Tippapatt

Investment Summary

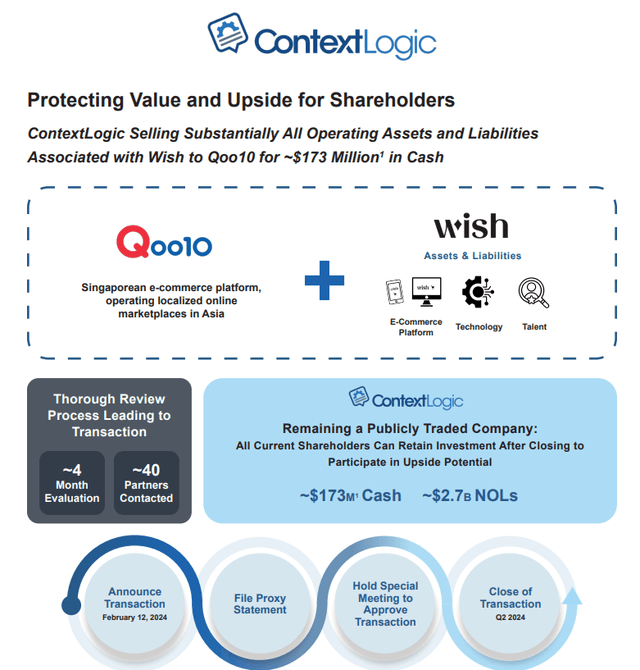

My recommendation for ContextLogic Inc. (NASDAQ:WISH) is a buy rating. I believe this is a very attractive investment situation that does not appear often. WISH is going to sell all its operating assets and liabilities to Qoo10, and post-sale, WISH will become a holding company with $173 million in cash and $2.7 billion in NOL. There are two ways to take advantage of this opportunity. One, by buying the equity directly and hoping for a deal to happen. Two is by buying the equity and selling rolling 1-month forward call options to make an attractive ~4.4% monthly yield (based on current option chain data).

Acquisition Background

On 12 February 2024, WISH management agreed to sell all its core assets and liabilities to Qoo10 (formerly known as Gmarket), a large and popular e-commerce platform that operates in Asia. Fundamentally, this deal makes sense for Qoo10 given that it can leverage WISH’s technology and data science capabilities to offer a more comprehensive platform, and importantly, it is not an expensive deal. Over the past 5 years, WISH has cumulatively spent more than $600 million in research and development, but Qoo10 is only paying $173 million ($6.50/share). Qoo10 could easily strip away all the loss-making business that WISH is operating today to make this deal a lot more attractive.

For WISH shareholders, I believe this is a great exit for them given that the business share price has been in free-fall over the past year, dropping from $20+/share to as low as $3.5/share just 3 months ago. The premium that Qoo10 is paying (44% of the closing price on February 9, 2024) at least gives shareholders who bought at the bottom something to be happy about. Importantly, the business fundamentals have been horrible. Revenue fell from $2.5 billion in FY20 to just $357 million in the last 12 months, and underlying profits (EBITDA/EBIT/Net profit) are all in negative territory. In fact, over the last 12 months, WISH had an EBITDA margin of -115%, which means WISH lost $1.15 for every dollar of revenue. As such, I believe shareholders will be happy with this deal (also, the cash burn will become near zero, so shareholders do not need to worry about the need for additional capital injection).

The Company expects to complete the transaction in the second quarter of 2024, subject to the approval of ContextLogic’s shareholders and other customary closing conditions. The transaction is not subject to any financing contingency. As part of the agreement, ContextLogic will begin trading under a new ticker symbol within 30 days of the closing of the transaction.

The Board believes the transaction will effectively reduce the cash burn in ContextLogic to near zero.

From press release

NOL Is Not Priced In Yet

Here is where the opportunity lies (this refers to the potential merger, and not the deal agreement with Qoo10) for new investors that are coming in today. After the sale to Qoo10, WISH will essentially become a shell company with no operating assets. However, WISH will still own the ~$2.7 billion in net operating losses (NOL) (i.e., tax shield) and $173 million in net cash proceeds from the sale. In per-share terms, the $173 million of net cash proceeds is worth $6.50 (which is where the current share price is trading at), which means all the upsides from any potential merger (to realize the value of the NOL is not priced in yet). If we use the current US nominal federal corporate tax rate of 21%, the NOL is worth around $567 million, which translates to around ~$21 per share (assuming 26 million shares). This is more than three times the current share price.

The question is whether management is going to help shareholders realize this value. Based on the press release and deck released, it is clear that they are.

