bodnarchuk

[Gold investing offers a diverse marketplace of investment options and approaches for investors. The main motivations to invest in gold have been for diversification, as an inflation hedge, or for speculation, but the big reason is for the dynamics of this market that are different from traditional equities and for unique niches of opportunities like small-to-mid-size mining companies. Some of these opportunities, like the latter, have been hard to access and participate in. What also complicates this area of the market is that there are different kinds of investors in this unique ecosystem that can impact this marketplace.

To learn more about the marketplace for investing in gold, we were introduced to Axel Merk, President and Chief Investment Officer of Merk Investments – a $1 billion investment advisory firm offering investment funds and advisory services on the global gold and precious metals markets, including the ASA Gold and Precious Metals Limited (ASA) closed-end fund. We asked him questions to explore the theoretical arguments for investing in gold, understand the different investment options, and discover how GOLD is more than just a shiny brick that competes with cash.]

Hortz: How do you recommend that investors look at gold? What are some important considerations to think about before investing in the gold market?

Merk: Just like any investment, you need to think about why you are investing, what your goal for investing is. Gold has a few unique characteristics that can be looked at in different ways.

Some people look at gold as a barbaric relic. It just is. On the physical gold that you can buy, the challenge with that is the moment you have physical gold, you have to worry about losing it. And so, there are investment funds, and we manage one of them, where you can invest in physical gold through an exchange-traded product. These investors like that the price of gold has a near-zero correlation to equities over the long run. It does not mean that it is always uncorrelated, but it does serve to allay some fears of equity volatility and as an important hedge on portfolio risk.

I look at gold as the purest indicator of monetary policy because, ultimately, it competes with cash. If you are getting a real return on cash, then you may not need gold. But if you think that cash over time gets eroded, you may want to think about how you compensate for that with your investments, and gold is kind of the purest indicator.

You can also invest in gold businesses and that is another dimension of gold investing where you look to see how they complement other equity investments, other businesses in your portfolio. Now note that the risk profile is vastly different investing in gold mining companies versus the physical gold because you are adding corporate or management risk, and you are adding the risk that at some point these mines will run out of gold unless they acquire new assets. The risk profile is also quite different on the “positive side” when you buy a gold miner because you at least, in theory, lock in the cost of mining, and you get a disproportionate upside potential when the price of gold goes up. And so, it is a levered form of investing in gold and much more for a risk-friendly investor. Whereas physical gold, though the price of gold is volatile, tends to be more for the defensive investor.

And then, of course, there are day traders that may want to trade gold for speculation. I tend to not focus on that.

But to summarize, gold investing can address different investor goals from purchasing power protection, the diversification investor, the defensive investor, or the speculator. Those are the sort of people that tend to look at gold differently and then they look at how it fits into what else they are doing in their portfolio.

Hortz: Can you further explain the gold mining stocks? What does a deeper dive reveal in this market sector?

Merk: Gold mining stocks are comprised anywhere from the major gold producers to small development and exploration companies. The major producers literally have gold mines at their disposal with ongoing operations to, in essence, harvest the cash flow they get from the gold and they, along with their investors, have to worry about the depletion of the mine life. They would have to look for new gold mines, either themselves or by acquiring others.

The further you go down to smaller mining companies, you are literally buying an option for them to strike gold, so to speak, because those are projects that need to be developed. When you invest in these smaller companies, on the one hand, the upside potential is large. On the other hand, there are significantly more risks involved because these projects are capital intensive, and they are not producing yet. They are exploration companies, and they operate in a Federal Reserve style “higher for longer” environment that has had some of these companies have difficulty financing the projects and that makes them more speculative. On the other hand, that is where you can get a lot of bang for the buck in a positive gold market.

Hortz: How do you select and invest in these smaller gold mining stocks? What do you look for?

Merk: We tend to focus on the junior gold mining space, and we believe the most important aspect of these companies are the management teams that have a proven record of being able to develop mines. They tend to attract the right sort of resources, notably other strong investors.

