michal-rojek/iStock via Getty Images

Materialise (NASDAQ:MTLS) is about to emerge from a period of significant investment, which should see the company’s profit margins move higher over the next 1-2 years. A modest valuation, combined with solid growth and a transition to profitability, should see the stock perform well going forward. While Materialise is a quality company with a potentially bright future, there are risks. Competition is rising in Materialise’s Software segment, Manufacturing demand remains soft, and rising adoption of robotics in joint replacement surgeries threatens to undermine the Medical business.

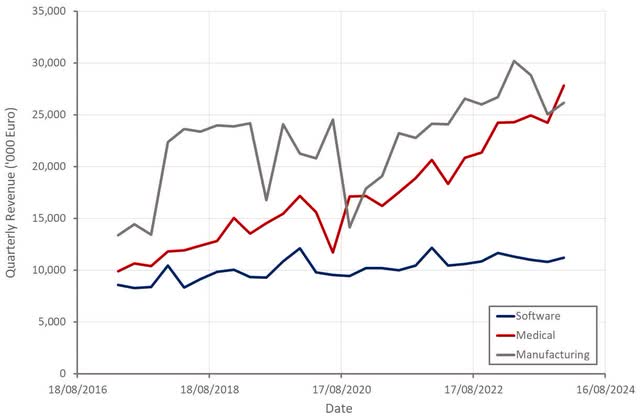

The last time I wrote about Materialise I suggested the stock was a hold. While there are still near-term risks around the manufacturing business, Materialise’s valuation has been fairly flat, even as stocks have generally moved sharply higher. Materialise’s relative valuation is now even more appealing, and the company is closer to realizing higher margins with its cloud transition maturing and the ACTech facility expansion nearing completion.

Market

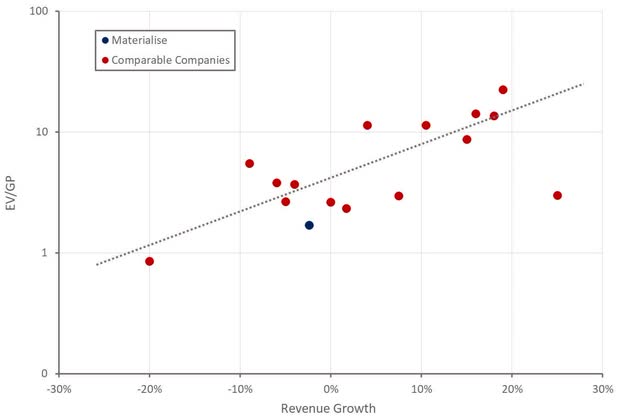

2023 was a challenge for additive manufacturing, with higher interest rates, geopolitical tensions and economic uncertainty making customers hesitant to invest in new technologies. In particular, prototyping demand has taken a hit, although additive manufacturing remains the technology of choice in this area. Printer sales have also been weak, which is weighing on Materialise’s Software sales. In addition, the macro environment has tempered healthcare R&D spend, which has impacted Materialise’s Medical software sales. While conditions are likely to remain soft in 2024, the worst may now be in the past, absent a recession.

Figure 1: Euro Manufacturing PMI (source: Created by author using data from Materialise)

The shift from prototyping to end-use products continues, particularly for use cases requiring customized parts, like medical applications. Materialise is also seeing increased adoption of additive manufacturing for serial end-use parts, like in the aerospace industry.

Software is an important enabler of this in areas like scheduling, monitoring, and quality assurance. More is needed, though. Software has allowed various stages of the 3D printing process to be automated, but individual processes still need to be integrated to create workflow automation. This is what Materialise’s CO-AM platform is aiming to do.

Medical

Materialise’s Medical segment continues to be the company’s strongest performer, both in terms of profitability and growth. Materialise wants to drive further growth through product innovation and by shortening lead times.

Additive manufacturing has a range of applications in the medical field, including:

- Models

- Prosthetics and Orthoses

- Medical equipment

- Surgical guides

- Implants

While Materialise is trying to diversify its Medical revenue, it is still largely dependent on surgical guides for knee replacements. 3D printed surgical guides compete with robotics and navigational solutions, which are rapidly taking market share in joint replacement surgeries.

I have previously written about Zimmer Biomet (ZBH) and Stryker (SYK), who are leaders in this area. Stryker has a particularly strong robotic surgery business and has become increasingly vertically integrated in additive manufacturing in recent years.

Materialise is developing solutions for submarkets outside of orthopedics and CMF, like planning tools for the cardiovascular market in the short term and the respiratory market longer term.

Materialise’s manufacturing plant in the US is now open, helping to reduce lead times, which is opening up new markets, like products for trauma patients.

