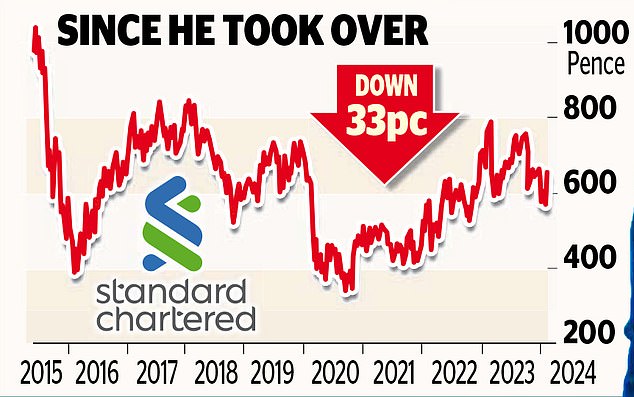

- London-listed bank’s value has sunk by a third since Winters took over in 2015

- But Standard enjoyed rally as it reported 19% increase in profits to £4bn

- It hiked dividend, announced £790m share buy-back and £1.2bn cost-cut plan

‘C**p’ performance: Bill Winters

Standard Chartered’s boss has admitted that the lender’s share price performance has been ‘c**p’.

Bill Winters’ blunt assessment came as the Asia-focused bank published full-year results yesterday.

The London-listed giant’s value has sunk by a third since Winters – the longest serving chief executive of a major UK bank – took over in June 2015.

However, Standard Chartered enjoyed a significant rally as it reported a 19 per cent increase in profits to £4billion, hiked its dividend and announced a £790m share buy-back, as well as a three-year plan to cut costs by £1.2billion.

Shares closed higher by 4.9 per cent, or 29.4p, at 635p.

The bank, which has no UK branches and operates in markets such as China, Hong Kong and Singapore, is best known in Britain as the shirt sponsor of Liverpool FC.

Winters said the lender was in a ‘privileged position’ to take advantage of strong economic growth in Asia and an expected fall in global interest rates.

Risks to this included slowdowns in major economies, sustained inflation pressure, a sluggish housing market in China, and increased geopolitical tensions, he said.

But Winters added: ‘Our share price reflects little of our optimism about prospects and seems heavily influenced by the downside concerns.’

Winters said the ‘concerns are real and we take them seriously’ but that he believed the value of the bank would ‘become increasingly clear to the broader market as we continue to grow our profits’. And he was more frank in a call with reporters, saying: ‘The share price is c**p. I know that’s going to be a quote.’

Winters said he needed to address misperceptions that costs are too high, the bank is too complex and that it is ‘spread too thin’ across various products, clients and markets.

He added: ‘We will be completely focused on addressing shareholders’ concerns because we are completely optimistic about our delivery.’

The chief executive’s comments reflected issues that are specific to Standard Chartered but come at a time of wider concerns about UK stock market valuations.

That has persuaded the likes of chip design giant Arm Holdings to list in New York rather than in London. This week saw another example of the trend when drug maker Indivior said it planned to move its primary listing to Wall Street. Low valuations have also made UK companies vulnerable to takeover speculation – with retailer Currys this week becoming the subject of interest from US and Chinese predators.

Worries about Standard Chartered are also reflective of problems in China, where the economic recovery has been sluggish and the property market is in turmoil. Yesterday’s results saw it book a £121m writedown on its stake in China Bohai Bank, adding to a £552m charge taken during last year.

Standard Chartered also took a direct hit of £222m set aside to cover loan losses related to the country’s beleaguered real estate sector. It comes after rival HSBC earlier this week took a £2.4bn hit on its stake in a Chinese bank.

Gary Greenwood, banking analyst at Shore Capital, said he agreed with Winters’s comments on the share price but added that the bank had struggled with returns during the chief executive’s time in charge ‘during which it has consistently underperformed its return on capital targets’.

- Winters saw his pay increase to £7.8m last year from £6.4m in 2022. The 22 per cent jump was largely due to a big rise in long-term share awards, which climbed by more than 70 per cent to £3.3m. His annual bonus was 2.5 per cent lower at £1.46m.