Sanjog Mhatre

Summary

India is a market consensus buy. The combination of a large and growing population, high GDP growth as well a democratic system, property rights, and the rule of law have made India one of the best long-term buys in emerging markets. The Indian market has dethroned China and Brazil for investor interest and should continue to gain weight, capital flow, and valuation. I took a deep dive into the iShares MSCI India ETF (BATS:INDA), one of the largest in the market with US$8bn in AUM. The consensus bottom-up portfolio analysis suggests good EPS growth and a lower PEG than the S&P 500, but modest upside potential short term.

Performance

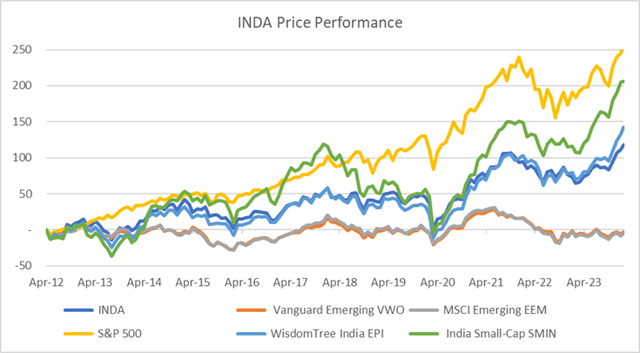

The ETF has performed in line with the Indian market (in USD terms) and has handsomely beaten the broader emerging markets including China and Brazil. However, INDA has not managed to outperform the S&P 500 (SPX). Many asset allocation models suggest investors should have a sizable exposure to emerging markets, including India. However, the long-term historical data does not yet support this, and a selected approach may be more advantageous.

INDA vs Peers (Created by author with data from Capital IQ)

India Macro Economic Overview

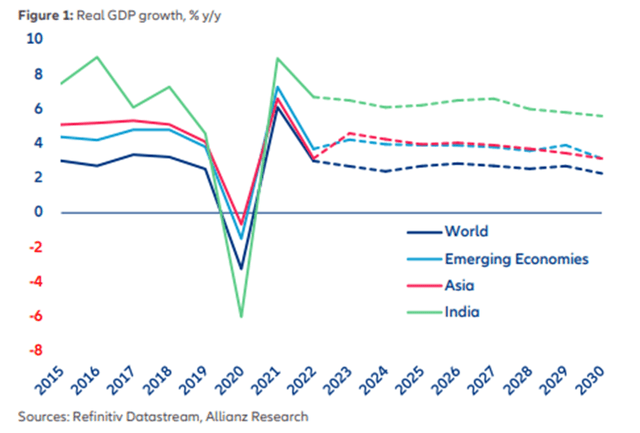

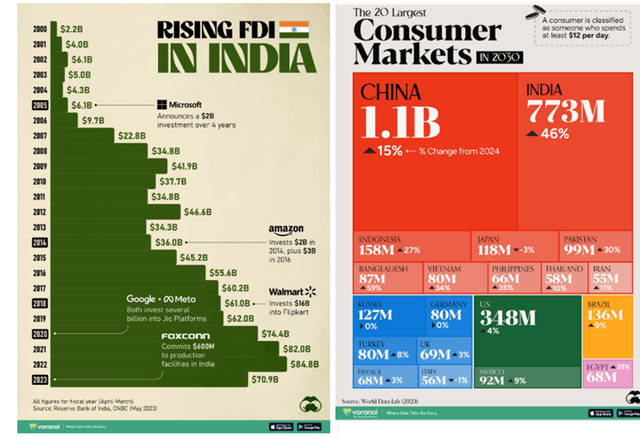

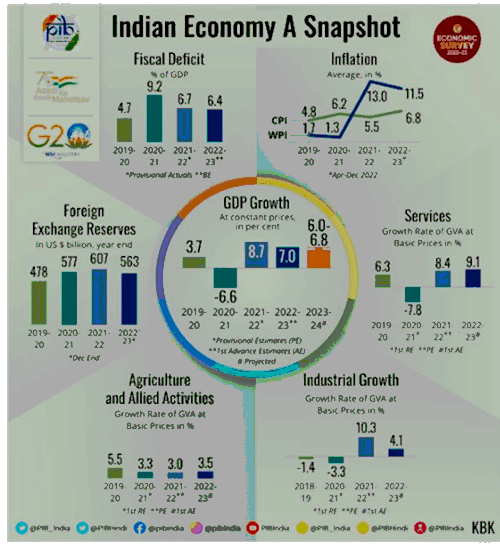

India’s economic story is well known, and I will highlight a few salient points. The first is the demographics, with the largest and still growing population on the planet, India is a target of significant Foreign Direct Investment (FDI) focused on a rapidly growing middle class that may eclipse China in the medium term. Another aspect of India is its incredible human capital, it is no coincidence that the US C-suite is filled with Indian executives. This human capital combined with improving economic freedom indicators may lead to higher entrepreneurial expansion that feeds into sustained GDP growth and a higher stock market. India may grow at nearly three times the rate of the rest of the world at over 6%.