Materialise has also conducted a limited launch of Mimics Flow, a case management solution that helps hospitals to manage their 3D printing operations. Materialise believes the adoption of additive manufacturing at the point-of-care will be a tailwind for this solution. Materialise expects to use 2024 as a learning opportunity before launching Mimics Flow in other segments in 2025.

Software

Materialise is in the process of transitioning its Software business to the cloud and wants to capture the end-use parts opportunity with Magics, build processors, and CO-AM. Materialise has released new functionality for Magics which is specifically targeted at metal production, a growth area for production use cases. The company continues to onboard partners and add functionality to CO-AM, including recently announced partnerships with HP and Ansys. Materialise also recently released its next generation of build processors, which are designed to increase printer performance and reduce part cost, a critical determinant of success in production use cases.

Revenue growth in 2023 was soft due to the market conditions and Materialise’s transition towards subscription software.

While software is a traditional strength for Materialise, competition has increased in recent years, and the success of Materialise’s transition to the cloud is not guaranteed. Competition includes:

- Open-source software applications

- 3D printer manufacturers bundling software with equipment

- CAD software vendors who have been expanding into additive manufacturing

Manufacturing

Materialise’s prototyping services continue to perform reasonably well, despite the challenging macro environment. Materialise is also positioning its Manufacturing business to help customers begin producing end-use parts in segments like aerospace, medical equipment, and wearables. In support of this, Materialise has established certified manufacturing services, offering customers documented and validated parts production.

Materialise also continues to make investments in its Motion and Eyewear business. The company has said little about these businesses in recent quarters, though, and it appears that they are performing poorly. As indicated by the recent impairment of Materialise Motion assets.

The start-up of the expanded ACTech facility towards the end of the year has the potential to stimulate Manufacturing growth. The near-term success of this will likely be dependent on the demand environment, though.

Financial Analysis

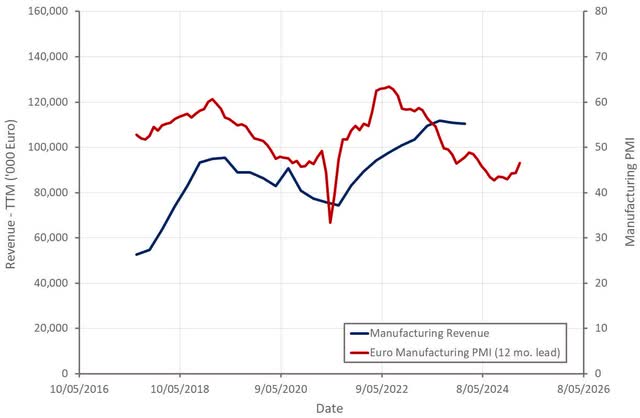

Materialise’s fourth quarter revenue was 65.3 million Euro, down 2.4% YoY. Strong Medical segment growth was offset by software and manufacturing weakness.

Materialise is currently expecting 265-275 million Euro revenue in 2024, with this guidance assuming ongoing macroeconomic uncertainty and elevated geopolitical tensions. All three segments are expected to grow, although the transition to a subscription model will continue to weigh on the software business.

Figure 2: Materialise Revenue (source: Created by author using data from Materialise)

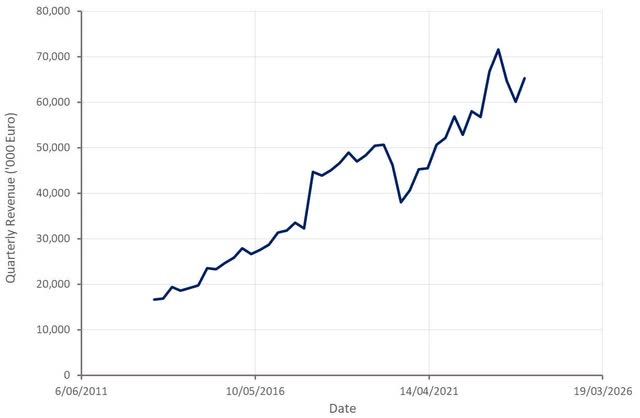

Materialise’s Medical business continues to steadily expand, while Manufacturing and Software growth has been weak due to a combination of soft demand and segment specific issues.

Software accounted for 17% of our Materialise’s revenue in the fourth quarter, with Manufacturing contributing 40% and Medical 43%. Software is responsible for around 31% of the Medical segment’s revenues.

