‘Clever’ ways to beat April’s Capital Gains Tax allowance cuts and save ‘thousands’ (Image: Getty)

Following last year’s reduction in allowances, Capital Gains Tax receipts hit £11.4billion in January, latest figures show.

With the Capital Gains Tax (CGT) allowance set to be halved again in April, people may be looking for ways to reduce the burden. Fortunately, there are several “savvy” ways to do this.

Laura Suter, director of personal finance at AJ Bell, commented: “More than a quarter of a million more individuals and trusts will be paying capital gains tax for the first time thanks to the Government crackdown on gains.

“From April the tax-free allowance for CGT will be less than a quarter of what it was just a year ago, dragging more people into paying tax, filing a tax return and seeing tax eat into their returns.”

The capital gains tax-free allowance was reduced from £12,300 to £6,000 for the current tax year, and it will be halved again in April, dwindling to just £3,000.

The Capital Gains Tax allowance will halve again in April (Image: Getty)

Ms Suter said: “It means that from April this year, a higher-rate taxpayer will pay up to £1,860 more tax on their investments compared to a year ago, assuming they were to realise gains up to the previous £12,300 limit, while a basic-rate taxpayer will be hit with up to £930 more on their tax bill.

“Because the rate of tax hasn’t changed but the point at which it kicks in has fallen, those with relatively small investment gains are hit with the same tax increase as those with much larger gains.

“A very wealthy individual harvesting £1million in capital gains a year will face the exact same additional tax of £1,860 as a result of the cut to the capital gains tax allowance, highlighting how the cut hits small shareholders every bit as much as the very wealthy in pounds and pence. But it will hurt a lot more in relation to the size of their gain.”

However, people still jave time before the tax year ends to protect their investments from the taxman.

Ms Suter said: “Some clever financial planning now can help you keep more of your money not just next year, but in future years too.”

The “savviest” move is to transfer money held outside of a tax wrapper into an ISA (Image: EXPRESS)

Use up your allowances

Those sitting on large capital gains outside an ISA or pension can use up their tax-free allowance of £6,000 this year before it’s slashed to £3,000.

Ms Suter said: “If you sell investments to realise gains up to this level you won’t pay any tax on the money. You just need to check what gains you’ve already realised this tax year, across all your investments, and make sure you don’t exceed the tax-free limit.”

Fill your ISA

Ms Suter said: “If you have investments outside a tax wrapper, the savviest move is to transfer that money into an ISA, or into a pension if you can afford to tuck it away for longer.”

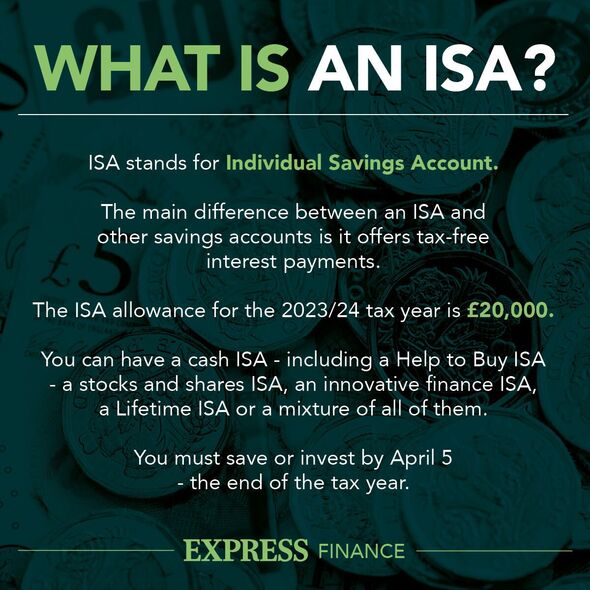

People should check how much ISA allowance they have remaining this tax year to make sure they don’t go over the £20,000 annual limit.

- Support fearless journalism

- Read The Daily Express online, advert free

- Get super-fast page loading

Ms Suter continued: “For those sitting on large capital gains you can sell assets to realise a gain up to your remaining tax-free allowance and then buy it back within your ISA, which means you’ll make use of the tax-free allowance and protect any future gains from the taxman.

“You can use your platform’s Bed and ISA service, just make sure you check the deadline, which is usually a few working days before the tax year-end.

“The cumulative effect of this really adds up. Someone who realised capital gains up to the allowance each year for the next 10 years and moved that money into an ISA could save £15,550 in tax if they were a higher rate taxpayer, compared to leaving the gains to build up in a non-ISA account and realising them all in one year. For a basic-rate taxpayer the saving would be £7,775.”

Transfer money to a spouse

Any investments a person transfers to their spouse or civil partner are exempt from Capital Gains Tax.

Ms Suter explained: “This means that if your spouse hasn’t used up their tax-free allowance this year and has some ISA allowance remaining, you can make use of those tax breaks. You just need to make sure you keep a note of the original cost of the asset, as that’s what will be used when your partner comes to sell it.

“If your spouse is in the basic rate income tax bracket but you’re a higher or additional rate taxpayer, there’s a double benefit, as they will pay capital gains tax at a lower rate.

“That means even if they have used up their tax-free CGT allowance, there could still be a benefit to transferring the assets to them. For example, if you have a £5,000 gain and have already used your allowance a basic-rate taxpayer would pay £500 in CGT while a higher-rate payer would pay £1,000 – meaning a potential saving of £500.”

Use your losses

Ms Suter tipped people to “use their losses”. She explained: “While no investor wants to make a loss, losses can be your friend for capital gains tax purposes.”

Losses made in the current tax year can be offset against any gains before the tax-free allowance is deducted.

Ms Suter said: “If you don’t use them this year you can carry forward any losses for future tax years, to offset against any future gains. Just make sure you register the losses with HMRC within four years after the end of the tax year in which you made the sale in question.”

Use pension contributions to drop an income tax band

Ms Suter said: “One particularly clever trick is to use your pension contributions to reduce your income tax band.”

When people contribute to their SIPP, Ms Suter said the gross value of the contribution has the effect of extending the person’s basic rate tax band.

She explained: “This means that the rate of capital gains tax you pay could be lower if it means you are no longer a higher-rate taxpayer.

“This is a particularly handy trick if you’ve only just tipped over into the next tax band, meaning a small pension contribution would bring you under the threshold. If you have used your full pension allowance this year or cannot make a pension contribution, you can also lower your taxable income by donating to charity. If you’re eligible, you can then also claim gift aid on the donation.”