It’s not all about the Benjamins, baby — particularly for executive compensation, but increasingly, all levels of employees at firms around the globe.

At the start of the first dot com boom in the 1990s, equity emerged as one of the most compelling parts of new hire offer packages for employees at varying levels, according to Matt Simon at MyStockOptions.com. This was particularly true, and has remained true, at tech firms and startups — even as macroeconomic trends have caused a slowdown in total value of equity awards.

But throughout all this time, the question for companies awarding equity has been how to ensure it is portioned out wisely, sagely, for the sake of the business’s success, and tracked to comply with all applicable laws in the places in which employees work? A secondary question that remains urgent to the employees themselves: how to track and access their equity awards and maturation cycles?

Now a new startup, Slice, based in Tel Aviv, Israel and San Francisco, California, has emerged from stealth to help answer these questions. Armed with $7 million in seed funding, it seeks to offer an automated solution for global equity management geared toward both company finance departments and the employees they serve.

VB Event

The AI Impact Tour – NYC

We’ll be in New York on February 29 in partnership with Microsoft to discuss how to balance risks and rewards of AI applications. Request an invite to the exclusive event below.

Founded by Maor Levran, Aviram Berg, and Yoel Amir, Slice introduces an AI-powered global equity platform designed to simplify the process of issuing equity while ensuring compliance with local laws and optimizing tax benefits.

The funding round, led by TLV Partners and supported by R-Squared Ventures, Jibe Ventures, and prominent law firms Wilson Sonsini and Fenwick & West, alongside notable angel investors, marks a significant step for the company in addressing the complexities of equity distribution across different countries, states, and governing entities.

The equity award conundrum

Equity compensation comes in various forms, including stock options, restricted stock units (RSUs), and employee stock purchase plans (ESPPs), each with its own mix of benefits and drawbacks to both employees and employers. Understanding all of them and ensuring they comply with applicable laws is often a bewildering experience.

Though they ballooned in the 90s, such equity packages have actually been issued for more than 70 years, according to Levran, and helped grow Silicon Valley into the world-changing behemoth it is today.

Despite that, “no solution was built in order to cope with the very complex tax laws and regulations that each country has embraced,” Levran said in an exclusive video call interview with VentureBeat. “It’s impossible.”

