Дина Орлова/iStock via Getty Images

Summary

I recall my first exposure to the stock market was during the nightly news, a reporter would say it was a good/bad day on Wall Street, the Dow was up/down some points. It was not until I entered the investment world that the Dow Jones Industrial Average (DJIA) was virtually forgotten and replaced by the S&P 500 (SPX) and the NASDAQ (NDX). Up until just today, I had virtually written off the Dow as a viable investment idea given the simpatico nature of its index methodology and slowness to change. However, looking at the performance I must eat my words. I ran a bottom analysis of the SPDR® Dow Jones Industrial Average ETF Trust (NYSEARCA:DIA) to gauge how wrong I may be.

Performance

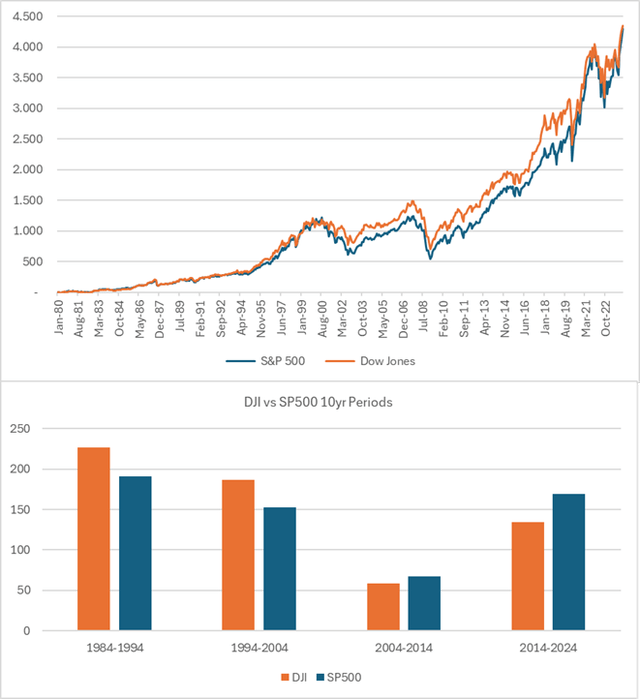

The Dow has mostly kept pace with the SP500 over the last 40 years and before that had similar returns. It was not until the last 10 years that a gap appeared caused by the absence of some large technology names such as Google (GOOGL), Meta (META), and most recently Nvidia (NVDA). However, as we saw a few days ago the folks at SP Global, who run the Dow Jones Index, added Amazon (AMZN) with a 2.6% weight. It may be fair to assume that the Dow can provide a good long-term return with a bit less volatility given its more conservative selections.

DJIA performance vs SP500 (Created by author with data from Capital IQ)

The Index Methodology

It’s a simpatico methodology, and by this, I mean odd, different, a bit silly really. The selectors choose companies from the SP 500 that have a solid reputation and represent the US economy in their sector. In the Amazon case, it replaced Walgreens, both broadly classified as consumer retail even though Amazon is far more than this. In addition, Walmart’s weight was cut due to Amazon’s larger share price. Yes, it’s not a typo, one of the index constituents’ methods is based on the absolute share price, the higher the larger the weight. This is why UnitedHealth (UNH) is 8% with a current price of US$498 and Verizon (VZ) is .7% with a US$40 price. Despite this odd method the index has performed well.

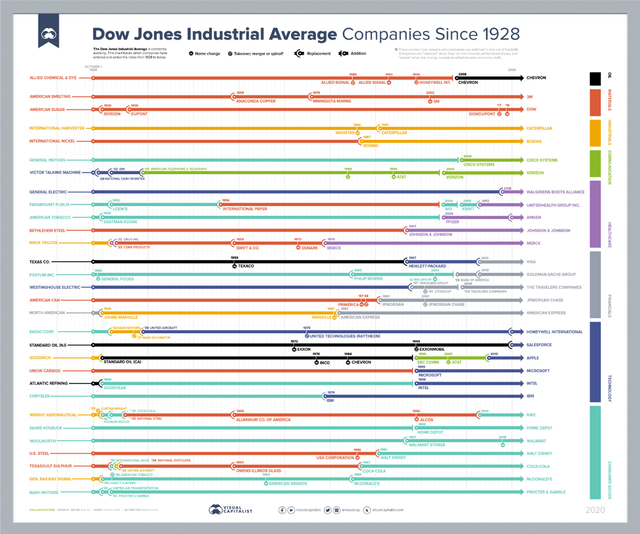

A more important attribution for the Index is that it has tried to keep up with the times, i.e. adding technology names like Microsoft (MSFT) in 1999, Apple (AAPL) in 2015, and Salesforce (CRM) in 2020 for example. The Dow is more growth-oriented than one may have believed. The Image from Visual Capitalist as well as a few articles from Wikipedia and other sources demonstrate the changes.

