A survey of wealthy investors by Wealth Club, the UK’s largest high net worth investment broker, has found that while inheritance tax (IHT) remains the tax investors dislike the most, they see more value for boosting the wider economy in cutting income and corporation tax.

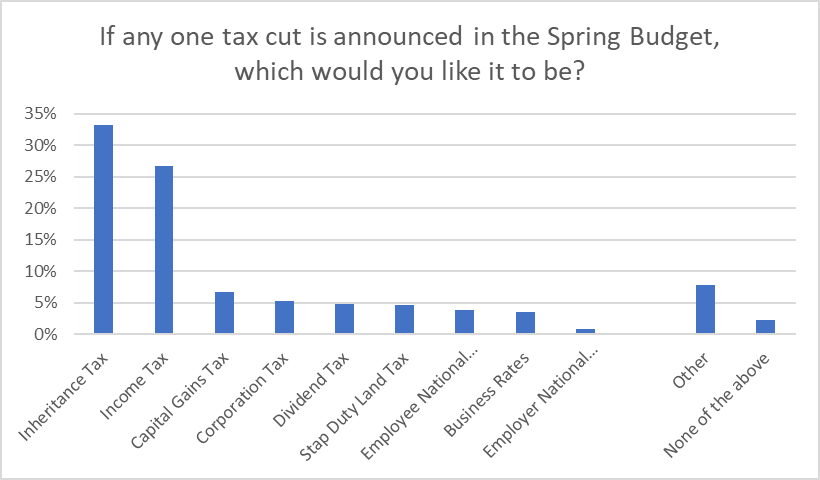

In a survey of over 400 wealthy investors this week, 33% said that if only one tax were cut at the Spring Budget, they would like it to be inheritance tax.

That came in just ahead of Income tax, which 27% of investors said they would like to see cut.

Source: Wealth Club, 25/02/2024

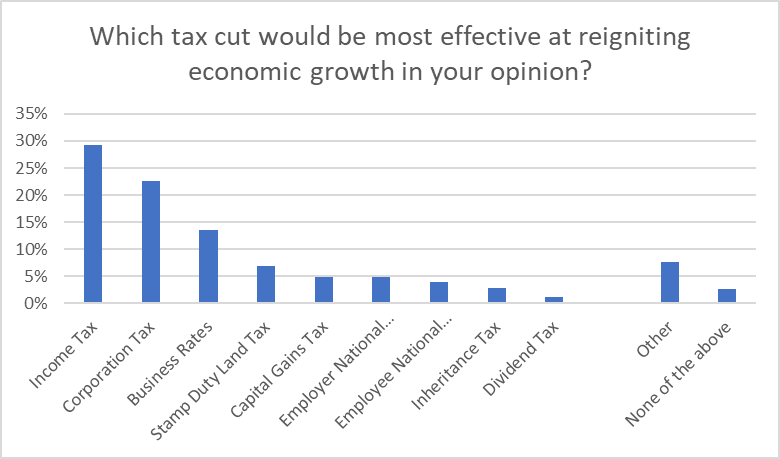

Source: Wealth Club, 25/02/2024

IHT is particularly unpopular with entrepreneurs, with 40% of entrepreneurs surveyed favoring a cut in this over any other tax.

However, when asked which tax cuts they thought would be most effective at sparking economic growth investors backed cuts to income tax (29%), corporation tax (23%) and business rates (13%). Just 3% of respondents backed cutting IHT as a way to spark economic growth.

Source: Wealth Club, 25/02/2024

Source: Wealth Club, 25/02/2024

When asked which policies they would introduce, investors who focused on IHT generally preferred to make tweaks rather than abolish the tax altogether. Suggestions included reducing the tax rate from 40% or increasing the threshold at which it applies.

Nicholas Hyett, Investment Manager at Wealth Club, said, “Inheritance tax remains the least popular tax with wealthy investors – and the one they would most like to see cut at the Budget.

However, the government would do well to note that many wealthy voters would favor tweaking the rules around the UK’s most hated tax rather than abolishing it altogether. Cutting the rate at which inheritance tax is charged, or raising the value of the estates on which it is applied could deliver a popular tax cut without completely discarding a valuable source of tax revenue.

However, it seems likely that wealthy investors would also back a decision to focus on tax cuts in areas like income tax, corporation tax and business rates – all of which are seen as having the potential to boost the wider economy.”