Earlier this decade, Moscow launched the Arktika, the world’s largest and first post-Soviet nuclear icebreaker, hailing it as a crucial part of Moscow’s plan to open up the Northern Sea Route to year-round trade. Putin personally oversaw the launch of two more nuclear powered icebreakers of the same class in 2022.

The Soviet-era “50 Years of Victory” icebreaker, which also assisted Red Box, carried the Olympic flame to the North Pole in 2014 ahead of the Sochi Winter Games, and has featured on commemorative stamps.

Unlike their distinctive orange and black-painted forebears, Arktika and the other new icebreakers are bedecked in the colours of the Russian flag. They have featured on advertising hoardings and Zvezda, a Russian version of Airfix, sells a scale model of the Arktika alongside figures commemorating Russia’s annexation of Crimea.

The gas that came in from the cold

The question of just what Red Box has transported from China to Russia remains the thorniest issue.

The Arctic LNG 2 project is a modular construction, with equipment made in China and assembled in a Russian shipyard, before being towed to its final destination on the Gyda peninsula in the country’s far north.

The Gyda site sits opposite the Yamal peninsula, where Novatek’s first large-scale LNG project, Yamal LNG, was launched by Putin in 2017. France’s TotalEnergies, which worked on both projects, dubbed Yamal “the gas that came in from the cold”, a knowing nod to a John Le Carré Cold War spy novel about double-crossing and amorality.

Adkins provided shipping services for deliveries to Yamal too during its construction.

But partners in Arctic LNG 2, like TotalEnergies and Japan’s Mitsui and Co, have pulled back from the latest project since Washington increased sanctions at the end of last year. The first LNG train at the project started up in December, but it is yet to ship its first cargo.

Adkins says Red Box Energy, which is incorporated in Singapore but also has an office in Rotterdam, never had a direct contract with Novatek and ended relationships with its suppliers after US restrictions were imposed. “We sent in a termination notice. Bang, we’re out,” Adkins says.

The contracts now are with a “non-sanctioned international counterparty” and “non-Russian”, he says.

Mehdy Touil, an LNG operations specialist who worked on Novatek’s Yamal LNG project for almost 5 years, says he was able to identify the structures Red Box is transporting from the photos.

“I’ve been studying this project for years — and these structures are key components for the Arctic LNG 2 project that will house the drivers of the liquefaction process used to liquify the natural gas by chilling it to -162 degrees centigrade,” says Touil.

“Technically they may be able to argue that these modules in their current form are just structures, as the compressors and Chinese-made electric motors are likely already at Belokamenka shipyard. But there is no doubt that these are highly complex structures that will be key to Arctic LNG 2’s success.”

Adkins says that so-called experts were “categorically wrong in their speculations”. “The steel structures do not contain sanctioned components,” he adds.

He says they are “two generic steel structures” under an “HS Code” — the internationally agreed system for classifying products — that he claims are not covered by western sanctions.

“We don’t know what they will be doing with these steel structures once they get them,” he adds. “We’re just being paid to get the bag to the airport.”

Ice cold in Audax

Adkins says the two vessels are earning Red Box $100,000-$120,000 a day each on their voyage to Murmansk, which suggests total revenues from the trip could be as high as $12.5mn. He says the daily rate is roughly triple what Red Box would earn manoeuvring wind turbines or other heavy equipment in Europe. In 2021 Red Box had total revenues of $19mn, according to its accounts filed in Singapore, before leaping to $70.7mn in 2022.

Adkins has had a varied career, and moves in circles where expensive lifestyles are the norm. He worked as an investment banker in Japan in the 1980s, where he helped finance Walt Disney movies. He has run a sizeable brewery in Australia. He entered the shipping industry in 2007, and founded Red Box in 2016, with a plan to focus on the Arctic.

His ex-wife, Corinna zu Sayn-Wittgenstein-Sayn, pursued a relationship after their divorce with the then king of Spain, Juan Carlos.

Adkins himself became close friends with Juan Carlos, and was on the fringes of a financial scandal that eventually contributed to the king going into self-imposed exile in the UAE. Adkins was never accused of wrongdoing.

His friendship with the former king has continued; people close to them say they share a love of fine wine, cigars and horses. Once the king stopped smoking following a cancer scare he gifted his cigar collection to Adkins, including a selection sent by Fidel Castro. Adkins says he and the king talk “every day”.

A keen equestrian and three-day eventer, Adkins had hoped to one day represent the US at the Olympics, but instead joined Team GB in 2008. Although he did not compete, Adkins says he was accredited as a UK athlete and travelled to Beijing with the squad after lending his horse, Parkmore Ed, to William Fox-Pitt, one of the UK’s leading riders.

Adkins says he is now based in Singapore. He would not confirm if he has a British passport — even though eligibility for Team GB requires an athlete to hold one. There is also no record in US federal registries that he has renounced US citizenship. When asked about his status, he says only that he is a citizen of St Kitts and Nevis in the Caribbean.

The sanctions that the US and UK imposed last week on Arctic LNG 2 sharpen the focus on those unanswered questions. Adkins disputes that he has assets in the UK or that he is primarily based there. In 2021, The Sun tabloid newspaper published a video of Adkins on a farm in Peterborough, wielding a riding crop while bellowing at “trespassers” to “get off my property”.