One of the key things we do is we help develop these mines through “institutionalizing” them by providing longer-term capital investment. We tend to come in when they are fairly small and then provide funding together with other investors to take them to the next stage. The next time they need to access the capital markets, other bigger players can also help provide the funding. And unlike other spaces where you would think that the dilution, as part of the capital raise, is going to take the share price down, investors are happy that funding is available and that tends to provide a disproportionate gain.

Hortz: So, you are also actively involved in helping them raise their needed capital and not just a passive stock investor?

Merk: Yes. We are not a broker, but with the closed-end fund that we manage, we are able to provide capital directly to the industry and what is unique about that is we are an active participant in that space. That gives us access to some of the more attractive opportunities in the smaller gold mining arena.

Now, obviously, as I mentioned, it is a high-risk place. Not all of these opportunities may work out, but in return for participating in these deals, quite often warrants are issued as well, and we believe warrants are a win-win for both the company and the investor. Basically, if the company reaches certain targets, most notably on the share price, it provides the investor an opportunity to participate at the price of the warrant and then at the same time, it provides additional funding down the road to the companies. So, the companies love it, and we love it as it provides economic leverage when one participates in these deals, and it is one of the things that we are able to do in a closed-end fund.

Hortz: Why did you originally choose a closed-end fund vehicle for your ASA Gold and Precious Metals fund? Does the closed-end fund structure provide any other benefits than you just mentioned for your investment strategy and for investors?

Merk: This fund was founded in 1958. At the time, gold investing was all but impossible in the US and so the fund was actually incorporated in South Africa, making us one of the oldest of closed-end funds. It was reincorporated in Bermuda in 2004, and we received permission to function as a closed-end fund in the US and be accessible on a major stock exchange. So, it is a bit of a unique vehicle.

The key to the closed-end structure is that it does not have daily inflows and outflows. When you have daily redemptions, your investment strategy has to be very different because you have to be able to liquidate your position on short notice. Whereas in a closed-end fund structure, you are able to provide more long-term capital, and it buys you the time to ride the ups and downs in the market and, as an investor, you have an opportunity to decide when you want to participate.

It also uniquely provides access to invest in illiquid and volatile assets, like small mining companies, which would be hard to manage for long-term returns in traditional liquid vehicles. It is a very different dynamic and unique way of investing over traditional liquid, on-demand markets. In a positive gold market, it can be a very lucrative one, but because we are investing in the junior mining space, it is also a very volatile way of investing. However, given our longstanding history and performance, we are confident in our investment structure.

Hortz: Can you also discuss any other unique aspects or potential issues about investing in closed-end funds?

Merk: Closed-end funds do not trade at net asset value (NAV) most of the time, like mutual funds and ETFs and most investors buy at a discount, and then down the road again, sell at a discount. It typically does not make much of a difference to long-term investors. Discounts to NAV also attract certain investors that like to trade the discount; buying when the discount is large and then selling when the discount is small. In the case of our ASA Gold and Precious Metals Limited and other closed-end funds, it unfortunately also attracts activist investors at times who do not fully understand this investment structure.

We currently have an activist investor that is trying to affect change in a way that we do not think is constructive or beneficial to our shareholders. Historically, what an activist investor would want to do is to force the issue of closing the discount. And with a fund like ours, that is much easier said than done because unlike some closed-end funds, we do not think you can convert our investment strategy to an open-end mutual fund, for example, because of its Bermuda status and, more importantly because 70% of this fund is comprised of junior mining companies that tend to be very illiquid, and you would have to sell them at a significant loss, which would result in diminished value for shareholders.

And then at the other end of the spectrum, this is quite a volatile fund, so while our closed-end fund might have a 10-15% discount, you can also have a 10% move in the week. And so, the question becomes is a conversion really the best method to increase shareholder value in order to capture a 10%-15% discount? Is it worthwhile to disrupt a fund and long-term investors to do so?

