVB) and Essex Property Trust (ESS), over the last year.

Our favorite apartment REIT in the Sunbelt, BSR REIT (OTCPK:BSRTF), has been marked down even more than these two, offers a ~4.6% yield, and is almost entirely concentrated in the fast-growing state of Texas.

What about industrial? We can see almost the same story in industrial starts for this sector of real estate, which surged in the post-COVID years of 2021 and 2022 only to slide considerably over the course of 2023.

CBRE, via EastGroup Properties

Unlike the multifamily space, industrial does not appear to be meaningfully overbuilt anywhere in particular, even though the sector is undergoing a cyclical slow period right now.

By the second half of 2024, however, as long as demand holds up, new deliveries of industrial space will begin to decline considerably, creating a much more favorable supply-demand environment.

This should especially be true for our favorite industrial REIT, STAG Industrial (STAG), which is concentrated largely in Eastern and Southern secondary markets where supply growth is more muted. Another part of STAG’s appeal is the fact that its payout ratio has now reached around 70% of adjusted funds from operations, or AFFO, giving the REIT the ability to start increasing its dividend growth rate at a similar pace as its AFFO per share growth going forward.

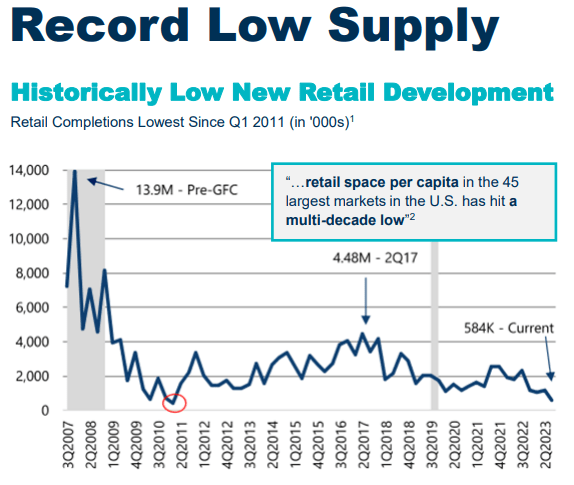

Finally, you may have noticed that the first chart in this section did not include the retail sector. That is probably because retail real estate has had such a minimal level of new supply delivered in recent years.

According to this chart from shopping center REIT Kimco Realty (KIM), retail completions are currently at their lowest level since Q1 2011, which was their lowest level after the GFC.

Kimco Realty Presentation

Retail, restaurant, and select medical tenants exhibit strong and steady demand for retail space, but there is very little new retail space being delivered.

This is a recipe for many years of above-average returns for retail REITs.

We are especially bullish on our favorite pick in this space, Whitestone REIT (WSR), which owns shopping centers in five of the hottest Sunbelt markets in the nation: Phoenix, Dallas/Fort Worth, Houston, San Antonio, and Austin. WSR effectively gets to enjoy all the population growth of these markets with extremely little new competition from new supply.

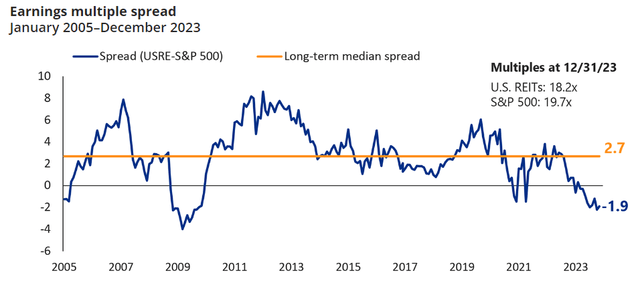

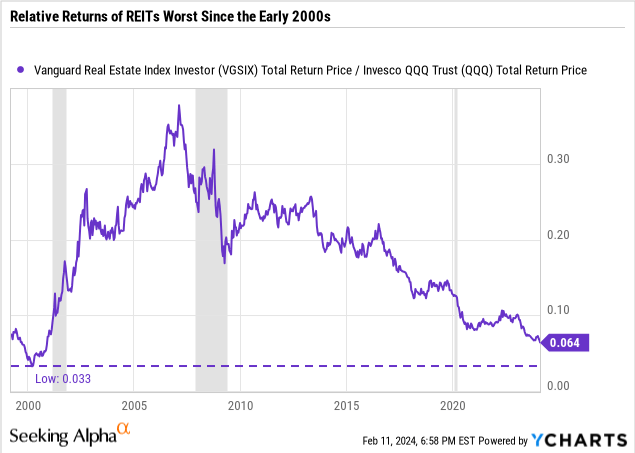

3. Relative Valuations Are The Lowest Since The GFC

Finally, consider that the valuations of REITs relative to the broader market has not been this low since the Great Financial Crisis in 2008-2009.

The tech-driven major indices have soldiered on, driven higher by the strong growth of a handful of names and hype surrounding artificial intelligence.

We certainly think AI has exciting potential to impact our everyday lives and improve productivity, but there are other valuable assets worthy of investor attention besides just AI stocks.

If you look at the total returns of REITs relative to the tech stocks in the Nasdaq index (QQQ), you’ll find that REITs are having their worst performance since the dot-com bubble around 2000.

Eventually, investors in the early 2000s realized that there are other stocks worthy of consideration besides just tech companies, and real estate enjoyed a multi-year period of strong outperformance.

We think REITs could be just at the cusp of another strong period like this.

Bottom Line

Investors often think of REITs as nothing more than income vehicles to be treated like bond alternatives, but they are much more than that.

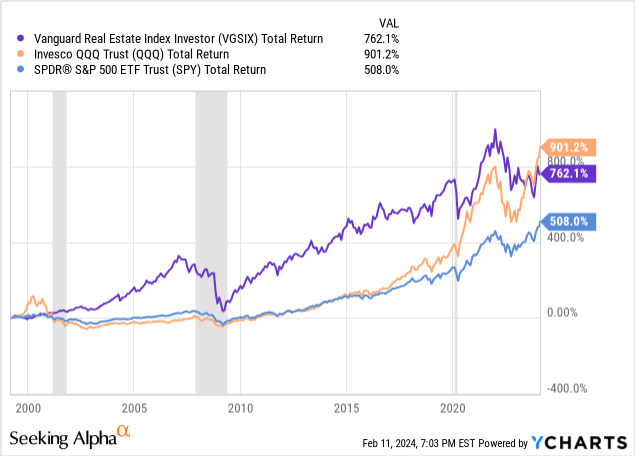

Since the late 1990s, the US real estate index, represented below by the Vanguard Real Estate mutual fund (VGSIX), has greatly outperformed the S&P 500 (SPY) and spent most of that period outperforming the Nasdaq.

Only in the last year or so, amid the investor frenzy around the Magnificent 7, has the QQQ pulled ahead to turn in the strong total return performance over that multi-decade period.

You might object that, over this period, REITs enjoyed the benefit of generally falling long-term interest rates. But so did tech stocks! So did every other stock!

Contrary to popular belief, REITs are not hurt on a fundamental basis from rising interest rates any more than the average stock. After all, REITs’ average leverage ratio is only about 35% of assets (based on market prices), and REITs typically have as long or longer debt maturities than other non-real estate companies of their equivalent credit rating.

Despite that, REITs still trade like bond alternatives, making them more rate-sensitive on a technical basis than the average stock.

Thus, between falling interest rates, the coming decline in new deliveries, and attractive relative valuations, REITs appear to be poised for a strong rally over the next few years.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.