SOPA Images/LightRocket via Getty Images

After Q4 and the 2023 fiscal year results, Roche (OTCQX:RHHBF, OTCQX:RHHBY, OTCPK:RHHVF) is back at the price of our strong buy recommendation. Our team has a long-standing buy rating for Swiss pharma players. Despite downside risks of COVID-19 lower turnover and Key failure, we believe Roche is progressing well thanks to inorganic acquisitions and its pipeline. Backed by a fortress balance sheet (Roche has an AA credit rating) and CHF 25 billion firepower, the CEO “is open to acquiring both early-stage and late-stage drug development assets.”

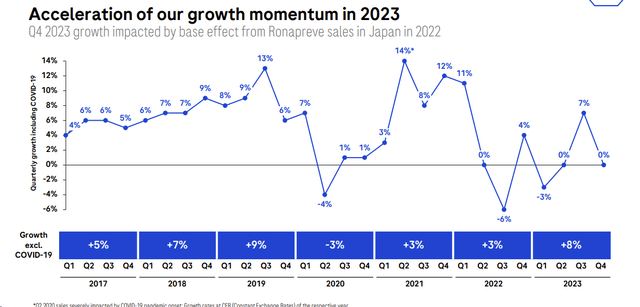

The company’s financial performance in 2023 showcased a remarkable achievement, despite the challenges posed by the decline in COVID-related sales. While the company experienced a sharp drop in revenues due to the pandemic, it achieved overall growth. In numbers, Roche’s top-line sales grew by 1% at constant exchange rates and performed a minus 7% in CHF. Compared to its internal guidance and considering biosimilar erosion, the company outperformed its 2023 sales estimates, and this was due to the ‘New Drugs advancements.‘ Furthermore, excluding COVID-19 sales, Roche sales increased by 8%.

Ongoing Upside

Recent acquisitions have expanded the pipeline. That said, the company is navigating a highly competitive market. Looking at the Wall Street criticism, Roche faces challenges related to its weak late-stage pipeline and the high-risk nature of upcoming Phase 2 readouts.

It is vital to report the company’s recent highlights. Between min-Jan and mid-February, the company achieved:

- The US approval of Vabysmo for the retinal vein occlusion. This is a severe eye disease

- The US positive review of Xolair to expand the focus on food allergies

- The EU approved Tecentriq, a subcutaneous form of injection, to cure multiple cancer types

Roche’s eye disease drug Vabysmo played a pivotal role in driving revenue. First approved by the FDA in January 2022, Vabysmo witnessed an impressive surge in sales, exceeding analysts’ expectations. In 2023, Vabysmo generated CHF 2.36 billion Swiss francs (approximately $2.7 billion), more than tripling its 2022 sales. It now ranks sixth among Roche’s top-selling drugs. In the U.S., Vabysmo secured a 22% market share in age-related macular degeneration and 15% in diabetic macular edema. Notably, nearly half of Vabysmo users were new to any treatment, indicating its establishment as the new standard of care.

In addition, the company believes investors underestimate the near-term news flow from P2 readouts in 2024.

Parkinson’s disease is a progressive disorder that affects the nervous system and leads to a range of symptoms, including tremors, stiffness, slowed movement, and speech changes. It is estimated that there are over 1 million patients diagnosed with Parkinson’s disease in the US. The target population for prasinezumab would be early Parkinson’s disease patients (Hoehn & Yahr Stage 1 and 2), of which there are approximately 650,000 in the US and about 770,000 in the EU. Early results indicate that prasinezumab’s primary efficacy is delaying motor progression, although it is unlikely to impact other aspects of disease progression significantly. While other assets in development may also affect disease progression (such as Biogen’s BIIB122), it remains challenging to assess their potential for approval or how competitive they would be compared to prasinezumab. Our estimates forecast an unadjusted peak sales of $2.5 billion, with a price of approximately 25% less than treatments approved for slowing disease progression in Alzheimer’s.