There are many unique facets to this closed-end fund. Unfortunately, it is currently part of an activist attack as I would call it, but at the same time, we believe that shareholders are aligned with our board’s proven strategy and do not want to implement the short-sighted strategy this activist is advocating for. If an activist were to succeed, it would mean the end or change of the current investment strategy to something outside of small mining companies. We do not think that is what our core investors want from this fund, nor is this the best way to enhance shareholder value. This space is complex and requires a lot of education and, most importantly, experience. Ultimately, I think it will be for the benefit of our investors to show everybody, including the activists, that there is no interest or real benefit in the sort of disruptive change they want.

Hortz: Can you share your research and perspectives on where we are in the current gold mining cycle? What forces are at play, and how may they affect gold investing in 2024?

Merk: As I mentioned earlier, the junior mining companies in particular require access to funding periodically. And so, in some ways, they are credit plays. And what that means is that in the Federal Reserves’ “hire for longer” environment, many of these companies have been suffering with the tightening cycle of the Federal Reserve. The gold mining space tends to do disproportionately well as a pure indicator reacting to monetary policy. The gold mining space reacts also quite fast because funding tends to become more readily available as the environment turns to be more favorable.

And then, at the other end of the spectrum to additional equities, in an economic downturn, if it is a more severe downturn, equities tend to perform poorly and investors increase their need for diversification. And so, it is that combination of it being favorable for gold and gold mining and at the same time being not favorable for equities, that tends to provide the sector a boost. Obviously, the exact timing of that is difficult to say though I would discourage anybody from timing these things too closely, but that is the sort of dynamic we see historically that we are speaking about.

Hortz: What thoughts can you share with financial advisors and investors on how they may want to consider positioning your ASA fund and gold mining in client portfolios?

Merk: As I mentioned earlier, we have different types of gold investors in this investment arena. One is mostly concerned about purchasing power, one about diversification, and then the speculator, but let us talk about the diversification investor. Everybody knows about the Magnificent Seven stocks. If somebody believes that this will continue, obviously there is no reason to diversify, but if people believe there is going to be some sort of mean reversion, then diversification into things like gold miners may make sense.

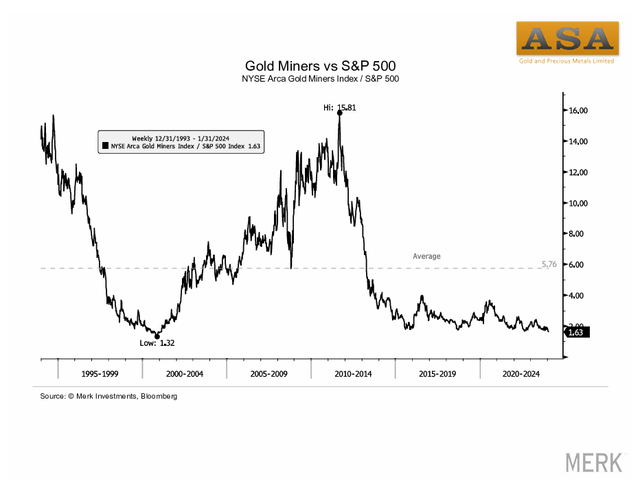

I referenced the volatility of gold mining investments a few times. What that means from a practical point of view is that a fairly small allocation to this space might give you quite a bit of bang for the buck as far as diversification is concerned. There is a big opportunity now for investors who strongly believe that the smaller gold mining space is a good place to be and as to where we are in the cycle. Here is a chart from our research on smaller gold mining companies to share what we see as favorable timing for allocation to this area of the marketplace.

NYSE Arca Gold Miners Index vs S&P (Merk Investments)

Personally, I have been an insider buyer of ASA in recent months, so I may be biased, but I happen to particularly like, and believe in, the investment and the current timing. And then there is the general notion that the Federal Reserve may be past peak hawkishness, which could be very beneficial to the gold miners, as many of them have been suffocating because of a lack of access to credit. And if I just look historically at how these companies have performed during easing cycles, then there may be a significant opportunity here.