Figure 3: Materialise Revenue by Segment (source: Created by author using data from Materialise)

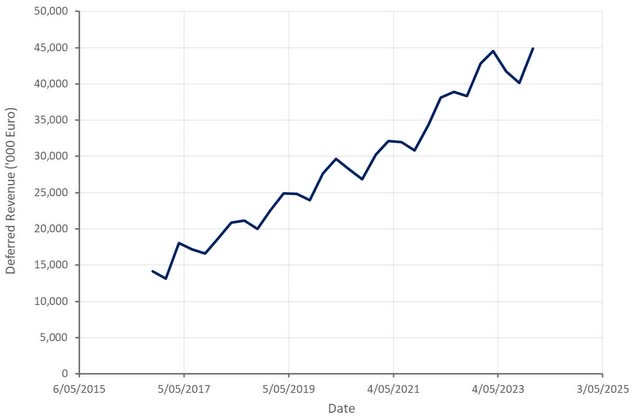

Materialise’s software growth has been soft in recent years, but some of this is due to the transition to a subscription business model. Recurring revenue increased 5% YoY in the fourth quarter, while non-recurring revenue declined 16% YoY. Materialise’s deferred revenue continues to increase though, reaching 44.9 million Euro at the end of 2023. Software sales have also been impacted by lower demand from OEM machine sales.

Figure 4: Materialise Deferred Revenue (source: Created by author using data from Materialise)

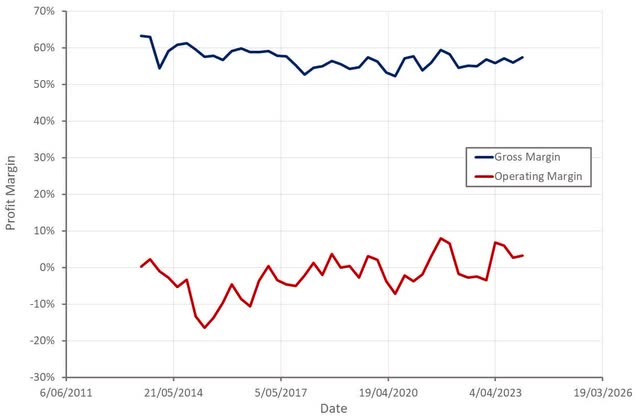

Materialise’s margins were impacted by inflationary pressures (labor, energy, materials, and freight) in 2022, some of which was offset by price increases. The company is now starting to move past some of these headwinds, though. Materialise’s gross profit margins continue to edge higher, likely driven in large part by revenue mix. This should be aided by improved fixed cost utilization once the demand environment improves.

Materialise’s operating expenses declined by 6.5% YoY in the fourth quarter. A net loss was recorded in the fourth quarter though due to a 4.2 million Euro impairment of goodwill, tangible and intangible assets. Approximately 3.6 million Euro of this was attributed to Materialise Motion.

Figure 5: Materialise Profit Margins (source: Created by author using data from Materialise)

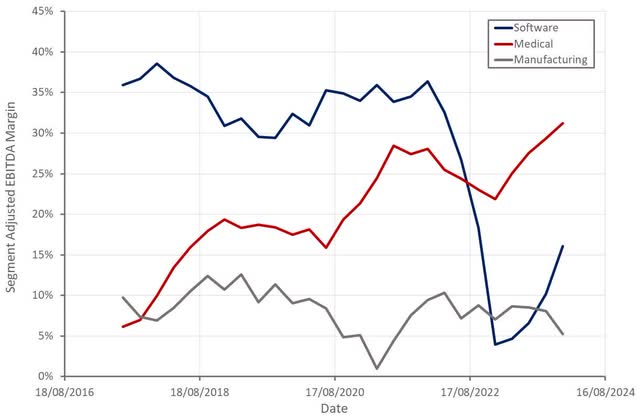

Software margins continue to bounce back as Materialise’s transition to a subscription business model matures. This, along with further Medical margin expansion, should be supportive of profitability going forward. Manufacturing margins have continued to deteriorate, although the opening of the expanded ACTech facility and a rebound in demand have the potential to change this.

Figure 6: Materialise Adjusted EBITDA Margins by Segment (source: Created by author using data from Materialise)

Free cash flows are expected to be reduced by investments in the first half of 2024. Cash flows are expected to improve in the second half of the year with an easing of investments and the startup of the expanded ACTech facility. Materialise generated marginally positive free cash flow in 2023 and ended the year with 127 million Euro of cash and equivalents on the balance sheet.

Conclusion

Materialise business continues to face demand headwinds, which are being exacerbated by the company’s transition to a subscription software business model. The past few years have also been a period of heavy investment, which has weighed on both profits and cash flows. These investments should begin to pay off over the next few years, particularly if macro conditions improve. Given Materialise’s current valuation, this situation could create strong returns going forward. There are risks though, including the rise of robotic surgery reducing demand for Materialise’s surgical guides.

Figure 7: Materialise Relative Valuation (source: Created by author using data from Seeking Alpha)