India GPD Growth (Allianz Research)

India FDI & Consumer Market (Visualcapitalist.com)

India Macro Snapshot (India Economic Ministry)

India MSCI Index

The ETF tracks the MSCI India Index, which uses an adjusted free float market cap to weights stocks. Free float is the percentage of shares that are readily available for trading, they exclude controller shareholder stakes and those in shareholders agreements. For example, if a company has a US$100bn market cap, with 51% held by a control or ownership group, the effective free float-adjusted market cap is US$49bn. The Index and thus the ETF has very broad sector exposure, covering most economic sectors in India.

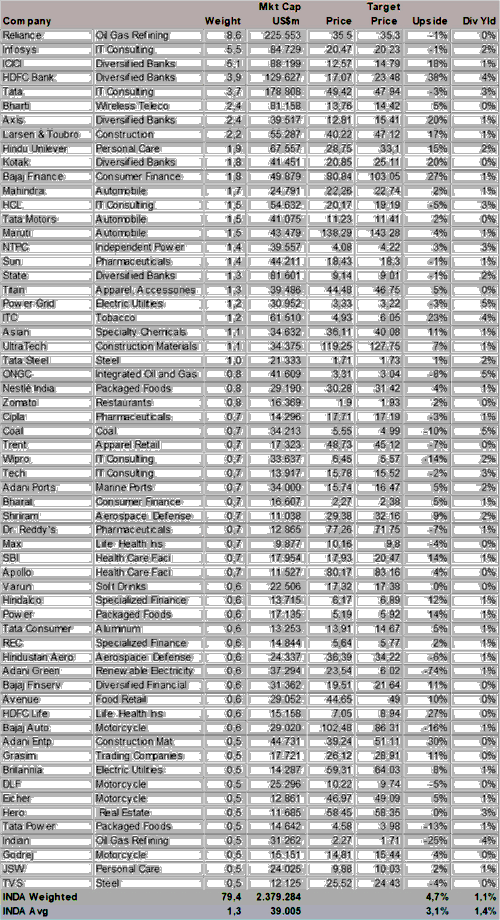

Portfolio Upside

I used consensus price target estimates for 79% of the AUM or 61 holdings (of 131) and arrived at a rather low upside potential of 4.7% to year-end 2024. The market estimates that the ETF holdings, in aggregate, are in fair value territory. However, as can be seen in the table below, the consensus has more than a dozen stocks with over 15% potential return. The largest upside is in HDFC Bank (HDB) which has an ADR listing.

INDA Consensus Price Target (Created by author with data from Capital IQ)

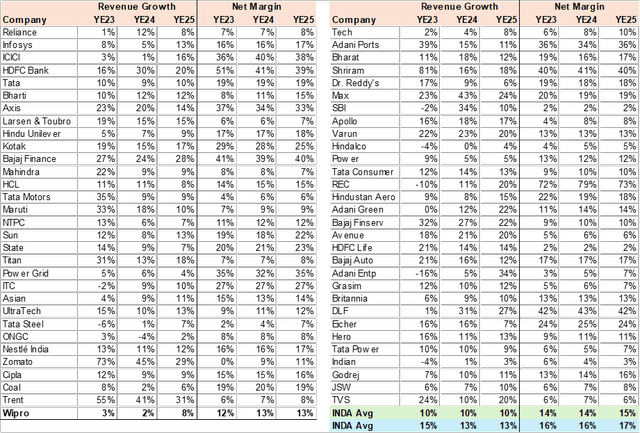

Revenue and Margins

The INDA portfolio is a good representative of the economy and, as such, revenue growth coincides with GDP growth, according to consensus estimates. In addition, net income margins are estimated to increase, which may drive EPS higher. The financial sector seems to offer some above-average growth as seen in HDB and Bajaj Finance as well as delivery company Zomato.

