adventtr

The Exscientia Experiment: When AI Meets Pharma Realities

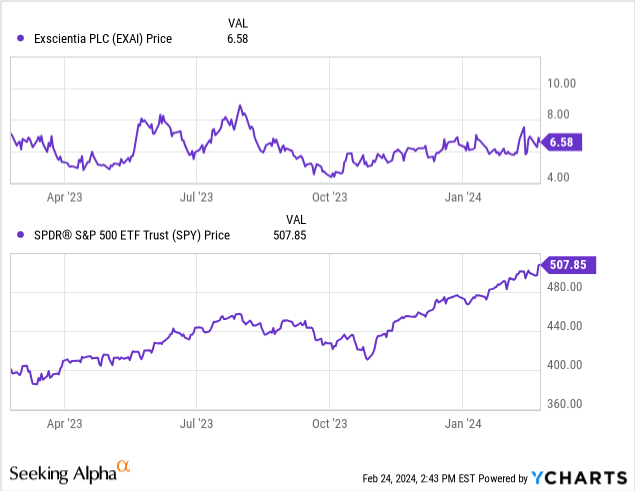

Exscientia’s (NASDAQ:EXAI) stock is off 22% since my “Buy” recommendation in August. It appears I called a top. The stock has been essentially flat in the past year. The company has garnered some interest at this time due to its utilization of artificial intelligence [AI] in drug discovery. While this is an exciting application in the biotechnology sector, we also need to see progress and results in clinical trials.

Recently, the company announced it terminated CEO Andrew Hopkins due to “inappropriate conduct” with employees. Hopkins was the founder of Exscientia, so this news is especially disappointing. Investors responded by dropping the stock’s value by 20%, which is pretty remarkable given the circumstances are, predominately, unrelated to business developments. But this serves as a reminder of the nature of biotechnology investing and the “unseen” risks involved with investing. These valuations the market assigns to speculative, clinical-stage biotechs, in particular, are fickle. Anyways, I don’t interpret this as a major event that warrants a major change in valuation or thesis.

Moving on to pipeline efforts, as of November’s update, Exscientia’s ELUCIDATE trial for CDK7 inhibitor GTAEXS617 progresses, targeting multiple cancers. The firm focuses on advancing the LSD1 inhibitor EXS74539, with clinical trials starting this year. At ESMO 2023, preclinical data on EXS74539 for AML and its combination potential were showcased.

Our preclinical data demonstrated ex vivo efficacy of ‘539 against AML blast cells and supported the combinatorial potential of ‘539 with first line clinical AML treatment strategies. Leveraging the reversibility of ‘539 allowed the design of adapted drug regimens, to preserve the safety profile of this inhibitor on non-transformed healthy cells.

Lastly, its MALT1 inhibitor EXS73565 is advancing, with updates expected soon, with a focus on its safety profile.

In December, Exscientia announced a collaboration with pharma giant Sanofi (SNY). Sanofi will utilize Exscientia’s AI-discovery platform to develop a drug. Exscientia will be owed up to $45 million in upfront and preclinical milestones, as well as an additional $300 million and tiered royalties, assuming the asset advances through trials, achieves approval, and finds success on the market.

Given the above events, it’s not surprising that Exscientia’s stock has been stagnant for some time. The company awaits a “signal” that demonstrates their supposed technological moat (AI-driven drug discovery) actually leads to differentiated outcomes.

Financial Health

Turning to Exscientia’s balance sheet, the company’s liquid assets total approximately £366.6 million, comprising £109.3 million in cash and cash equivalents and £257.3 million in short-term bank deposits. When comparing these assets to the company’s liabilities, which include £10.3 million in trade payables, £2.3 million in lease liabilities, and £22.5 million in contract liabilities among other current liabilities totaling £66.4 million, the current ratio is approximately 5.52, indicating a strong liquidity position. The monthly cash burn, derived from a net cash used in operating activities of £118.8 million over nine months, averages about £13.2 million. This suggests a cash runway of approximately 27.8 months, based on current burn rates. However, these figures are based on past performance and may not accurately predict future conditions.

Exscientia’s significant cash outflow towards operating activities, alongside a substantial investment in short-term bank deposits despite a net loss, indicates a strategy focused on safeguarding liquidity. The likelihood of needing additional financing within the next twelve months seems low, given the current cash runway and the company’s strategy to manage liquidity efficiently.

(Note: As of writing, 1 pound sterling (£) equals 1.27 United States dollars.)

Market Sentiment

According to Seeking Alpha data, EXAI presents a nuanced profile with a market capitalization of $822.10 million, signaling a mid-tier biotech player. Analysts project a revenue jump to $77.47 million by 2024. However, stock momentum trails the SPY, notably over 6 to 12 months, highlighting potential underperformance.

Per Fintel, short interest stands at 3,439,455 shares, a moderate 3.76% of float, suggesting a balanced yet cautious market sentiment. Institutional ownership sees a dynamic shift, with 632,411 acquired shares versus 2,036,845 sold out, indicating an institutional perspective that is leaning negative. Key institutions like Softbank Group and Laurion Capital Management adjust holdings, reflecting strategic realignments. Glancing at Nasdaq data did not reveal any insider activity in the past twelve months.

Given these factors, EXAI’s market sentiment qualifies as “fragile.” Negative institutional sentiment and poor stock performance dominate the picture here.

Is EXAI Stock a Buy, Sell, or Hold?

Exscientia’s trajectory post my “Buy” nod has been fraught with challenges, notably a key shift in leadership and prevailing investor skepticism, despite strides in AI-facilitated drug discovery. The ousting of CEO Hopkins, a pivotal figure, casts a shadow on the firm’s journey, diluting the impact of recent pipeline advancements and a notable collaboration with Sanofi. Financially, Exscientia stands on firm ground, boasting commendable liquidity and a prudent cash burn strategy. Yet, the market’s tepid reception hints at underlying apprehensions concerning the immediate value and outcomes of its AI-driven endeavors.

The cornerstone of Exscientia’s prospective success hinges on its AI prowess. The tangible benefits of this technological superiority in drug development and gaining market approval are, however, pending realization. Signals from the market, including shifts among institutional backers and a modest short interest, point to a guarded optimism, indicating potential hurdles in keeping up the momentum.

In light of the amalgamation of breakthrough technology, solid financial health, yet mixed market sentiments and recent executive upheaval, my recommendation shifts to “hold.” This cautious approach is in anticipation of definitive signs of clinical achievement and market endorsement that could pivot Exscientia’s growth path. Stakeholders should keep a vigilant eye on imminent trial data and the integration of AI discoveries into the market. These elements are pivotal in gauging the firm’s capability to translate its technological vanguard into long-lasting, unique success.