How Slice uses AI to help finance teams and employees

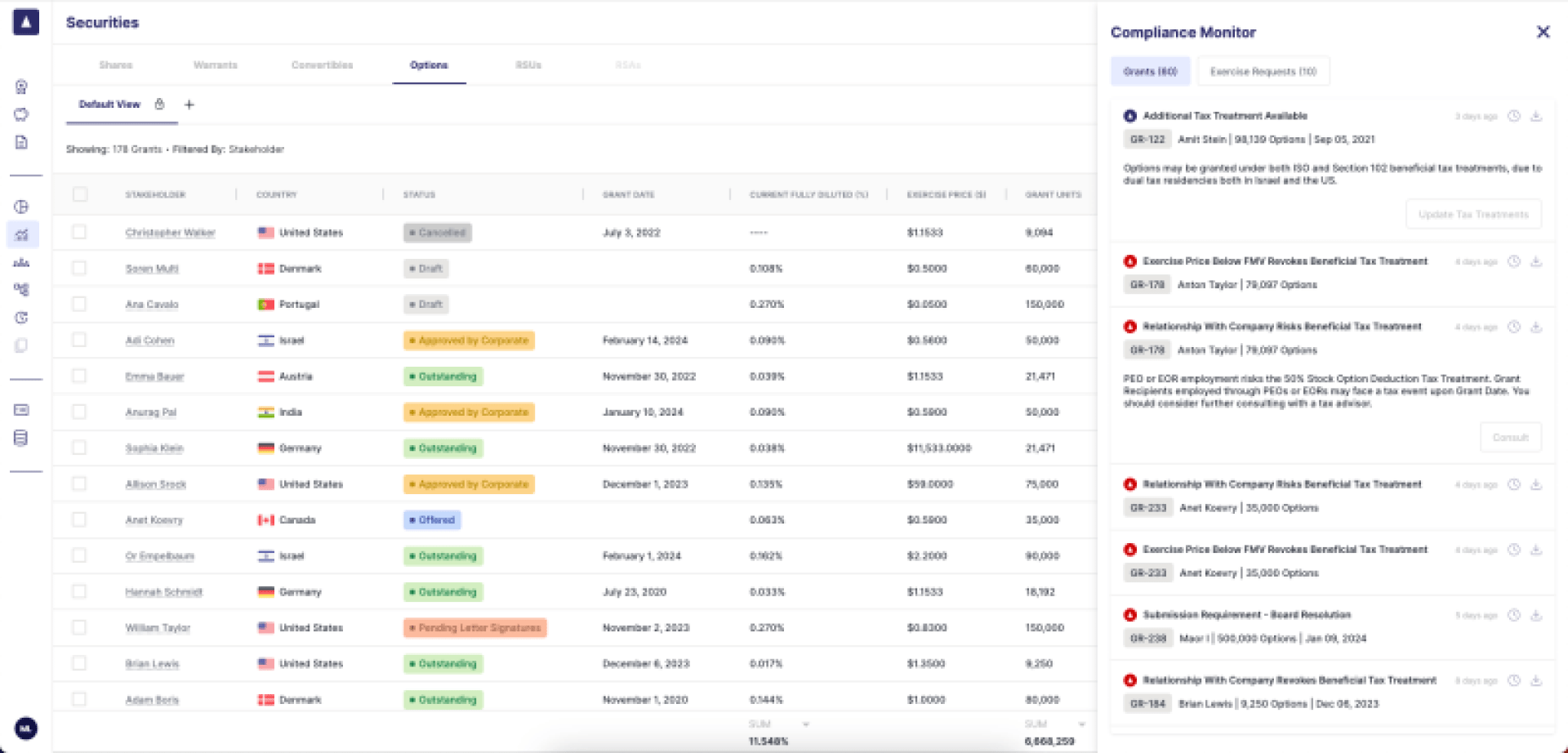

At least until now. Slice offers a “Global Equity Assurance Platform” powered by generative AI under the hood, designed for chief financial officers (CFOs) and finance teams to be able to create, issue, track, and monitor equity awards while complying with applicable regulations in the areas their employees reside.

The tool already contains a vast array of data on 23 countries’ regulations (a combined total of 100 is targeted for the end of this year), and is able to surface these depending on where the finance team selects equity to be issued, and automatically generates the correct documentation for that region.

“We really slice and dice all through regulations to make sure your equity complies, and we generate all the equity award documentation, tailor-made according to each country’s tax treatments, regulations, and everything,” said Levran.

Even if tax law changes — as it has often on a global scale — Slice will be able to keep its customers in compliance because it works with top-tier law firms around the world to stay updated on the latest regulations.

“We translate this data to our software, and we’re training it to track changes,” said Amir, the company’s chief product officer (CPO), in the same video call interview with VentureBeat. “Obviously, we’re checking everything the models spit out.”