Firstly, they ensured that they were in the driver’s seat to maximize shareholder value by putting together a Tax Benefits Preservation Plan. In essence, this plan deters any hostile shareholders from acquiring equal to or more than 4.9% of WISH’s outstanding shares, as the acquirer will face massive dilution. Below are the actual details:

In order to protect the Company’s ability to use its substantial NOLs in the future, the Board has also unanimously adopted a tax benefits preservation plan (the “Plan”). Pursuant to the Plan, the Company will issue, by means of a dividend, one preferred share purchase right for each outstanding share of the Company’s Class A common stock to stockholders of record at the close of business on February 22, 2024. Stockholders are not required to take any action to receive the rights. Initially, these rights will not be exercisable and will trade with, and be represented by, the shares of Class A common stock.

Under the Plan, the rights generally become exercisable only if a person or group (an “acquiring person”) acquires beneficial ownership of 4.9% or more of the outstanding shares of Class A common stock in a transaction not approved by the Board. In that situation, each holder of a right (other than the acquiring person, whose rights will become void and will not be exercisable) will be entitled to purchase, at the then-current exercise price, additional shares of Class A common stock at a 50% discount. The Board, at its option, may exchange each right (other than rights owned by the acquiring person that have become void) in whole or in part, at an exchange ratio of one share of Class A common stock per outstanding right, subject to adjustment. Except as provided in the Plan, the Board is entitled to redeem the rights at $0.001 per right. If a person or group beneficially owns 4.9% or more of the outstanding shares of Class A common stock prior to today’s announcement of the Plan, then that person’s or group’s existing ownership percentage will be grandfathered. However, grandfathered shareholders will generally not be permitted to acquire any additional shares. From press release

Secondly, the board has made it clear that they are going to monetize its NOLs and are already searching for a financial sponsor. In addition, the fact that the CEO is from GGV Capital, a global VC firm that owns 3.54% of WISH as of December 31, 2023, makes me believe that they are incentivized to find a buyer or an entity that is willing to merge with WISH for its NOLs.

The Board intends to use the proceeds from the transaction to help monetize its NOLs. The Board also intends to explore the opportunity for a financial sponsor to help ContextLogic realize the value of its tax assets. From press release

Investors could just purchase the equity today and let management do their job in realizing the NOL. The reason the discount exists, I believe, is because nobody knows when or if the deal is going to happen. It could happen in a couple of weeks, months, or years. However, I do think it will happen. A good case study is WMI Holdings, which had $6 billion of NOLs and managed to merge with Nationstar Mortgage Holdings (now named Mr. Cooper Group Inc.) in 2018. The stock went up by more than 100% in 6 months.

Option Strategy

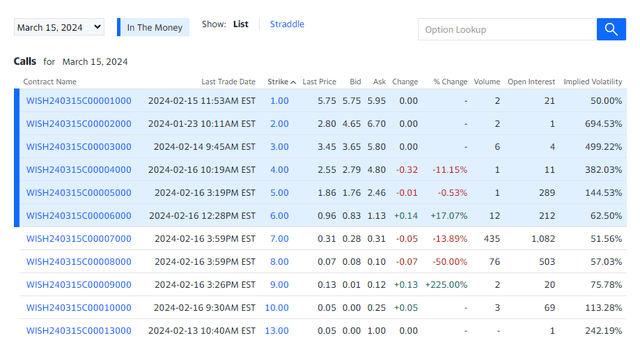

Another strategy that investors can take advantage of is buying the stock and selling 1-month call options until a deal happens. This combination protects the investor from any upside from a potential deal (from the equity position) and allows an investor to earn an attractive yield while waiting for the deal to happen (from the premium earned). I believe there will be a lot of buyers for the call option because arbitrage investors will look to take advantage of this situation. Based on the current option chain data, the $7 strike option is worth $0.31, or about 4.4% of monthly yield.

Risk

The risk is that shareholders vote down the Qoo10 deal. If this happens, the current support at $6.50 will immediately disappear, causing the stock to collapse. In addition, arbitrage investors will also look to dump the stock as the upside is no longer attractive. Lastly, I don’t think there will be any fundamental investors looking to invest in this, given how the business has fared over the past few years. In order to continue operating, management will need more cash (the current burn rate is more than $300 million based on LTM EBITDA), so a massive capital raise is likely to come, further diluting shareholders.

Conclusion

I believe WISH presents a compelling investment opportunity with the sale of its assets to Qoo10. The deal not only provides a significant premium for existing shareholders but also positions WISH as a holding company with substantial NOL and cash. The untapped value of the NOL, not yet reflected in the current share price, offers potential for substantial returns. There are 2 ways to take advantage of this situation: direct equity investment or a hybrid equity-and-options strategy, to capitalize on this opportunity.