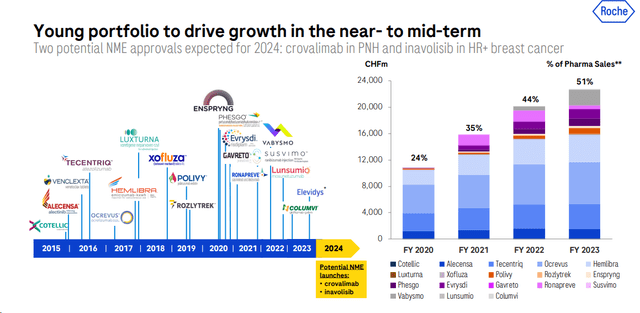

Of course, drugs like prasinezumab (Parkinson’s) and tontinemab (Alzheimer’s) carry high risks. However, Roche has a young portfolio to drive turnover and face biosimilar competition. In detail, the Swiss Pharma player has 16 blockbusters (drugs with sales > USD 1 billion). This represents more diversification and less risk if a drug loses exclusivity and faces competition from biosimilar products.

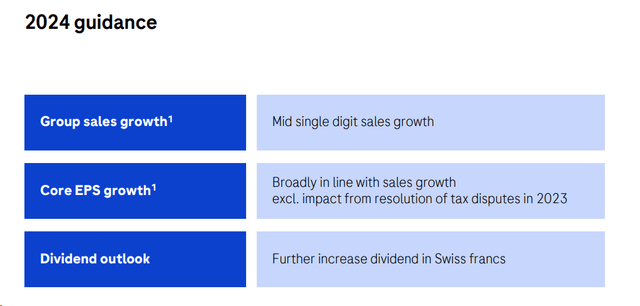

Changes To Our Forecasts

Following the company’s guidance, Roche expects to increase sales in the mid-single-digit range, and core EPS growth aligns with prior estimates. However, we now anticipate a higher impact on foreign exchange and are cutting our core EPS by 12%. In addition, diagnostics margins were lowered, reflecting a decrease in profitability post-COVID (already evident in Q4). We have made limited changes to the evolution of our sales and arrived at a turnover of CHF 59.3 billion in 2024. Furthermore, during the Q&A analyst call, the CEO pointed out lower tax rate assumptions. The management team was more constructive, confirming that there would be fewer headwinds in 2024. In our forward-looking estimates, we take into account the following:

- Xolair biosimilars competition starting in H2 2025

- A limited growth in US Tecentriq. That said, we estimate a franchise growth driven by the EU

- Elevidys gene therapy development with a potential sales of $1.5 billion outside the US market

Even if we see Roche’s development positively, 2023 EPS reached CHF 18.57. In our previous estimates, we were targeting a 2024 EPS of CHF 22. With lower margins from the Diagnostic division and negative FX, we now cut our EPS estimates to CHF 19.5.

Valuation And Risk

Roche trades at a 12x P/E versus EU major peers at 13.5x. In detail, Novartis is 14x, AstraZeneca > 15x, and Sanofi 11x. Here at the Lab, we decided to lower Roche’s price target to CHF 292, leaving the unchanged P/E multiple target at 15x. PEs are calculated based on Mare Evidence Lab-adjusted numbers. Roche 2024 FCF is forecasted at CHF 12 billion, and considering the dividend payment of CHF 7.7 billion, there is CHF 5.3 billion in cash at disposal. In our numbers, without considering M&A, Roche is also a deleveraging story with an EBITDA of CHF 22 billion and a cash flow generation of CHF 19 billion. Looking at the multiples on an EV/EBITDA basis, Roche trades at 9x, and we believe this is unjustified. As a reminder, this company has an ROIC of>40% and a core operating profit of above 30%.

Company-specific downside risks include lower sales for Vabysmo due to higher competition, limited near-term pipeline replacement power, faster-than-expected biosimilar erosion, and lower diagnostics sales.

Conclusion

Roche will provide further strategic updates with catalysts in March (Neuroscience investor event), May (Diagnostics investor event), and September (Roche Pharma investor event). We believe the company’s pipeline will be explained in detail. In addition, the company expects to increase its dividend in Swiss francs further. In a nutshell, we believe that Roche’s valuation reflects all negative fears from Wall Street. The company’s core business grows at an attractive rate, and there are value triggers that are ignored by the market. Our buy rating is then confirmed.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.