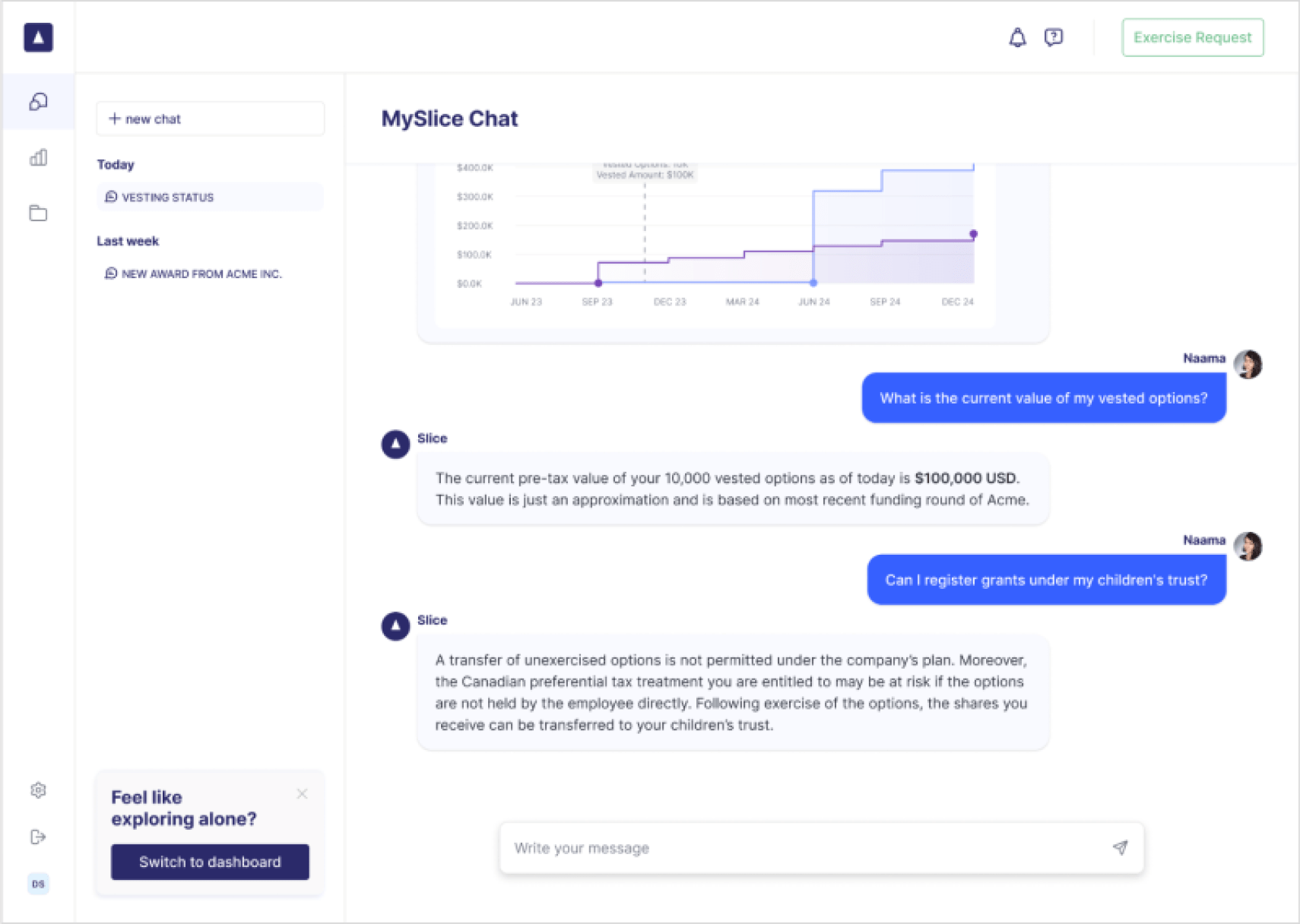

For employees, Slice offers a generative AI powered chatbot called “MySlice Chat” that they can query with common yet individualized questions about their equity — such as current value, when it vests, can it be registered under different trusts, and more.

Integrating with a wide array of workplace apps used by finance teams including Google Workspace, ADP, Deel, and Workday, among many others, Slice enables finance teams to handle equity management tasks that would typically require months of work in just minutes.

Besides providing a master organizer and equity issuance tracker, improving the efficiency of finance teams, Slice also says it has saved its early beta customers and their employees money — “last month, we saved two of customers almost one million dollars” by catching a mistake in the equity award proposal before it went out.

Backed by industry vets

Industry veterans have recognized the potential of Slice’s platform to simplify global compensation strategies.

Shawn Lampron, a partner at Fenwick & West, and Eitan Bek of TLV Partners have expressed their support for the platform’s approach to addressing the challenges of global equity management.

Eynat Guez, CEO of Papaya Global and an angel investor in Slice, also acknowledges the solution’s capacity to tackle the intricate details of legal and tax issues related to global equity.

The recent funding will facilitate further development of the platform and strategic market entry efforts, particularly in the US and Europe.

For companies navigating the complexities of global talent management, Slice offers a solution aimed at simplifying the process of equity compliance and taxation.

As the platform continues to evolve, it aims to provide a valuable tool for finance and HR teams dealing with equity compensation at all levels.

VentureBeat’s mission is to be a digital town square for technical decision-makers to gain knowledge about transformative enterprise technology and transact. Discover our Briefings.