INDA Consensus Revenue & Net Margin (Created by author with data from Capital IQ)

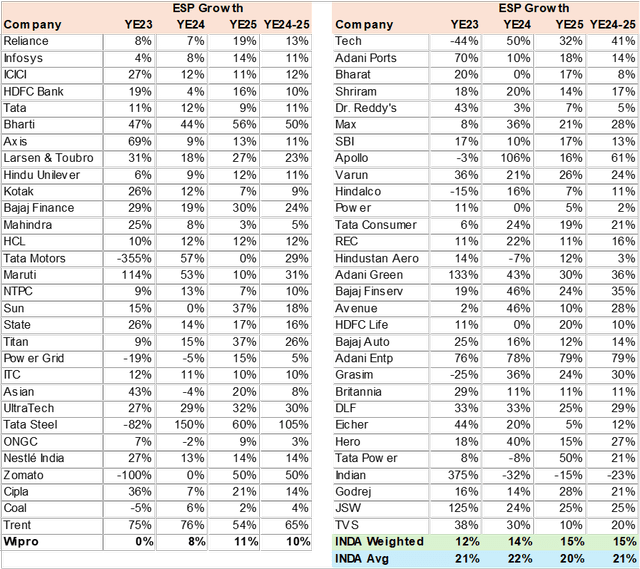

EPS Growth

The bottom-up consensus estimates for the INDA portfolio point to 15% EPS growth in the YE24-25 period, which is above the S&P 500 growth rate of 12%. According to the consensus, margin gains help drive EPS 500 basis points higher than revenue growth. Bharti (Wireless Service) is a big outlier with 50% EPS growth.

INDA Consensus EPS Growth (Created by author with data from Capital IQ)

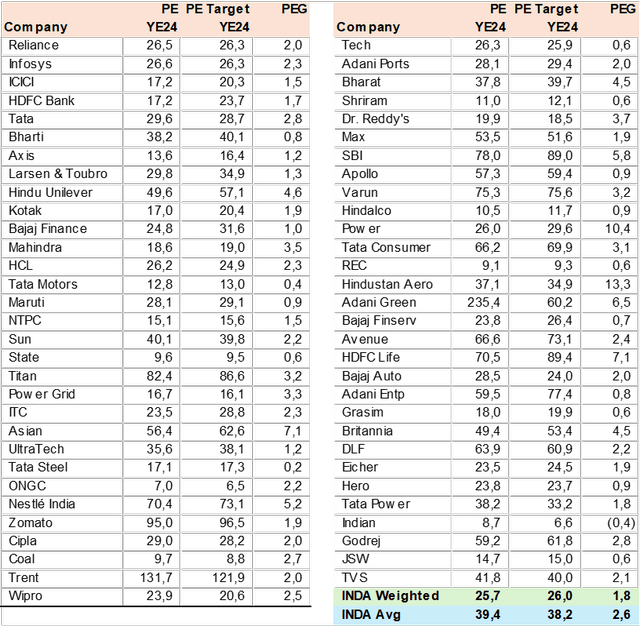

Valuation

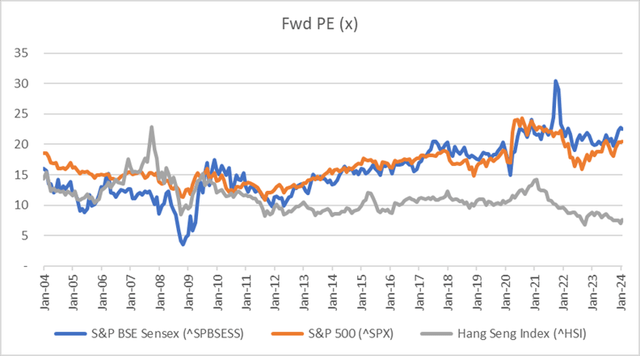

INDA is trading at 26x PE on YE24 EPS consensus estimates. This is above the S&P 500 estimated PE of 20x but cheaper on a relative basis given the 15% EPS growth rate vs 9% of the S&P 500. INDA is at a 1.8x PEG ratio, while the S&P 500 is 2.2x. Overall, the Indian market seems not to be overvalued and should support current valuations, in my view.

INDA Consensus Valuation (Created by author with data from Capital IQ)

Sensex vs SPX PE valuation (Created by author with data from Capital IQ)

Conclusion

I rate INDA a BUY. The ETF’s portfolio holds a broad-based economic representation of the Indian economy that is estimated to grow at over 6% for many years driven by demographics, human capital, FDI, a large consumer market as well as improving economic freedom metrics. It could replace China as the major emerging market and garner increasing investment flow that can support a higher valuation vs other EM peers. The main risks are politics, any change in the direction of economic liberalization could result in a halt of broad-based macro growth and multiple contraction.