Chonlatee Sangsawang

What’s New

Another month, another new all-time high for major US equity indices. While the end result was more of the same compared to a number of previous months, the backdrop was noticeably different.

In many ways, February was a month of shifting expectations. Following a hot CPI print in mid-February, stocks temporarily pulled back as the market was forced to once again wrestle with the idea of inflation. It’s likely that bond markets had already caught on, as sovereign rates and inflation breakevens had been drifting higher to start the month.

Expectations for the Federal Reserve also saw a significant reset during the month of February. Coming into the month, the market had been pricing six cuts for 2024, with the first coming in May. We are now in a position where the market is pricing closer to three cuts for the year, with the first coming in June.

Despite the rise in yields, equity markets continued to drift higher, with the major indices returning:

- S&P 500: 5.17%

- Dow Jones Industrial Average: 2.22%

- Nasdaq: 6.12%

What was interesting to note is that the rally has broadened out and become more reflective of a stronger economic environment. Rather than Information Technology continuing to lead the way, Industrials, Consumer Discretionary, and Materials were the strongest sectors during the month. It is also worth noting that the Russell 2000 and equal-weighted S&P 500 index—both of which are more reflective of economic activity—generated returns of 5.52% and 3.96%, respectively, during the month. The relative strength was also reflected in high yield bond spreads, which remain near multi-year lows despite the run-up in Treasury yields.

The question, then, continues to be one of risk-reward in financial markets. With the economy remaining resilient and some of the strength we have seen in equity markets broadening out to other sectors, it is tempting to ignore the warning signs we continue to see on the economic side of the ledger. However, inflation is showing that there remain upside risks, and this is against a backdrop of an expensive equity market and spreads near the lows. We continue to believe that such an environment argues for a somewhat defensive, yet opportunistic approach to markets.

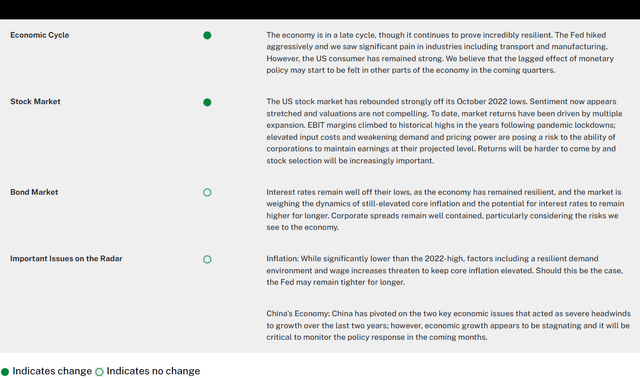

Our Perspective

We have been adamant that a soft landing is unlikely as we progress through the economic cycle. Historical evidence suggests that the Fed has never brought inflation down from the levels we’ve seen without causing significant economic hardship. Should the Fed begin cutting rates aggressively this year, we believe it is more likely than not that it will be in response to an adverse economic outcome or exogenous shock. Earnings would likely be hit hard by the economic slowdown, driving the Fed to cut. However, the continued resiliency of the US economy and the downward trend in inflation has increased the odds of a more benign outcome.

Given the above, the market is likely going to have to reprice its outlook with higher yields, rising uncertainties, and weaker earnings. While the market is typically forward-looking, recessions tend not to be priced into the market until their arrival is imminent.

With that in mind, we are placing an emphasis on risk management and have adopted a defensive position strategy in our core portfolios.

Sector Insights: What Could Go Right in 2024?

2023 was an eventful year, and 2024 promises to be no less. So, what could go right this year?

Every sector has its bright spots, hear what they are directly from our analysts as they share opportunities emerging this year given the current market and economic environment – including in life sciences/healthcare, capital goods, fixed income, tech, services, and consumer goods.

Read the opportunities in: Sector Insights: What Could Go Right in 2024?

Our View

Source: Bloomberg

Editor’s Note: The summary bullets for this article were chosen by Seeking Alpha editors.