Saul Kavonic, an LNG specialist at MST Financial, says it is surprising that western powers have allowed the structures to be delivered without taking action, given their vow to disrupt the Arctic LNG 2 project. France’s Technip delivered similar structures last year, before withdrawing from the Arctic LNG 2 project entirely.

“[The US] approach to sanctions is often more nuanced than publicly acknowledged, such as when they allowed crude exports from Iran to rise during the [2021-23] energy crisis,” he says.

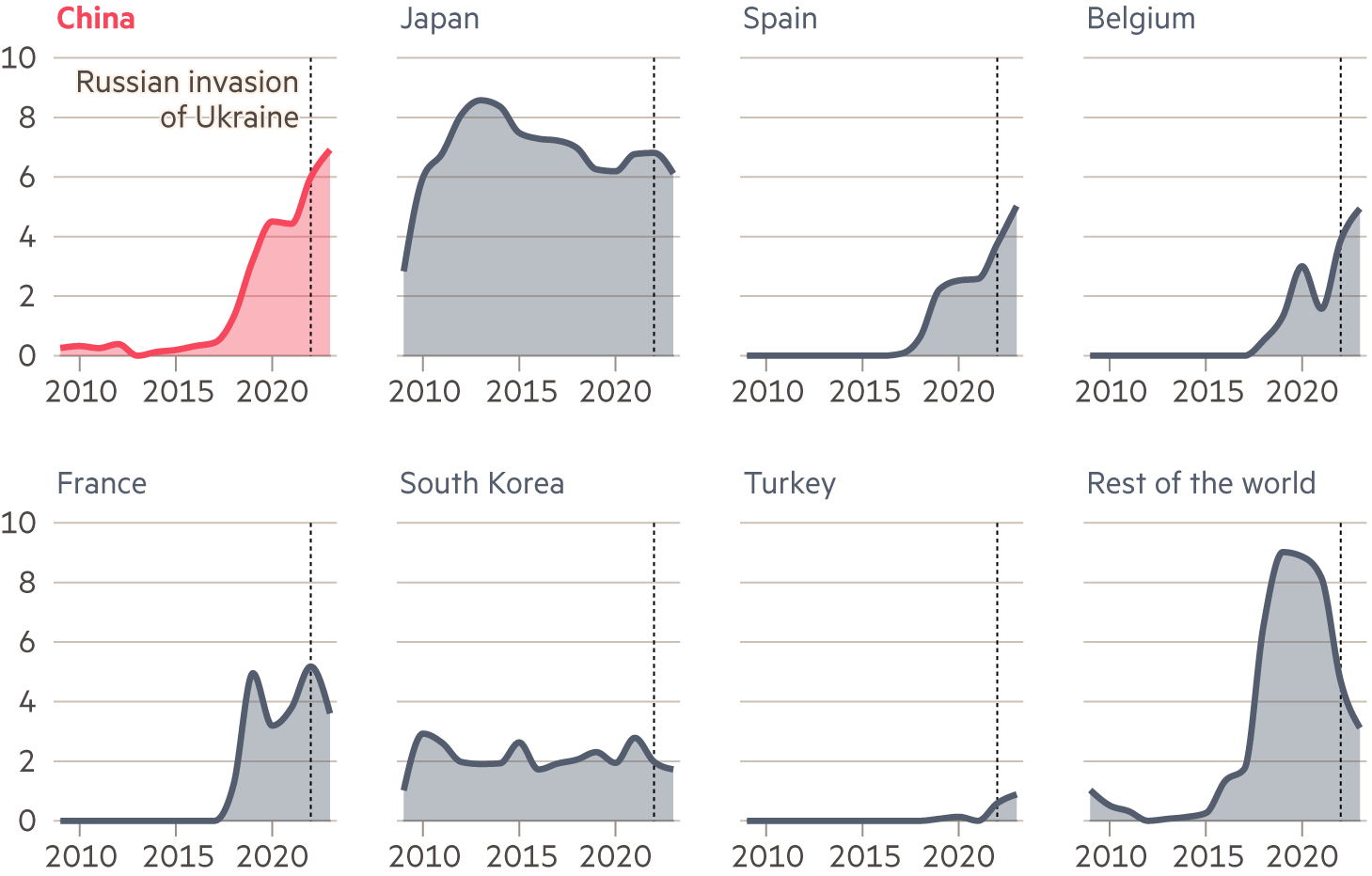

Europe’s dependence on Russian gas has fallen sharply since Putin slashed pipeline supplies following the invasion of Ukraine. But LNG exports from Russia to Europe have actually increased since 2021, even as China becomes Moscow’s biggest market.

Adkins’ behaviour does not suggest he fears falling foul of authorities in the US. Last weekend he flew to Houston, where he was a speaker at an LNG conference, which Red Box sponsored.

Adkins says that if offered the hypothetical choice between more prosaic LNG projects and servicing Russia’s Arctic ambitions, the answer would be easy. “I’d rather be working in the cold,” he says. “Because it’s a lot more lucrative.”