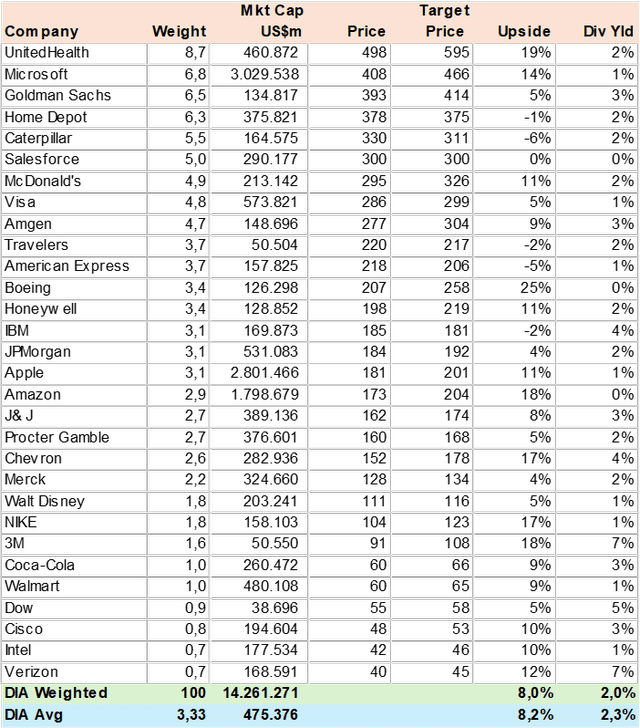

Portfolio Upside

Using consensus price targets for the 30 holdings I calculated a portfolio upside potential of 8% plus a 2% dividend yield for a 10% total return. This is very much in line with SP500 bottom-up expectations. The most controversial holding may be Boeing (BA) with its never-ending MAX 737 crises. At the same time, it’s interesting to see the top-weighted stock, UnitedHealth, with a 19% upside potential followed by the recently added Amazon at 18%.

DIA Consensus Price Target (Created by author with data from Capital IQ)

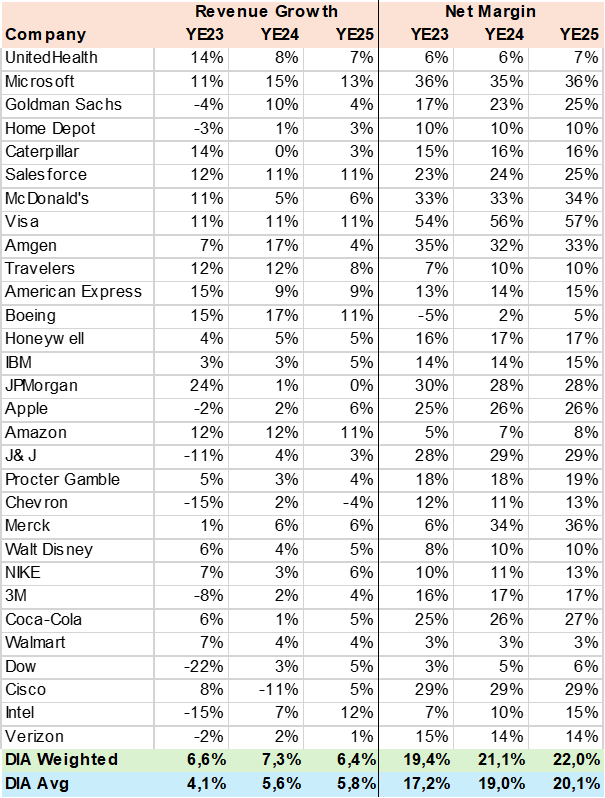

Revenue and Margins

The consensus, constructed by 100s of analysts that cover the 30 holdings, forecasts fairly consistent revenue growth of 6.5% in the YE24-25 period. However, the ETF is not without its problem companies such as Boeing and surprisingly Cisco (CSCO) with an 11% revenue decline estimated for YE24. On the net margin side, the market expects a healthy increase from 19.4% in YE23 to 22% by YE25 which should provide for good EPS growth.

DIA Consensus Revenue Growth (Created by author with data from Capital IQ)

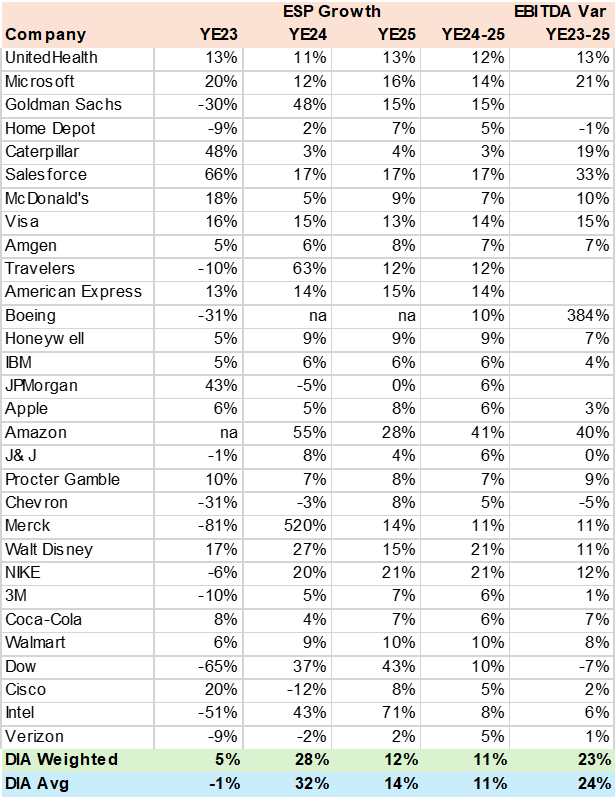

EPS Growth

The portfolio has a consensus EPS growth rate of 28% of YE24 which is due to a low comparison base, especially for Merck (MRK), Goldman Sachs (GS), Travelers (TRV), and Amazon. Looking at a two-year average or a three-year EBITDA growth rate provides a more consistent data set which is very important for valuation. It’s relevant to note that this estimated growth rate is lower than the Nasdaq as I recently measured in the Invesco QQQ Trust (QQQ) analysis.

DIA Consensus EPS Growth (Created by author with data from Capital IQ)

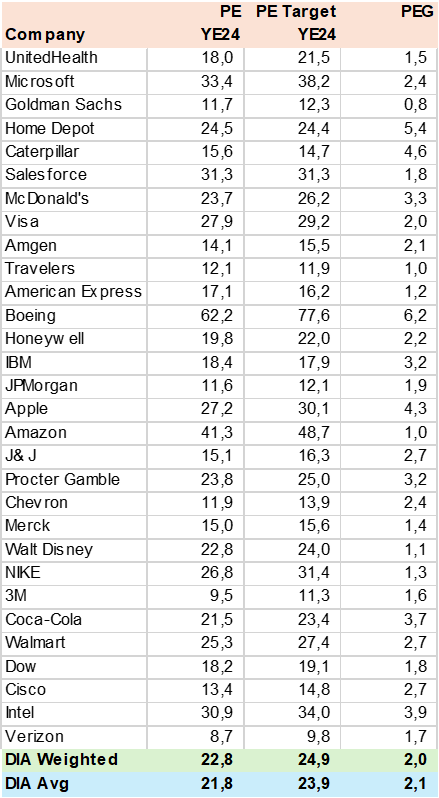

Valuation

As is the case with the SP500 and NASDAQ as well as many sector and individual stocks, value or a cheap valuation for quality companies is not easy to find. DIA is trading at 22.8x PE on YE24 estimates while the consensus has a PE target of almost 25x. This produces a relative valuation of 2x PEG (PE to EPS Growth), which is in the expensive camp in my view. The main outlier is Goldman Sachs at under 1x PEG and surprisingly Amazon at 1x PEG. The market seems to be pricing in the start of Fed rate cuts and a 2% + GDP growth rate in my view.

DIA Consensus Valuation (Created by author with data from Capital IQ)

Conclusion

I rate DIA a hold. While the Dow Jones has a very good long-term track record and has rotated holdings into growth and tech stocks it does so at a far slower pace than the SP500 and Nasdaq. Of particular disagreement is the portfolio weighting method that uses absolute share price vs market cap or some other more rational fundamental method. Nonetheless, the selected top 30 stocks have not been serial underperformers and may offer investors lower daily volatility vs the other two major US indexes.